Rigid packaging solutions manufacturer Silgan Holdings (NYSE:SLGN) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 3.2% year on year to $1.75 billion. Its non-GAAP profit of $1.21 per share was also 2% below analysts’ consensus estimates.

Is now the time to buy Silgan Holdings? Find out by accessing our full research report, it’s free.

Silgan Holdings (SLGN) Q3 CY2024 Highlights:

- Revenue: $1.75 billion vs analyst estimates of $1.83 billion (4.6% miss)

- Adjusted EPS: $1.21 vs analyst expectations of $1.23 (2% miss)

- EBITDA: $234 million vs analyst estimates of $275.5 million (15.1% miss)

- Management lowered its full-year Adjusted EPS guidance to $3.60 at the midpoint, a 1.4% decrease

- Gross Margin (GAAP): 16.8%, in line with the same quarter last year

- Operating Margin: 9.6%, down from 10.8% in the same quarter last year

- EBITDA Margin: 13.4%, down from 14.8% in the same quarter last year

- Free Cash Flow Margin: 14.5%, up from 9.5% in the same quarter last year

- Market Capitalization: $5.42 billion

"Our third quarter results continued to benefit from the success of our long-term strategic growth initiatives, the power of the Silgan portfolio and the strength and agility of our operating teams," said Adam Greenlee, President and CEO.

Company Overview

Established in 1987, Silgan Holdings (NYSE:SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

