TORONTO, ON / ACCESSWIRE / December 12, 2023 / Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce the maiden mineral resource estimate ("MRE") for its regolith-hosted ion adsorption clay project located in the State of Goias, Brazil, known as the Carina Module (the "Project").

Highlights

- The initial inferred mineral resource for the Project is estimated at 168 Mt with a grade of 1,510 ppm total rare earth oxide ("TREO") and 477 ppm desorbable rare earth oxide ("DREO"1)

- The average net smelter return ("NSR"2) value of the resource is US$32.3/t when using a cut-off value of US$7.4/t

- The deposit contains significant quantities of dysprosium (Dy), terbium (Tb), neodymium (Nd) and praseodymium (Pr), which are the rare earth elements critical to the production of permanent magnets used in electric vehicles and wind turbines

- Recovery of rare earths from the Project is fully compatible with the technology patented and successfully demonstrated on a pilot scale by Aclara in Chile, designed to minimize both cost and environmental footprint

- The near-surface location of the deposit results in a very low strip ratio (<0.4) providing a positive backdrop for a low-cost mining operation

- The 168Mt of inferred mineral resources at the Carina Module complements the 27.5 Mt of measured and indicated mineral resources, and 1.7 Mt of inferred mineral resources at Aclara's Penco Module in Chile

Next Steps

- Production of samples by processing the Project's ionic clays at Aclara's pilot plant in Chile during December 2023 and January 2024

- Completion of a Preliminary Economic Assessment ("PEA") in January 2024

- Pursuit of additional resources through the completion of a reverse circulation ("RC") drilling campaign, which is already underway and scheduled to be completed in Q2 2024

Aclara CEO, Ramon Barua, commented:

"The combination of its large size and attractive grades makes the Carina Module an outstanding deposit of ionic clays and significantly increases Aclara's total resource base. The fact that we can apply our patented metallurgical recovery process, which combines competitive costs with superior environmental qualities, provides a promising backdrop for the upcoming Preliminary Economic Assessment. We are excited by the possibility of becoming a significantly larger supplier of magnetic rare earths, especially dysprosium, given how critical these elements are in our planet's fight against climate change."

1 DREO: Desorbable Rare Earth Oxide is the recoverable fraction of the total contained rare earths (TREO) using the Penco Module´s ammonium sulfate based metallurgical process.

2 NSR Cut-off: The NSR Cut-off used is based on the marginal costs of the Project. Using a marginal cut-off to discriminate between waste and plant feed (ore) ensures that the net revenue value of the rare earth concentrate produced is equal to the cost of producing it. Since this strategy is applied only to material contained by the "optimal" pit, which contains material that must be mined out, it will maximize cash flow over the life of the operation.

Mineral Resource Statement

The mineral resource has been estimated using the results obtained from 201 auger drill holes (1,630 m) and 1,418 samples. At a 7.4 US$/t NSR cut-off the mineral resource stands at 168 million tonnes ("Mt") in the inferred mineral resources category, @ 1,510 ppm TREO containing an average Dy and Tb grade of 42.1 ppm and 6.9 ppm, respectively. The mineral resource is reported in accordance with the requirements of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Table 1. Carina Module Inferred Mineral Resource Estimate (Effective November 3, 2023) *

Geological Domain |

Mass (t) |

Total Grade (ppm) Oxides |

Content (t) Oxides |

||||||

TREO |

NdPr |

Dy |

Tb |

TREO |

NdPr |

Dy |

Tb |

||

Upper Pedolith |

10.8 |

900 |

121.5 |

12.0 |

1.9 |

9,693 |

1,309 |

129 |

21 |

Lower Pedolith |

28.0 |

1,274 |

193.1 |

22.3 |

3.6 |

35,683 |

5,410 |

624 |

100 |

Upper Saprolite |

122.5 |

1,669 |

347.0 |

49.9 |

8.2 |

204,462 |

42,515 |

6,113 |

1,011 |

Lower Saprolite |

6.0 |

597 |

89.9 |

31.3 |

4.7 |

3,565 |

537 |

187 |

28 |

Sap Rock |

0.8 |

557 |

76.3 |

29.5 |

4.8 |

450 |

62 |

24 |

4 |

Total |

168.1 |

1,510 |

296.5 |

42.1 |

6.9 |

253,853 |

49,832 |

7,077 |

1,163 |

- *Notes:

- CIM (2014) definitions were followed for mineral resources

- Mineral resources are estimated above a net smelter return (NSR) value of 7.4 US$/t

- Mineral resources are estimated using average long term metal prices and metallurgical recoveries as outlined in the paragraph discussing Cut-off Determination and Selection

- Mineral resources are not mineral reserves and do not have demonstrated economic viability

- Totals may not add or multiply accurately due to rounding

Cut-off Determination & Selection

The MRE is pit-constrained using GEOVIA Whittle 2022 software, with an overall slope angle of 25° and a mining cost of US$2.13/t. The MRE is reported at an NSR marginal cut-off cost of US$7.4/t based on processing costs, plus royalties and general and administrative cost estimates. The NSR calculation uses recoveries that are based on preliminary metallurgical test work performed by the AGS Laboratory in La Serena, Chile3.

- Selling prices for rare earth oxides: The price estimates in US$/kg used for pit optimization are La2O3 = 0.68, CeO2 = 0.69, Pr6O11 = 144.18, Nd2O3 = 150.75, Sm2O3 = 2.39, Eu2O3 = 27.45, Gd2O3 = 71.55, Tb4O7 = 1,789.25, Dy2O3 = 477.25, Ho2O3 = 137.25, Er2O3 = 59.10, Tm2O3= 0.0, Yb2O3 = 19.85, Lu2O3 =834.75, Y2O3 = 2.86.

- Metallurgical recoveries: Obtained from the 1,432 drilling sample analyses performed by AGS Laboratory in La Serena, Chile, tested under conditions that carry out desorption at a pH of 4.0, plus a synthetic lixiviant solution designed to emulate the predicted concentrations of recycled salts generated in the closed-circuit process.

