Network application delivery and security specialist F5 (NASDAQ:FFIV) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 5.6% year on year to $746.7 million. Guidance for next quarter’s revenue was also better than expected at $715 million at the midpoint, 1.3% above analysts’ estimates. Its non-GAAP profit of $3.67 per share was also 6.4% above analysts’ consensus estimates.

Is now the time to buy F5? Find out by accessing our full research report, it’s free.

F5 (FFIV) Q3 CY2024 Highlights:

- Revenue: $746.7 million vs analyst estimates of $730.6 million (2.2% beat)

- Adjusted EPS: $3.67 vs analyst estimates of $3.45 (6.4% beat)

- EBITDA: $257,000 vs analyst estimates of $281.1 million (99.9% miss)

- Revenue Guidance for Q4 CY2024 is $715 million at the midpoint, above analyst estimates of $706 million

- Adjusted EPS guidance for Q4 CY2024 is $3.35 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 80.8%, in line with the same quarter last year

- EBITDA Margin: 0%, down from 38.1% in the same quarter last year

- Free Cash Flow Margin: 25.7%, up from 22% in the previous quarter

- Billings: $767 million at quarter end, up 11% year on year

- Market Capitalization: $12.64 billion

“Our fourth quarter revenue of $747 million reflects 6% growth year over year and includes a 19% increase in software revenue from the fourth quarter of fiscal year 2023,” said François Locoh-Donou, F5’s President and CEO.

Company Overview

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

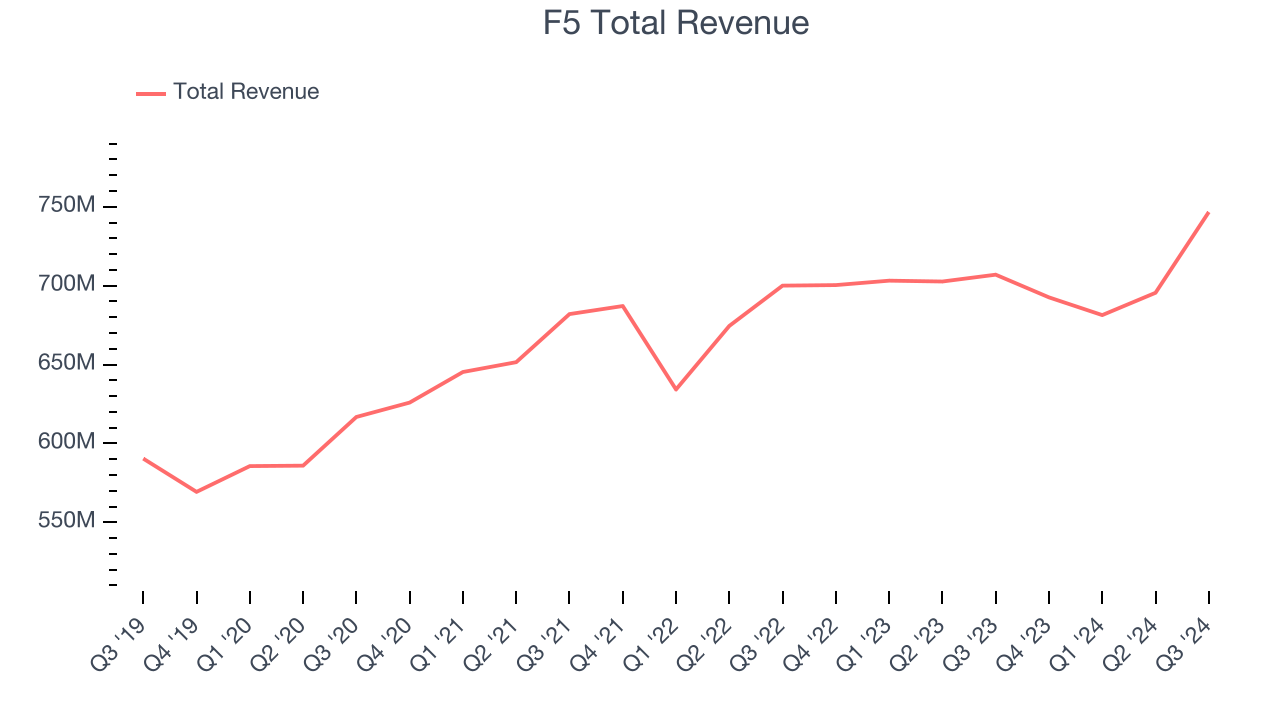

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, F5’s 2.6% annualized revenue growth over the last three years was weak. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, F5 reported year-on-year revenue growth of 5.6%, and its $746.7 million of revenue exceeded Wall Street’s estimates by 2.2%. Management is currently guiding for a 3.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates the market believes its newer products and services will not lead to better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

