Industrial components supplier NN (NASDAQ:NNBR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 8.7% year on year to $113.6 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $475 million at the midpoint. Its GAAP loss of $0.13 per share was 29.1% above analysts’ consensus estimates.

Is now the time to buy NN? Find out by accessing our full research report, it’s free.

NN (NNBR) Q3 CY2024 Highlights:

- Revenue: $113.6 million vs analyst estimates of $120.5 million (5.7% miss)

- EPS: -$0.13 vs analyst estimates of -$0.18 ($0.05 beat)

- EBITDA: $11.58 million vs analyst estimates of $12.97 million (10.7% miss)

- The company reconfirmed its revenue guidance for the full year of $475 million at the midpoint

- EBITDA guidance for the full year is $49 million at the midpoint, below analyst estimates of $49.6 million

- Gross Margin (GAAP): 14.5%, down from 16% in the same quarter last year

- Operating Margin: -3.3%, down from -2.2% in the same quarter last year

- EBITDA Margin: 10.2%, up from 5.2% in the same quarter last year

- Free Cash Flow was -$1.34 million, down from $11.15 million in the same quarter last year

- Market Capitalization: $196.2 million

“We achieved a faster pace in our enterprise transformation across cost-out and growth programs within our current capital structure,” said Harold Bevis, President and Chief Executive Officer of NN,

Company Overview

Formerly known as Nuturn, NN (NASDAQ:NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