- Plant efficiency: Variable by element, ranging from 90.5 to 99.1% with an approximate average of 94%.

- Carbonate transportation and selling cost= US$0.032/kg of carbonates.

- Carbonate purity= 92.7%

3 NSR values were estimated based on metallurgical tests using the process parameters developed for the Penco Module in Chile (see news release dated 9 November 2022 titled "Aclara Confirms Successful Completion Of Its Process Flowsheet At Lab Scale". No QA/QC program was applied to this initial metallurgical test campaign and, as such, the results should be considered speculative in nature, and have not been reported in the mineral resources.

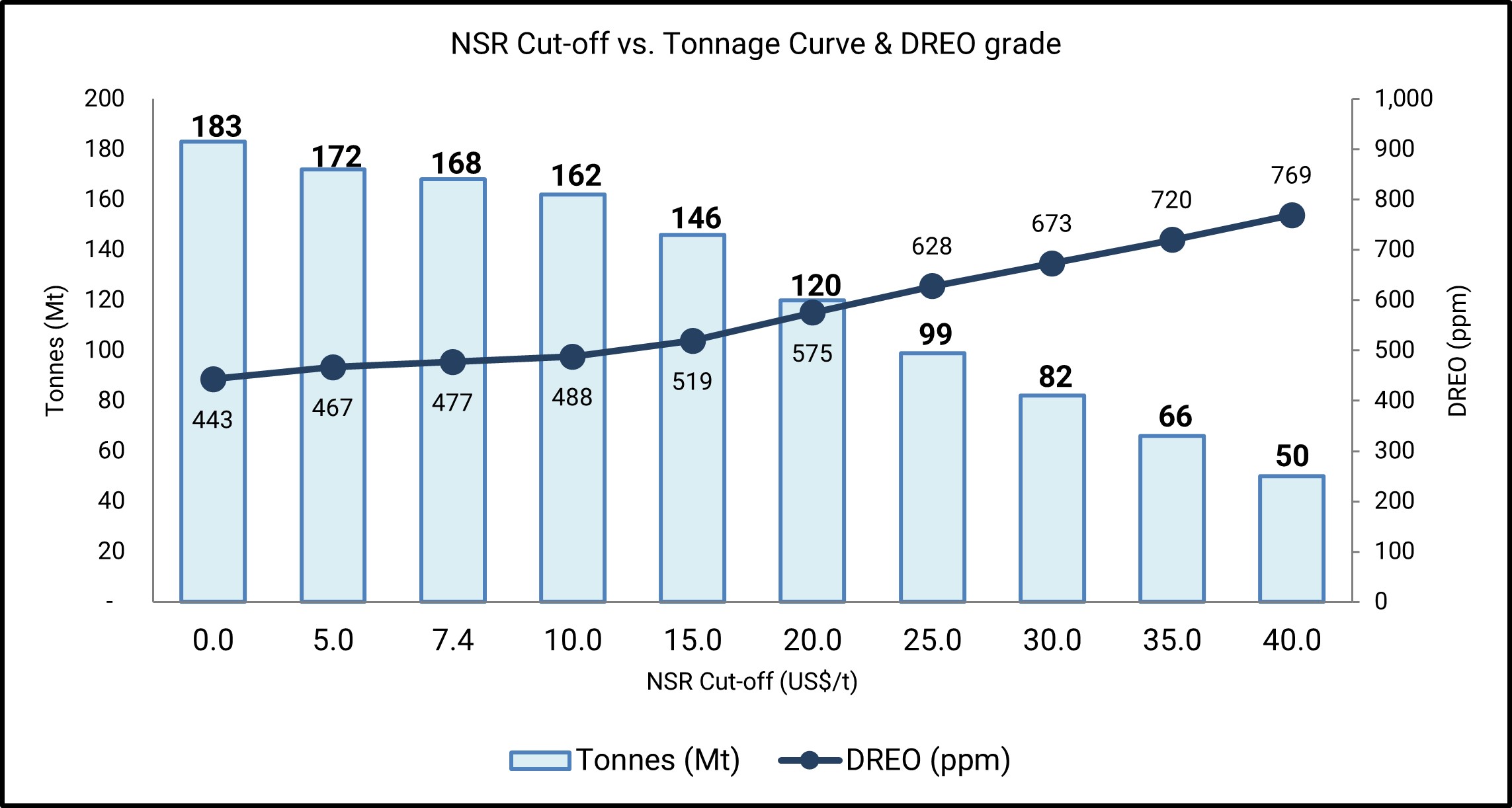

Table 2 below shows the recoveries associated with the four magnetic rare earth elements (NdPr, Dy and Tb) and TREO together with the associated net smelter return per lithology. Chart 1 shows the NSR Cut-off (US$/t) against tonnage (Mt) and DREO grade (ppm).

Table 2: Carina Module - Mineral Resource Estimate (Effective November 3, 2023) - Including Recoveries and NSR Values by Lithology

Geological Domain |

Mass (t) |

Total Grade (ppm) Oxides |

Content (t) Oxides |

Recoveries (%) |

NSR ($/t) |

|||||||||

TREO |

NdPr |

Dy |

Tb |

TREO |

NdPr |

Dy |

Tb |

TREO - Ce |

NdPr |

Dy |

Tb |

|||

Upper Pedolith |

10.8 |

900 |

121.5 |

12.0 |

1.9 |

9,693 |

1,309 |

129 |

21 |

62% |

73% |

45% |

54% |

15.7 |

Lower Pedolith |

28.0 |

1,274 |

193.1 |

22.3 |

3.6 |

35,683 |

5,410 |

624 |

100 |

60% |

64% |

44% |

51% |

23.8 |

Upper Saprolite |

122.5 |

1,669 |

347.0 |

49.9 |

8.2 |

204,462 |

42,515 |

6,113 |

1,011 |

54% |

39% |

47% |

49% |

36.6 |

Lower Saprolite |

6.0 |

597 |

89.9 |

31.3 |

4.7 |

3,565 |

537 |

187 |

28 |

45% |

36% |

49% |

54% |

17.1 |

Sap Rock |

0.8 |

557 |

76.3 |

29.5 |

4.8 |

450 |

62 |

24 |

4 |

42% |

29% |

50% |

51% |

14.8 |

Total |

168.1 |

1,510 |

296.5 |

42.1 |

6.9 |

253,853 |

49,832 |

7,077 |

1,163 |

43% |

43% |

47% |

49% |

32.3 |

Chart 1: Carina Module grade tonnage curve

All technical and economic parameters will be subject to further consideration during the preparation of the PEA, which is expected to be issued in January 2024.

