Engineered products manufacturer ESCO (NYSE:ESE) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 9.5% year on year to $298.5 million. On the other hand, the company’s full-year revenue guidance of $1.1 billion at the midpoint came in 6% below analysts’ estimates. Its non-GAAP profit of $1.46 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy ESCO? Find out by accessing our full research report, it’s free.

ESCO (ESE) Q3 CY2024 Highlights:

- Revenue: $298.5 million vs analyst estimates of $282.6 million (5.6% beat)

- Adjusted EPS: $1.46 vs analyst estimates of $1.44 (1.4% beat)

- Adjusted EBITDA: $64.11 million vs analyst estimates of $59.16 million (8.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.1 billion at the midpoint, missing analyst estimates by 6% and implying 7.1% growth (vs 7.3% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.80 at the midpoint, in line with analyst estimates

- Gross Margin (GAAP): 40.1%, in line with the same quarter last year

- Operating Margin: 16.8%, in line with the same quarter last year

- EBITDA Margin: 21.5%, up from 10.6% in the same quarter last year

- Free Cash Flow Margin: 20.4%, up from 15.5% in the same quarter last year

- Backlog: $879 million at quarter end

- Market Capitalization: $3.69 billion

Bryan Sayler, Chief Executive Officer and President, commented, “We finished the year strong with a solid Q4, highlighted by 9 percent sales growth, 130 basis points of Adjusted EBIT margin improvement, and a 17 percent increase in Adjusted EPS. It was great to see all three segments deliver sales growth and margin improvement in the quarter. We were also able to offset the impacts of profitability erosion on Space development programs at VACCO through outstanding performance across our other businesses. PTI and Crissair in particular delivered excellent results in the quarter."

