Liverpool, New York--(Newsfile Corp. - May 4, 2021) - Supurva Healthcare Group, Inc. (OTC Pink: SPRV) "Booming." Booming is the only word to describe demand for medical office buildings ("MOBs"). With the nation slowly recovering from the COVID-19 pandemic, investors have concluded that the number one real estate investment opportunity today is MOBs.

The formerly niche product has moved front and center as multifamily yields have compressed in recent years and the current retail and broader office investment landscapes have seen a large-scale disruption related to the ongoing COVID-19 issue. The MOB asset class has exhibited consistent growth in recent years, buoyed by both increased demand for outpatient services and strong historical performance. MOBs are a significant subset of the greater office asset class and are growing in stature among experienced real estate investors. As the name suggests, MOBs are developed specifically for tenants in the medical field to consult with patients and perform various surgical procedures.

Supurva's decision to invest in MOBs is coming at an opportunistic time as it seeks to create a portfolio of MOBs. It is the Company's firm belief that that despite the economic turmoil caused by COVID-19 and the growth of telehealth, the MOB market has and will remain resilient. MOBs will sustain their power through the coming decades as the U.S. population ages, consumes more healthcare services, and receives more of those health care services at outpatient settings. With advances in medical technologies, procedures that once could only be performed at hospitals or ambulatory care facilities can now be performed at the physician's office, further fueling demand for MOBs. Investors are beginning to realize that MOBs represent an alternative asset class that is rapidly increasing in popularity.

Mr. Murphy, Supurva's chief executive officer, reported that the number one takeaway from a recent real estate investment symposium was simple and straightforward: Investors should liquidate their other real estate holdings and put their money into MOBs. Mr. Murphy added, "for real estate investors seeking a steady return on their investment the only safe, secure, and reliable real estate investment opportunity today is clearly MOBs. Supurva will be working with real estate professionals throughout the country to identify undervalued and underutilized medical office buildings."

Jones Lang Lasalle (JLL), a leading real estate investment company reported in a February 2021 article that despite the economic downturn of 2020, there has been no downturn in demand for MOBs. Despite the financing obstacles witnessed during the pandemic, sales of MOBs exceeded $13 billion in 2020, which was on par with pre-pandemic sales levels in both 2018 and 2019. While other real estate investments declined by an average of 33%, MOBs sales remained strong, further demonstrating that MOBs can withstand pandemic-related operational challenges. JLL went on to report that medical offices remain a favored sector for real estate investment as evidenced by new entrants into the space, including institutional investors, private equity funds, and individual investors. The compelling investment thesis for medical office space has generated a significant supply of investment capital (both debt and equity) waiting to be deployed into this space, providing a very liquid and competitive market for sellers. The demand-driven increase in healthcare services from a growing and aging population (10,000 people per day turning 65) has pushed hospitals and health systems to create lower cost outpatient care alternatives.

If you cannot view the image above, please visit:

https://orders.newsfilecorp.com/files/7967/82753_2f7d028b74504869_001full.jpg

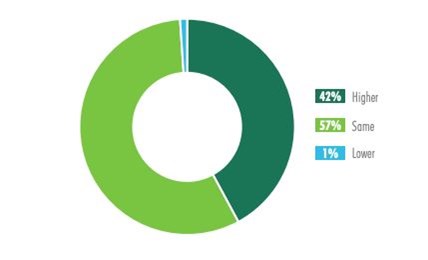

JLL is not the only real estate investment company focusing on MOBs. According to the CBRE Group, compared to other asset classes and the overarching office class specifically, MOBs generally exhibit uniquely steady long-term occupancy rates. CBRE data suggests that medical office vacancy rates have consistently been lower than the total office sector, with vacancy rates falling from 11.1% in 2010 to 8.4% by mid-year 2018. According to the CBRE 2019 Healthcare Real Estate Investor & Developer Survey Results, 99% of CRE firms stated that between 2018 and 2019 the occupancy of their medical office portfolios either remained stable or increased from the year prior.

The strength of MOB occupancy rates is partly due to the length of leases that medical tenants typically sign. Because the physical features of MOBs are very specific-offices, medical treatment rooms, surgical rooms, and waiting rooms-the build-out is often more costly than that of a traditional office tenant, and medical tenants typically sign longer leases for this reason. Tenants also tend to stay put longer given the high switching costs associated with relocating. In addition to stable occupancy rates, MOBs have also exhibited consistent rent growth over the past ten years, which can be seen in the below graph. In 2018, the average asking rental price increased to almost $23/SF, a 1.4% increase year-to-year. Average asking rent for U.S. MOBs remained at a near-record level in Q2 2019 according to CBRE.

Finally, Mr. Murphy commented that, "MOBs represent the Company's future and MOBs represent the RX for success."

Forward-Looking Statements and Disclaimers

This release may include "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") Future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable securities laws. Information that is based upon beliefs of, and information currently available to, the company's management as well as estimates and assumptions made by the company's management are forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historic or current facts. When used in this press release the words "estimate," "expect," intend," believe," plan," "anticipate," "projected" and other words or the negative of these terms and similar expressions as they relate to the company or the company's management identify forward-looking statements. Such statements reflect the current view of the company with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the company's industry, its operations and results of operations and any businesses that may be acquired by the company. Should one or more of these risks or uncertainties materialize, or the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned. Although the company believes that the expectations reflected in the forward-looking statements are reasonable, the company cannot guarantee future results, performance, or achievements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the Company's control, and that actual results may differ materially from those projected in the forward-looking statements. Except as required by applicable law, the company does not intend to update any of the forward-looking statements to conform these statements to actual results.

For additional information

(888) 448-3877

Email: investor@medicalsouthern.com

Website: https://sprvcorp.com

Twitter: https://twitter.com/sprvcorp

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/82753