Engineering and automation solutions company Emerson (NYSE:EMR) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 12.9% year on year to $4.62 billion. On the other hand, the company expects next quarter’s revenue to be around $4.21 billion, slightly below analysts’ estimates. Its GAAP profit of $1.73 per share was also 50.8% above analysts’ consensus estimates.

Is now the time to buy Emerson Electric? Find out by accessing our full research report, it’s free.

Emerson Electric (EMR) Q3 CY2024 Highlights:

- Revenue: $4.62 billion vs analyst estimates of $4.56 billion (1.2% beat)

- EPS: $1.73 vs analyst estimates of $1.15 (50.8% beat)

- EBITDA: $1.14 billion vs analyst estimates of $1.24 billion (8.2% miss)

- Revenue Guidance for Q4 CY2024 is $4.21 billion at the midpoint, below analyst estimates of $4.25 billion

- Gross Margin (GAAP): 51.3%, up from 49.2% in the same quarter last year

- Operating Margin: 22.9%, up from 19.7% in the same quarter last year

- EBITDA Margin: 24.6%, up from 22.8% in the same quarter last year

- Free Cash Flow was $916 million, up from -$812 million in the same quarter last year

- Market Capitalization: $62.82 billion

"Emerson completed an outstanding fiscal 2024, with strong underlying sales growth, operating leverage, adjusted earnings per share and cash generation. I want to thank our employees around the world for their commitment and passion which were integral to delivering these results," said Emerson President and Chief Executive Officer Lal Karsanbhai.

Company Overview

Founded in 1890, Emerson Electric (NYSE:EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

