Agent Satisfaction with Carriers Reaches Highest Level Ever as Industry Aligns around Growth Potential of Independent Agent Channel

Despite independent agents having long driven the lion’s share of property & casualty (P&C) insurance industry revenue, many have been feeling neglected by carriers who have had their sights set on the direct-to-consumer market for the past several years. That’s changing, according to the J.D. Power 2021 U.S. Independent Agent Performance and Satisfaction StudySM released today, which finds that agent satisfaction with carriers has surged as industry shifts have placed a renewed focus on the independent agent channel.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211005005521/en/

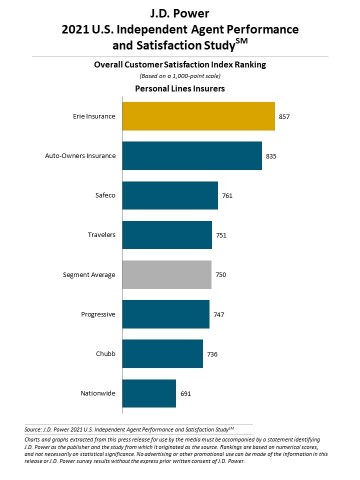

J.D. Power 2021 U.S. Independent Agent Performance and Satisfaction Study (Graphic: Business Wire)

The study, now in its fourth year, was developed in alliance with the Independent Insurance Agents & Brokers of America (IIABA). It evaluates the evolving role of independent agents in P&C insurance distribution, general business outlook, management strategy and overall satisfaction with personal lines and commercial lines insurers in the United States.

“During the past year, some of the industry’s most notable acquisitions and operating model investments have thrust the independent agent channel back to the forefront, resulting in improved agent-carrier relations,” said Tom Super, head of property & casualty insurance intelligence at J.D. Power. “While carriers still have a long way to go, independent agent satisfaction with carriers has reached an all-time high, with many agents citing better communications with carriers, improved servicing levels and higher satisfaction with digital tools.”

Following are key findings of the 2021 study:

- Agent satisfaction reaches all-time high: The overall satisfaction score among personal lines agents is 750 (on a 1,000-point scale), up a significant 18 points from 2020. Overall satisfaction among commercial lines agents is 740, up a significant 29 points from a year ago. Gains in satisfaction with quoting, support and communications and servicing helped to drive these year-over-year increases.

- Variety is the spice of life: Overall satisfaction is significantly higher among agents servicing multiple lines of business, such as health, life and group benefits, than among those who only offer P&C policies. Agents servicing multiple lines also report receiving increased flexibility and support from their carriers.

- A “Goldilocks effect” emerges: While overall agent satisfaction surged this year, there were some outliers: notably, both the largest commercial agents (those with more than $500,000 in direct-written premiums) and the agents with the smallest books of business (under $15,000 in direct-written premiums) see a decline in satisfaction. Issues at both ends of the spectrum involve communication challenges as accounts grow more complex and as agents require more hands-on training and support.

- Digital tools helping but still have a long way to go: The only interaction channels that do not show declines in usage this year are digital chat (12% utilization rate) and mobile app (11% utilization rate). While utilization rates remain stubbornly low for these channels, overall satisfaction is notably higher among agents who do use them.

Study Ranking

Erie Insurance ranks highest among personal lines insurers with an overall satisfaction score of 857. Auto-Owners Insurance (835) ranks second and Safeco (761) ranks third.

Auto-Owners Insurance ranks highest among commercial lines insurers with an overall satisfaction score of 838. The Hartford (777) ranks second and Liberty Mutual (750) ranks third.

For the 2021 U.S. Independent Agent Performance and Satisfaction Study, P&C insurance independent agents were surveyed, which resulted in 3,102 evaluations of personal and commercial lines insurers with which agents had placed policies during the prior 12 months. The study was fielded from April through July 2021.

For more information about the U.S. Independent Insurance Agent Performance and Satisfaction Study, visit https://www.jdpower.com/business/resource/us-independent-agent-performance-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021131.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211005005521/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com