The firm’s U.S. index reflects a 6% increase month-over-month led by an uptick in travel, dining out

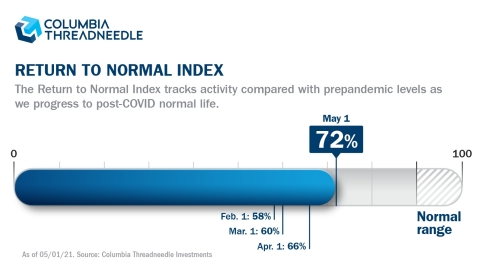

Columbia Threadneedle Investments today announced its Return to Normal Index rose to 72% as of May 1, 2021, reflecting a meaningful rise from 58% at the beginning of the year. The index tracks and measures activity data in the U.S. including travel, return to work and school, brick-and-mortar shopping and eating out, relative to pre-pandemic levels. It is constructed by the firm’s data scientists and fundamental research analysts to help augment investment decision making. Much of what’s driving this month’s data can be attributed to expanded vaccination eligibility, school re-openings, return to work, improving weather, and states lifting restrictions on activities like indoor dining.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210503005443/en/

The Columbia Threadneedle Return to Normal Index as of May 1, 2021.

The firm’s analysis suggests the U.S. has reached an important immunity range (~70%) through a combination of vaccinations and prior infections. This will likely lead to a decline in active cases over the next couple of weeks and lower the incidence of severe/fatal outcomes, which should accelerate broader economic activity. The firm’s recovery assumptions, based on projections made in the fourth quarter of 2020, predict that the index will hit 90% of pre-pandemic levels of activity by August 2021. The upside case is June pending faster vaccine distribution and changes to mask mandates, while the downside case is November if variants continue to spread and vaccine uptake slows.

Paul DiGiacomo, Head of U.S. Equity Research at Columbia Threadneedle Investments, said: “We are seeing some countries face a critical rise in cases, while others are experiencing green shoots that suggest return to normal consumer behavior is swift and can even exceed pre-Covid levels for a period of time. With that said, the index could hit ‘normal’ at a point lower than 100 due to continued changes in behavior like working from home and reduced business travel.”

DiGiacomo continued, “This index, powered by our firm’s research intensity, is a valuable tool that provides us with a systematic and efficient way to monitor real-time data and generate actionable insights for our investment teams.”

By design, the index is focused on measuring components of daily life rather than economic indicators like GDP growth. The data science team aggregates data from sources such as OpenTable, TSA, and hotel bookings to pinpoint sector-level activity, whether it’s identifying positive momentum or trouble spots. The index suggests that we’re still 28% below pre-Covid activity levels, with brick-and-mortar data showing the most promise at 82% of pre-pandemic activity and travel and entertainment lagging at 57% of pre-pandemic activity.

The Columbia Threadneedle Return to Normal Index is updated on a monthly basis and can be accessed here.

About Columbia Threadneedle Investments

Columbia Threadneedle Investments is a leading global asset manager that provides a broad range of investment strategies and solutions for individual, institutional and corporate clients around the world. With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $564 billion1 of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives.

Columbia Threadneedle Investments is the global asset management group of Ameriprise Financial, Inc. (NYSE: AMP). For more information, please visit columbiathreeedneedleus.com. Follow us on Twitter.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

1As of March 31, 2021. Includes all assets managed by entities in the Columbia and Threadneedle group of companies.

© 2021 Columbia Management Investment Advisers, LLC. All rights reserved.

Adtrax: 3567094

View source version on businesswire.com: https://www.businesswire.com/news/home/20210503005443/en/

Contacts

Lisa Feuerbach

617.897.9344

lisa.feuerbach@ampf.com