Tanking company Scorpio Tankers (NYSE:STNG) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 7.3% year on year to $268 million. Its non-GAAP profit of $1.75 per share was also 6.7% below analysts’ consensus estimates.

Is now the time to buy Scorpio Tankers? Find out by accessing our full research report, it’s free.

Scorpio Tankers (STNG) Q3 CY2024 Highlights:

- Revenue: $268 million vs analyst estimates of $282.7 million (5.2% miss)

- Adjusted EPS: $1.75 vs analyst expectations of $1.88 (6.7% miss)

- EBITDA: $166.1 million vs analyst estimates of $166.3 million (small miss)

- Gross Margin (GAAP): 66.1%, down from 72% in the same quarter last year

- Operating Margin: 63.8%, up from 48.9% in the same quarter last year

- EBITDA Margin: 62%, down from 64.1% in the same quarter last year

- Free Cash Flow Margin: 69.9%, up from 60.4% in the same quarter last year

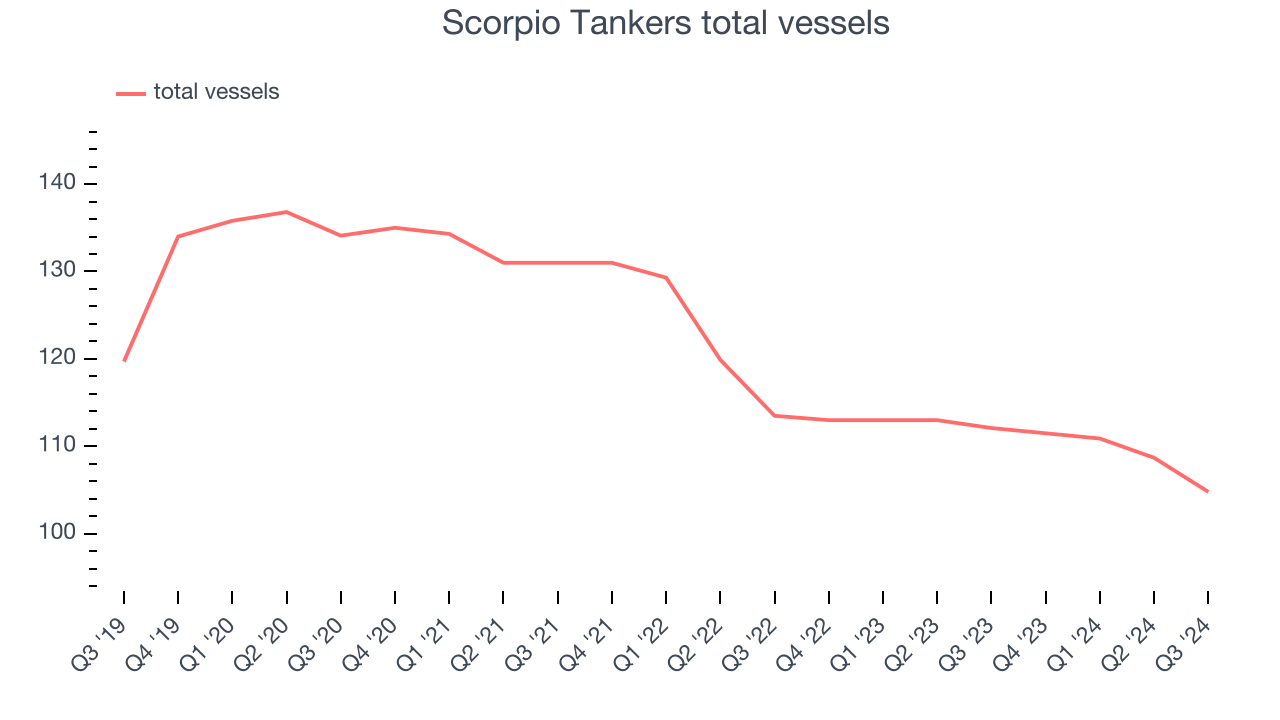

- total vessels: 104.8, down 7.3 year on year

- Market Capitalization: $2.90 billion

Company Overview

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Sales Growth

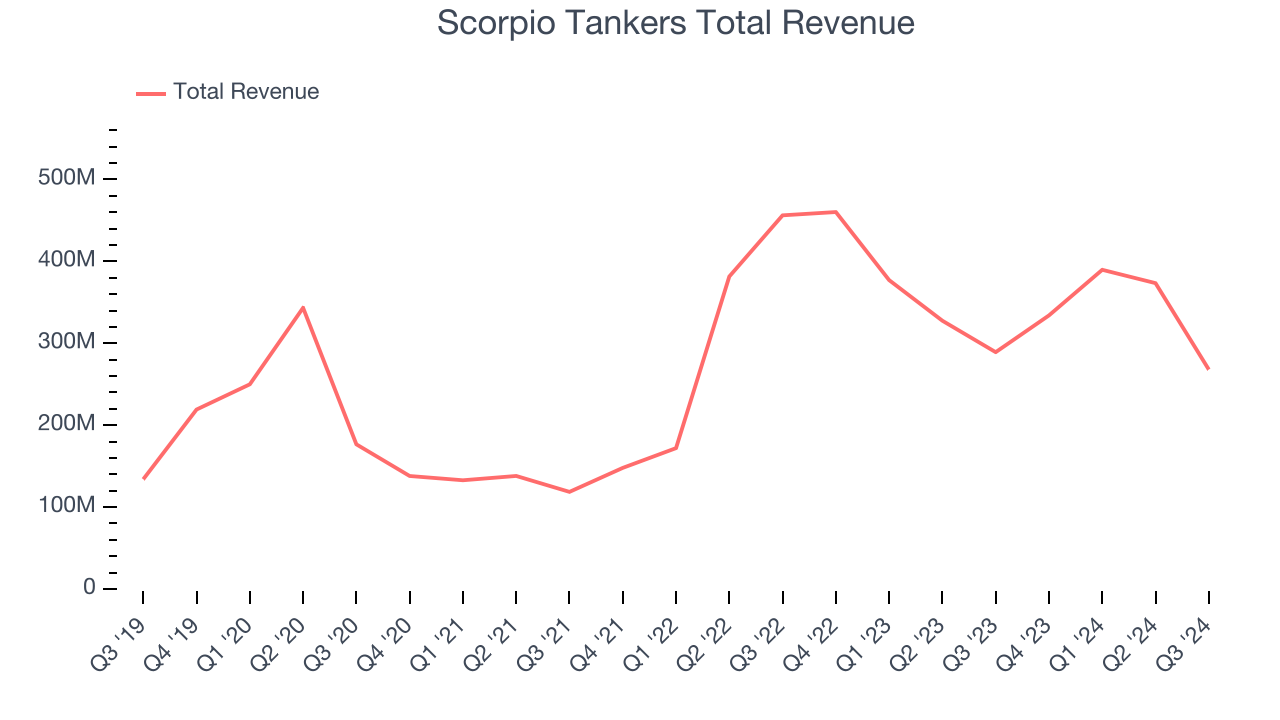

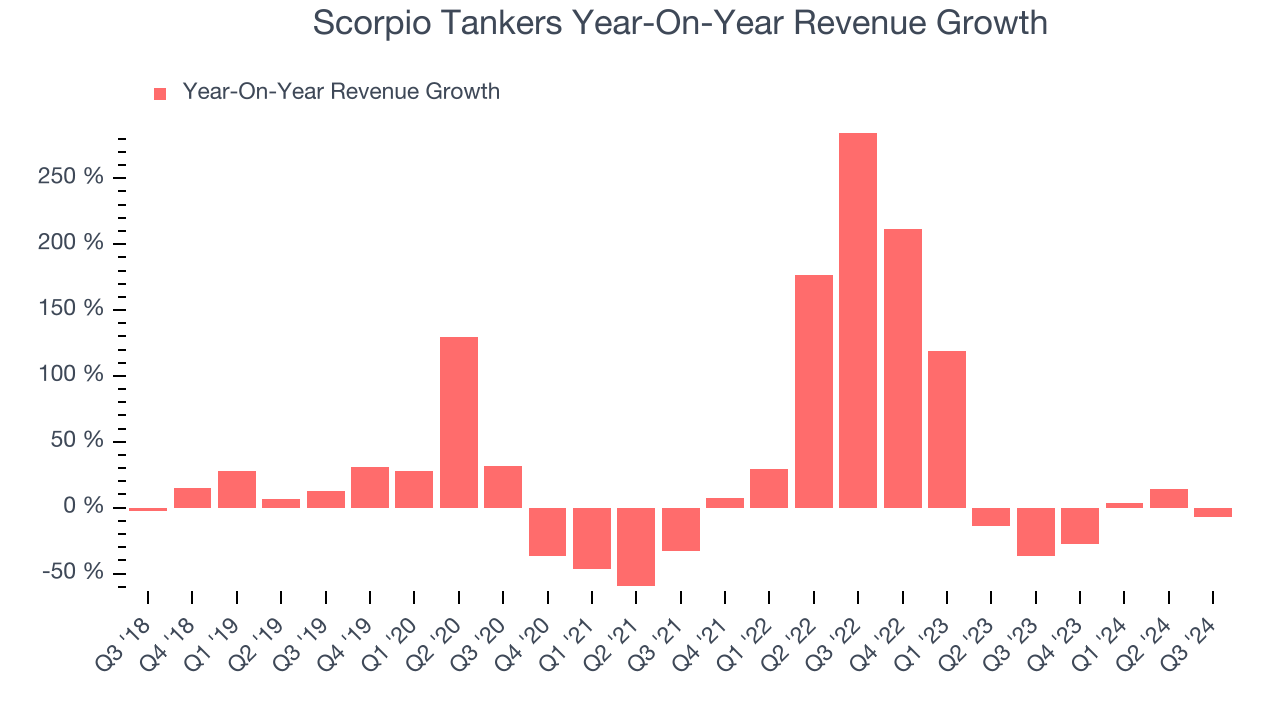

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Scorpio Tankers grew its sales at an incredible 16.1% compounded annual growth rate. This is a great starting point for our analysis because it shows Scorpio Tankers’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Scorpio Tankers’s annualized revenue growth of 8.6% over the last two years is below its five-year trend, but we still think the results were respectable. We also think Scorpio Tankers’s is one of the better Marine Transportation businesses as many of its peers faced declining sales because of cyclical headwinds.

We can dig further into the company’s revenue dynamics by analyzing its number of total vessels, which reached 104.8 in the latest quarter. Over the last two years, Scorpio Tankers’s total vessels averaged 5.9% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Scorpio Tankers missed Wall Street’s estimates and reported a rather uninspiring 7.3% year-on-year revenue decline, generating $268 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline 19.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

