Construction management software maker Procore (NYSE:PCOR) announced better-than-expected revenue in Q3 CY2024, with sales up 19.4% year on year to $295.9 million. On the other hand, next quarter’s revenue guidance of $297 million was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.24 per share was also 9.4% above analysts’ consensus estimates.

Is now the time to buy Procore? Find out by accessing our full research report, it’s free.

Procore (PCOR) Q3 CY2024 Highlights:

- Revenue: $295.9 million vs analyst estimates of $287.6 million (2.9% beat)

- Adjusted EPS: $0.24 vs analyst estimates of $0.22 (9.4% beat)

- Revenue Guidance for Q4 CY2024 is $297 million at the midpoint, below analyst estimates of $301 million

- Gross Margin (GAAP): 81.4%, in line with the same quarter last year

- Operating Margin: -12.3%, up from -20.3% in the same quarter last year

- Free Cash Flow Margin: 7.8%, down from 16.4% in the previous quarter

- Customers: 16,975, up from 16,750 in the previous quarter

- Billings: $300.5 million at quarter end, up 16.7% year on year

- Market Capitalization: $9.37 billion

Company Overview

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE:PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

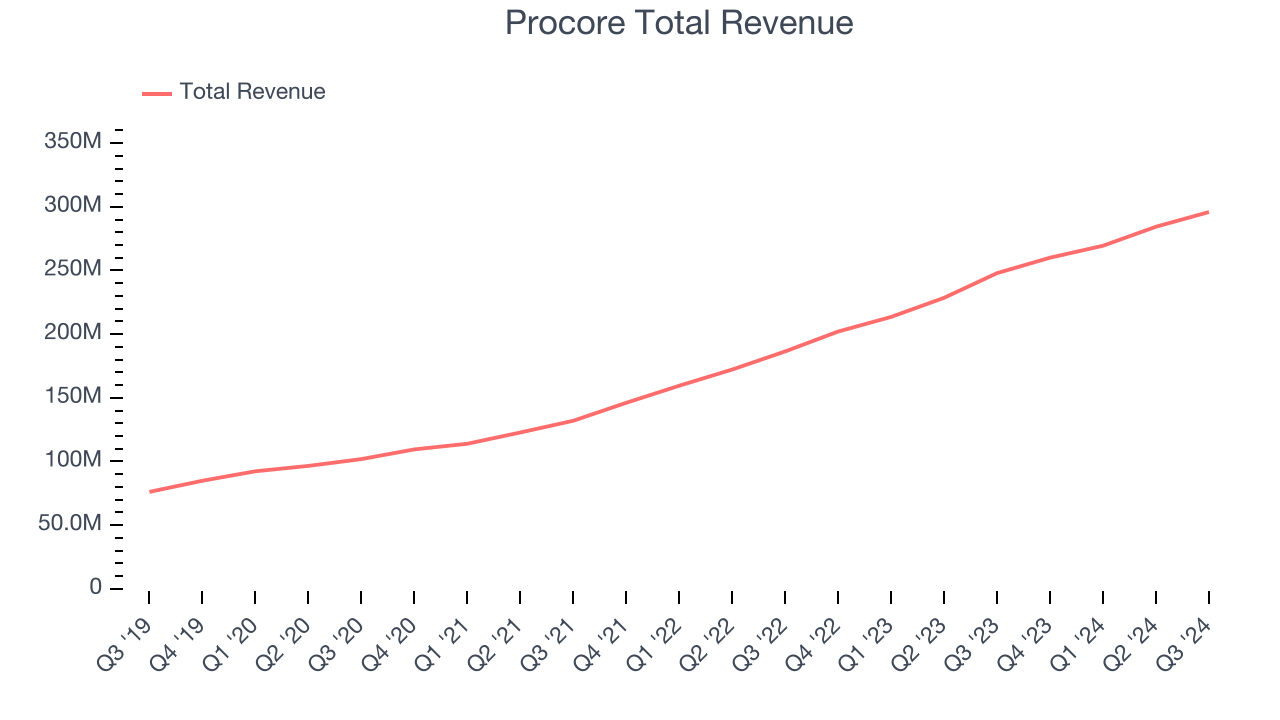

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Procore grew its sales at an excellent 32.4% compounded annual growth rate. This is encouraging because it shows Procore’s offerings resonate with customers, a helpful starting point.

