The end of the year brings with it portfolio adjustments, window dressing and tax harvesting. This results in fund managers and investors selling their losers and buying the winners. The wash rule requires a 30-day waiting period to repurchase stocks that were sold for a capital loss. This tends to result in selling pressure for losing stocks into the end of the year, followed by a rebound in January when they are repurchased after the 30-day waiting period.

Prudent and risk-tolerant investors anticipating the rebound will often buy a tax-loss selling candidate in December, expecting a rebound in January to sell for a significant profit. Here are three stocks in the consumer discretionary sector that qualify as tax-loss selling candidates to buy for a rebound in January. They also carry high short interest, which is a key factor for bear traps.

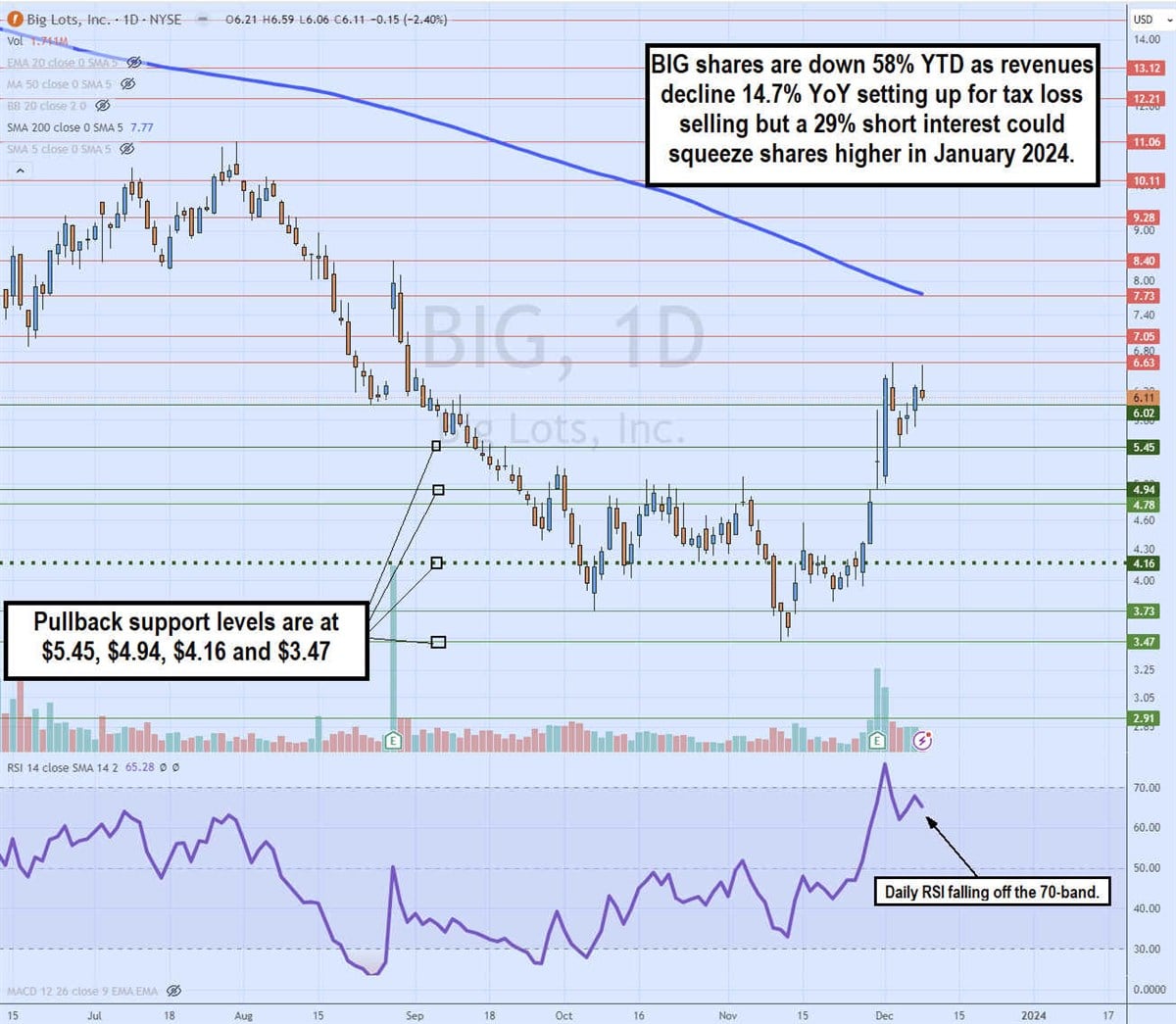

Big Lots Inc. (NYSE: BIG)

This discount retailer of home goods and décor is down 58% year-to-date (YTD) as the macroeconomic slowdown and high inflation caused consumers to trim down on discretionary spending. The company sells a wide range of home items, from beauty supplies, mattresses, furniture, electronics and apparel to pet food and groceries.

As a discount retailer, one would assume they would see an influx of bargain shoppers, but losses keep racking up as revenues continue to decline. However, its recent Q3 2023 earnings report showed some signs of stabilization. The company expects margins to improve to 38%, driven by reduced markdown activity, lower freight prices and cost reduction initiatives.

Signs of improvement

Big Lots reported a Q3 2023 non-GAAP EPS loss of $4.38, beating consensus analyst estimates for a loss of $4.68, a 30-cent beat. GAAP EPS was 16 cents, including a net after-tax benefit of $132.7 million or $4.53 per share. Excluding the benefit, the company lost $127.9 million. Revenues fell 14.7% YoY to $1.03 billion, matching consensus analyst estimates.