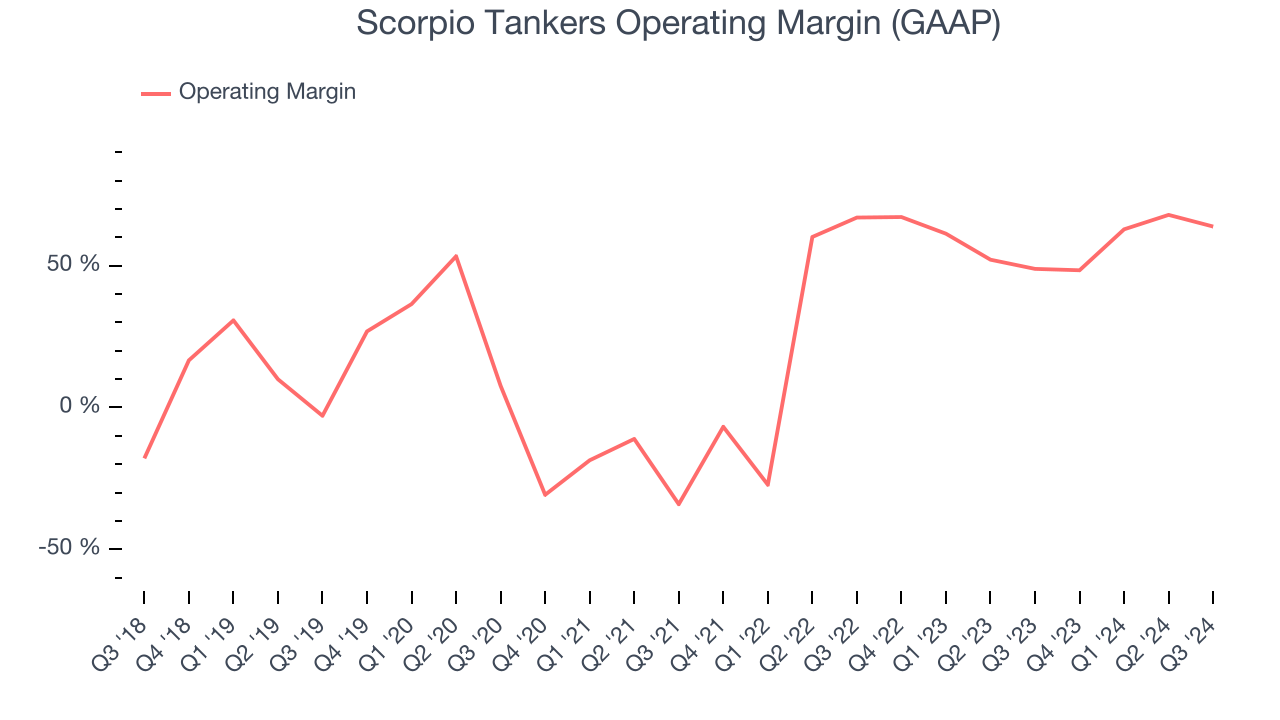

Operating Margin

Scorpio Tankers has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 43.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Scorpio Tankers’s annual operating margin rose by 25.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Scorpio Tankers generated an operating profit margin of 63.8%, up 14.9 percentage points year on year. The increase was solid, and since its revenue and gross margin actually decreased, we can assume it was recently more efficient because it trimmed its operating expenses like marketing, R&D, and administrative overhead.

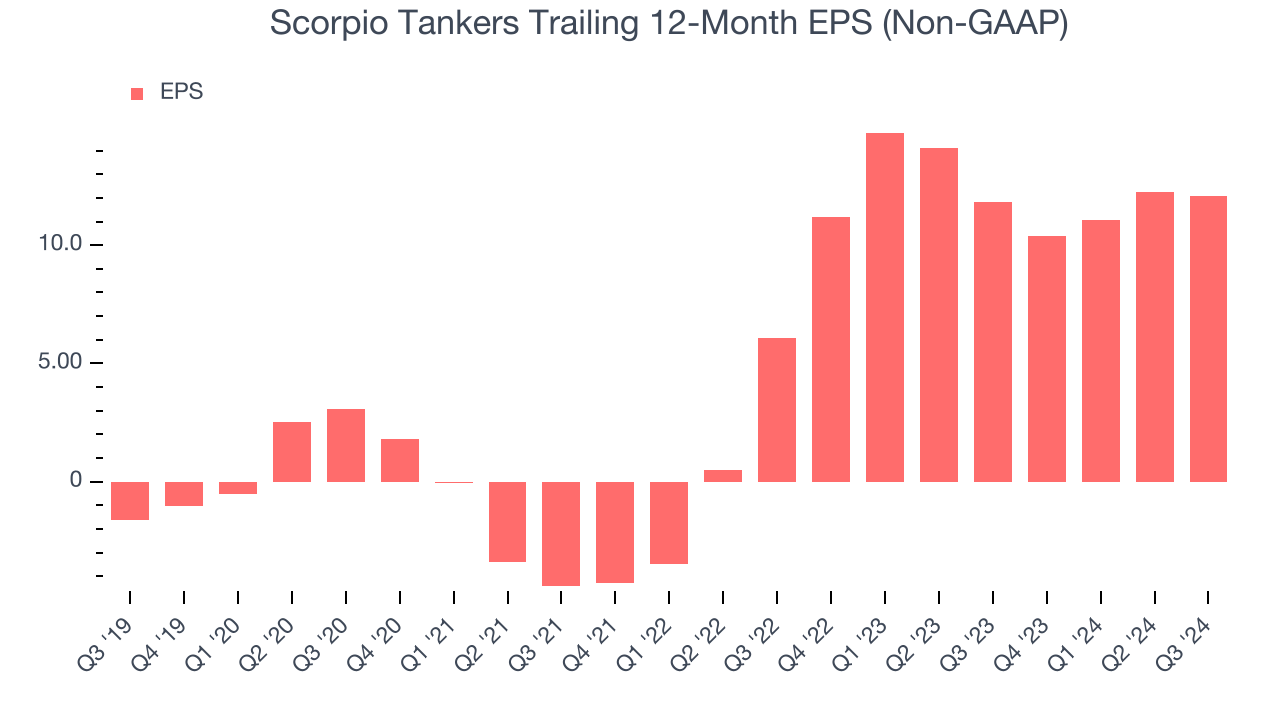

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Scorpio Tankers’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