Aclara's Projects Resources

Table 3: Carina Module - Mineral Resource Estimate (Effective November 3, 2023) & Penco Module Mineral Resource Estimate (Effective October 13, 2022)

Geological Domain |

Mass (t) |

Total Grade (ppm) Oxides |

Content (t) Oxides |

Recoveries (%) |

Desorbable Grade (ppm) Oxides |

||||||||||||

TREO |

NdPr |

Dy |

Tb |

TREO |

NdPr |

Dy |

Tb |

TREO - Ce |

NdPr |

Dy |

Tb |

DREO |

NdPr |

Dy |

Tb |

||

| Carina Module | |||||||||||||||||

| Inferred Resources | 168.1 |

1,510 |

296.5 |

42.1 |

6.9 |

253,853 |

49,832 |

7,077 |

1,163 |

43% |

43% |

47% |

49% |

477 |

127.1 |

19.6 |

3.4 |

| Penco Module* | |||||||||||||||||

| Measured and Indicated Resources | 27.5 |

2,292 |

446.5 |

66.6 |

9.4 |

63,030 |

12,278 |

1,831 |

258 |

31% |

17% |

41% |

37% |

496 |

77.0 |

27.1 |

3.7 |

| Inferred Resources | 1.7 |

1,999 |

350.0 |

71.6 |

10.0 |

3,385 |

593 |

122 |

17 |

29% |

15% |

34% |

34% |

419 |

53.3 |

24.7 |

3.4 |

*Note: For additional information about the Penco Module mineral resource estimate please refer to the news release issued on December 1, 2022 named "Aclara Provides an Update on the Mineral Resource Estimate at the Penco Module Project".

Aclara's Low Cost and Environmentally Friendly Production Process

Aclara's extraction process presents several attributes that are favourable from a cost and environmental perspective. Notably, this process refrains from employing energy intensive techniques such as blasting, crushing, or milling. REE rich clays will be extracted using mechanical excavation as opposed to explosives and will benefit from an average strip ratio of less than 0.4. Furthermore, it obviates the generation of tailings, thereby negating the need for a tailings storage facility. The patented extraction process maximizes the recirculation of water within the process. The ionic clay feedstock demonstrates susceptibility to leaching via a common fertilizer (ammonium sulphate), and concurrently, it does not engender the concentration of radionuclides. All these attributes result in a low cost, low carbon footprint mining operation that is positioned very favourably when compared to other rare earths producers.

Auger Drilling Campaign Summary

A total of 201 auger holes over a combined length of 1,630 metres were drilled between February and August 2023 and form the basis of the initial MRE covering approximately 1,400 hectares within the Project area. The average drill hole spacing across the mineralized area was 200 metres, with an area in the north east of the resource drilled to 100 metre centres for the purposes of confirming variogram parameters in this area.

