Manufacturing equipment and systems provider Advanced Energy (NASDAQ:AEIS) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 8.7% year on year to $374.2 million. The company expects next quarter’s revenue to be around $392 million, coming in 1.6% above analysts’ estimates. Its non-GAAP profit of $0.98 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Advanced Energy? Find out by accessing our full research report, it’s free.

Advanced Energy (AEIS) Q3 CY2024 Highlights:

- Revenue: $374.2 million vs analyst estimates of $372.5 million (in line)

- Adjusted EPS: $0.98 vs analyst estimates of $0.91 (8.1% beat)

- Revenue Guidance for Q4 CY2024 is $392 million at the midpoint, above analyst estimates of $385.9 million

- Adjusted EPS guidance for Q4 CY2024 is $1.08 at the midpoint, above analyst estimates of $1.00

- Gross Margin (GAAP): 35.8%, in line with the same quarter last year

- Operating Margin: -3%, down from 7.3% in the same quarter last year

- EBITDA Margin: 1.8%, down from 14.8% in the same quarter last year

- Free Cash Flow Margin: 5.7%, down from 14.5% in the same quarter last year

- Market Capitalization: $4.18 billion

“In the third quarter, we delivered results above the midpoint of guidance due to higher demand in the semiconductor and data center computing markets,” said Steve Kelley, president and CEO of Advanced Energy.

Company Overview

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ:AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Sales Growth