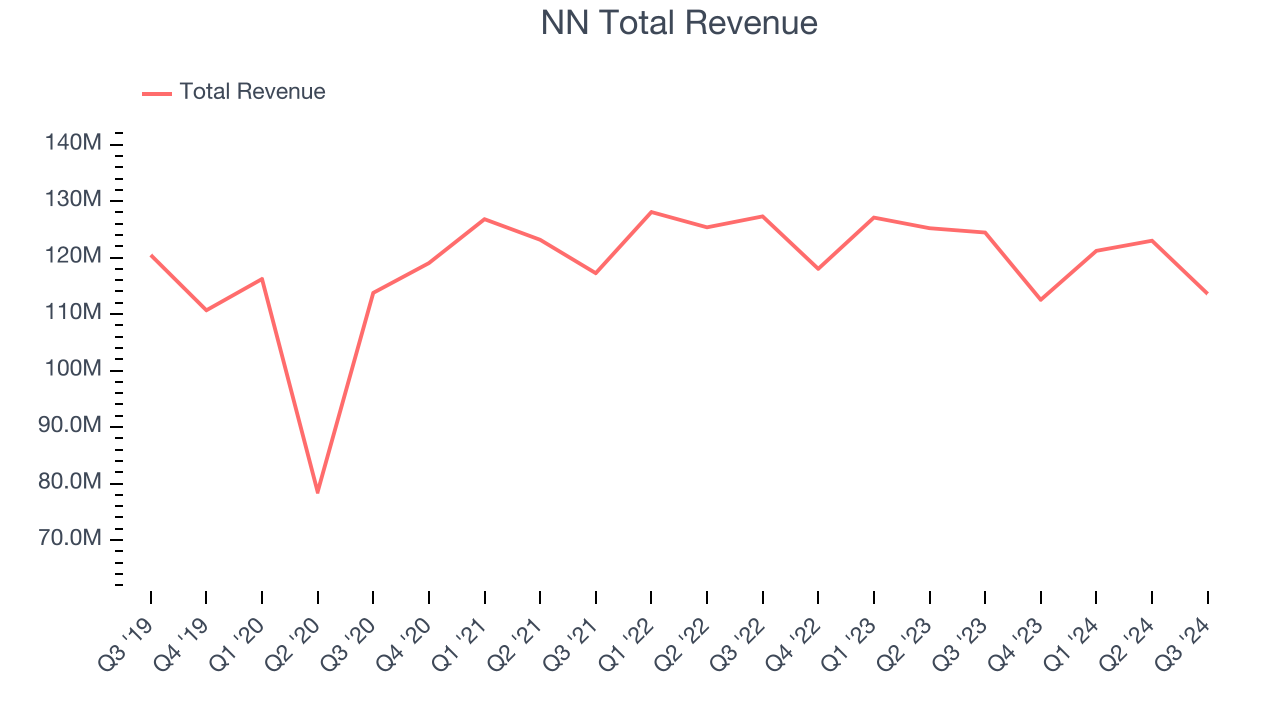

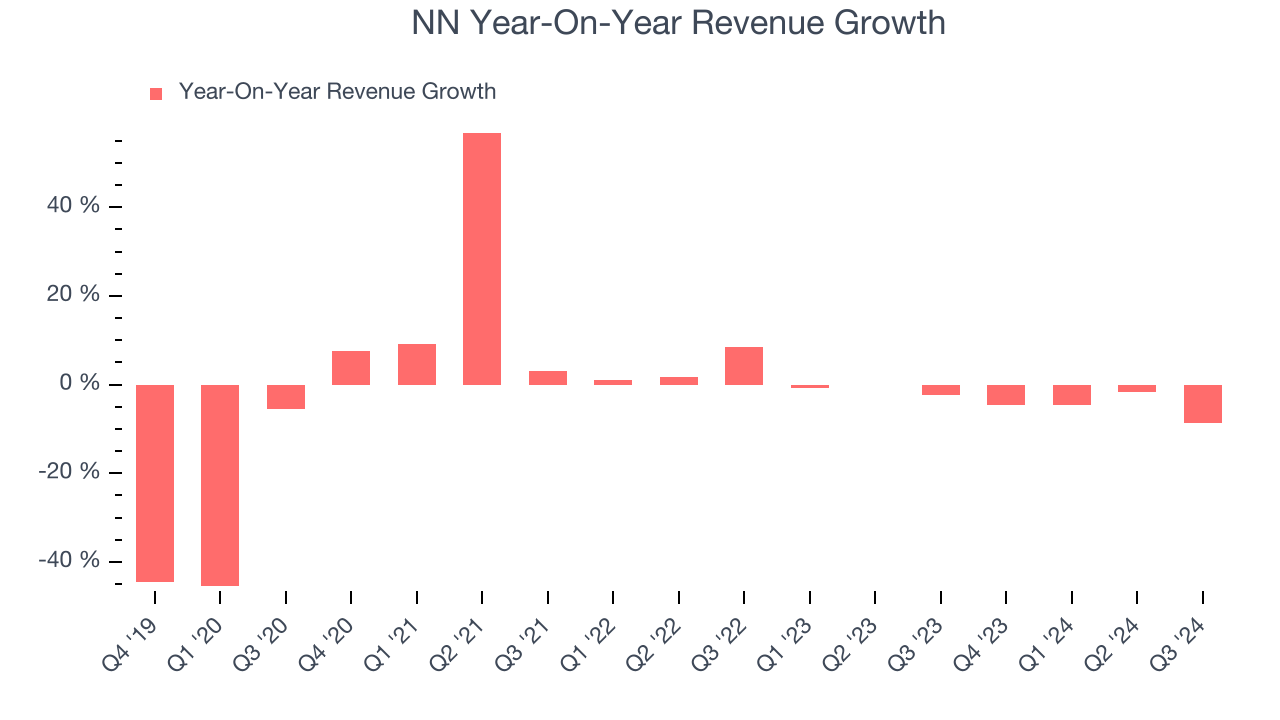

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, NN’s 2.9% annualized revenue growth over the last four years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. NN’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.1% annually.

This quarter, NN missed Wall Street’s estimates and reported a rather uninspiring 8.7% year-on-year revenue decline, generating $113.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, an improvement versus the last two years. Although this projection illustrates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