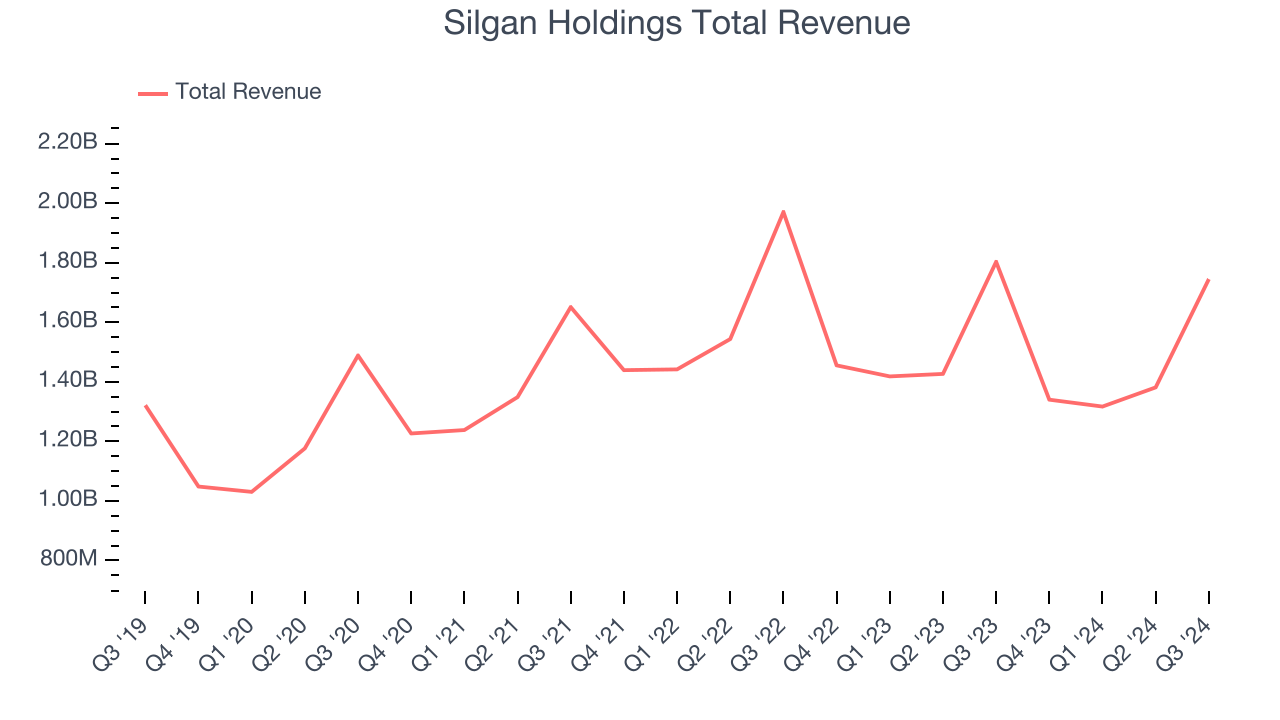

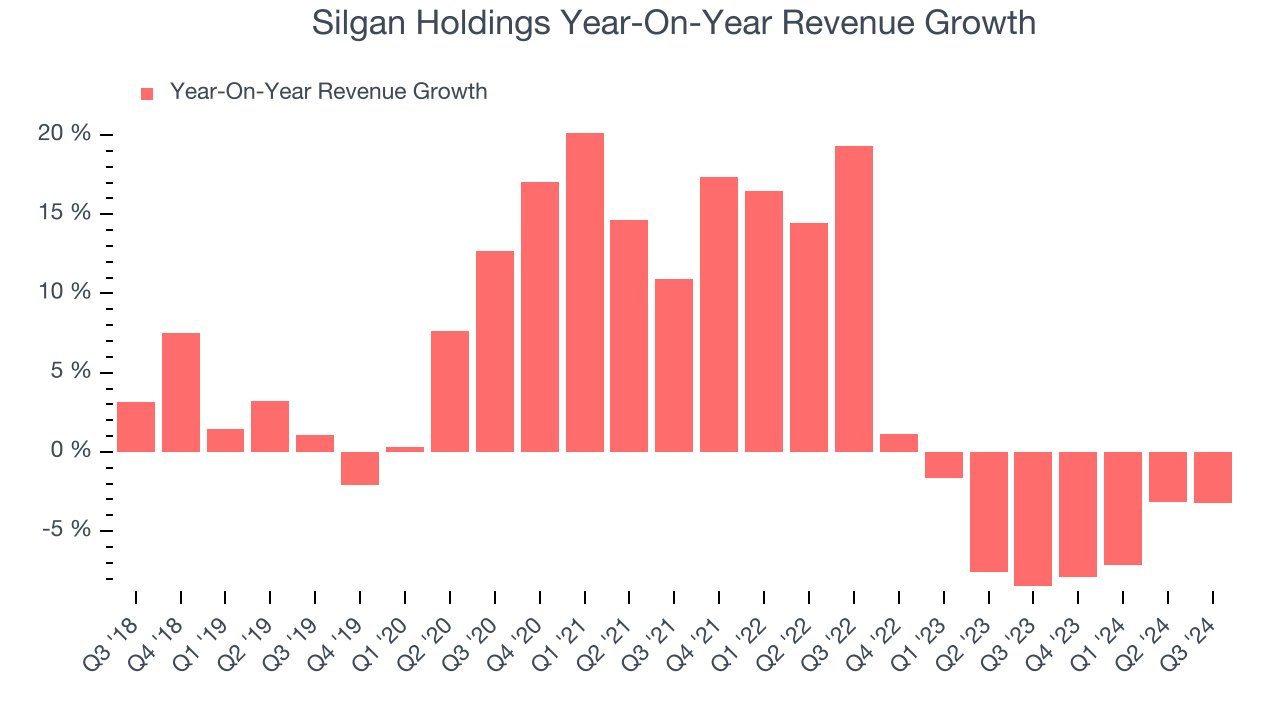

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, Silgan Holdings’s sales grew at a tepid 5.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Silgan Holdings’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.9% annually. Silgan Holdings isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Silgan Holdings missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $1.75 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, an improvement versus the last two years. This projection is healthy and illustrates the market believes its newer products and services will catalyze higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