This quarter, Procore reported year-on-year revenue growth of 19.4%, and its $295.9 million of revenue exceeded Wall Street’s estimates by 2.9%. Management is currently guiding for a 14.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and illustrates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Acquisition Efficiency

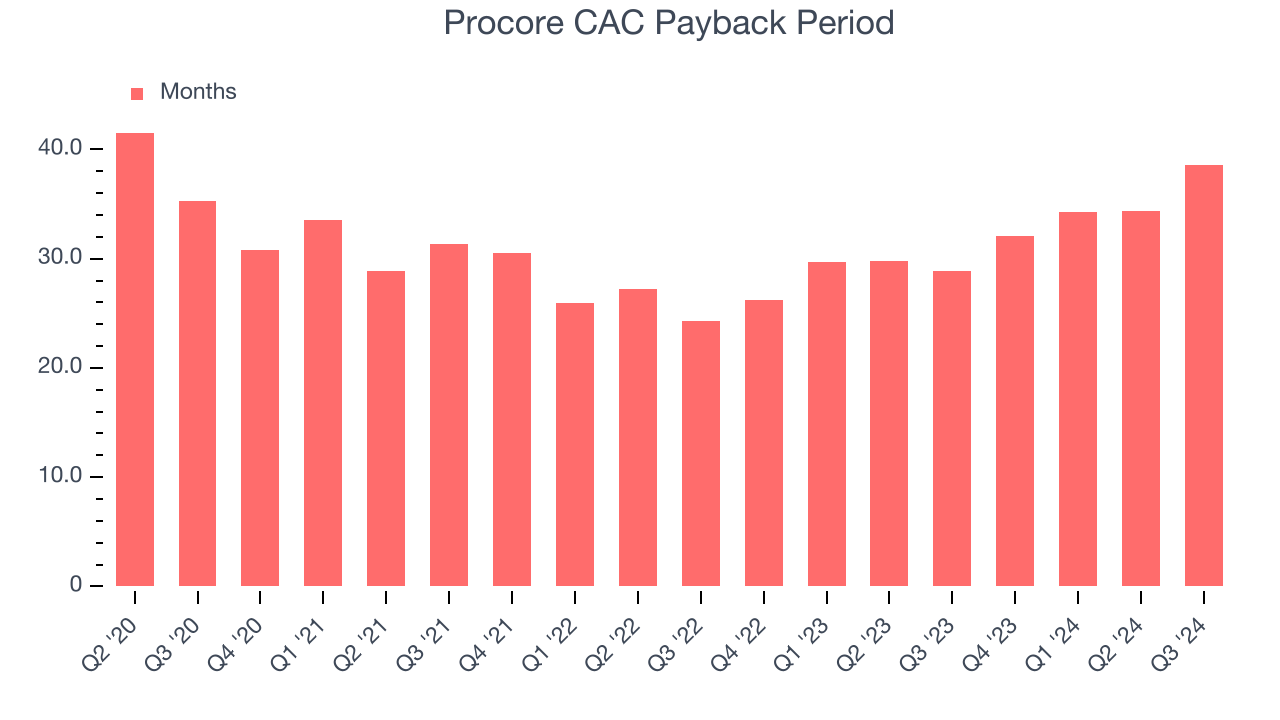

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Procore is efficient at acquiring new customers, and its CAC payback period checked in at 38.6 months this quarter. The company’s performance indicates relatively solid competitive positioning, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Procore’s Q3 Results

We were impressed by Procore’s strong growth in customers this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its gross margin decreased. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The areas below expectations seem to be driving the move, and the stock traded down 5% to $59.51 immediately following the results.

So do we think Procore is an attractive buy at the current price?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.