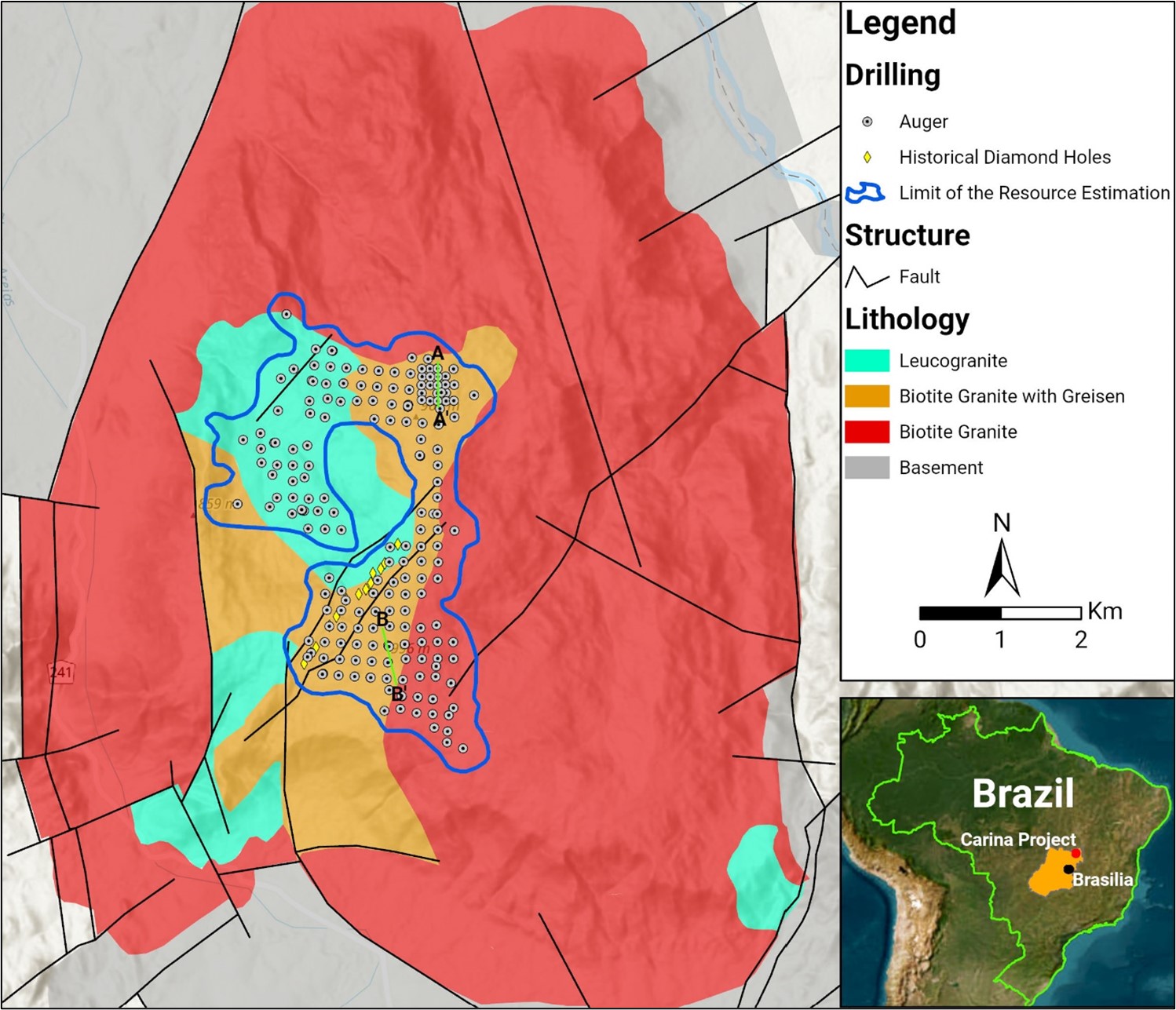

Figure 1: Plan view showing the lithology and current drill collar locations. The green trace lines indicate the location of the cross-sections A-A' and B-B' displayed in Figures 2 and 3, respectively. The blue contour indicates the boundary of the mineralized area representing the inferred resource.

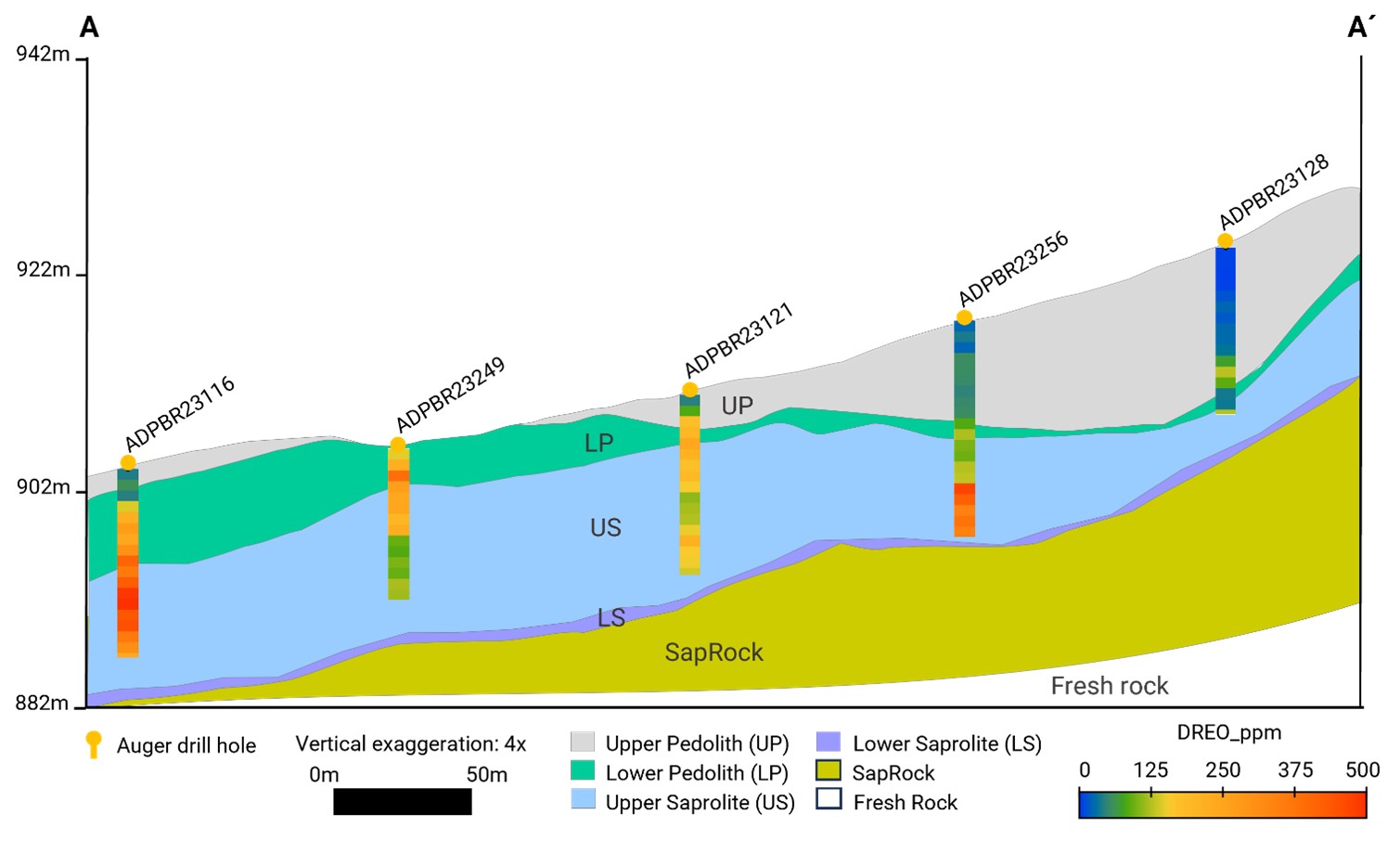

Figure 2 below shows the cross-section A-A' indicated in Figure 1, which exhibits the association between the regolith and select auger drill holes displaying DREO in ppm. The image shows that the mineralized horizons (LP and US) found at the Project are controlled by the development and conservation of favourable regolith horizons at certain topographic levels where continuity is exhibited. The Upper Saprolite is the principal mineralized geological domain and hosts 73% of the declared resource.

Figure 2. Regolith profile interpretation in cross-section A-A' cutting across the north-eastern portion of the mineralised zone as shown in Figure 1.