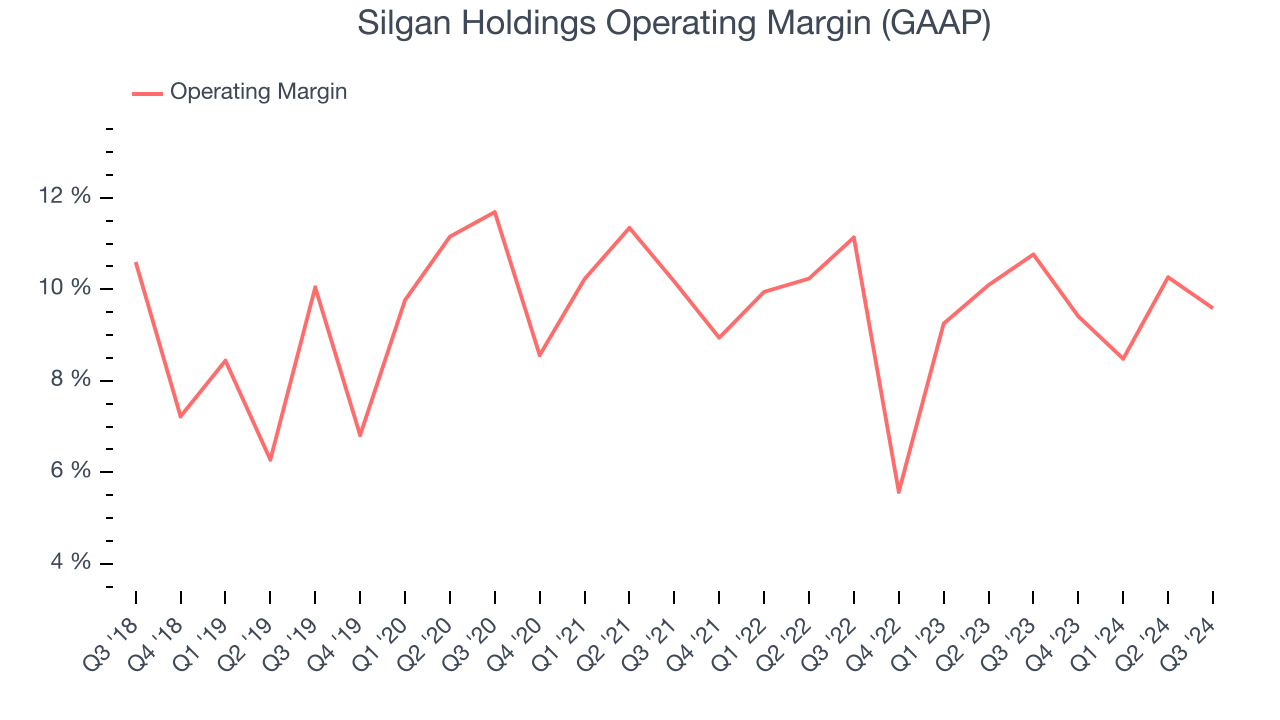

Operating Margin

Silgan Holdings has done a decent job managing its cost base over the last five years. The company produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Silgan Holdings’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years. Shareholders will want to see Silgan Holdings grow its margin in the future.

In Q3, Silgan Holdings generated an operating profit margin of 9.6%, down 1.2 percentage points year on year. Since Silgan Holdings’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

