Safety and security company Federal Signal (NYSE:FSS) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 6.2% year on year to $474.2 million. Its non-GAAP profit of $0.88 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Federal Signal? Find out by accessing our full research report, it’s free.

Federal Signal (FSS) Q3 CY2024 Highlights:

- Revenue: $474.2 million vs analyst estimates of $481.7 million (1.6% miss)

- Adjusted EPS: $0.88 vs analyst estimates of $0.84 (5.3% beat)

- EBITDA: $93 million vs analyst estimates of $89.23 million (4.2% beat)

- Management raised its full-year Adjusted EPS guidance to $3.35 at the midpoint, a 2.3% increase

- Gross Margin (GAAP): 29.6%, up from 26.4% in the same quarter last year

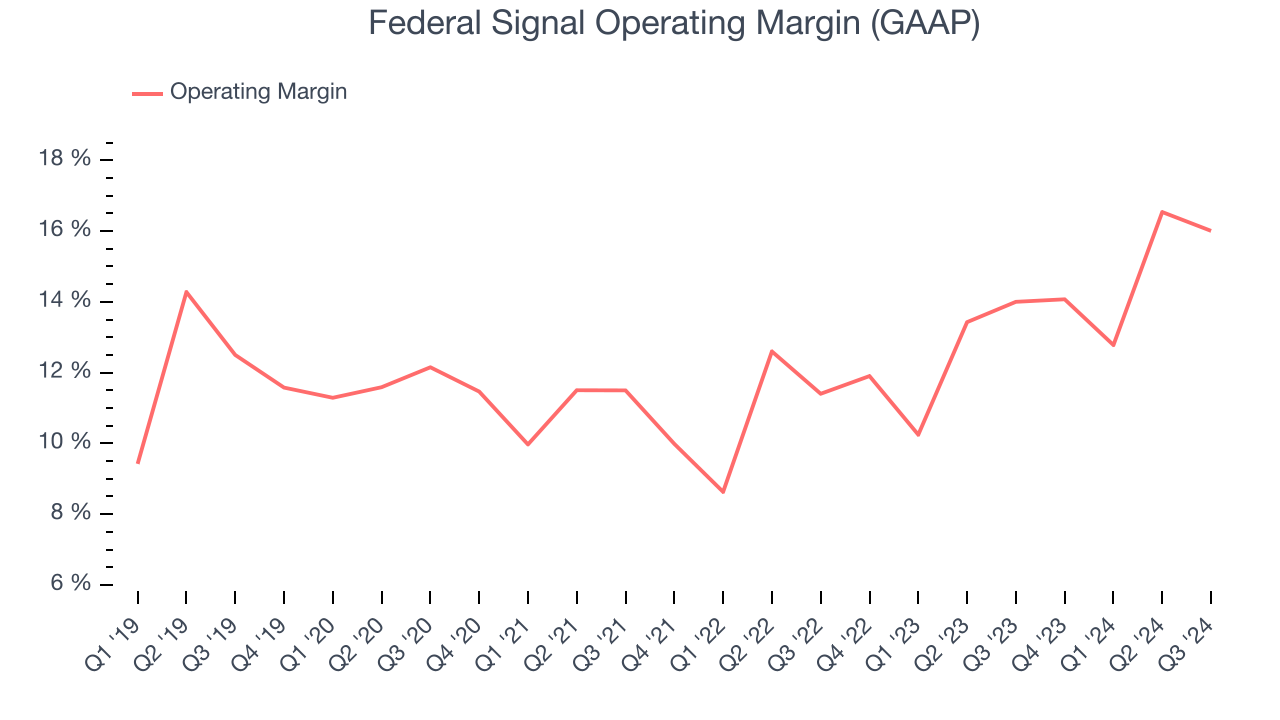

- Operating Margin: 16%, up from 14% in the same quarter last year

