Dodge Ranks Highest Overall in J.D. Power Initial Quality Study; Alfa Romeo Ranks Highest among Premium Brands for First Time

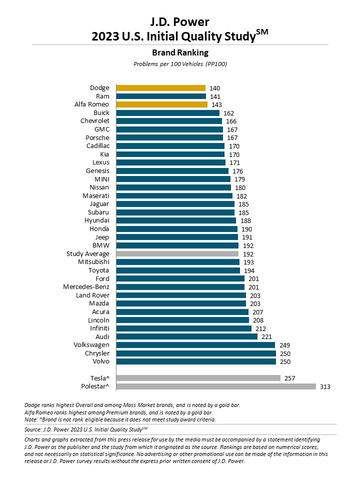

New vehicles are becoming more problematic, evidenced by the number of problems per 100 vehicles (PP100) rising a record 30 PP100 during the past two years. According to the J.D. Power 2023 U.S. Initial Quality StudySM (IQS), released today, the rise in problems is 12 PP100 greater than in 2022, which follows an increase of 18 PP100 in 2022 from 2021. In 2023, the industry average is 192 PP100. A lower score reflects higher vehicle quality.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230622865136/en/

J.D. Power 2023 U.S. Initial Quality Study (Graphic: Business Wire)

The continuing decline in quality can be attributed to multiple factors such as greater usage and penetration of technology; continued integration of known problematic audio systems into other new models; poor sounding horns; cupholders that don’t serve their purpose; and new models with 11 PP100 more than carryover models.

“The automotive industry is facing a wide range of quality problems, a phenomenon not seen in the 37-year history of the IQS,” said Frank Hanley, senior director of auto benchmarking at J.D. Power. "The industry is at a major crossroad and the path each manufacturer chooses is paramount for its future. From persistent problems carrying over from years past to an increase in new types of problems, today’s new vehicles are more complex—offering new and exciting technology—but not always satisfying owners.”

The U.S. Initial Quality Study, now in its 37th year, is based this year on responses from 93,380 purchasers and lessees of new 2023 model-year vehicles who were surveyed early in the ownership period. The study is based on a 223-question battery organized into nine vehicle categories: infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; and climate. The study is designed to provide manufacturers with information to facilitate the identification of problems and to drive product improvement. The study was fielded from February through May 2023.

While problems with driving experience are flat year over year, quality declines in all other categories. The largest year-over-year increase in the number of problems is in the features, controls and displays category (+3.2 PP100), followed by infotainment (+2.3 PP100).

Following are key findings of the 2023 study:

- Vehicle basic—door handles—are increasingly problematic: Opening a door was once a non-discussion point—an aspect of a vehicle that had been examined, engineered and mastered. The basic touch point of door handles is now a percolating problem area as manufacturers attempt to redesign them. Owners are having issues with high-tech approaches to this basic function; seven of the 10 most problematic models in this area are battery electric vehicles (BEVs).

- Safety systems causing problems: More than three-fourths (80%) of owners say their new vehicle includes all four of the primary driver assistance features—forward collision warning; lane keeping assistance; lane departure warning; and blind spot warning. However, problems owners encounter in the driver assistance category have increased 1.8 PP100 year over year. The most problematic areas are lane departure warning/lane keeping assistance (7.2 PP100) and forward collision warning/automatic emergency braking (5.0 PP100) for those that have these features.

- Owners increasingly happier with apps: Manufacturer smartphone apps improve 0.4 PP100 this year as the market penetration rate grows to 76%. BEV owners in particular use their app at least 68% of the time, primarily to monitor the charging process and to view their vehicle’s available range. The higher usage and unique BEV use cases translate to more problems experienced using the app in comparison to those with an internal combustion engine vehicle.

- Android Automotive Operating System (AAOS) issues: A 21.5 PP100 gap exists between vehicles that have an Android Automotive OS without Google Automotive Services (51.1 PP100) and those vehicles that don’t have this system (29.6 PP100). This is only for the operating system for in-vehicle infotainment, not for the smartphone mirroring systems of Android Auto or Apple CarPlay.

- Smartphone charging becomes most deteriorated problem: Across all 223 problems measured in the study, wireless charging pad not working properly has increased by a sizable 1.1 PP100 and is driven by both increased penetration and more usability issues with the technology. Users are experiencing several problems, including poor location; phone overheating; and intermittent charging, if at all. “This is the area where manufacturers really have the opportunity to delight customers with this convenience, but instead are creating a problem for them,” Hanley said.

- Biggest movers and shakers: Brands that show the largest year-over-year improvement are Maserati (73 PP100 improvement), Alfa Romeo (68 PP100 improvement) and Ram (45 PP100 improvement).

- Unofficially ranked automakers fill bottom spots: Tesla Motors, with 257 PP100, increases 31 PP100 year over year, while Polestar (313 PP100) improves 15 PP100 year over year. Lucid Motors (340 PP100) and Rivian Motors (282 PP100) are included in the industry calculations for the first time but have too small a sample size to be award eligible. These automakers are not officially ranked amongst other brands in the study as they do not meet ranking criteria. Unlike other manufacturers, they do not grant J.D. Power permission to survey its owners in states where authorization is required. Nonetheless, a score was calculated based on a sample of surveys from owners in the other states.

Highest-Ranking Brands and Models

Dodge is the highest-ranking brand overall in initial quality with a score of 140 PP100. Among mass market brands, Ram (141 PP100) ranks second and Buick (162 PP100) ranks third.

Among premium brands, Alfa Romeo ranks highest with a score of 143 PP100. Porsche (167 PP100) ranks second and Cadillac (170 PP100) ranks third.

The parent corporation receiving the most model-level awards is General Motors Company (seven awards), followed by Hyundai Motor Group (five) and Toyota Motor Corporation (four). Among brands, Chevrolet and Kia receive the most segment awards (four).

- General Motors Company models that rank highest in their respective segments are Buick Encore GX, Cadillac Escalade, Cadillac XT6, Chevrolet Camaro, Chevrolet Corvette, Chevrolet Equinox and Chevrolet Tahoe.

- Hyundai Motor Group models that rank highest in their respective segments are Genesis G80, Kia Carnival, Kia Forte, Kia Rio and Kia Stinger.

- Toyota Motor Corporation models that rank highest in their respective segments are Lexus GX, Lexus IS, Toyota Camry and Toyota 4Runner.

- Nissan Motor Co., Ltd. has the highest-ranking model overall, the Nissan Maxima with 106 PP100, and the Nissan Murano ranks highest in its respective segment.

Plant Quality Awards

Toyota Motor Corporation’s Tahara Lexus, Japan, plant, which manufactures the Lexus IS, Lexus LS and Lexus NX, receives the Platinum Plant Quality Award. Plant quality awards are based solely on defects and malfunctions and exclude design-related problems.

General Motors Company’s plant in San Luis, Potosi, Mexico, which produces the Chevrolet Equinox and GMC Terrain, receives the Gold Plant Quality Award for North/South America. BMW AG’s plant in Born, Netherlands, which produces the MINI Cooper and MINI Countryman, receives the Gold Plant Quality Award for Europe and Africa.

For more information about the U.S. Initial Quality Study, visit https://www.jdpower.com/business/automotive/us-initial-quality-study-iqs.

See the online press release at http://www.jdpower.com/pr-id/2023063.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20230622865136/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

Shane Smith; East Coast; 424-903-3665; ssmith@pacificcommunicationsgroup.com