Amica Mutual Ranks Highest in Auto Insurance Claims Satisfaction

The times have not been kind to the auto insurance industry. The volume of vehicle collisions is returning to pre-pandemic levels and, when combined with all-time-high repair costs, historic backlogs in repair shops and limited replacement parts availability, it is costlier and more time-consuming than ever to get customers’ vehicles back on the road after a collision. Today, the J.D. Power 2022 U.S. Auto Claims Satisfaction StudySM adds another dour fact to the mix: customer satisfaction has declined 7 points (on a 1,000-point scale) from 2021 as customers start to lose patience with the claims process.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221027005054/en/

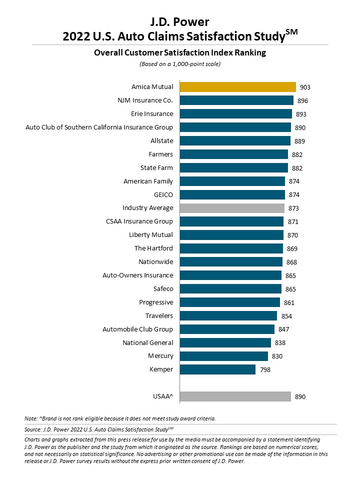

J.D. Power 2022 U.S. Auto Claims Satisfaction Study (Graphic: Business Wire)

“Insurers are in a tight spot with their own profitability strained and a host of external factors causing their customers to grow increasingly disillusioned with the entire claims experience,” said Mark Garrett, director of global insurance intelligence at J.D. Power. “The best way forward is for insurers to start focusing on carefully managing customers’ expectations and fine-tuning their digital engagement strategies to shepherd their customers through the process. There is one bright spot in the study: insurers that focused on managing timing expectations, were quickly available and responsive to customers and that provided multiple digital options for status updates were able to outperform the industry—with some even improving year over year."

Following are key findings of the 2022 study:

- Historically slow repair process drags on customer satisfaction: Overall satisfaction with the auto insurance claims process this year falls 7 points to 873. While satisfaction is down across nearly all factors in the study, satisfaction with the repair process registers a 9-point year-over-year decline. This year marks the first time a majority of customers cited supply chain issues such as waiting for parts on order and repair shop backlog as reasons for delays in getting their vehicle back on the road. The average repair cycle time is nearly 17 days, compared with a pre-pandemic average of about 12 days.

- Expectation management becomes key to customer satisfaction: The average overall satisfaction score among customers experiencing a repair cycle time greater than three weeks is 837. That score jumps 71 points to 908 when customers are provided with an accurate time estimate beforehand. Being empathetic throughout the process is key, especially for the longer-tailed claims that can create more effort for customers who have questions, need updates and are trying to determine next steps.

- Claims servicing is not one size fits all: Rising repair costs are challenging insurers’ profitability, so pressure is mounting to better manage expenses. This puts the focus on digital channels as a critical tool for efficiently managing customer relationships, but not all customers want to use such channels. In fact, 34% of customers say they have a stronger preference for working with people than using digital contact. These customers also have a notably worse claims experience, as satisfaction is 31 points lower than among those who are equally comfortable with both people and digital as contact channels.

- Getting digital formula just right is critical, but not easy: Not all digital experiences are created equal. When digital is used for delivering status updates, overall satisfaction rises 56 points, with those using text messaging having the highest levels of satisfaction. However, when digital is used to report first notice of loss (FNOL) via the internet or mobile app, overall satisfaction falls 4 points.

- Right hand, meet left hand: A common complaint about the auto insurance claims process is the need to repeatedly provide the same information to different people at various points in the process. Overall satisfaction scores are lowest (840) when customers interact with three or more representatives during the claims process—a decline of 13 points from a year ago. Scores are highest (912)—and have held steady year over year—when the insurer uses straight-through-processing technology to automatically approve and route the claim.

Study Ranking

Amica Mutual ranks highest in overall customer satisfaction with a score of 903. NJM Insurance Co. (896) ranks second and Erie Insurance (893) ranks third.

The redesigned 2022 U.S. Auto Claims Satisfaction Study is based on responses from 8,239 auto insurance customers who settled a claim within the past six months prior to participating in the survey. The study excludes claimants whose vehicle incurred only glass/windshield damage or was stolen, or who only filed a roadside assistance claim. The study was fielded from November 2021 through September 2022.

For more information about the U.S. Auto Claims Satisfaction Study, visit

https://www.jdpower.com/resource/jd-power-us-auto-claims-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022151.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20221027005054/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com