Amid evolving consumer behaviors and economic turbulence, payment methods that offer more choice and control are rapidly gaining traction

Up to $89 billion (4.6%) of global payment revenues could be at risk in the next three years for banks that are slow to offer next-generation payments options, according to a new report by Accenture (NYSE: ACN).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221213005802/en/

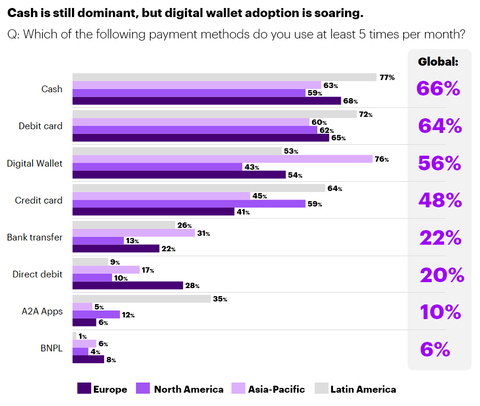

While cash remains the dominant payments method, next-generation payments solutions — including digital wallets, A2A Apps and buy now pay later — are becoming more popular. (Photo: Business Wire)

The report, “Payments Gets Personal,” is based on a survey of more than 16,000 consumers in 13 countries across Asia, Europe, Latin America and North America. It explores how leading banks and payments players can increase their relevance in the consumer transaction journey and capitalize on future payment innovations.

Breaking down the payment revenue risk by geographic region, the report identified that $34 billion of payment revenues is at stake in North America, more than $25 billion is under threat in Latin America, and more than $24 billion in Asia-Pacific. In Europe, where more than 55% of consumers do not make use credit cards regularly, more than $4 billion of payment revenue is at risk.

Although traditional payment methods still dominate the consumer payments landscape, next-generation offerings are rapidly gaining traction. The survey identified high usage of traditional payments methods such as cash (used by 66% of survey respondents), debit cards (64%) and credit cards (48%). However, more than half (56%) of consumers surveyed use digital wallets and 10% use account-to-account (A2A) payment apps.

More disruption is expected from biometrics payments (authentication of physical characteristics such as retinas, palm/fingerprints and faces). More than four in 10 respondents (42%) believe that biometrics are likely to be widely used by 2025, and 9% said they would be willing to use it as their in-person primary method of payment, if available, by 2025.

The research also found that external macroeconomic factors including inflation and rising interest rates are shaping consumers’ payment choices as they look to reduce debt interest. Almost one third (31%) of credit card users said that they are considering switching to other payment instruments for in-person shopping, with slightly more than half (54%) of these planning to use non-interest-charging payment methods including debit cards, cash and buy now, pay later financing.

Sulabh Agarwal, Global Payments lead at Accenture, said: “As consumers re-evaluate how they pay and move their money, traditional payments providers are rapidly losing their hold over the customer payments experience to newer market entrants. This significant threat to core banking revenue is compounded by the current economic volatility, accelerating digitization, and consumer demand for seamless payments.”

The report recommends several strategies for banks seeking to deliver seamless payments experiences, including:

- Embracing partnerships to scale – Collaboration with other banks and fintechs can help defend core payments revenue and lock out new entrants.

- Offering simplicity and speed – Apps and digital wallets can replace physical branch interactions and digitize payments while offering deeper insights into customers’ behaviors and needs.

- Moving beyond payments – Online marketplaces and “super-apps” can position banks at the center of consumers’ digital lives.

“Now is the time for banks to put a stake in the ground and implement a strategy to defend their core payments revenue,” Agarwal said. “Banks that make bold moves to embrace next-generation payment methods offering people more choice and control could unlock higher levels of customer engagement and drive growth in a rising-interest-rate environment.”

Read the full report, “Payments Gets Personal,” to understand how banks and payments providers can ensure their future growth and relevance in payments.

Methodology

The report draws on insights from the Accenture 2022 Global Consumer Payments study, based on a survey of 16,000 customers in 13 countries across Asia, Europe, Latin America and North America. Fieldwork took place during August and September 2022. To calculate the amount of bank payments revenue at risk, Accenture Research examined data provided by GlobalData and UK Finance and the survey responses to estimate the payment revenue pools for in-person card payments and total online payments. Accenture included interchange fees from all card transactions, interest income from credit cards, and fees attributable to banks from alternative online payments. Using the survey results and examination of the recent payment trends, Accenture used scenario analysis to estimate the future payment methods used by consumers by each of the 13 countries (which represent 83% of bank payments revenues globally) and extrapolated the results globally. The baseline as-is scenario, which is built on the proprietary Accenture Payments Revenue Model, was adjusted accordingly, incorporating inflation and country-specific dynamics and input from Accenture’s global payment experts.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Technology and Operations services and Accenture Song — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 721,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221213005802/en/

Contacts

Michael McGinn

Accenture

+1 312 693 5707

m.mcginn@accenture.com

Victoria Ancell

Accenture

+44 7746 277759

v.ancell@accenture.com