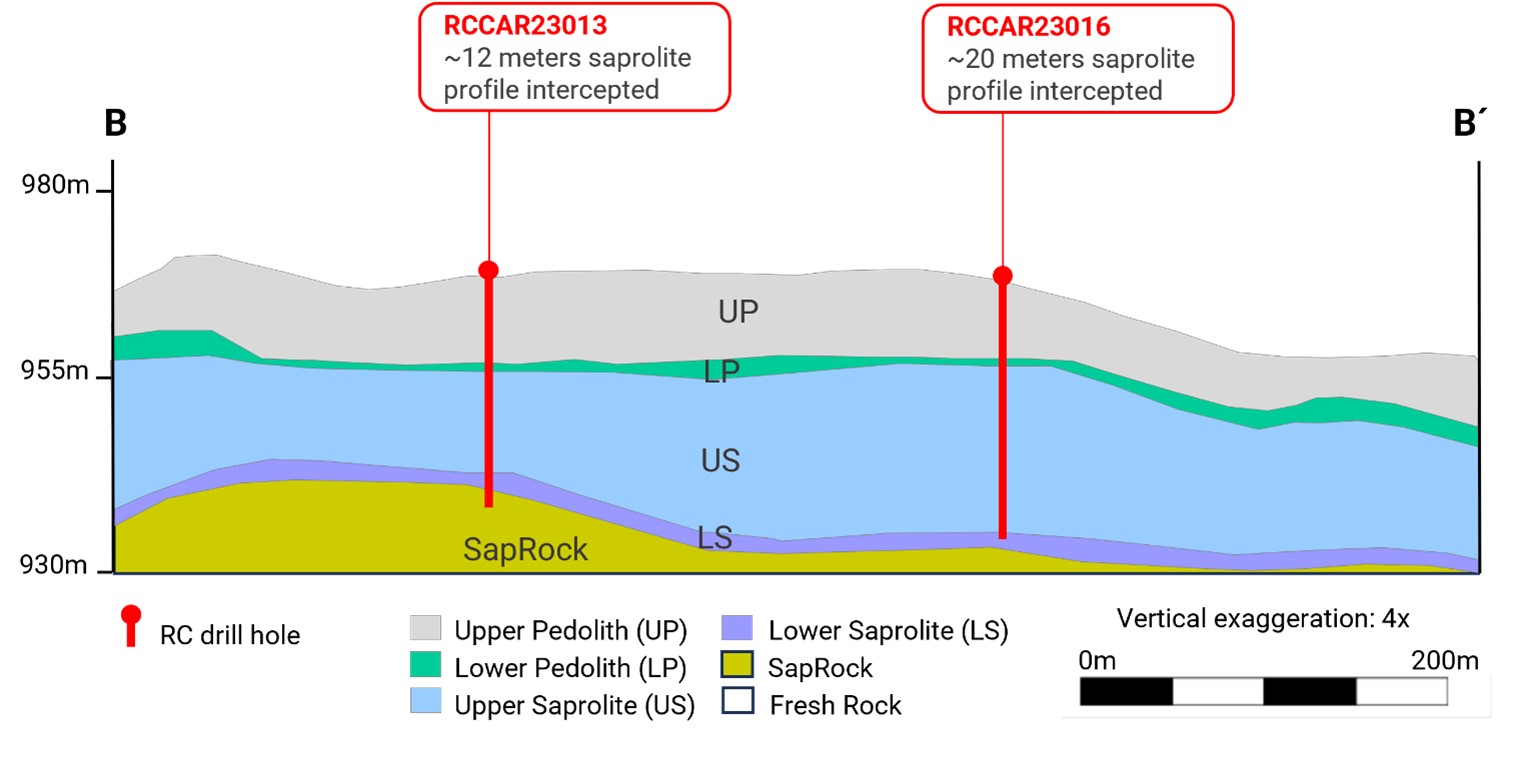

Reverse Circulation Drilling Campaign

The average drill depth of the MRE is 8.1 metres, which did not consistently reach the bottom limits of the lower Pedolith and Saprolite. Over 70% of the auger drillholes indicated a high anomalous exchangeable fraction in the last interval, which suggested that the deposit remained open at depth. As a result, a 9,090-metre RC drilling campaign has been planned, which will reach the bottom limit of the saprolite zone and may result in the discovery of additional inferred mineral resources at depth of the deposit.

The Company is currently executing the initial phase of the RC drilling campaign, which includes 1,500-metres within 56 drill holes. As of the date of this news release, 47 holes had been completed measuring a total of 1,275 metres.

The remaining 7,590 metres of the RC campaign will commence at end of Q1 2024 after receiving the suppression permits necessary to enter the remaining areas of the Project. The complete set of results of the RC drilling campaign are expected by the end of Q2 2024.

Figure 3 below shows the cross-section B-B' as indicated in Figure 1, which presents preliminary evidence of the extension of saprolite development at depth from the current RC drilling campaign. The interval of saprolite interceptions of the RCCAR23013 and RCCAR23013 holes highlight new areas that were not previously reached by the auger drill holes.

Figure 3. Regolith profile interpretation in cross-section B-B' cutting across the southern portion of the mineralized zone as shown in Figure 1.

