Power transmission and fluid power solutions provider Gates Corporation (NYSE:GTES) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 4.8% year on year to $830.7 million. Its non-GAAP profit of $0.33 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Gates Industrial Corporation? Find out by accessing our full research report, it’s free.

Gates Industrial Corporation (GTES) Q3 CY2024 Highlights:

- Revenue: $830.7 million vs analyst estimates of $831.7 million (in line)

- Adjusted EPS: $0.33 vs analyst estimates of $0.31 (8.1% beat)

- EBITDA: $182.5 million vs analyst estimates of $176.9 million (3.1% beat)

- Management raised its full-year Adjusted EPS guidance to $1.35 at the midpoint, a 2.3% increase

- EBITDA guidance for the full year is $755 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 40.4%, up from 39.3% in the same quarter last year

- Operating Margin: 13.6%, in line with the same quarter last year

- EBITDA Margin: 22%, in line with the same quarter last year

- Free Cash Flow Margin: 11.3%, similar to the same quarter last year

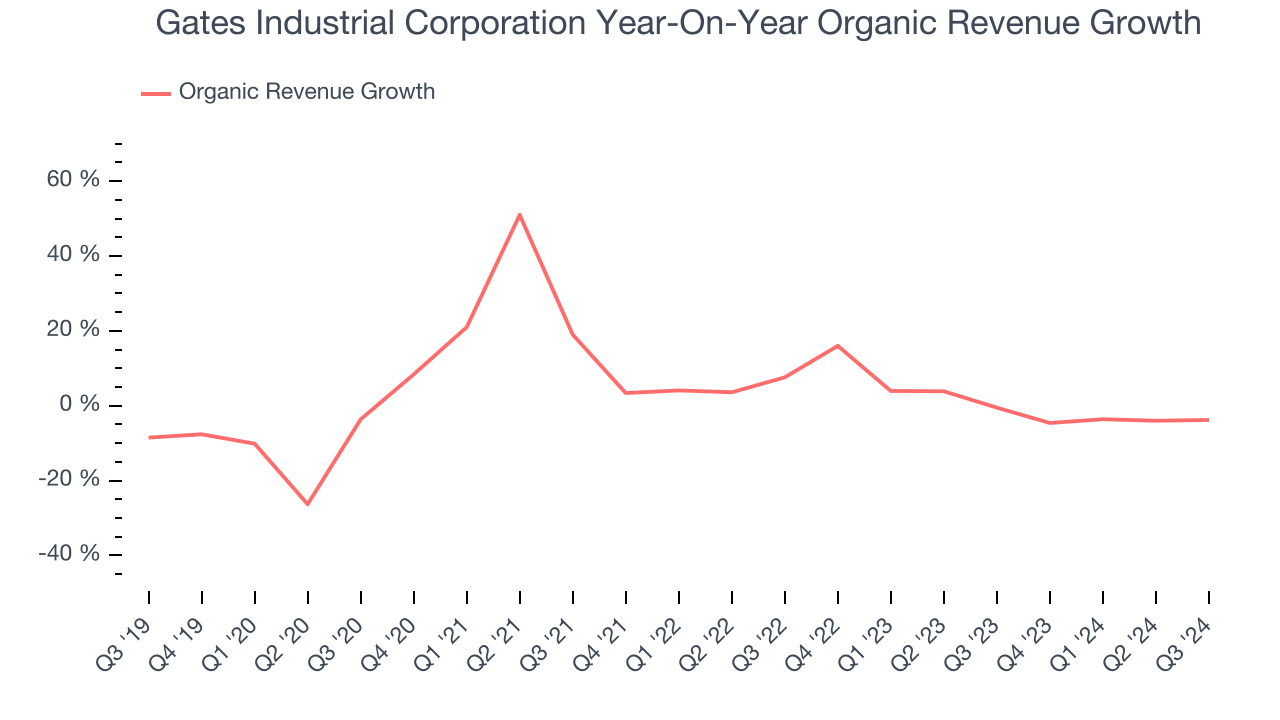

- Organic Revenue fell 3.8% year on year (-0.5% in the same quarter last year)

