American Family Ranks Highest among Small Commercial Insurers

Even in an environment of rising rates in which 36% of small business owners have experienced premium increases during the past year, overall customer satisfaction, loyalty and brand advocacy stay strong when customers trust their commercial insurance providers. According to the J.D. Power 2024 U.S. Small Commercial Insurance Study,SM released today, among small businesses with the highest levels of trust in their insurers 81% say they “definitely will” renew with their carrier and 79% say they “definitely will” recommend their carrier. Overall trust levels, however, vary widely by insurer.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240820939265/en/

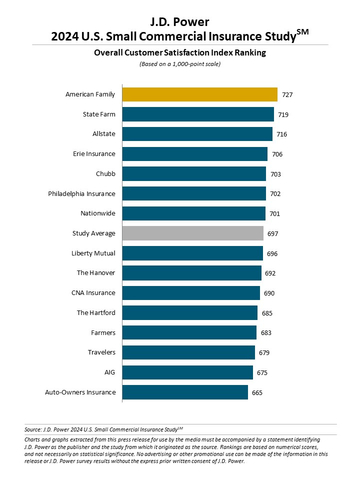

J.D. Power 2024 U.S. Small Commercial Insurance Study (Graphic: Business Wire)

“Trust is the single most important variable in the customer relationship with commercial insurance providers,” said Stephen Crewdson, senior director of global insurance intelligence at J.D. Power. “Across virtually every business metric that matters to insurers—customer loyalty, advocacy, premium retention, share of wallet—small business owners who trust their insurers represent significantly higher value. While some insurers are doing a great job cultivating that trust, others have a lot of work to do.”

Following are some key findings of the 2024 study:

- Trust is key value driver for commercial insurers: Overall small business customer satisfaction with commercial insurers is 697 (on a 1,000-point scale). Among customers who have the highest levels of trust in their insurance providers, overall satisfaction jumps 180 points to 877. Similarly, 81% of customers with the highest levels of trust say they “definitely will” renew with their carrier and 79% say they “definitely will” recommend their carrier.

- Trust varies widely among small commercial insurers: A 77-point gap separates the insurer with the highest overall trust score from the insurer with the lowest trust score. Insurers that achieve the highest levels of trust perform well on helping their customers understand policy coverage, understand their business needs and personalize products to their specific business needs.

- Premium increases rising: Overall, 36% of small businesses experienced a premium increase this year, up from 34% in 2023. Of those, 51% of increases were initiated by the insurer, 16% were the result of changing business needs and 13% were due to a change the customer made to their policy.

- Understanding reasons for premium increases critical to maintaining trust: When customers completely understand the reasons for a premium increase, trust is 142 points higher than when they do not understand. Notifying customers in advance, particularly via phone and/or in person, and proactively discussing ways to reduce the increase will help customers understand the reasons and build trust.

- Know your customer: Personalization has become a key driver of commercial insurance customer satisfaction, but nearly half of customers are not receiving it. Overall, 55% of commercial insurance customers say they’ve received information personalized to their business from their insurer, which in turn drives an average overall trust score of 761. Overall trust is 106 points lower (655) among the 45% of businesses for which insurance information is not personalized.

Study Ranking

American Family ranks highest in overall customer satisfaction with a score of 727. State Farm (719) ranks second and Allstate (716) ranks third.

The U.S. Small Commercial Insurance Study was redesigned for 2024. It is based on responses from 2,817 small commercial insurance customers. The study, now in its 12th year, examines overall customer satisfaction among small commercial insurance customers with 50 or fewer employees. Overall satisfaction is measured across seven core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance): trust; price for coverage; product/coverage offerings; ease of doing business; people; problem resolution; and digital channels. The study was fielded from February through June 2024.

For more information about the U.S. Small Commercial Insurance Study, visit https://www.jdpower.com/business/insurance/us-small-commercial-insurance-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024087.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20240820939265/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com