The decrease was driven by a comparable sales decrease of 13.2%. A net decrease in stores contributed to a 150 bps sales decline. The company didn’t provide specific forward guidance but did state it expects Q4 2023 adjusted operating result to be ahead of last year.

Big Lots CEO Bruce Thorn commented, "Although the environment remains challenging, we continued to make significant progress in turning around our business. Our key strategic actions are building momentum, and we continue to play offense with our efforts to deliver incredible bargains and communicate unmistakable value. As a result, we are now on track to deliver an adjusted Q4 operating result ahead of last year, which would mark the first quarter of year-over-year improvement in nearly three years, and we expect quarterly year-over-year improvements to continue through 2024."

Big Lots analyst ratings and price targets are at MarketBeat. Big Lots peers and competitor stocks can be found with the MarketBeat stock screener. Check out the sector heatmap on MarketBeat. BIG shares are trading down 58.88% YTD with a 29% short interest.

Daily descending triangle breakout

The daily candlestick chart on BIG illustrates a daily cup pattern that is completed at $6.63. Shares skyrocketed higher into the $5 range on its Q3 2023 earnings results. The daily 200-period moving average resistance sits at $7.73. The daily market structure low (MSL) breakout formed on the $4.16 trigger. The daily relative strength index (RSI) recently peaked on a surge up to the 80-band on the earnings reaction. Shares have slipped back under the 70-band with a potential divergence top. Pullback support levels are at $5.45, $4.94, $4.16 and $3.47.

DISH Network Co. (NASDAQ: DISH)

Satellite TV, mobile and broadband provider Dish Networks caters to rural and communities geographies that may have limited broadband options. Its legacy satellite pay TV business has been steadily declining as the cut-the-cord trend grows. It acquired over-the-top (OTT) streaming service Sling TV as a more affordable and personalized alternative for cord cutters that wish to have live TV and on-demand streaming access.

The company entered the mobile broadband market with the acquisition of Boost Mobile, which was divested as a condition of the T-Mobile US Inc. (NASDAQ: TMUS) and Sprint merger.

5G network and EchoStar merger

DISH has been building out its 5G network and accomplished the requirement of providing 5G access to 70% of the United States population. However, more buildout expenses are expected to accrue in order to take on the wireless incumbents like Verizon Communications Inc. (NYSE: VZ) and AT&T Inc. (NYSE: T). Dish had announced in August that they would be merging with satellite company EchoStar Co. (NASDAQ: SATS) in a stock swap.

Ugly quarter

DISH reported an ugly quarter, causing shares to collapse by 37%. It lost more money and subscribers than expected while funding fears arose regarding the further buildout of its wireless network. On Nov. 6, 2023, DISH reported its Q3 2023 EPS loss of 26 cents, missing analyst estimates by 37 cents. Revenue fell 9.66% YoY to $3.7 billion, missing consensus analyst estimates of $3.82 billion.

Weak metrics

Net pay TV subscribers fell by 64,000 in the quarter, compared to a net increase of 30,000 in the year-ago period. The company closed the quarter with 8.84 million pay-TV subscribers comprised of 6.72 million DISH TV and 2.12 million SLING TV subscribers. Retail wireless subscribers fell by 225,000 compared to a net gain of 1,000 subscribers a year ago.

The company ended the quarter with 7.5 million retail wireless subscribers. For its merger, the CEO of EchoStar, Hamid Akhavan, was appointed the new CEO of DISH as well as the CEO of EchoStar. Management’s comments about a “narrow path” to financial stability spooked investors.

DISH Network analyst ratings and price targets are at MarketBeat. DISH shares are trading down 67.5% YTD with a 22% short interest.

Daily cup pattern formation

The daily candlestick chart on DISH illustrates a cup pattern completion attempt. The Q3 2023 earnings gap formed the cup lip line as shares fell 37% to $3.21. DISH continued to chop, forming a rounding bottom and base to slowly grind back up towards the cup lip line at $4.85. The daily RSI has been climbing towards the 70-band. Pullback support levels are at $4.08, $3.51, $3.21 and $2.65.

Sleep Number Co. (NASDAQ: SNBR)

Sleep Number manufactures customized adjustable beds using its SleepIQ technology to collect data to help improve a user's sleep quality. The level of firmness can be adjusted after determining what the best sleep number setting is for the user. SleepIQ technology measures billions of data points nightly and various aspects of a user's sleep, including movements, heart rate, sleep duration and patterns. The beds are ideal with consumers who struggle with sleep issues, including apnea, insomnia and restless leg syndrome.

Turnaround measures

The Q3 2023 earnings report was a disaster as the company missed analyst estimates for a profit of 16 cents by 26 cents, posting a loss of 10 cents. Revenues tumbled 13% YoY to $473 million, well below the $508.56 million that analysts expected. To speed up a turnaround, the company will implement another $50 million in cost reductions on top of the $80 million it initiated in 2023. Sleep Number will implement a 10% headcount reduction and close 40 to 50 stores in 2024. This prompted the company to lower its full-year 2023 estimates for a loss of 70 cents inclusive of a 35-cent restructuring charge.

Sleep Number analyst ratings and price targets are at MarketBeat. Shares are trading down 43.5% YTD with a 16% short interest.