- Market Capitalization: $4.64 billion

Ivo Jurek, Gates Industrial's Chief Executive Officer, commented, "In the third quarter, our teams executed well and generated over 100 basis points of gross margin improvement in an uneven end market environment. We continue to progress our enterprise initiatives and improve our balance sheet while opportunistically returning capital to our shareholders. "

Company Overview

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE:GTES) offers power transmission and fluid transfer equipment for various industries.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

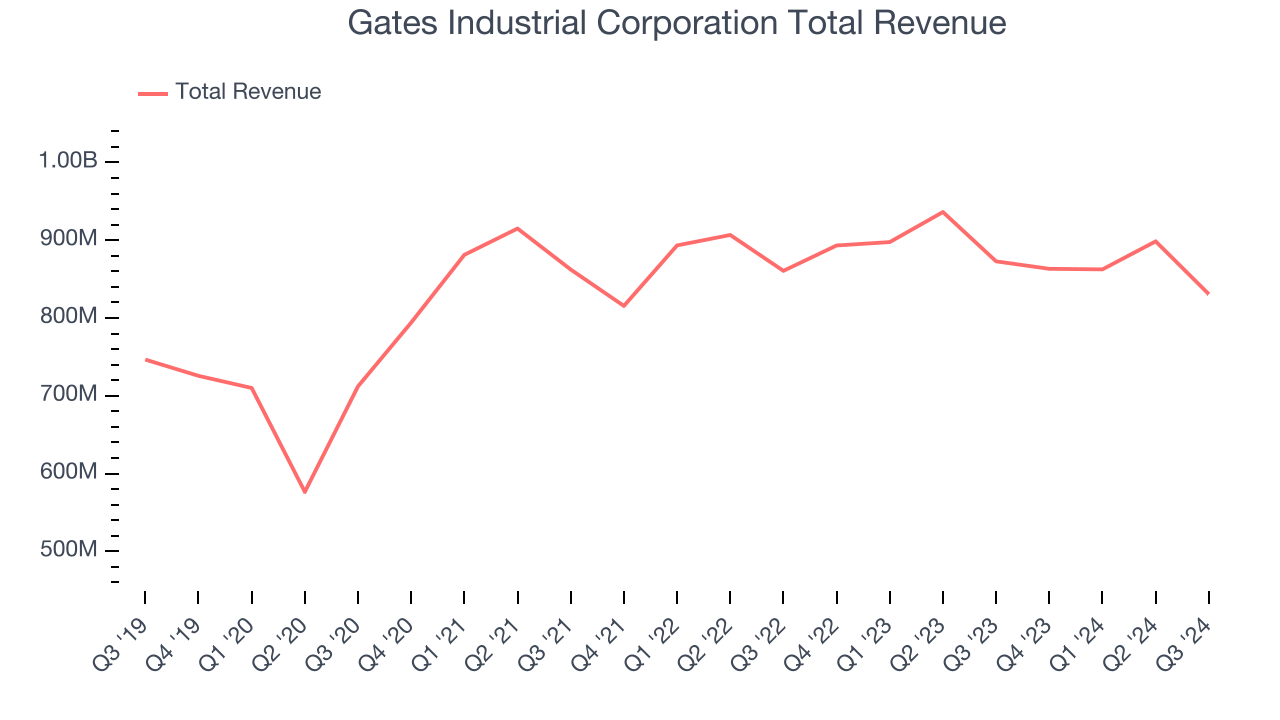

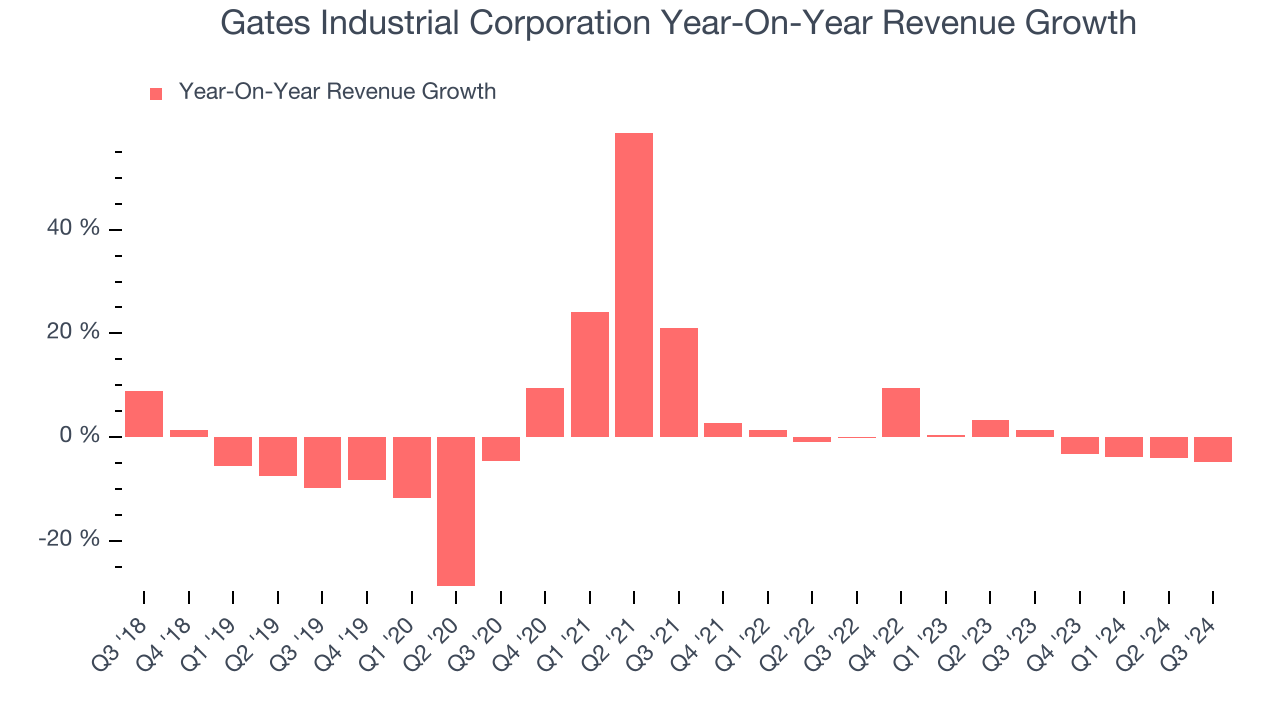

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Gates Industrial Corporation grew its sales at a sluggish 1.8% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Gates Industrial Corporation’s recent history shows its demand slowed as its revenue was flat over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Gates Industrial Corporation’s organic revenue was flat. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not M&A) drove most of its performance.

This quarter, Gates Industrial Corporation reported a rather uninspiring 4.8% year-on-year revenue decline to $830.7 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection illustrates the market thinks its newer products and services will catalyze better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

