Steel and waste handling company Enviri (NYSE:NVRI) fell short of the market’s revenue expectations in Q3 CY2024, but sales rose 9.3% year on year to $573.6 million. Its GAAP loss of $0.16 per share was also 1,700% below analysts’ consensus estimates.

Is now the time to buy Enviri? Find out by accessing our full research report, it’s free.

Enviri (NVRI) Q3 CY2024 Highlights:

- Revenue: $573.6 million vs analyst estimates of $613.6 million (6.5% miss)

- EPS: -$0.16 vs analyst estimates of $0.01 (-$0.17 miss)

- EBITDA: $84.66 million vs analyst estimates of $88.25 million (4.1% miss)

- EBITDA guidance for the full year is $322 million at the midpoint, below analyst estimates of $332.1 million

- Gross Margin (GAAP): 20.7%, down from 22.1% in the same quarter last year

- Operating Margin: 6.5%, up from 4.9% in the same quarter last year

- EBITDA Margin: 14.8%, up from 11.7% in the same quarter last year

- Free Cash Flow was -$40.19 million compared to -$9.31 million in the same quarter last year

- Market Capitalization: $804.3 million

“Enviri reported results within our quarterly earnings guidance range, despite market weakness in Harsco Environmental as well as shipment delays and operational challenges within Harsco Rail,” said Enviri Chairman and CEO Nick Grasberger.

Company Overview

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE:NVRI) offers steel and waste handling services.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