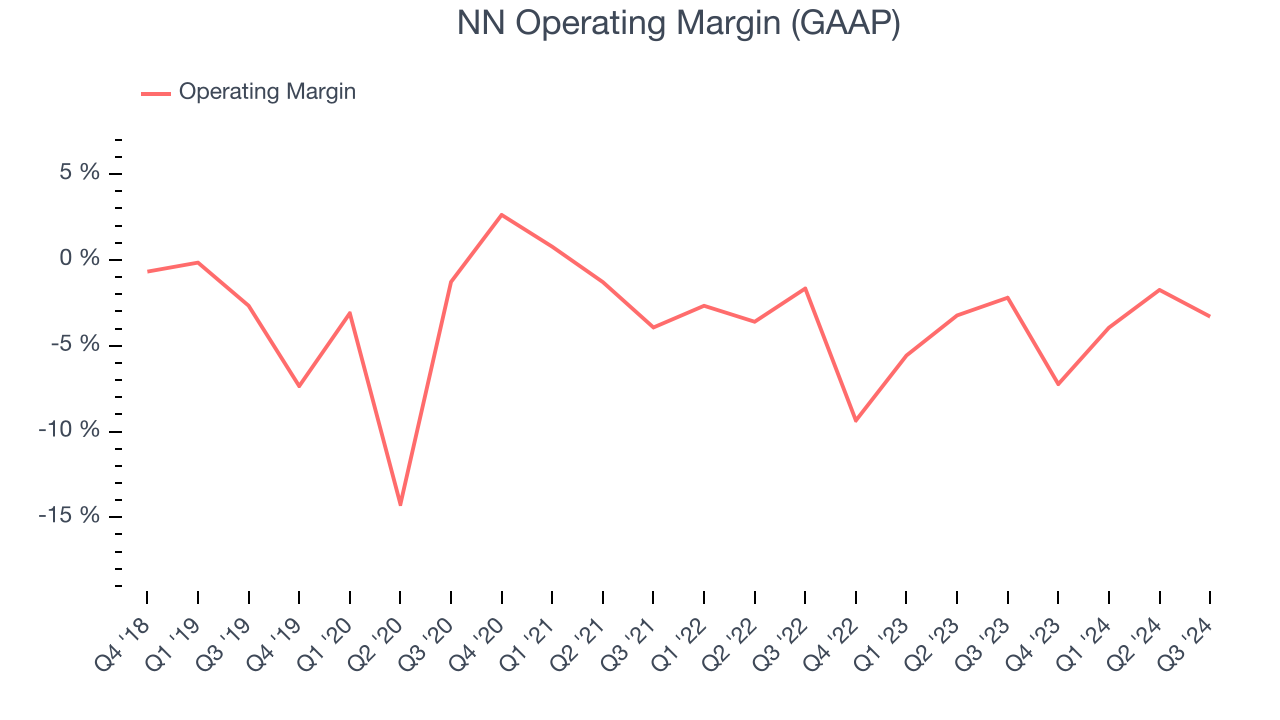

NN’s high expenses have contributed to an average operating margin of negative 3.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, NN’s annual operating margin rose by 1.8 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

NN’s operating margin was negative 3.3% this quarter. The company's lacking profits are certainly concerning.

Earnings Per Share

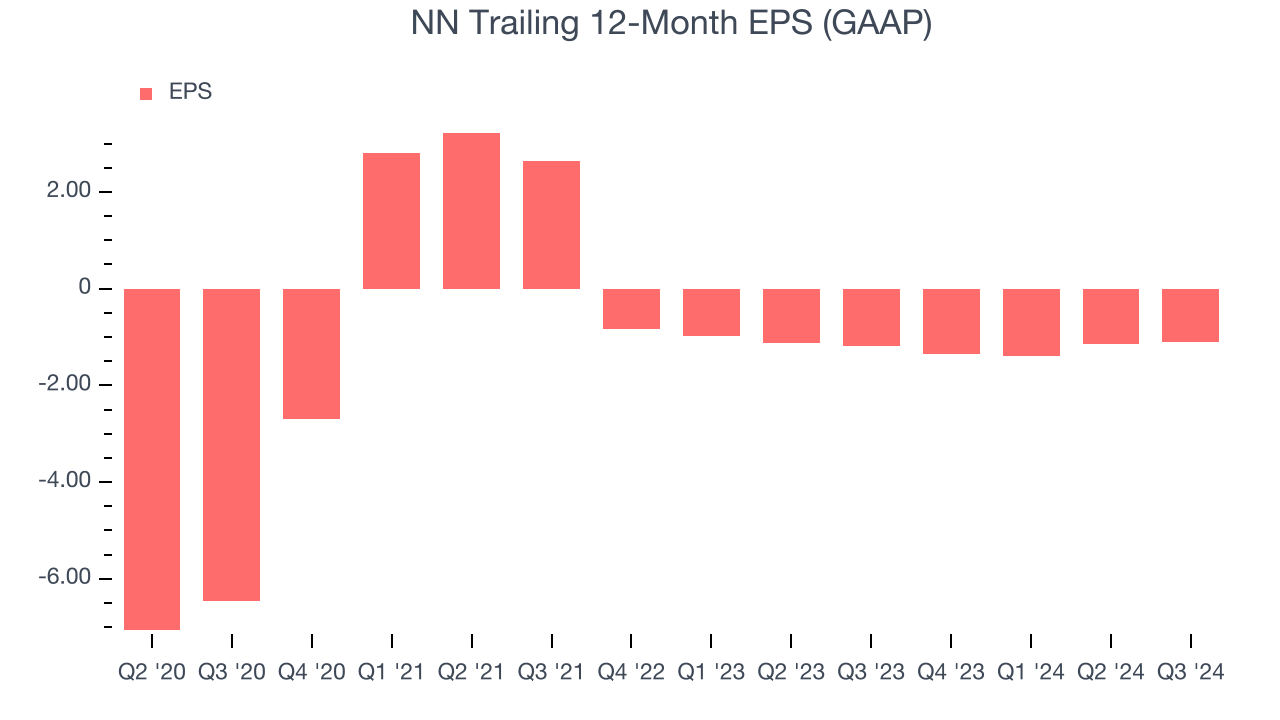

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although NN’s full-year earnings are still negative, it reduced its losses and improved its EPS by 35.8% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For NN, its two-year annual EPS declines of 9.6% mark a reversal from its (seemingly) healthy four-year trend. We hope NN can return to earnings growth in the future.In Q3, NN reported EPS at negative $0.13, up from negative $0.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects NN to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.10 will advance to negative $0.64.

Key Takeaways from NN’s Q3 Results

We were impressed by how significantly NN blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.6% to $3.75 immediately following the results.

NN’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.