Geology & Geological Interpretation

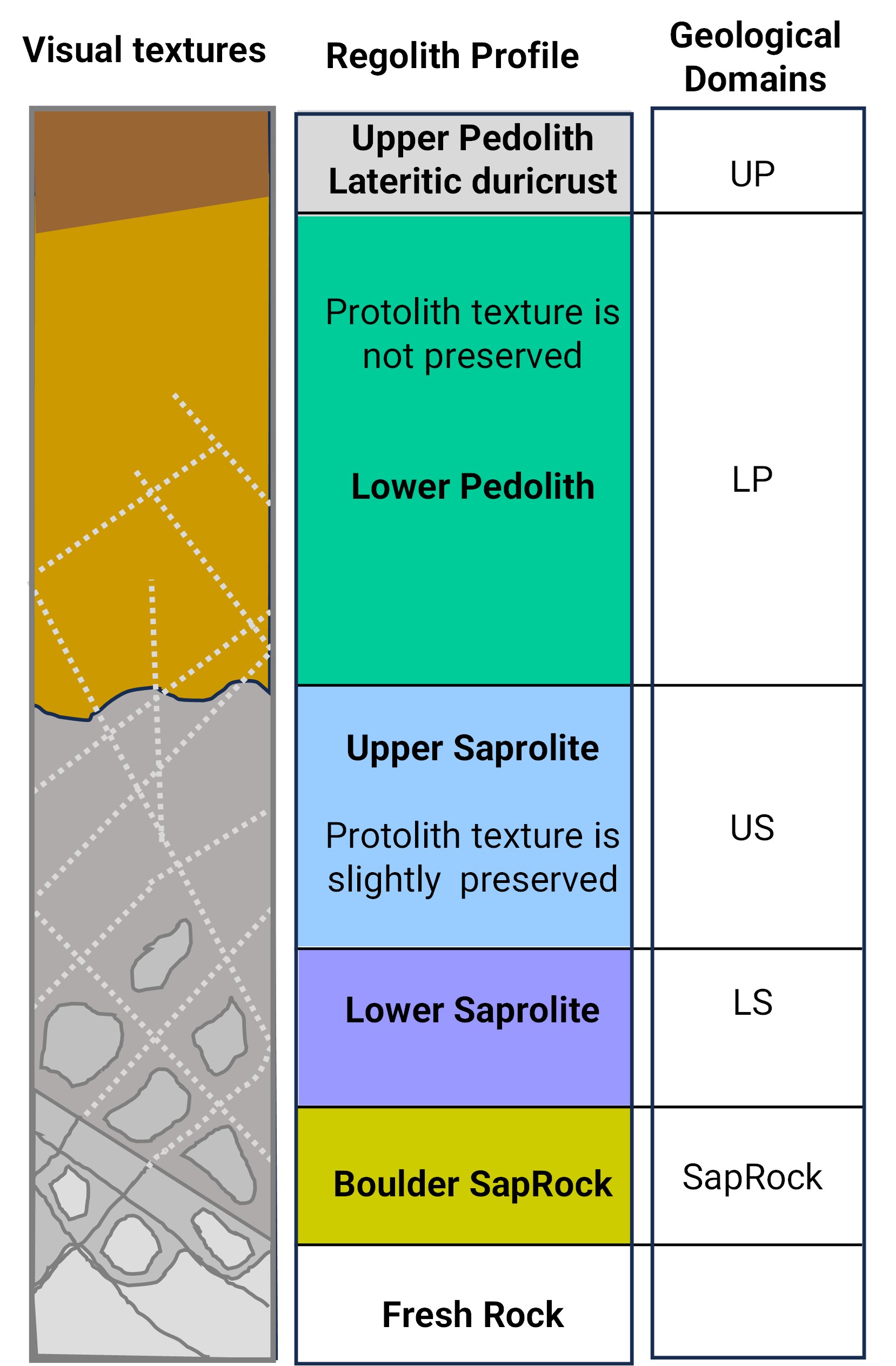

The dominant lithologies of the Project are pink porphyritic biotite granite composed of quartz, oligoclase, microcline, and annite as essential minerals. Leucogranite is the secondary lithology, characterized by quartz, albite, and microcline. The contact of the biotite granite and leucogranite is given by faults trending from NE to SW. This fault event created a fracture zone where hydrothermal alteration is exhibited, giving rise to greisenized granites and gresisens. According to alteration and stratigraphic position, the regolith column in the Project area was subdivided into upper Pedolith (UP), lower Pedolith (LP), upper Saprolite (US), lower Saprolite (LS) and Saprock (SapRock), as graphically depicted in Figure 4 below.

Figure 4: Idealized regolith profile showing the geological domains recognized in the Project area and forming the basis for the present resource estimate.

Sampling, Assay & QA/QC Protocols

The 201 auger drill holes were sampled at intervals of 0.5 metres to 2 metres, for a total of 1,418 samples. The analytical batches included 233 QA/QC samples. All samples were sent for total REE analysis (REY T)4 to the ALS Laboratory in Lima, Peru, and desorption (REY D)5 analysis to AGS Laboratory in La Serena, Chile. The methodology for collecting the auger drill samples was designed following recommendations by expert mining industry groups GeoAnsata and GE21.

The quality of the assay data for the rare earth elements dysprosium (Dy), neodymium (Nd), praseodymium (Pr) and terbium (Tb) was statistically evaluated by GE21 based on QA/QC samples (analysis of certified reference materials, field duplicates and sample split duplicates, fine and coarse blanks) and via the execution of twin holes. GE21 is a Brazilian based engineering consultancy with considerable experience in resource modelling and estimation. They consider the assay results to be of sufficient precision and accuracy to support the estimation of the mineral resources.

4 The total REE analysis (REY T) is determined through a lithium metaborates digestion of the whole ore sample and ICP/MS readings.

5 The desorption analysis (REY D) is based on the metallurgical test protocol developed by Aclara where whole ore leaching takes place in an ammonium sulfate environment at a pH of 3, where the ionic exchange occurs.

Estimation Methodology & Reporting of Mineral Resources

High-grade capping supported by statistical analysis was completed on 2 metre composites and applied to the Project resource estimate.

The MRE was completed using the LEAPFROG EGDE software to generate a block model consisting of parent blocks measuring 50 metres x 50 metres x 4 metres with sub-blocks of 12.5 metre x 12.5 metre x 2 metre dimensions.

Variography was performed for each of the five geological domains in the Project zone, for three groups of elements: Heavy Rare Earth elements plus yttrium (Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu, Y), Light Rare Earth elements minus cerium (La, Pr, Nd, Sm, Eu), and cerium (Ce), which showed a poor correlation with the other two groups.

