Fast-food chain Shake Shack (NYSE:SHAK) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 14.7% year on year to $316.9 million. Its non-GAAP profit of $0.25 per share was 29.6% above analysts’ consensus estimates.

Is now the time to buy Shake Shack? Find out by accessing our full research report, it’s free.

Shake Shack (SHAK) Q3 CY2024 Highlights:

- Revenue: $316.9 million vs analyst estimates of $316.1 million (in line)

- Adjusted EPS: $0.25 vs analyst estimates of $0.19 (29.6% beat)

- EBITDA: $45.79 million vs analyst estimates of $43.92 million (4.3% beat)

- Gross Margin (GAAP): 38.4%, up from 37.1% in the same quarter last year

- Operating Margin: -5.7%, down from 2% in the same quarter last year

- EBITDA Margin: 14.4%, up from 13% in the same quarter last year

- Locations: 550 at quarter end, up from 495 in the same quarter last year

- Same-Store Sales rose 4.4% year on year (2.3% in the same quarter last year) (beat vs expectations of up 3.5% year on year)

- Market Capitalization: $4.54 billion

Company Overview

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

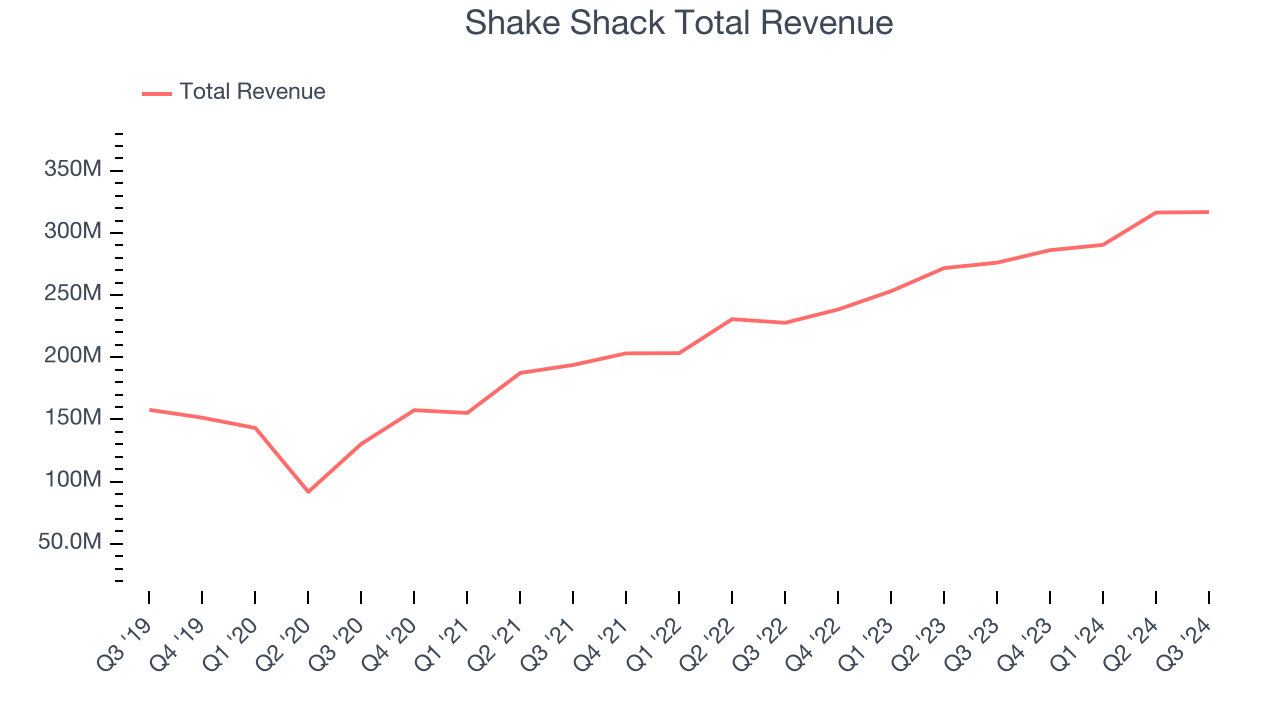

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Shake Shack is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Shake Shack’s sales grew at an excellent 16.4% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Shake Shack’s year-on-year revenue growth was 14.7%, and its $316.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months. This projection is still healthy and indicates the market is factoring in success for its offerings.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Restaurant Performance