Company Overview

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

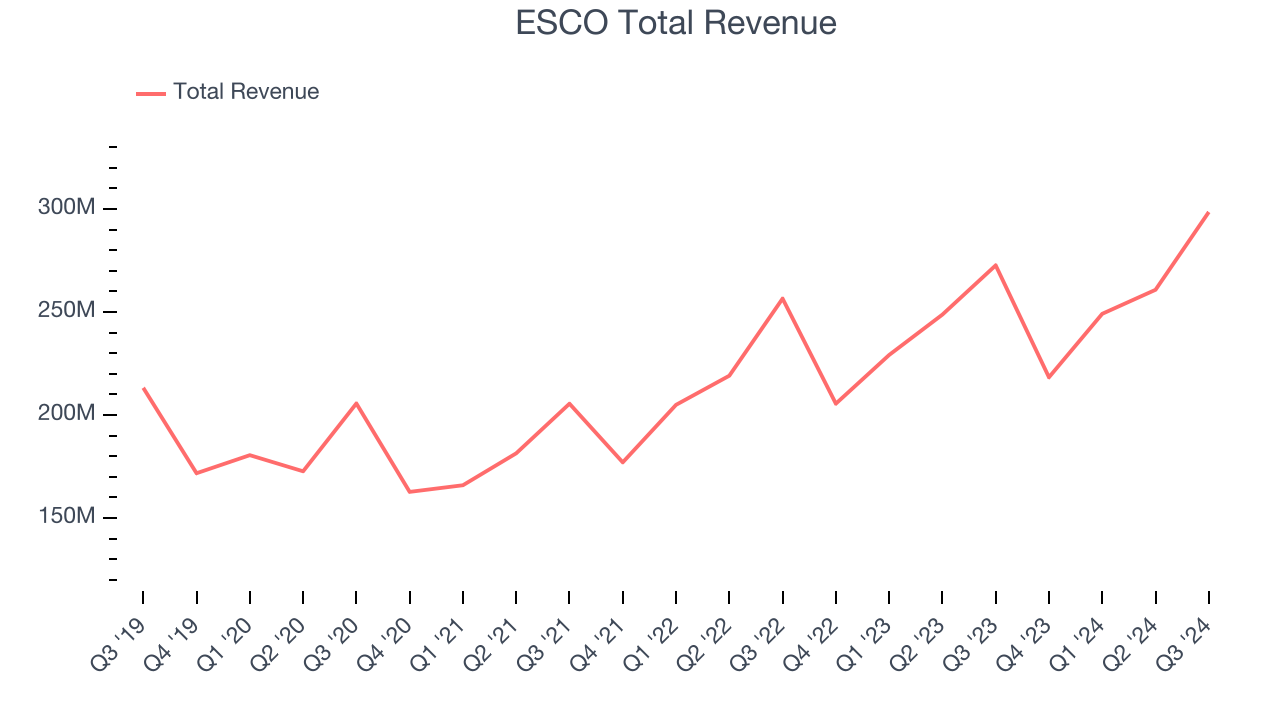

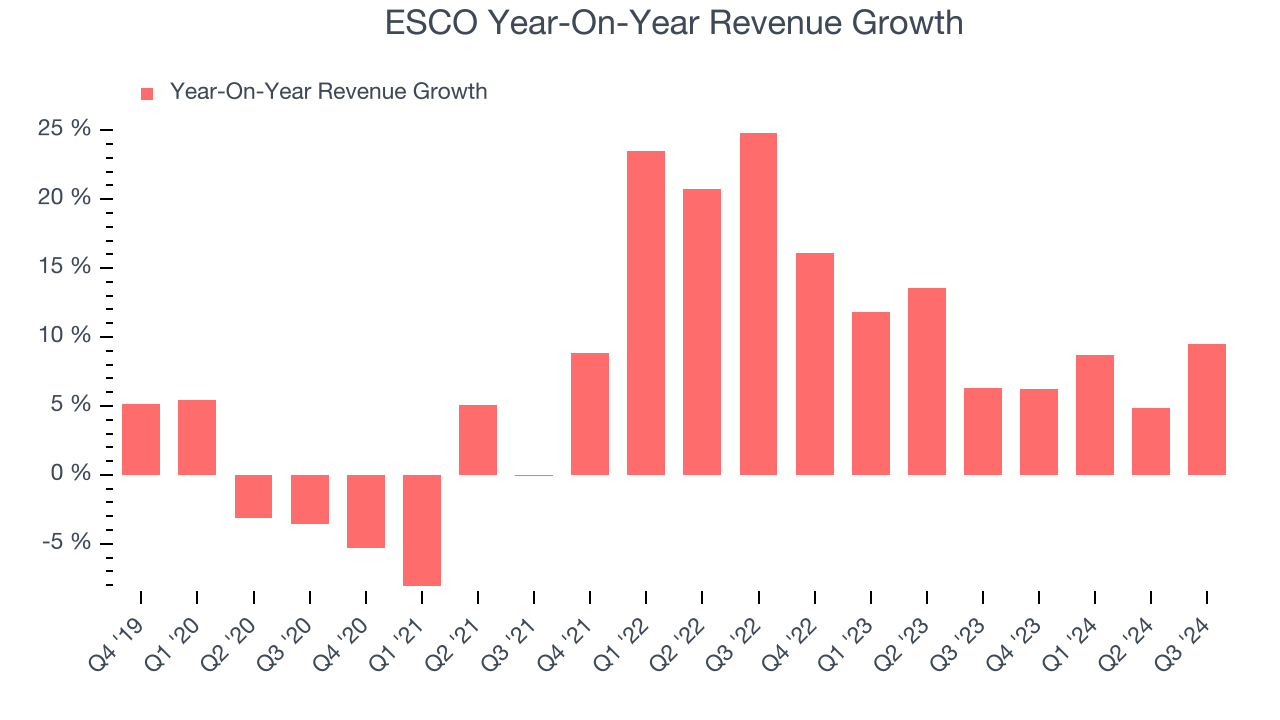

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, ESCO’s 7.2% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector, but there are still things to like about ESCO.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ESCO’s annualized revenue growth of 9.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, ESCO reported year-on-year revenue growth of 9.5%, and its $298.5 million of revenue exceeded Wall Street’s estimates by 5.6%.

