Consumer products giant Clorox (NYSE:CLX) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 27.1% year on year to $1.76 billion. Its non-GAAP profit of $1.86 per share was also 33.6% above analysts’ consensus estimates.

Is now the time to buy Clorox? Find out by accessing our full research report, it’s free.

Clorox (CLX) Q3 CY2024 Highlights:

- Revenue: $1.76 billion vs analyst estimates of $1.64 billion (7.6% beat)

- Adjusted EPS: $1.86 vs analyst estimates of $1.39 (33.6% beat)

- Management raised its full-year Adjusted EPS guidance to $6.78 at the midpoint, a 1.5% increase

- Gross Margin (GAAP): 45.8%, up from 39.2% in the same quarter last year

- Operating Margin: 10%, up from 5.3% in the same quarter last year

- Organic Revenue rose 31% year on year (-18% in the same quarter last year)

- Market Capitalization: $19.43 billion

"We achieved better-than-expected results this quarter and fully restored overall market share, enabling us to maintain our sales outlook and raise our gross margin and EPS outlook for the year," said Chair and CEO Linda Rendle.

Company Overview

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Clorox is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when you've already penetrated the market.

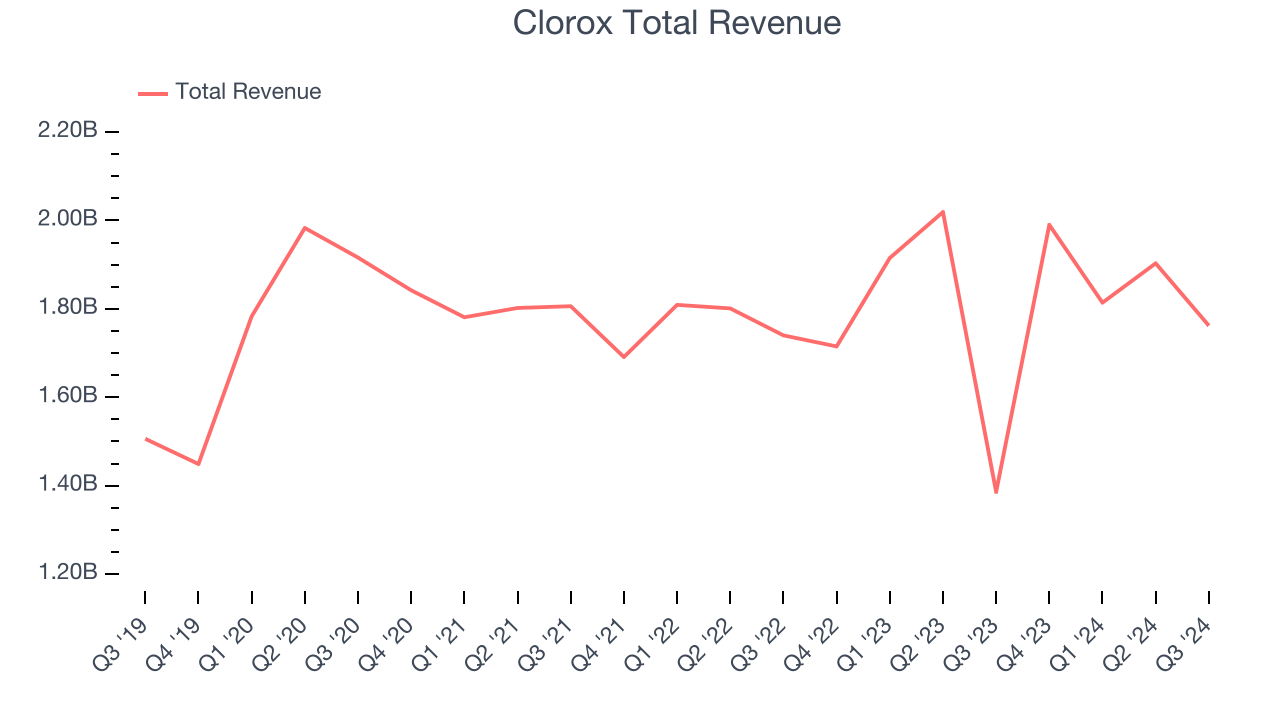

As you can see below, Clorox’s 1.1% annualized revenue growth over the last three years was weak. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Clorox reported robust year-on-year revenue growth of 27.1%, and its $1.76 billion of revenue topped Wall Street estimates by 7.6%.

