Water management company Northwest Pipe (NASDAQ:NWPX) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 9.7% year on year to $130.2 million. Its GAAP profit of $1.02 per share was also 19.5% above analysts’ consensus estimates.

Is now the time to buy Northwest Pipe? Find out by accessing our full research report, it’s free.

Northwest Pipe (NWPX) Q3 CY2024 Highlights:

- Revenue: $130.2 million vs analyst estimates of $127.2 million (2.4% beat)

- EPS: $1.02 vs analyst estimates of $0.85 (19.5% beat)

- Gross Margin (GAAP): 20.8%, up from 16.3% in the same quarter last year

- Operating Margin: 11.9%, up from 7.6% in the same quarter last year

- Market Capitalization: $448.5 million

"Our SPP revenues remained near record levels, with gross margins that improved 40 basis points to 19.4% versus the prior quarter," said Scott Montross, President and Chief Executive Officer of Northwest Pipe Company.

Company Overview

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ:NWPX) is a manufacturer of pipeline systems for water infrastructure.

HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

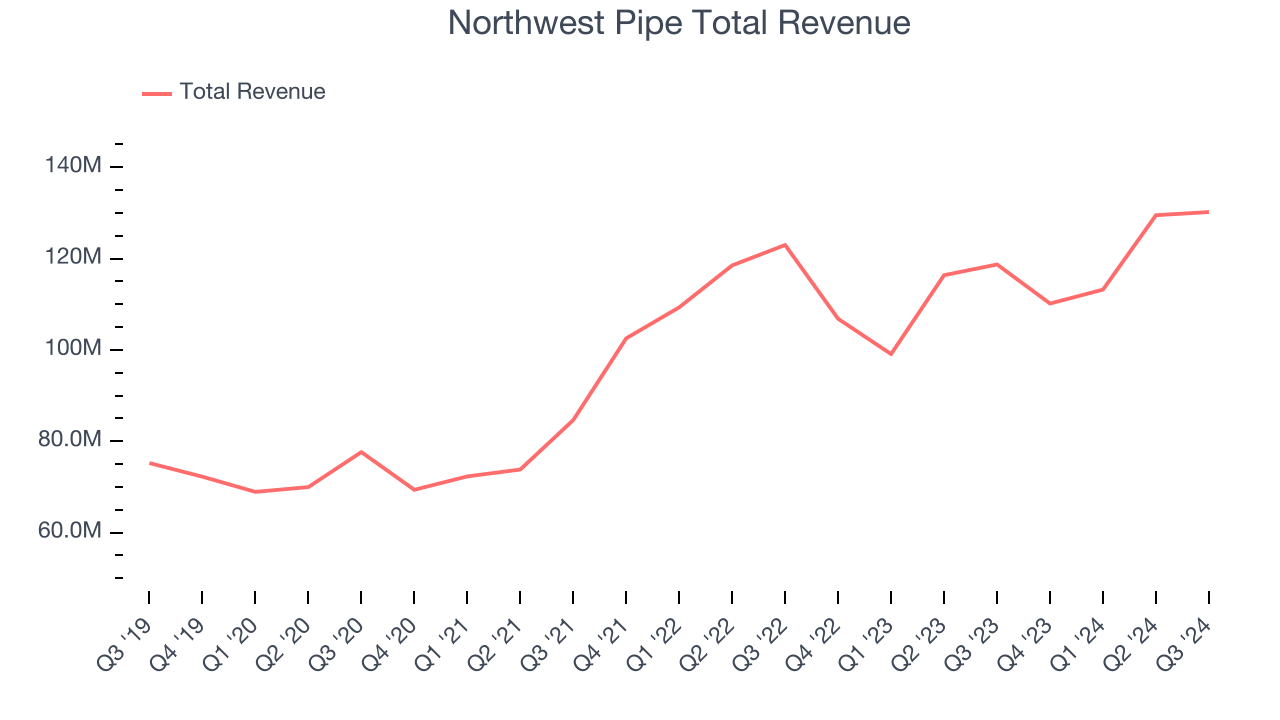

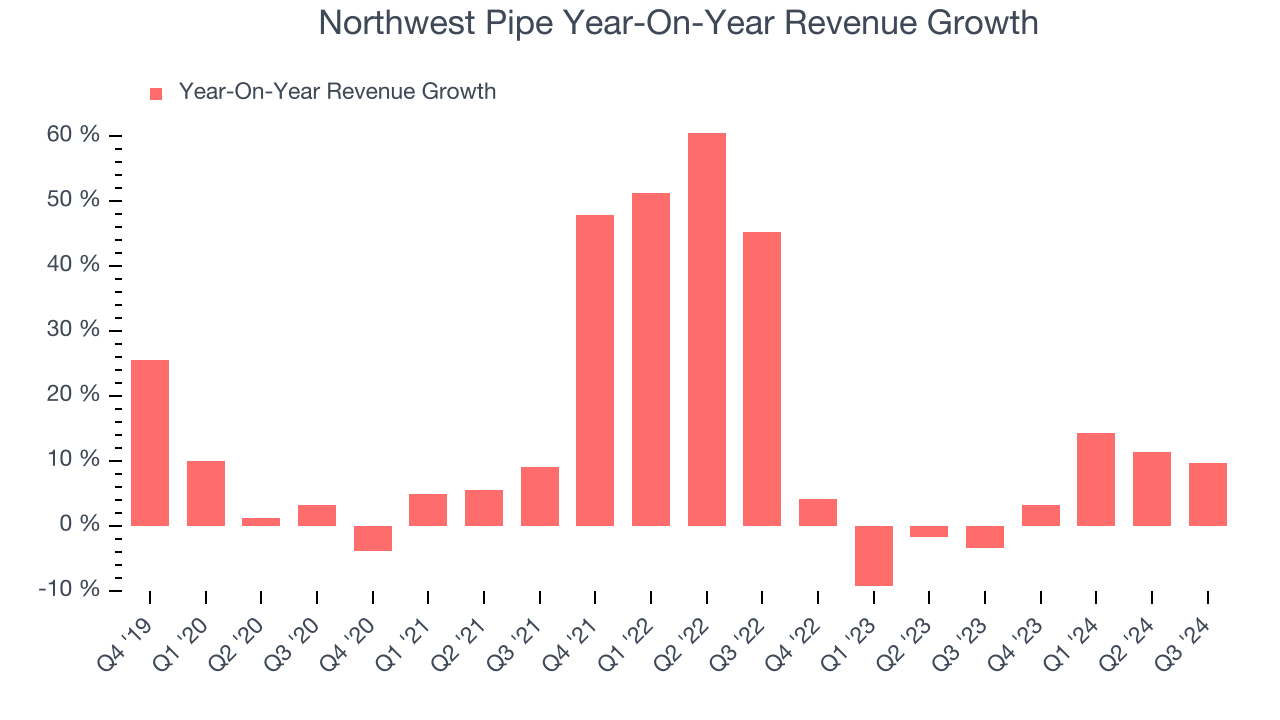

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Northwest Pipe’s 12.8% annualized revenue growth over the last five years was excellent. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Northwest Pipe’s recent history shows its demand slowed significantly as its annualized revenue growth of 3.2% over the last two years is well below its five-year trend.

This quarter, Northwest Pipe reported year-on-year revenue growth of 9.7%, and its $130.2 million of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates the market thinks its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