Grade interpolation for each of the 15 rare earth elements was performed via Ordinary Kriging into the parent blocks using hard boundaries. Estimation was conducted using a strategy to control geometry and number of samples in the interpolation.

Block estimation was validated visually, by global bias analysis and by trend analysis.

In-situ bulk density was assumed to have a value of 1.8 t/m3 for the pedolith profile, based on similar projects in the region.

The MRE is classified as inferred mineral resources. The classification was based on level of confidence in the data, geological continuity, and geostatistical parameters appropriate to deposit type.

Qualified Person

The technical information in this news release, including the information related to geology, drilling, and mineralization, has been reviewed and approved by Geologist Fábio Xavier (MAIG #5179) and Mining Engineer Porfírio Rodriguez (FAIG #3708), associated with GE21. GE21 is a specialized, independent mineral consulting company.

Mr. Rodriguez has more than 40 years of experience in the field of mineral resource and reserve estimate. Mr. Rodriguez is a fellow of the Australian Institute of Geoscientists (FAIG) and is a Qualified Person as defined under NI 43-101.

The MRE has been prepared by Fábio Xavier. Mr. Xavier is a Member of Australian Institute of Geoscientists (AIG) and is a Qualified Person (QP) as defined under NI 43-101. He is responsible for the MRE and has reviewed and approved the scientific and technical information related to the MRE contained in this news release.

Messrs. Rodriguez and Xavier visited the Project from August 16 to August 18, 2023, during the execution of the auger drilling campaign, conducted by the GE21 team under the coordination of Geologist André Costa (FAIG#7967). The visit was supported by Aclara's Exploration Manager, Luiz Jorge Frutuoso Junior.

Mr. Frutuoso is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and Fellow of Australian Institute of Geoscientists (AIG) and is a Qualified Person as defined under NI 43-101. Relevant geological information, database and analysis of the QA/QC relating to the Project were provided by Mr. Frutuoso.

A technical report for the Project, to be prepared in accordance with NI 43-101, will be filed under the Company's profile on SEDAR+ at www.sedarplus.com within 45 days of this news release.

About Aclara

Aclara Resources Inc. (TSX: ARA) is a development-stage company that focuses on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. Its primary project is known as the Penco Module and is located in the BioBio Region of southern Chile. The Company is also evaluating a second module, the Carina Module, located in the State of Goiás in central Brazil.

Presently, Aclara has a strong focus on the development, construction, and future operation of the Penco Module, with the primary objective of establishing a processing plant designed to produce heavy rare earths concentrate.

Aclara's extraction process offers several environmentally attractive features. It does not involve blasting, crushing, or milling. Additionally, it does not generate tailings, eliminating the need for a tailings storage facility. The Company utilizes 100% recycled water and minimizes water consumption through high levels of water recirculation. The ionic clay feedstock is amenable to leaching with a fertilizer, and harmful radionuclides are not concentrated.

Simultaneously, alongside the development of the Penco Module, the Company intends to identify and evaluate further opportunities, such as the Carina Module, for increasing production of heavy rare earth elements. This will involve intensive greenfield exploration programs and the development of additional project "modules" within the Company's concessions in Brazil, Chile and Peru.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, methodology, production timing and upside at the Penco Module and Carina Module, the Company's exploration plan, drilling campaigns and activities in Brazil and the expectations of the Company's management as to the results of such exploration works and drilling activities; timing, cost and scope in respect of the exploration activities in Brazil, the results and interpretations of its maiden MRE relating to the Carina Module, the timing and issuance of a Preliminary Economic Assessment relating to the Carina Module, and the contemplated development of greenfield targets and expected reduction in permitting risk. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Chile and Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Penco Module and/or the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 28, 2023, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this news release is provided as of the date of this news release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Bonzi Yokomizo Baptista

Brazil General Manager

investorrelations@aclara-re.com

Aclara Resources has engaged Reflex Media to provide marketing services in connection with a digital marketing campaign aimed at increasing the knowledge and awareness of the Company to new audiences.

Table 4: Carina Module - Mineral Resource Estimate (Effective November 3, 2023)- By the Total Rare Earth Oxides at 7.4 US$/t NSR cut-off*

Domain |

Mass |

La |

Ce |

Pr |

Nd |

Sm |

Eu |

Gd |

Tb |

Dy |

Ho |

Er |

Tm |

Yb |

Lu |

Y |

TREO |

Mt |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

|

UP |

10.8 |

112.8 |

523.3 |

26.9 |

94.6 |

16.7 |

0.8 |

10.9 |

1.9 |

12.0 |

2.5 |

8.3 |

1.4 |

10.3 |

1.5 |

76.1 |

900 |

LP |

28.0 |

171.8 |

647.3 |

42.5 |

150.7 |

27.0 |

1.6 |

20.4 |

3.6 |

22.3 |

4.7 |

15.1 |

2.4 |

17.4 |

2.5 |

144.7 |

1,274 |

US |

122.5 |

319.0 |

433.6 |

76.8 |

270.2 |

56.3 |

2.5 |

49.0 |

8.3 |

49.9 |

10.0 |

30.8 |

4.8 |

32.6 |

4.6 |

320.6 |

1,669 |

LS |

6.0 |

61.2 |

106.9 |

18.9 |

71.1 |

23.4 |

0.2 |

23.4 |

4.7 |

31.4 |

6.4 |

21.3 |

3.6 |

26.0 |

3.9 |

195.0 |

597 |

SapRock |

0.8 |

47.2 |

101.8 |

15.7 |

60.6 |

22.0 |

0.1 |

23.1 |

4.8 |

29.5 |

6.2 |

19.5 |

3.1 |

23.8 |

3.3 |

196.5 |

557 |

Total |

168.1 |

270.8 |

461.8 |

65.5 |

231.0 |

47.6 |

2.1 |

40.8 |

6.9 |

42.1 |

8.5 |

26.3 |

4.1 |

28.4 |

4.1 |

270.6 |

1,510 |

Table 5: Carina Module - Mineral Resource Estimate (Effective November 3, 2023)- By the Recoverable Grades at 7.4 US$/t NSR cut-off*