- EBITDA Margin: 19.6%, up from 17.6% in the same quarter last year

- Free Cash Flow Margin: 12.8%, up from 9.5% in the same quarter last year

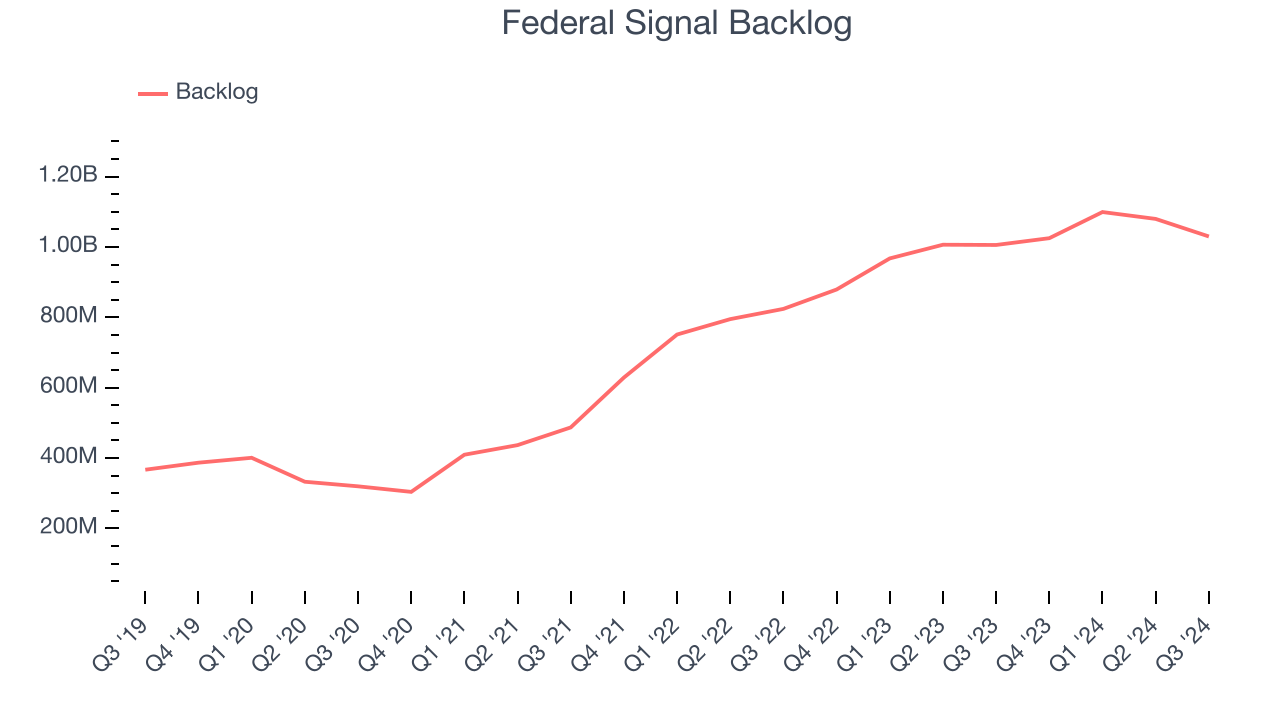

- Backlog: $1.03 billion at quarter end, up 2.4% year on year

- Market Capitalization: $5.18 billion

"With our teams' continued focus on operational execution and serving our customers, our businesses were able to deliver 6% year-over-year organic net sales growth, double-digit earnings improvement, gross margin expansion, and a 200-basis point increase in adjusted EBITDA margin during the third quarter," commented Jennifer L. Sherman, President and Chief Executive Officer.

Company Overview

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE:FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

