Specialty food company Lancaster Colony (NASDAQ:LANC) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 1.1% year on year to $466.6 million. Its GAAP profit of $1.62 per share was 2.7% below analysts’ consensus estimates.

Is now the time to buy Lancaster Colony? Find out by accessing our full research report, it’s free.

Lancaster Colony (LANC) Q3 CY2024 Highlights:

- Revenue: $466.6 million vs analyst estimates of $468.4 million (in line)

- EPS: $1.62 vs analyst expectations of $1.67 (2.7% miss)

- Gross Margin (GAAP): 23.8%, in line with the same quarter last year

- Operating Margin: 12%, in line with the same quarter last year

- Sales Volumes were up 1.9% year on year

- Market Capitalization: $5.1 billion

CEO David A. Ciesinski commented, “We were pleased to complete the quarter with record sales of $466.6 million and record gross profit of $110.8 million. In the Retail segment, we saw continued growth from our licensing program driven by the Subway® sauces we launched this past spring and expanding distribution for Texas Roadhouse® dinner rolls following a successful pilot test. Excluding the perimeter-of-the-store bakery product lines that we exited in March, Retail net sales increased 1.4% and Retail sales volume, measured in pounds shipped, increased 1.9%. In the Foodservice segment, despite industry-wide trends of slowing traffic, net sales grew 3.5% driven by increased demand from several of our national chain restaurant customers and volume gains for our branded Foodservice products.”

Company Overview

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

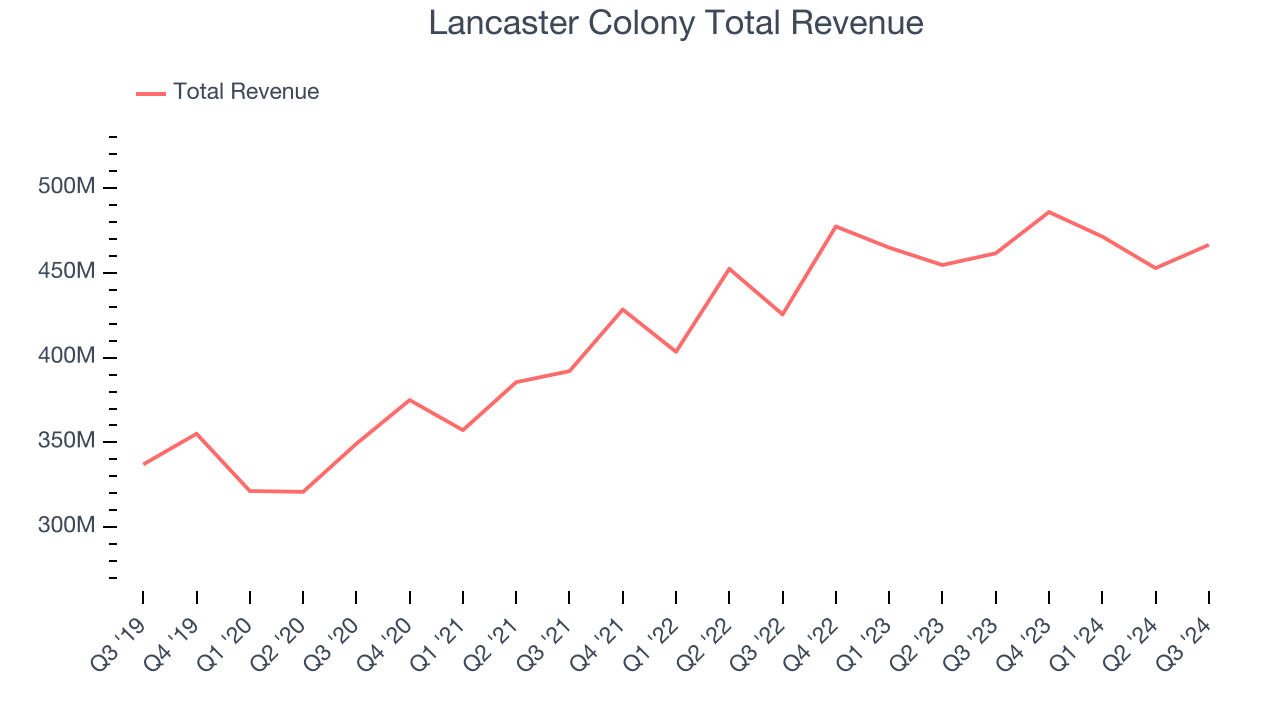

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Lancaster Colony is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