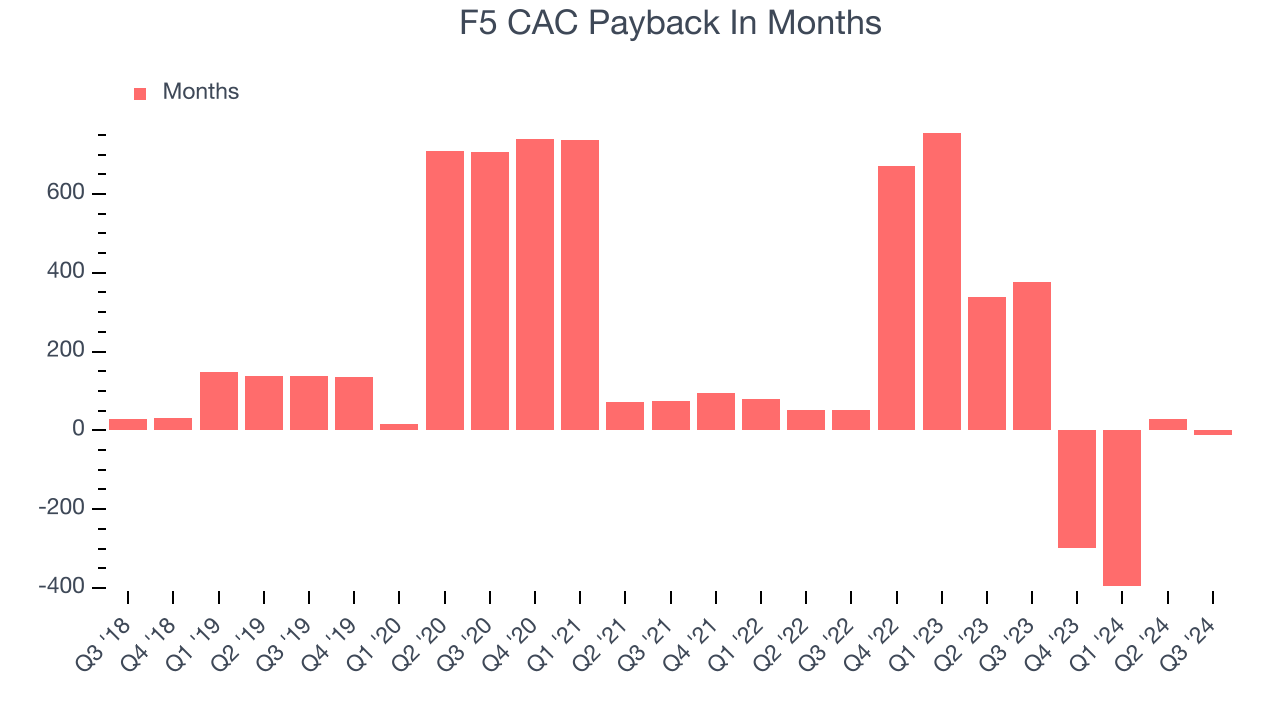

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for F5 to acquire new customers as its CAC payback period checked in at -12.4 months this quarter. The company’s inefficiency indicates a highly competitive environment with little differentiation between F5’s products and its peers.

Key Takeaways from F5’s Q3 Results

We were impressed by how strongly F5 blew past analysts’ billings expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Looking ahead, revenue guidance for next quarter came in ahead while EPS was in line. Zooming out, we think this was a solid quarter. The stock traded up 11.1% to $242.61 immediately after reporting.

Is F5 an attractive investment opportunity at the current price?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.