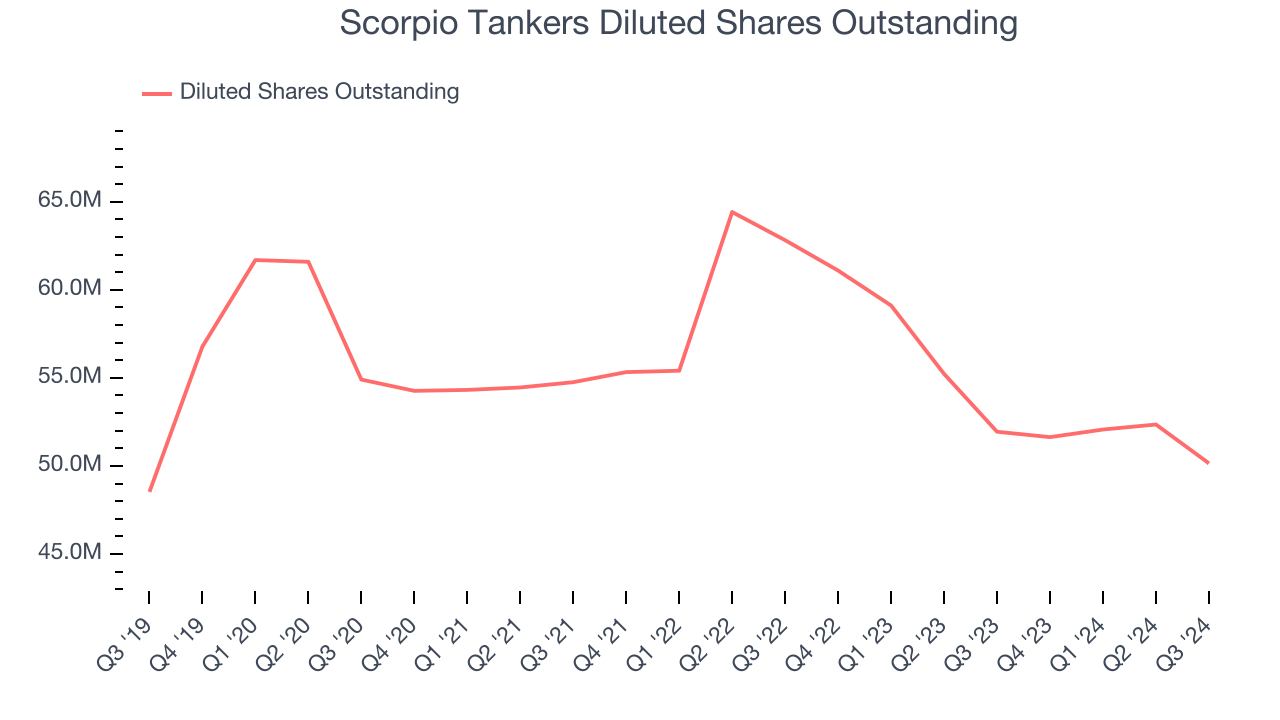

Scorpio Tankers’s EPS grew at an astounding 40.7% compounded annual growth rate over the last two years, higher than its 8.6% annualized revenue growth. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand during this timeframe.

Diving into Scorpio Tankers’s quality of earnings can give us a better understanding of its performance. A two-year view shows that Scorpio Tankers has repurchased its stock, shrinking its share count by 20.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Scorpio Tankers reported EPS at $1.75, down from $1.91 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Scorpio Tankers’s full-year EPS of $12.07 to shrink by 22.8%.

Key Takeaways from Scorpio Tankers’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 2.7% to $62.55 immediately after reporting, though, suggesting that perhaps expectations were low going into the print.

So do we think Scorpio Tankers is an attractive buy at the current price?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.