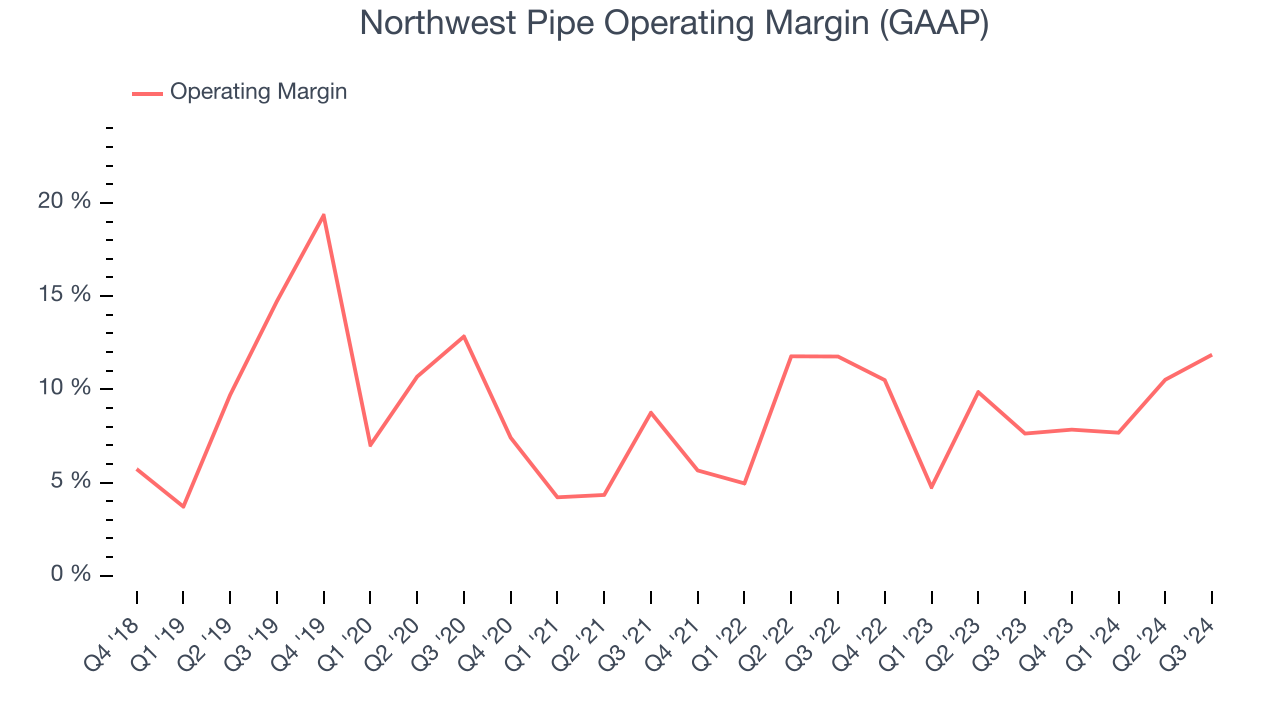

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Northwest Pipe has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Northwest Pipe’s annual operating margin decreased by 2.9 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Northwest Pipe become more profitable in the future.

This quarter, Northwest Pipe generated an operating profit margin of 11.9%, up 4.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

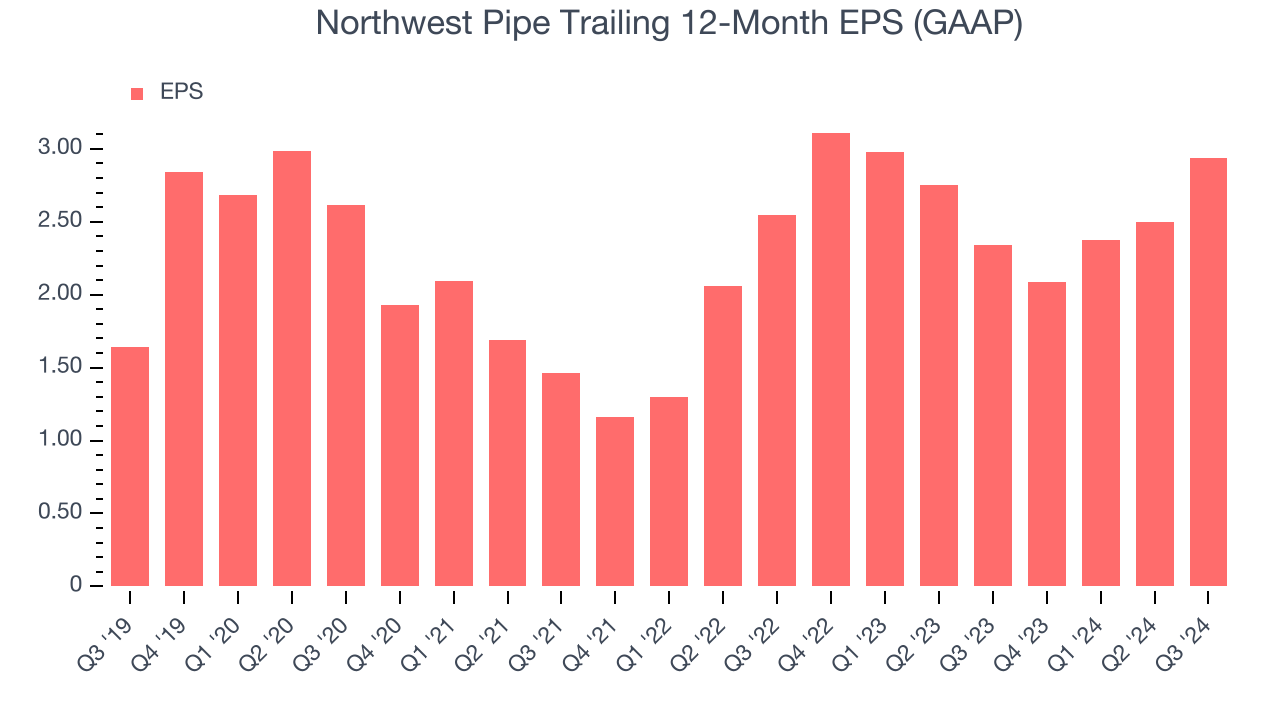

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Northwest Pipe’s remarkable 12.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Northwest Pipe, its two-year annual EPS growth of 7.3% was lower than its five-year trend. We hope its growth can accelerate in the future.In Q3, Northwest Pipe reported EPS at $1.02, up from $0.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Northwest Pipe’s full-year EPS of $2.94 to grow by 2.1%.

Key Takeaways from Northwest Pipe’s Q3 Results

We were impressed by how significantly Northwest Pipe blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock remained flat at $44.83 immediately after reporting.

Indeed, Northwest Pipe had a rock-solid quarterly earnings result, but is this stock a good investment here?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.