Looking ahead, sell-side analysts expect revenue to decline 5.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market believes its products will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

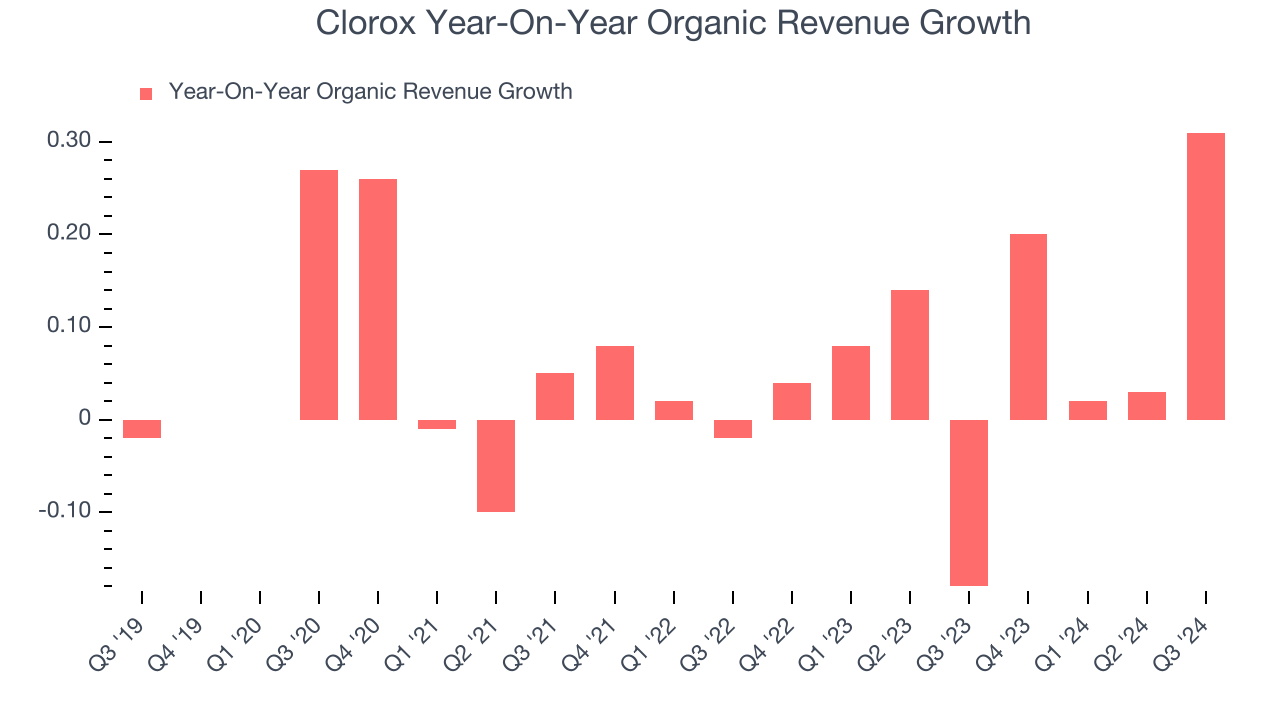

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Clorox has generated solid demand for its products over the last two years. On average, the company’s organic sales have grown by 8% year on year.

In the latest quarter, Clorox’s organic sales rose 31% year on year. This growth was a well-appreciated turnaround from the 18% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Clorox’s Q3 Results

We were impressed by how significantly Clorox blew past analysts’ organic revenue and EPS expectations this quarter. We were also excited it raised its full-year EPS guidance. Zooming out, we think this "beat and raise" quarter featured some important positives. The stock traded up 2.9% to $161.05 immediately following the results.

Clorox had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.