As you can see below, Lancaster Colony’s sales grew at a decent 7.5% compounded annual growth rate over the last three years despite selling a similar number of units each year. We’ll explore what this means in the "Volume Growth" section.

This quarter, Lancaster Colony grew its revenue by 1.1% year on year, and its $466.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market believes its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

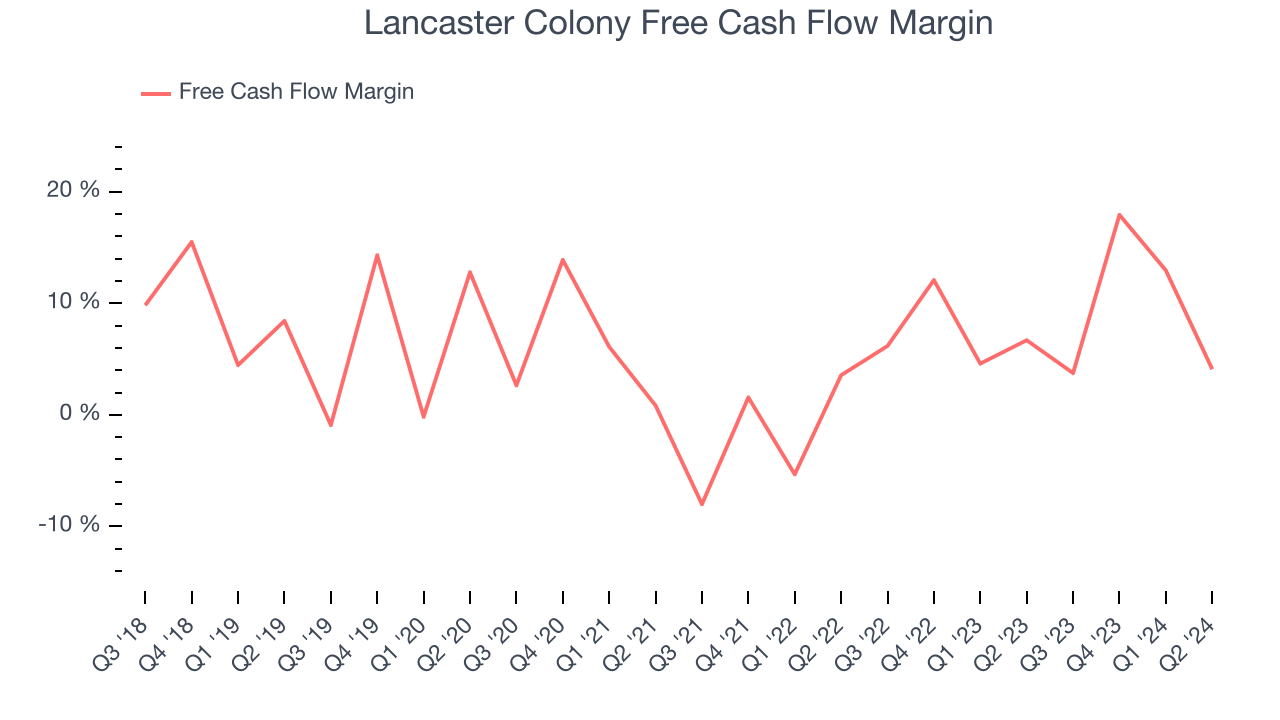

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Lancaster Colony has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9% over the last two years, better than the broader consumer staples sector.

Key Takeaways from Lancaster Colony’s Q3 Results

Revenue was in line but EPS missed. The stock remained flat at $182.82 immediately after reporting.

Lancaster Colony underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.