Amid high inflation and geopolitical tensions, investors are feeling more “Dazed and Confused”

E*TRADE from Morgan Stanley today announced results from the most recent wave of StreetWise, its quarterly tracking study of experienced investors. Results reveal a drop in positive sentiment following a volatile first quarter:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220413005686/en/

(Graphic: Business Wire)

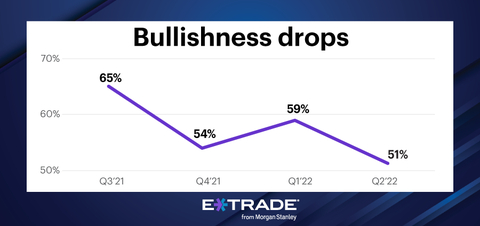

- Bullishness falls. Bullish sentiment dropped 8 percentage points from last quarter to 51%. And nearly a third believe we’re at the peak of the business cycle (32%) or in a recession (31%)—up 2 and 7 percentage points, respectively.

- Investors are feeling “Dazed and Confused”. Investors selected “Dazed and Confused” (29%) as the top movie choice to describe how they feel about the market, up 6 percentage points from the last quarter.

- And most expect volatility to rise. Nearly two in three investors (64%) said they expect volatility to increase this quarter.

- Inflation fears reign. For the fourth quarter in a row, inflation (56%) was selected as a top portfolio risk, followed by the Russia and Ukraine conflict (45%), and a recession (38%).

“A lot has shifted in the last year—inflation went from transitory to persistent, supply chain concerns pivoted to oil constraints, we entered a rising rate environment, and geopolitical tensions reached a tipping point,” said Mike Loewengart, Managing Director of Investment Strategy at E*TRADE from Morgan Stanley. “Amid this backdrop, it’s not surprising to see cracks in investors’ bullishness. In fact, this type of volatility is normal as we enter a new era of monetary policy. So while investors seem to be bracing for more, it’s important to remember that sticking to a diversified investment strategy is likely to serve most well over the long-term. Translation: Resist the urge to panic sell or buy when you see account balances fluctuate.”

The survey explored investor views on sector opportunities for the second quarter of 2022:

- Energy. With crude oil’s spike since the Ukraine conflict, the energy sector (48%) took the top spot this quarter, jumping 11 percentage points from Q1.

- IT. Despite the Fed raising rates last month and signaling more on the horizon, nearly two in five (38%) investors see opportunity in the IT sector. While it’s largely thought that rising rates can eat into growth potential of tech names, recent volatility and the pullback in the sector could be drawing investors into this still evolving and growing area of the market.

- Health care. Interest in this traditionally defensive sector remained high amid increased volatility (37%), but ticked down 9 percentage points from last quarter.

About the Survey

This wave of the survey was conducted from April 1 to April 11 of 2022 among an online US sample of 913 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

About E*TRADE from Morgan Stanley and Important Notices

E*TRADE from Morgan Stanley provides financial services to retail customers. Securities products and services offered by E*TRADE Securities LLC, Member SIPC. Investment advisory services offered by E*TRADE Capital Management, LLC, a Registered Investment Adviser. Commodity futures and options on futures products and services offered by E*TRADE Futures LLC, Member NFA. Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC. All are separate but affiliated subsidiaries of Morgan Stanley. More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE from Morgan Stanley, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE from Morgan Stanley. ETFC-G

ETFC

© 2022 E*TRADE from Morgan Stanley. All rights reserved.

E*TRADE engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com.

Referenced Data

And when it comes to the current market are you? |

||

|

Q1’22 |

Q2’22 |

Bullish |

59% |

51% |

Bearish |

41% |

49% |

What stage of the business cycle do you believe we are currently in? |

||

|

Q1’22 |

Q2’22 |

Peak (Economic growth reaches maximum limit, inflation takes hold, economic factors slow or stop) |

30% |

32% |

Recession (Economic growth decreases) |

24% |

31% |

Expansion (Economic growth is steady and economic factors increase) |

28% |

17% |

Recovery (Economy growth reaches lowest level and begins to move back into positive territory) |

10% |

10% |

Trough (Negative economic growth) |

8% |

10% |

If you had to pick a movie title that best describes how you personally feel about the market this quarter, which would it be? |

||

Q1'22 |

Q2’22 |

|

Dazed and Confused |

23% |

29% |

Easy Rider |

21% |

17% |

Singin’ in the Rain |

16% |

11% |

Jackass |

6% |

10% |

Raging Bull |

13% |

9% |

Pulp Fiction |

10% |

9% |

Fear and Loathing in Las Vegas |

7% |

8% |

Apocalypse Now |

4% |

7% |

Over the next quarter, do you think volatility will... |

|

|

Q2’22 |

Top 2 Box |

64% |

Greatly increase |

18% |

Somewhat increase |

46% |

Stay the same |

29% |

Somewhat decrease |

7% |

Greatly decrease |

-- |

Which of the following risks are you most concerned about when it comes to your portfolio? (Top four) |

||||

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

|

Inflation |

35% |

52% |

58% |

56% |

Russia/Ukraine conflict |

-- |

-- |

-- |

45% |

Recession |

17% |

38% |

35% |

38% |

Market volatility |

27% |

41% |

47% |

37% |

Supply chain constraints |

-- |

38% |

36% |

30% |

US trade tensions |

17% |

28% |

29% |

28% |

Coronavirus and other pandemic concerns |

23% |

38% |

44% |

25% |

Current presidential administration |

16% |

31% |

29% |

24% |

Economic weakness abroad |

12% |

31% |

25% |

22% |

Gridlock in Washington |

14% |

30% |

24% |

20% |

Fed monetary policy |

12% |

24% |

26% |

20% |

Commodity prices |

-- |

-- |

-- |

18% |

Job market |

15% |

24% |

24% |

17% |

The yield curve |

7% |

13% |

13% |

11% |

None of these |

3% |

3% |

3% |

2% |

Other |

1% |

1% |

1% |

1% |

What industries do you think offer the most potential this quarter? (Top Three) |

||

Q1'22 |

Q2’22 |

|

Energy |

37% |

48% |

Information technology |

43% |

38% |

Health care |

46% |

37% |

Real estate |

32% |

34% |

Utilities |

24% |

28% |

Financials |

30% |

24% |

Consumer staples |

22% |

22% |

Materials |

17% |

20% |

Communication services |

21% |

18% |

Industrials |

17% |

18% |

Consumer discretionary |

12% |

12% |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220413005686/en/

Contacts

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com