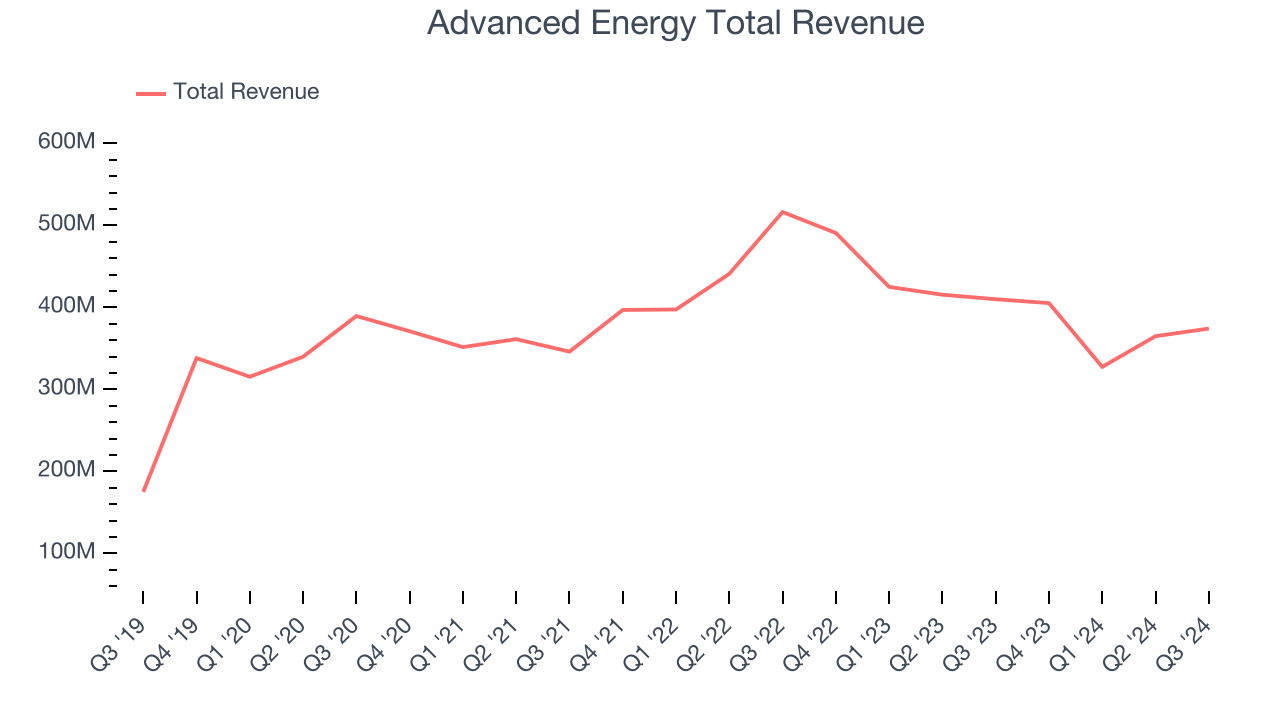

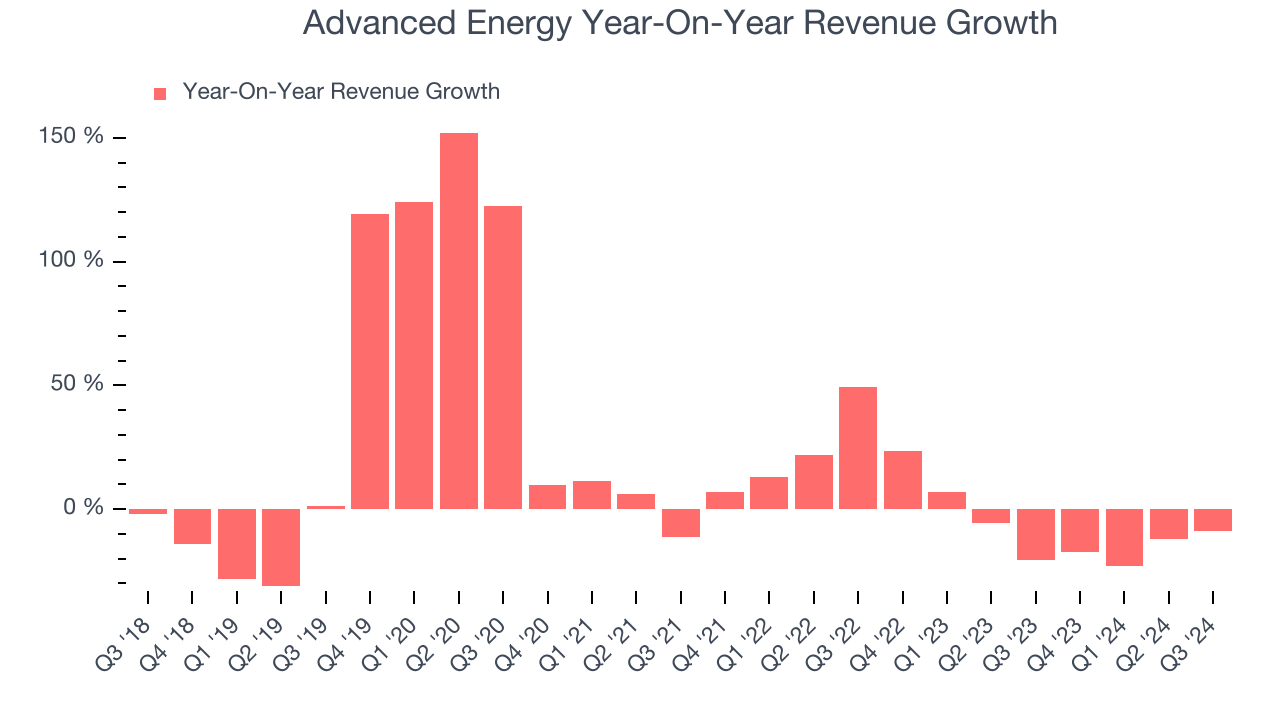

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Advanced Energy’s sales grew at an incredible 19.5% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Advanced Energy’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 8.3% over the last two years. Advanced Energy isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

Advanced Energy also breaks out the revenue for its most important segments, Semiconductor Equipment and Industrial and Medical Equipment, which are 52.8% and 20.5% of revenue. Over the last two years, Advanced Energy’s Semiconductor Equipment revenue (i.e., plasma power) averaged 4.9% year-on-year declines while its Industrial and Medical Equipment revenue (i.e., robotics) averaged 3.2% declines.

This quarter, Advanced Energy reported a rather uninspiring 8.7% year-on-year revenue decline to $374.2 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 3.3% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and shows the market thinks its newer products and services will catalyze higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