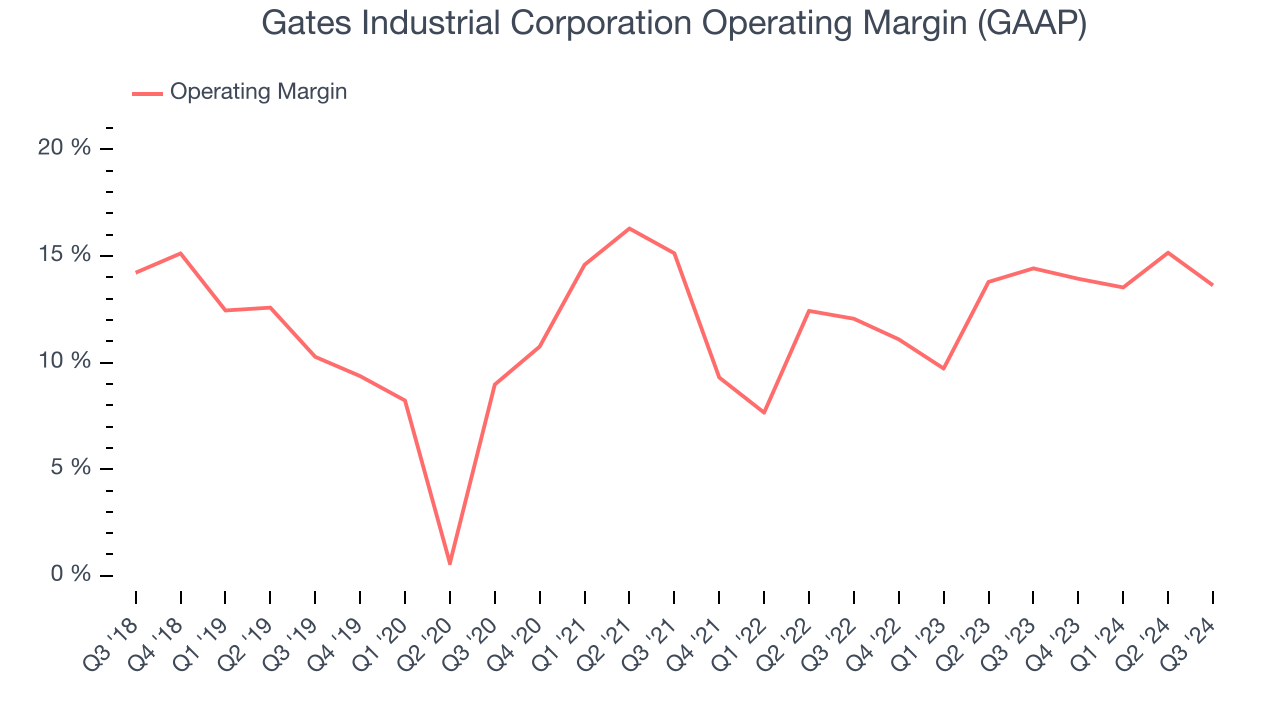

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Gates Industrial Corporation has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 11.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Gates Industrial Corporation’s annual operating margin rose by 7 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Gates Industrial Corporation generated an operating profit margin of 13.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

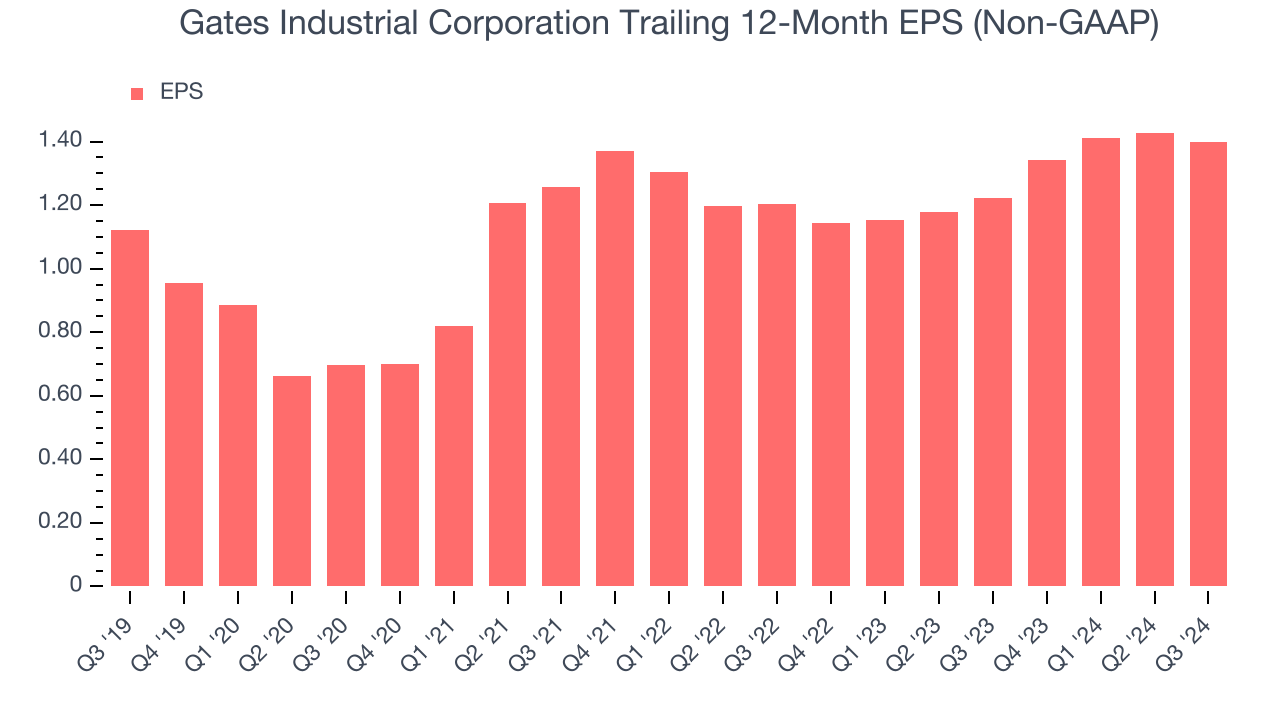

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Gates Industrial Corporation’s EPS grew at an unimpressive 4.5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.8% annualized revenue growth and tells us the company became more profitable as it expanded.