Looking ahead, sell-side analysts expect revenue to grow 14.4% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will spur faster growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

ESCO has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, ESCO’s annual operating margin rose by 1.8 percentage points over the last five years, showing its efficiency has improved.

In Q3, ESCO generated an operating profit margin of 16.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

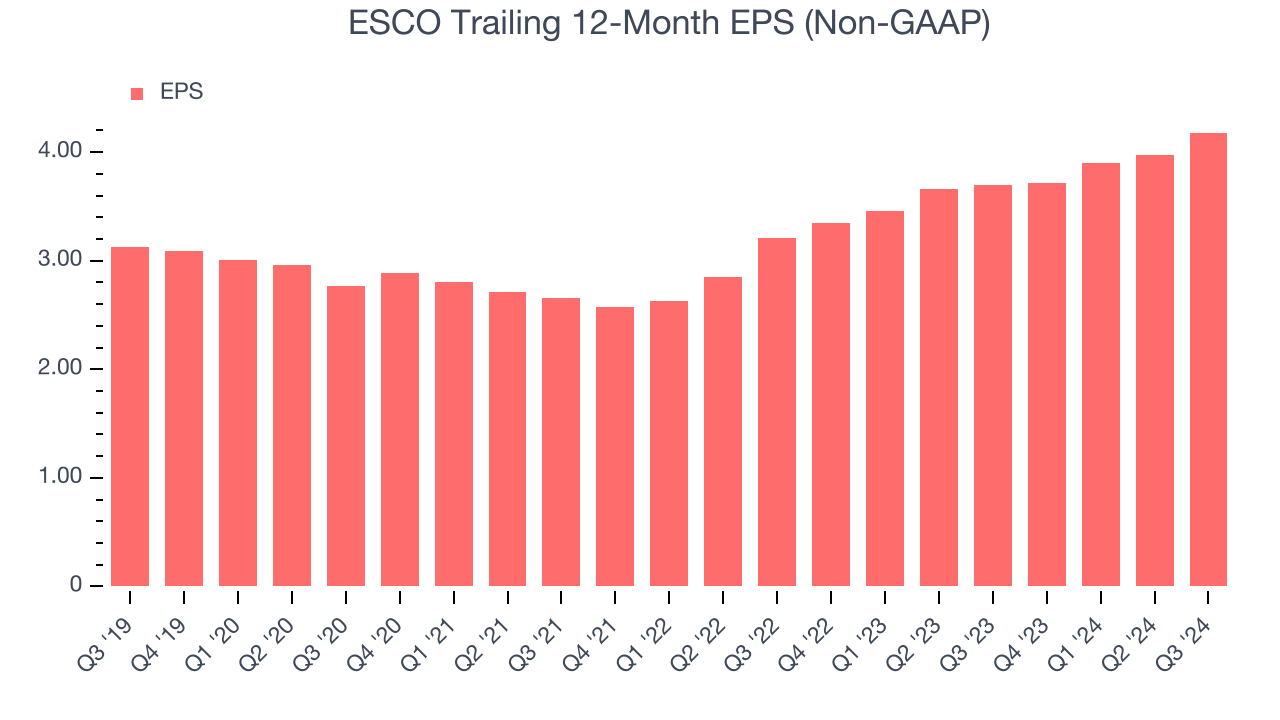

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

ESCO’s EPS grew at an unimpressive 6% compounded annual growth rate over the last five years, lower than its 7.2% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ESCO, its two-year annual EPS growth of 14.1% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, ESCO reported EPS at $1.46, up from $1.25 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects ESCO’s full-year EPS of $4.18 to grow by 15%.

Key Takeaways from ESCO’s Q3 Results

We were impressed by how significantly ESCO blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue meaningfully outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $140 immediately after reporting.

Is ESCO an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.