Domain |

Mass |

La |

Ce |

Pr |

Nd |

Sm |

Eu |

Gd |

Tb |

Dy |

Ho |

Er |

Tm |

Yb |

Lu |

Y |

TREO-Ce |

Mt |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

|

UP |

10.8 |

63.9 |

7.4 |

73.7 |

73.0 |

64.1 |

73.9 |

56.7 |

53.8 |

44.8 |

35.3 |

30.8 |

26.0 |

23.4 |

24.6 |

37.8 |

62.1 |

LP |

28.0 |

60.5 |

5.8 |

65.3 |

63.6 |

58.3 |

60.1 |

49.9 |

51.4 |

44.3 |

36.2 |

32.8 |

29.0 |

26.8 |

27.8 |

41.3 |

59.5 |

US |

122.5 |

36.5 |

3.3 |

38.3 |

39.7 |

41.7 |

38.3 |

38.4 |

48.9 |

46.7 |

42.4 |

41.4 |

39.4 |

37.8 |

42.7 |

50.9 |

53.7 |

LS |

6.0 |

30.7 |

3.9 |

35.1 |

36.8 |

43.3 |

48.9 |

41.1 |

54.4 |

49.5 |

43.2 |

41.5 |

39.0 |

39.7 |

45.1 |

50.4 |

44.7 |

SapRock |

0.8 |

22.3 |

2.6 |

27.0 |

29.5 |

33.0 |

61.0 |

38.3 |

51.3 |

49.6 |

39.6 |

38.1 |

35.8 |

30.6 |

42.0 |

54.2 |

42.0 |

Total |

168.1 |

39.7 |

4.2 |

42.1 |

43.1 |

43.8 |

41.9 |

39.8 |

49.4 |

46.5 |

41.7 |

40.4 |

38.0 |

36.4 |

40.8 |

49.8 |

43.5 |

Table 6: Carina Module - Mineral Resource Estimate (Effective November 3, 2023) - By the Desorbable Rare Earth Oxides at 7.4 NSR cut-off US$/t*

Domain |

Mass |

La |

Ce |

Pr |

Nd |

Sm |

Eu |

Gd |

Tb |

Dy |

Ho |

Er |

Tm |

Yb |

Lu |

Y |

DREO |

Mt |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

|

UP |

10.8 |

72.0 |

38.9 |

19.8 |

69.1 |

10.7 |

0.6 |

6.2 |

1.0 |

5.4 |

0.9 |

2.5 |

0.4 |

2.4 |

0.4 |

28.8 |

259.1 |

LP |

28.0 |

103.9 |

37.3 |

27.7 |

95.8 |

15.7 |

0.9 |

10.2 |

1.8 |

9.9 |

1.7 |

5.0 |

0.7 |

4.7 |

0.7 |

59.8 |

375.7 |

US |

122.5 |

116.4 |

14.3 |

29.4 |

107.2 |

23.5 |

0.9 |

18.8 |

4.0 |

23.3 |

4.2 |

12.8 |

1.9 |

12.3 |

2.0 |

163.1 |

534.2 |

LS |

6.0 |

18.8 |

4.2 |

6.6 |

26.1 |

10.1 |

0.1 |

9.6 |

2.5 |

15.5 |

2.8 |

8.9 |

1.4 |

10.3 |

1.7 |

98.3 |

217.0 |

SapRock |

0.8 |

10.5 |

2.7 |

4.2 |

17.9 |

7.3 |

0.1 |

8.9 |

2.5 |

14.7 |

2.5 |

7.4 |

1.1 |

7.3 |

1.4 |

106.6 |

194.9 |

Total |

168.1 |

107.5 |

19.3 |

27.6 |

99.5 |

20.8 |

0.9 |

16.2 |

3.4 |

19.6 |

3.5 |

10.6 |

1.6 |

10.3 |

1.7 |

134.7 |

477.2 |

*Notes:

1. UP = Upper Pedolith; LP = Lower Pedolith; US = Upper Saprolite; LS = Lower Saprolite.

2. TREY = Total Rare Earth Elements (La, Ce, Pr, Nd, Sm, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu) plus Yttrium.

3. LREE = Light Rare Earth Elements (La, Ce, Pr, Nd, Sm, Eu).

4. HREE = Heavy Rare Earth Elements (Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu).

5. TREO = Total Rare Earth Oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3) + Yttrium (Y2O3).

6. Totals may not balance due to rounding of figures.

7. Mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The estimate of mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors.

8. Mineral resources were classified as Inferred.

9. Mineral resources are reported with effective date November 3, 2023.10. Responsible QP Fábio Xavier (MAIG #5179)

11. Mineral resources are classified in accordance with the CIM (2014) Standards and Definitions of Mineral Resources.

12. Blocks estimated by Ordinary Kriging at support of 50m x 50m x 4m with sub-blocks 12.5m x 12.5 x 2m.

13. Mineral resources were estimated using TREO grades. Desorbable grades of REE were estimated based on the metallurgical recoveries resulting from using the Penco Module´s ammonium sulphate based metallurgical process.

14. NSR (Net Smelter Return) were calculated based on desorbable grades to support the RPEEE definition. NSR value are not part of mineral resource declaration.

15. The results are presented in-situ and undiluted, are constrained within optimized open pit shells, and are considered to have reasonable prospects of economic viability, using the following parameters:

- Pit slope angle: 25°.

- Price: 0.032US$/kg of concentrate.

- Costs: Mining: 2,13US$/t mined; Process: 7.23 US$/t processed; Royalties: 2% of revenue; Discount: 7.00US$/t processed.

- Metallurgical Recoveries calculated from the estimate of head and desorbable grades: UP: 28.72%; LP: 29.38%; US: 31.74%; LS: 36.01%; SapRock: 34.45%.

- NSR cut-off value = US$7.4/t.

SOURCE: Aclara Resources Inc.

View the original press release on accesswire.com