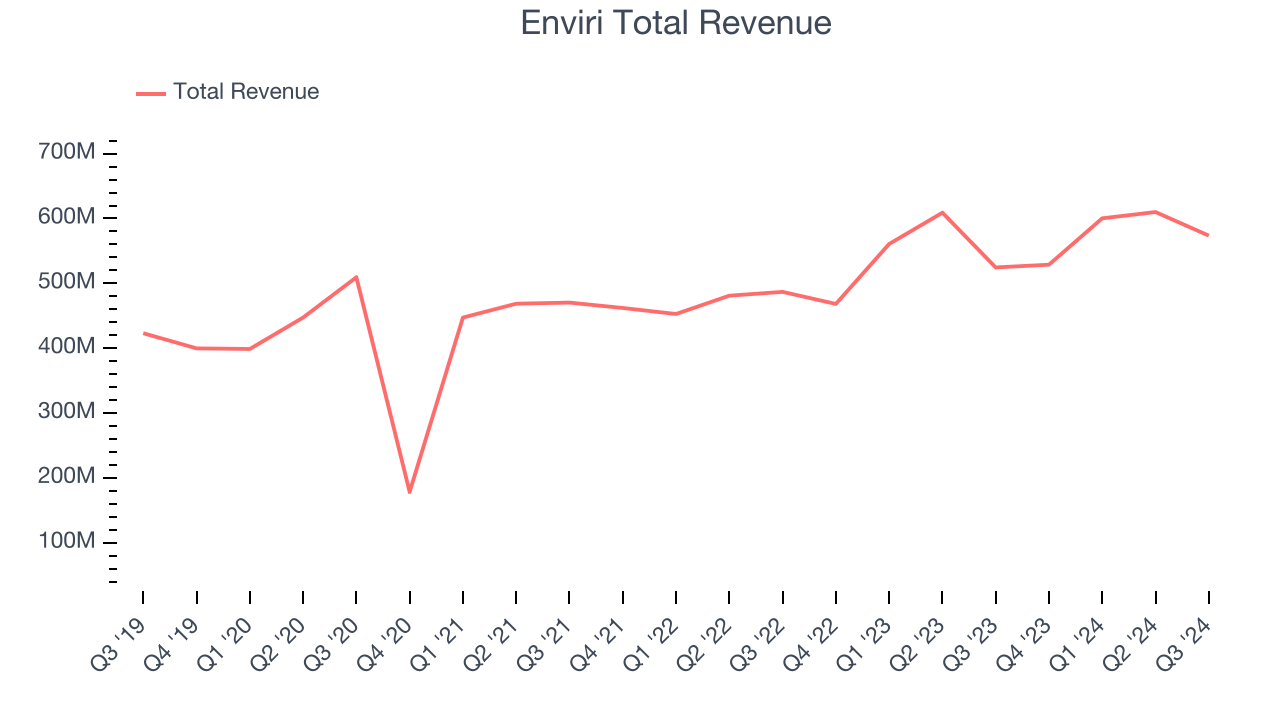

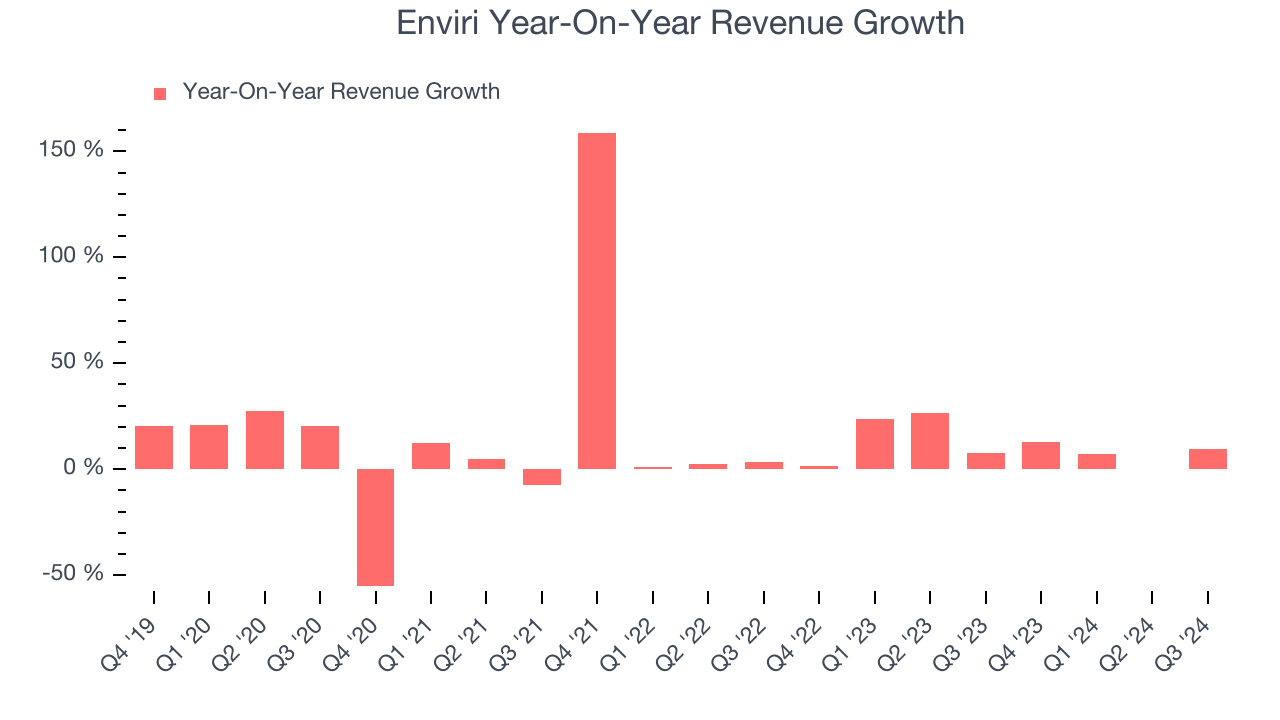

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Enviri’s sales grew at a solid 10% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Enviri’s annualized revenue growth of 10.8% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Enviri’s revenue grew 9.3% year on year to $573.6 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