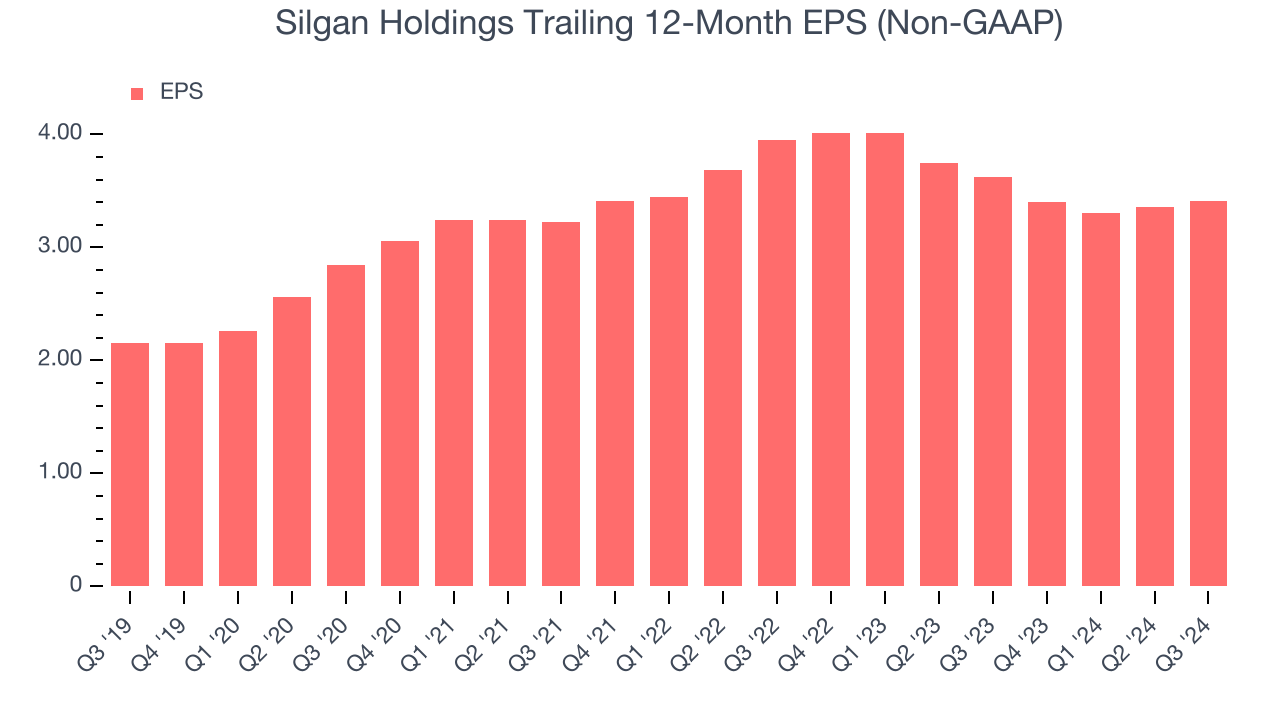

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Silgan Holdings’s EPS grew at a decent 9.6% compounded annual growth rate over the last five years, higher than its 5.1% annualized revenue growth. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

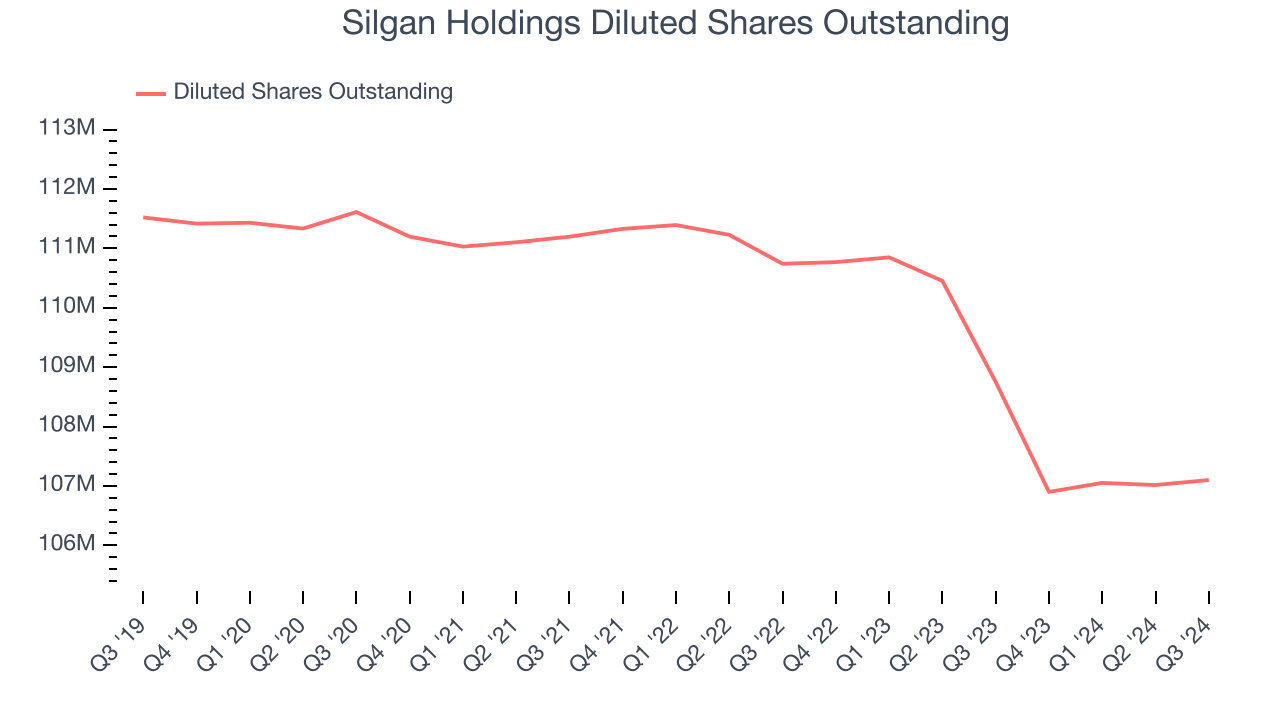

Diving into the nuances of Silgan Holdings’s earnings can give us a better understanding of its performance. A five-year view shows that Silgan Holdings has repurchased its stock, shrinking its share count by 4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Silgan Holdings, its two-year annual EPS declines of 7.1% mark a reversal from its five-year trend. We hope Silgan Holdings can return to earnings growth in the future.In Q3, Silgan Holdings reported EPS at $1.21, up from $1.16 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Silgan Holdings’s full-year EPS of $3.41 to grow by 23%.

Key Takeaways from Silgan Holdings’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $50.79 immediately after reporting.

The latest quarter from Silgan Holdings’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.