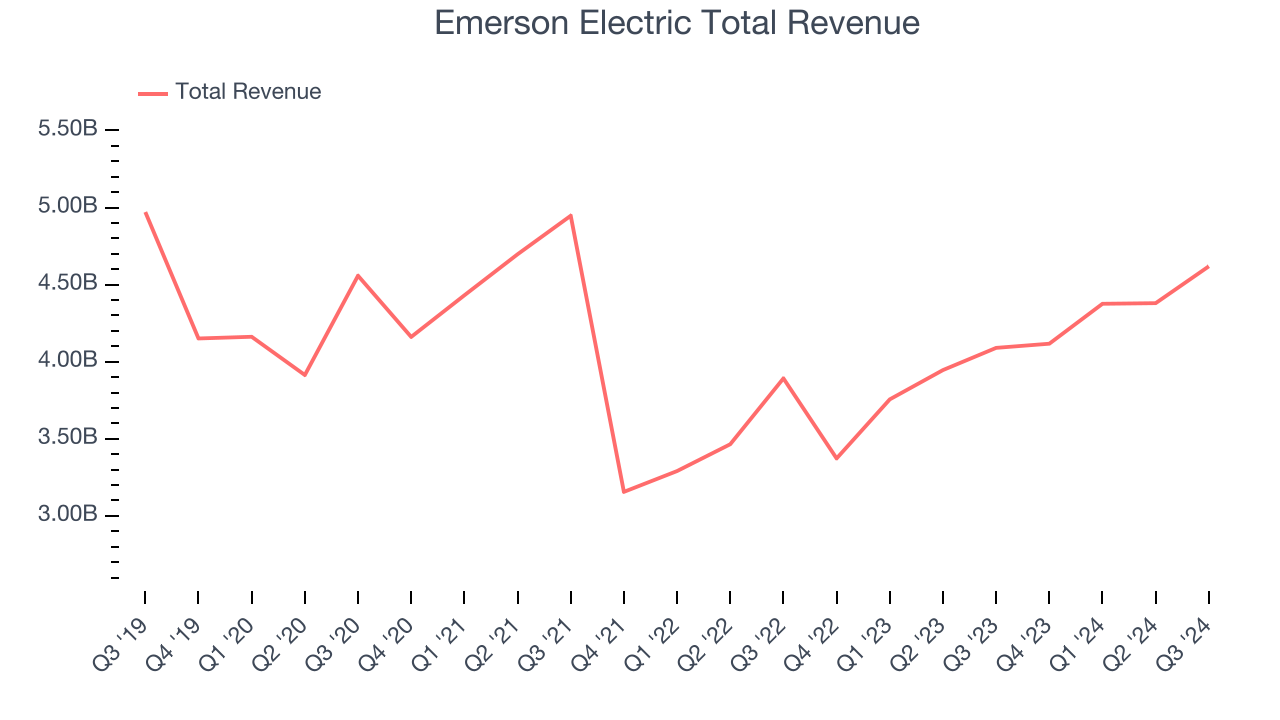

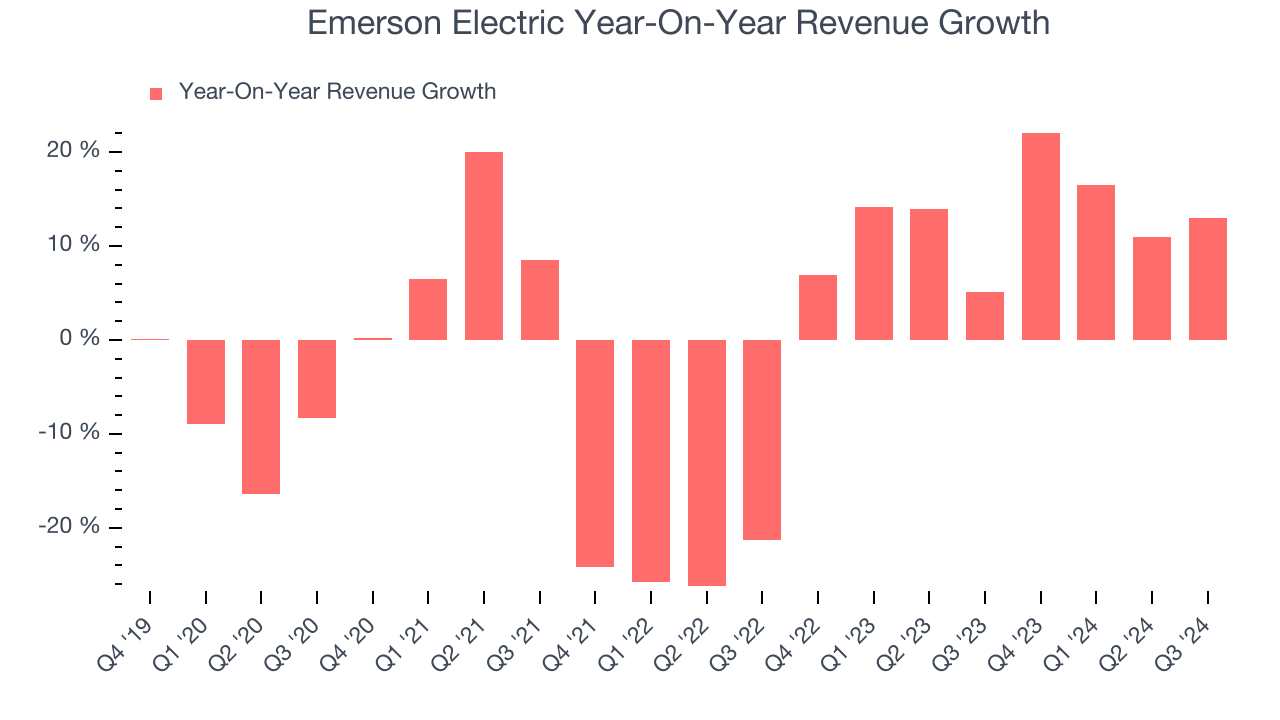

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Emerson Electric’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Emerson Electric’s annualized revenue growth of 12.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Emerson Electric reported year-on-year revenue growth of 12.9%, and its $4.62 billion of revenue exceeded Wall Street’s estimates by 1.2%. Management is currently guiding for a 2.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