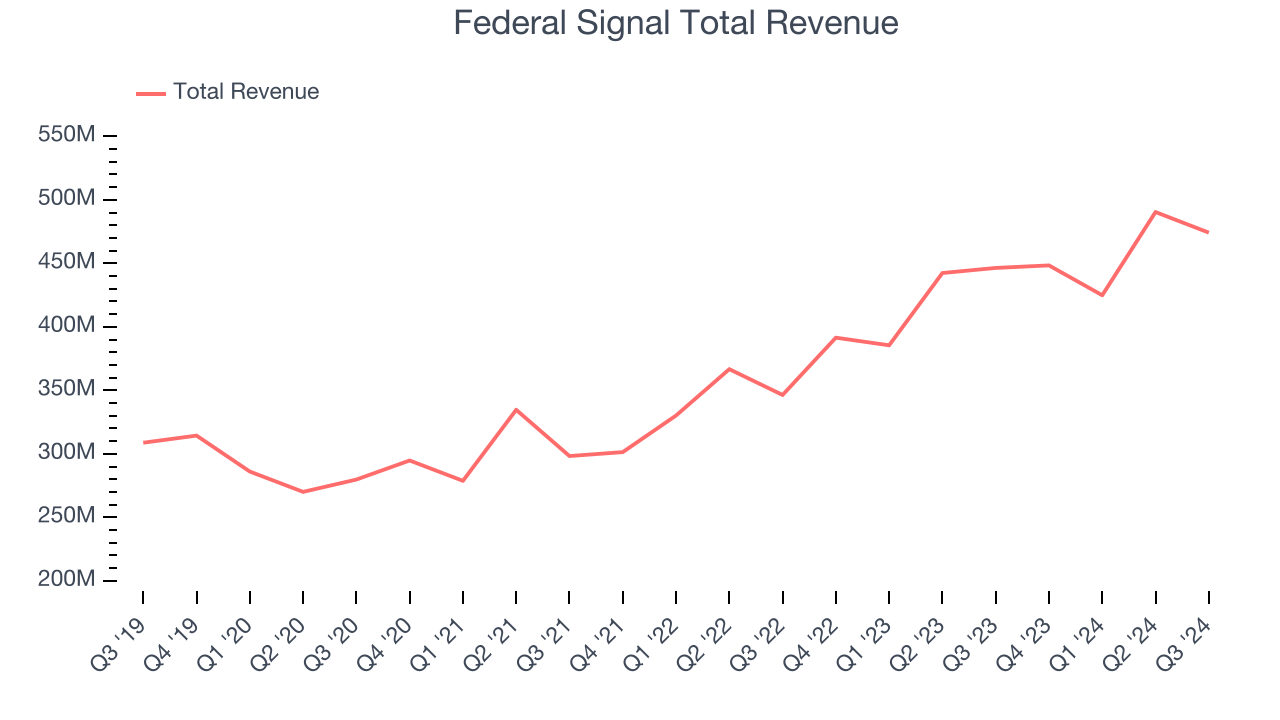

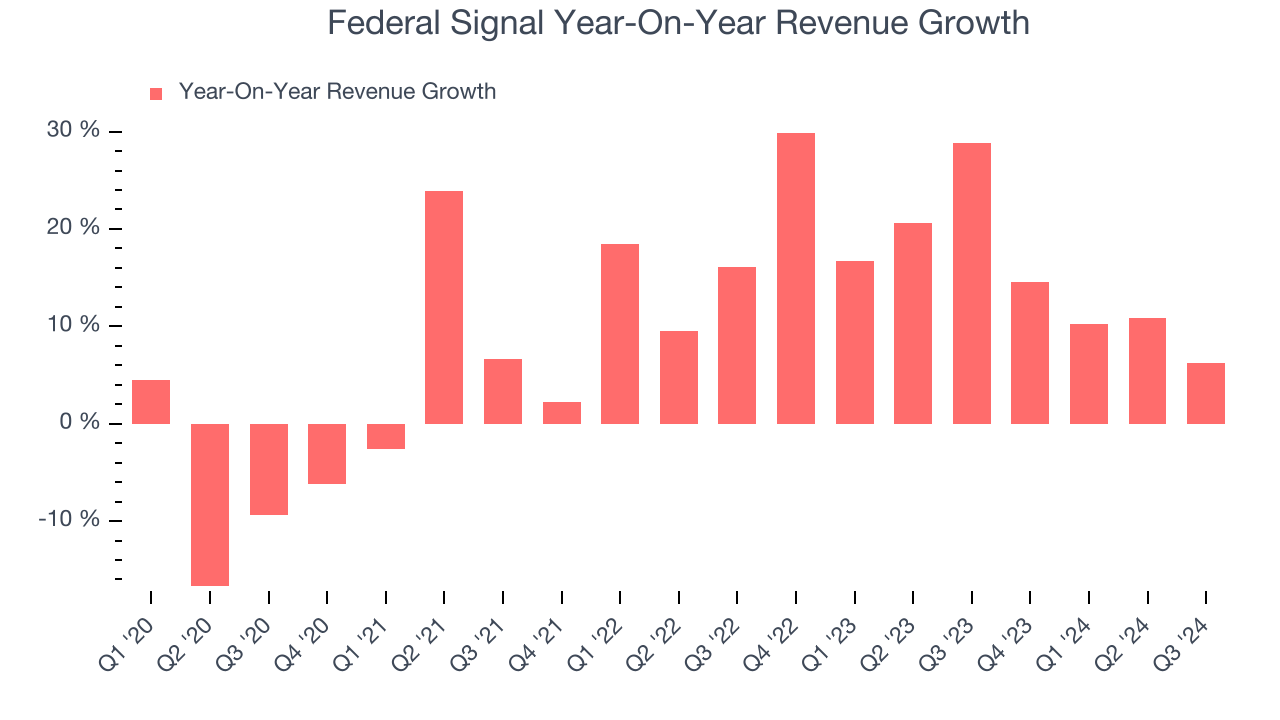

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Federal Signal’s sales grew at a decent 8.9% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Federal Signal’s annualized revenue growth of 16.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

Federal Signal also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Federal Signal’s backlog reached $1.03 billion in the latest quarter and averaged 19.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Federal Signal’s products and services but raises concerns about capacity constraints.