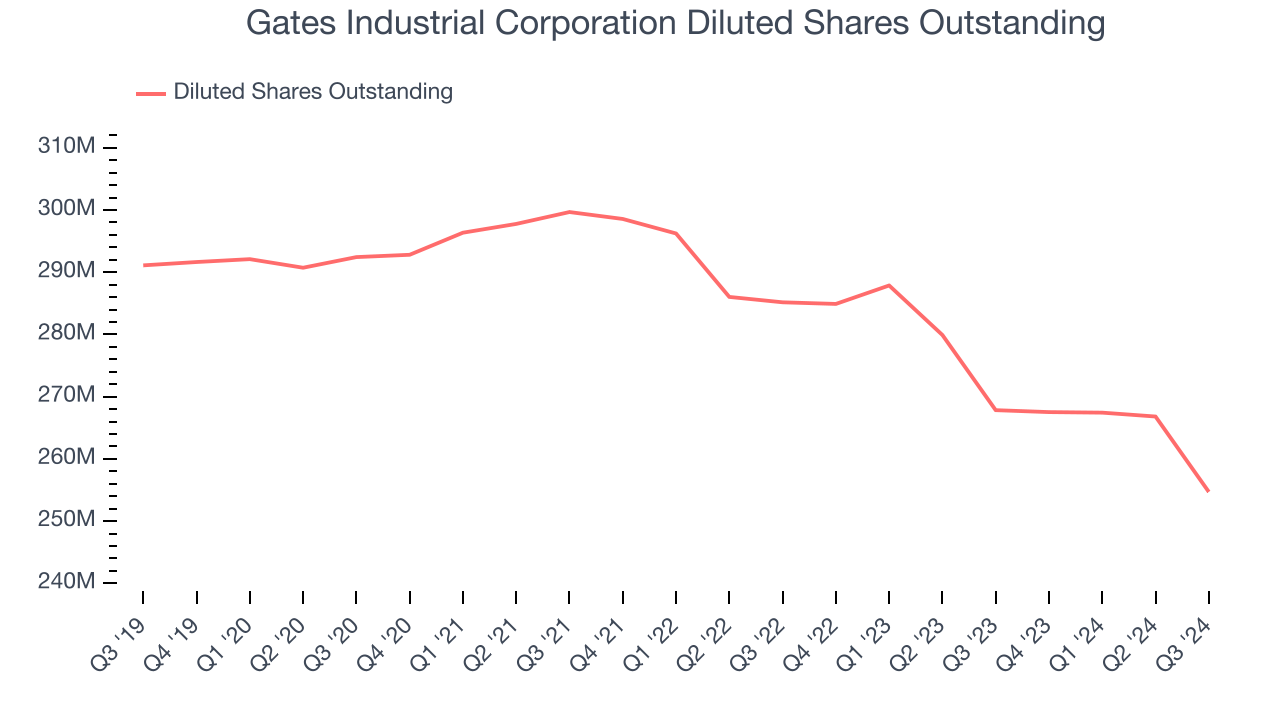

Diving into the nuances of Gates Industrial Corporation’s earnings can give us a better understanding of its performance. As we mentioned earlier, Gates Industrial Corporation’s operating margin was flat this quarter but expanded by 7 percentage points over the last five years. On top of that, its share count shrank by 12.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Gates Industrial Corporation, its two-year annual EPS growth of 7.8% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.In Q3, Gates Industrial Corporation reported EPS at $0.33, down from $0.36 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.1%. Over the next 12 months, Wall Street expects Gates Industrial Corporation’s full-year EPS of $1.40 to grow by 7.6%.

Key Takeaways from Gates Industrial Corporation’s Q3 Results

It was good to see Gates Industrial Corporation beat analysts’ EBITDA and EPS expectations this quarter. We were also glad the company raised its full year EPS guidance. Overall, this quarter was quite good. The stock traded up 7% to $19.55 immediately following the results.

Should you buy the stock or not?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.