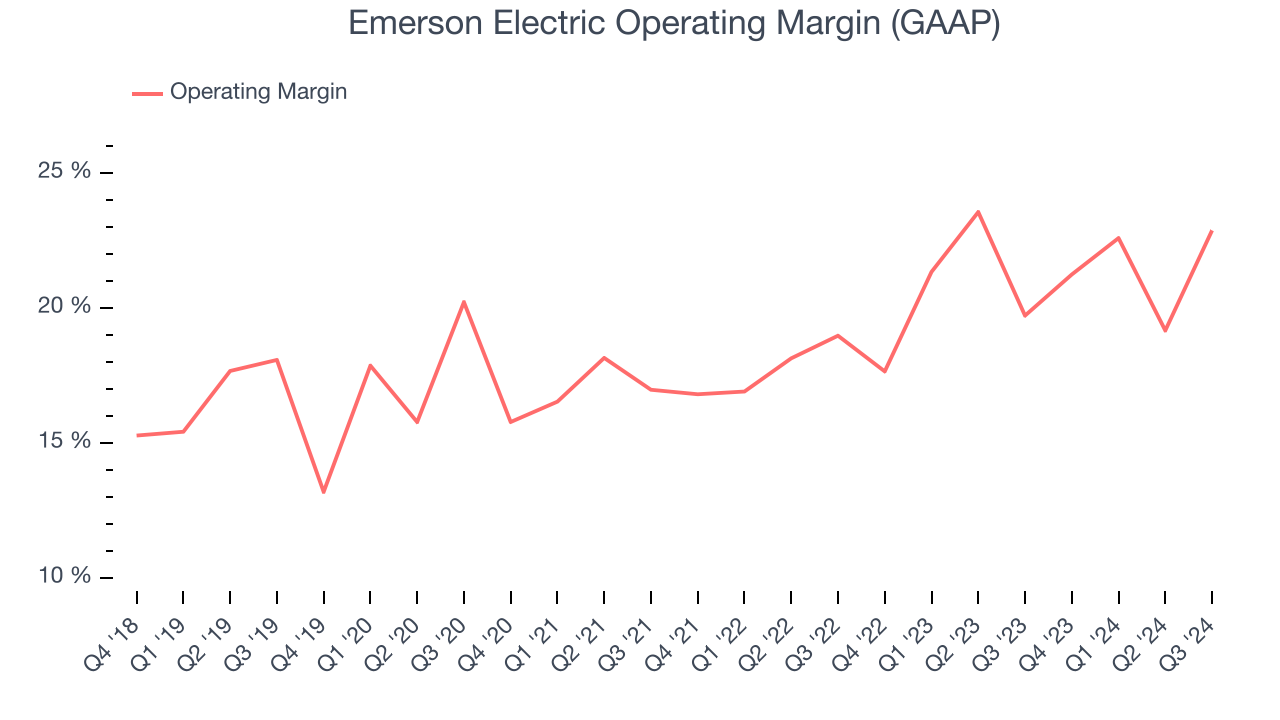

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Emerson Electric has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Emerson Electric’s annual operating margin rose by 4.6 percentage points over the last five years, showing its efficiency has improved.

In Q3, Emerson Electric generated an operating profit margin of 22.9%, up 3.2 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

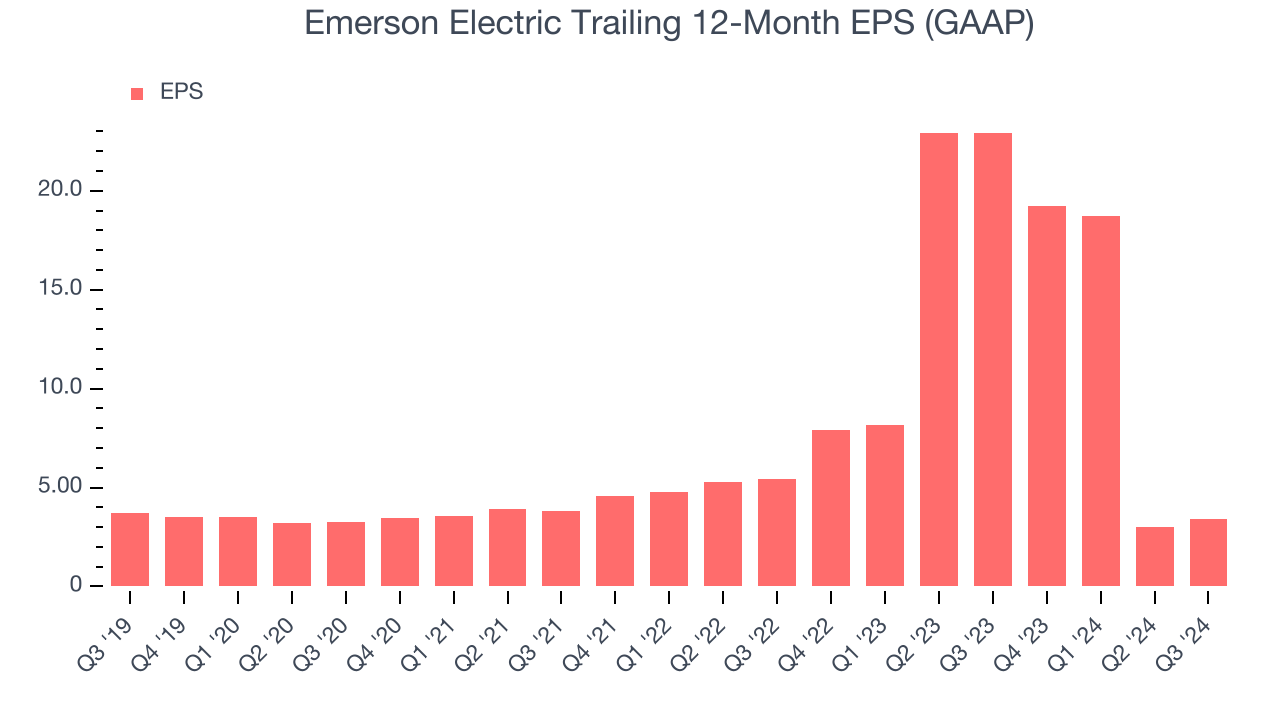

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Emerson Electric, its EPS declined by 1.6% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences.If the tide turns unexpectedly, Emerson Electric’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Emerson Electric, its two-year annual EPS declines of 20.6% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Emerson Electric reported EPS at $1.73, up from $1.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Emerson Electric’s full-year EPS of $3.42 to grow by 25.4%.

Key Takeaways from Emerson Electric’s Q3 Results

We were impressed by how significantly Emerson Electric blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter came in slightly below Wall Street’s estimates. Zooming out, we think this was a decent quarter, with the market willing to overlook the slightly underwhelming revenue guide. The stock traded up 5.9% to $116.25 immediately following the results.

Big picture, is Emerson Electric a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.