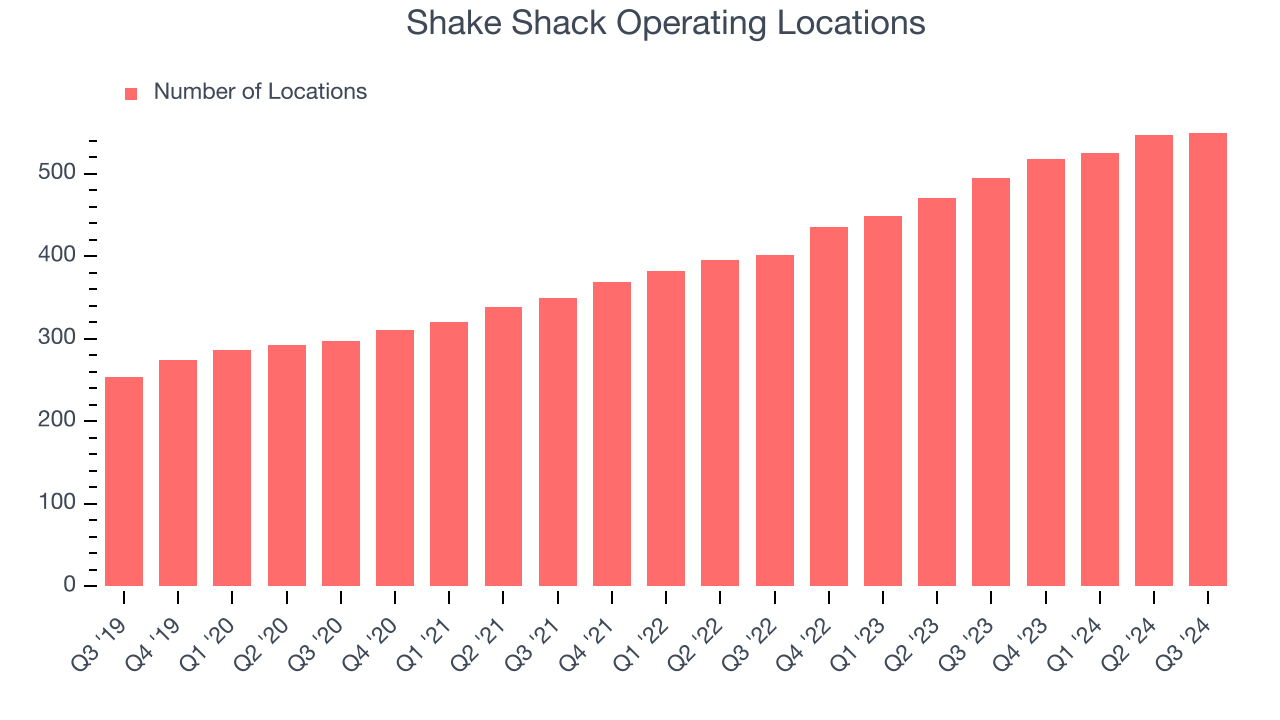

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Shake Shack sported 550 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip and averaged 17.6% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

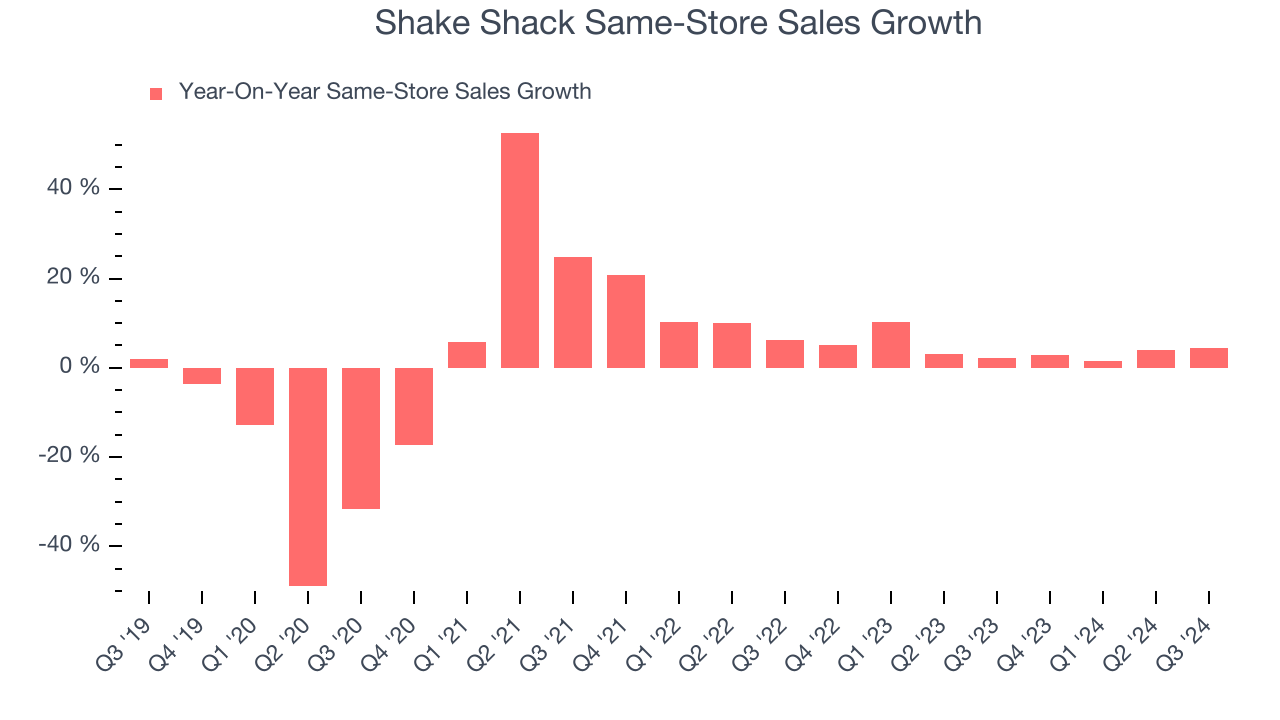

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Shake Shack’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 4.2% per year. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Shake Shack’s same-store sales rose 4.4% annually. This growth was an acceleration from the 2.3% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Shake Shack’s Q3 Results

We enjoyed seeing Shake Shack exceed analysts’ same-store sales expectations this quarter, leading to an EBITDA and EPS beat. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 7.5% to $122.09 immediately following the results.

Indeed, Shake Shack had a rock-solid quarterly earnings result, but is this stock a good investment here?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.