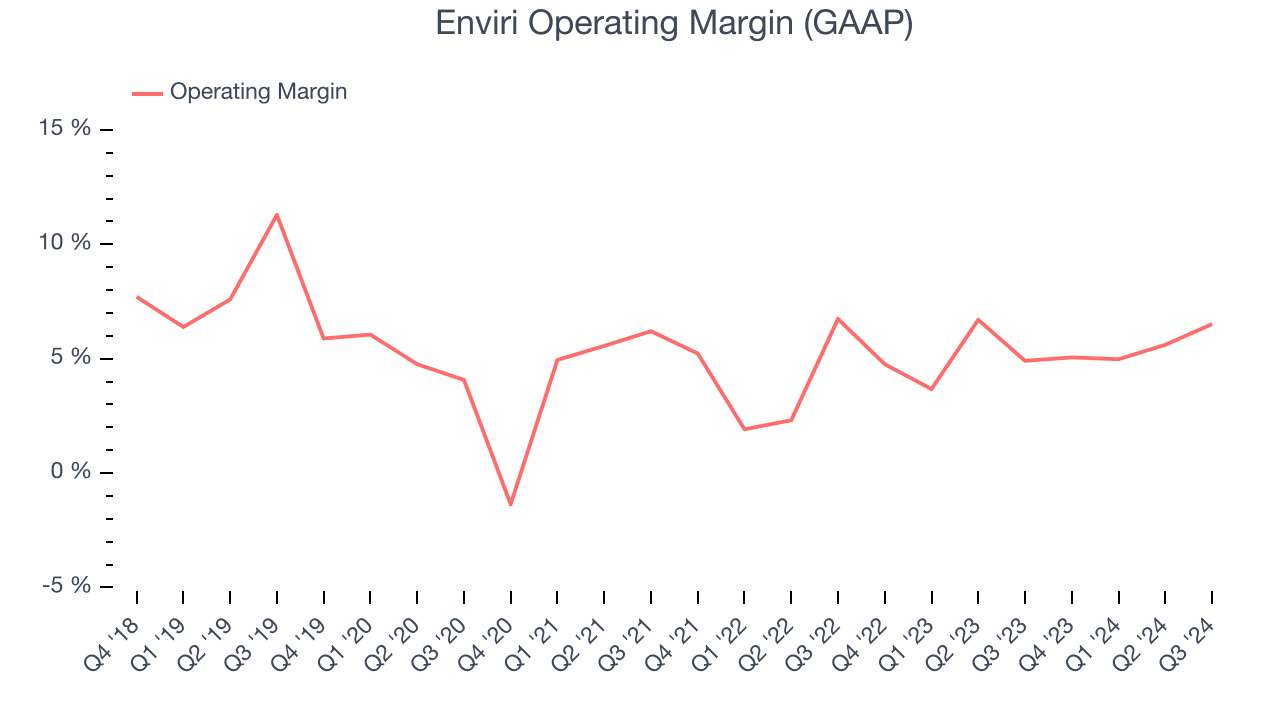

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Enviri was profitable over the last five years but held back by its large cost base. Its average operating margin of 5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Enviri’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

In Q3, Enviri generated an operating profit margin of 6.5%, up 1.6 percentage points year on year. The increase was encouraging, and since its gross margin actually decreased, we can assume it was recently more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

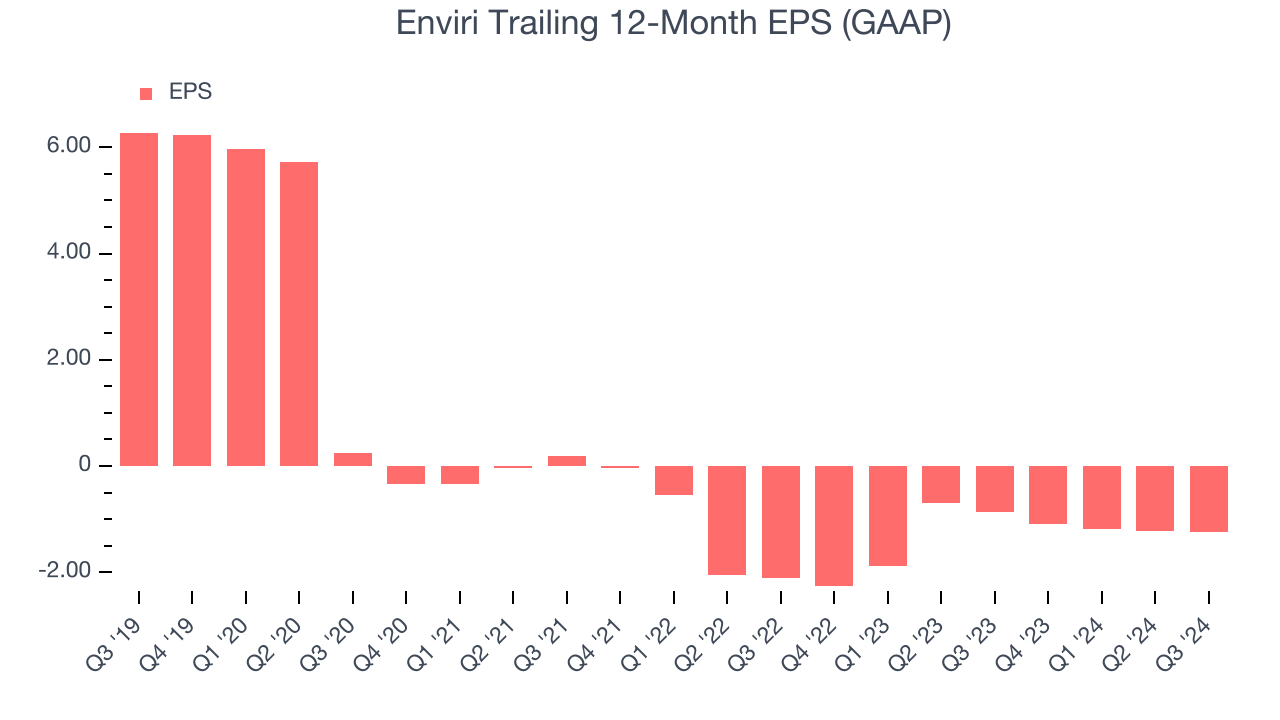

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Enviri, its EPS declined by 17.1% annually over the last five years while its revenue grew by 10%. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Enviri, its two-year annual EPS growth of 23.3% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Enviri reported EPS at negative $0.16, down from negative $0.14 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Enviri’s full-year EPS of negative $1.24 will reach break even.

Key Takeaways from Enviri’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA forecast for the full year missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $10.04 immediately after reporting.

So do we think Enviri is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.