This quarter, Federal Signal’s revenue grew 6.2% year on year to $474.2 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Federal Signal has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Federal Signal’s annual operating margin rose by 3.3 percentage points over the last five years, showing its efficiency has improved.

This quarter, Federal Signal generated an operating profit margin of 16%, up 2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

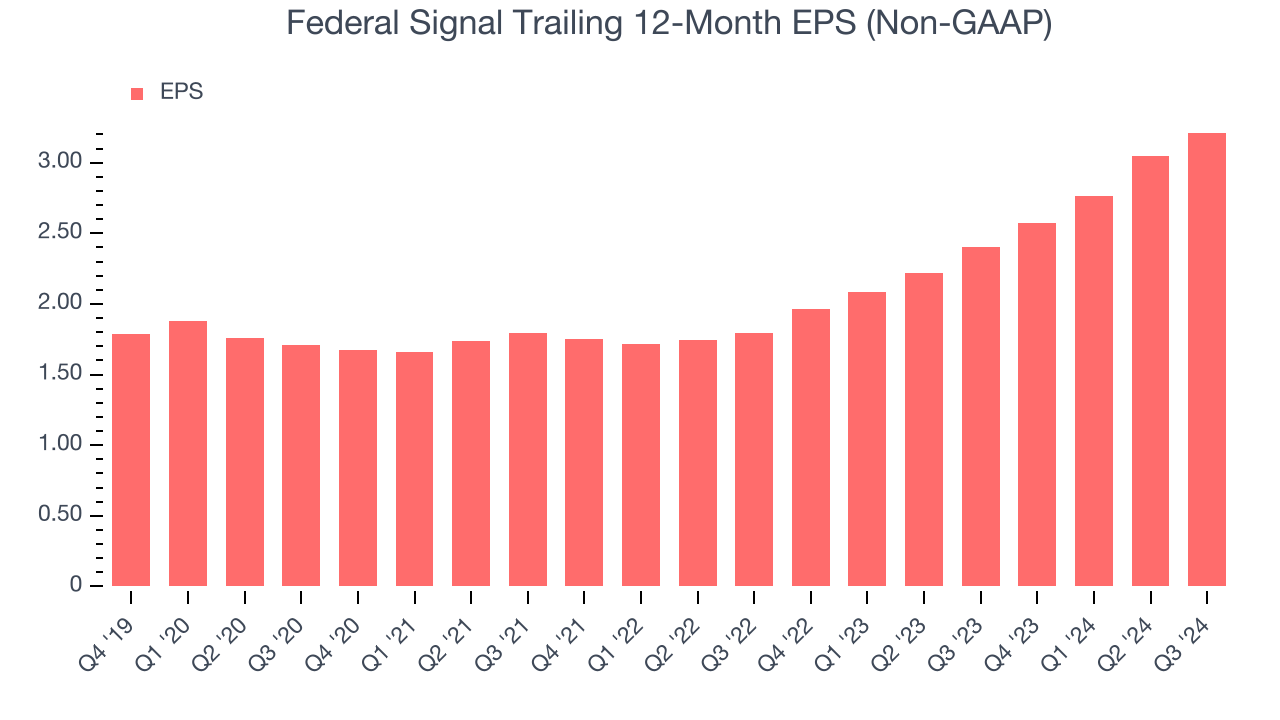

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Federal Signal’s EPS grew at a remarkable 13.6% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Federal Signal’s earnings can give us a better understanding of its performance. As we mentioned earlier, Federal Signal’s operating margin expanded by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Federal Signal, its two-year annual EPS growth of 33.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Federal Signal reported EPS at $0.88, up from $0.71 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects Federal Signal’s full-year EPS of $3.21 to grow by 9.7%.

Key Takeaways from Federal Signal’s Q3 Results

We were impressed by Federal Signal’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its backlog missed and its revenue fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $84 immediately following the results.

Federal Signal may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.