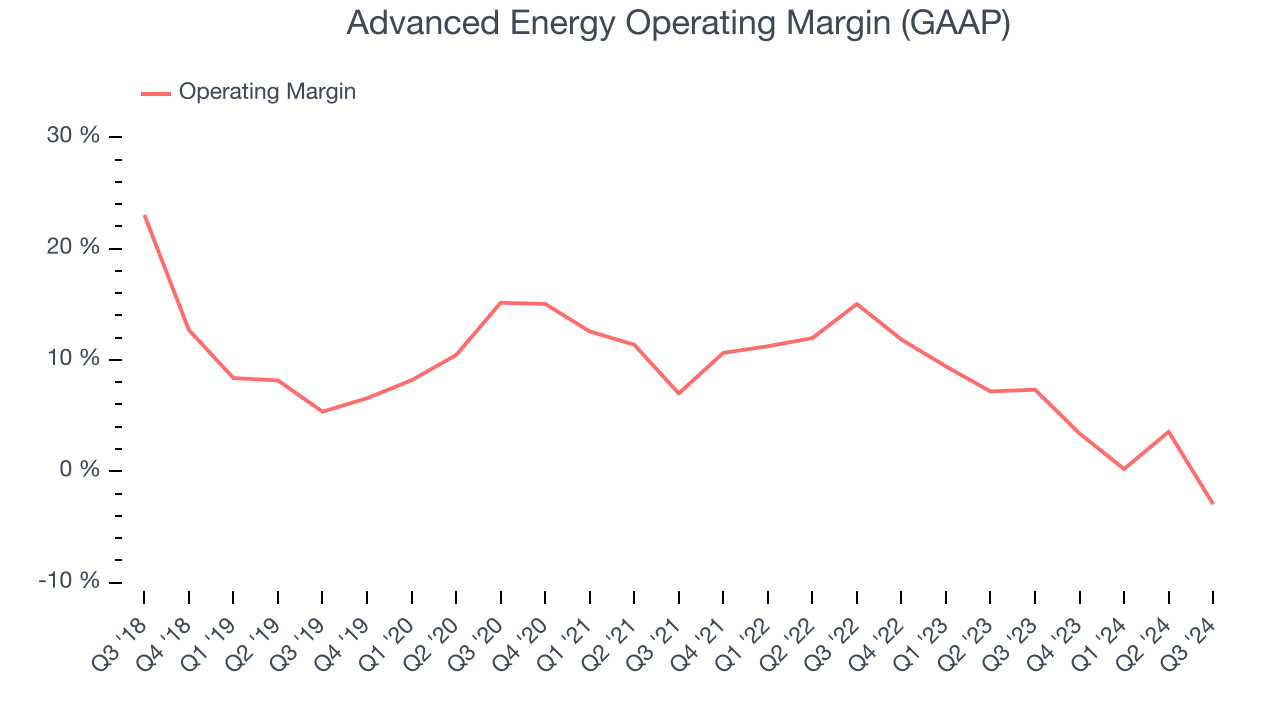

Advanced Energy has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Advanced Energy’s annual operating margin decreased by 9.2 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Advanced Energy become more profitable in the future.

In Q3, Advanced Energy generated an operating profit margin of negative 3%, down 10.3 percentage points year on year. Since Advanced Energy’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

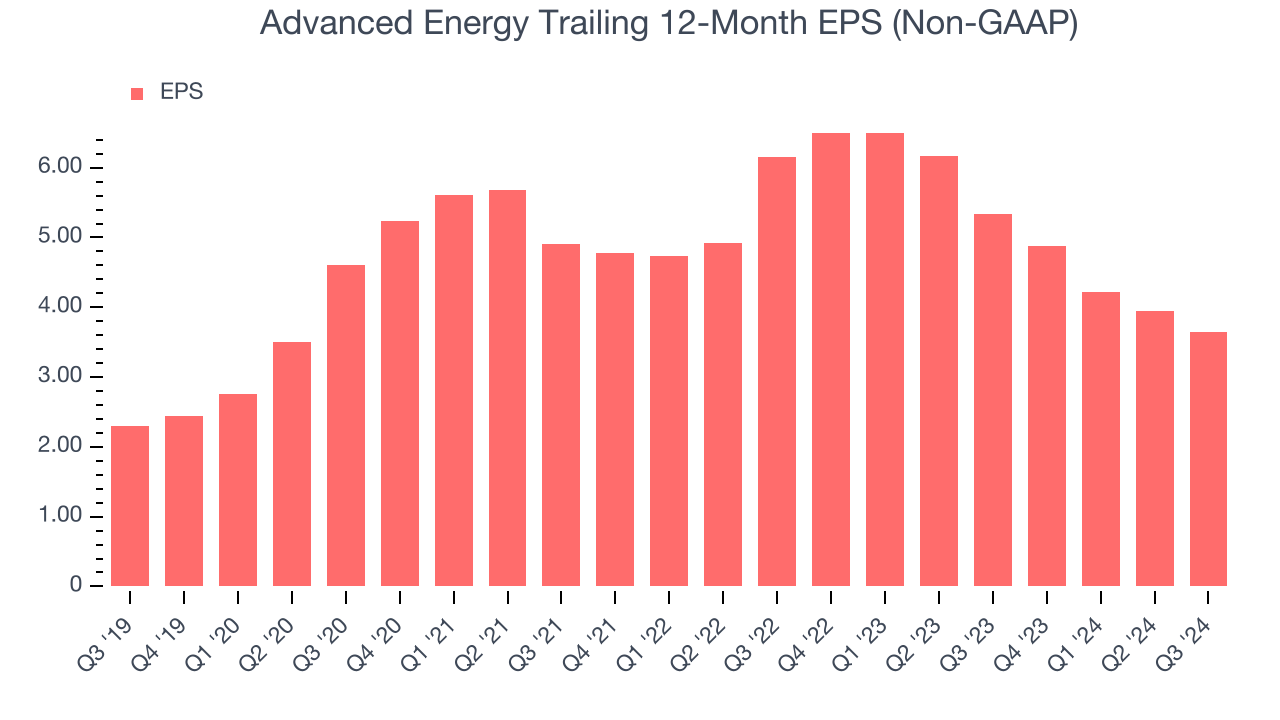

Advanced Energy’s EPS grew at a decent 9.7% compounded annual growth rate over the last five years. However, this performance was lower than its 19.5% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Advanced Energy’s earnings can give us a better understanding of its performance. As we mentioned earlier, Advanced Energy’s operating margin declined by 9.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Advanced Energy, its two-year annual EPS declines of 23% mark a reversal from its five-year trend. We hope Advanced Energy can return to earnings growth in the future.In Q3, Advanced Energy reported EPS at $0.98, down from $1.28 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.1%. Over the next 12 months, Wall Street expects Advanced Energy’s full-year EPS of $3.65 to grow by 28.6%.

Key Takeaways from Advanced Energy’s Q3 Results

We were impressed by Advanced Energy’s optimistic revenue and EPS forecast for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this was a good quarter. The stock remained flat at $107.77 immediately following the results.

Is Advanced Energy an attractive investment opportunity right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.