Industrial construction and maintenance company Matrix Service (NASDAQ:MTRX) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 16.2% year on year to $165.6 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $925 million at the midpoint. Its GAAP loss of $0.33 per share was also 3.1% below analysts’ consensus estimates.

Is now the time to buy Matrix Service? Find out by accessing our full research report, it’s free.

Matrix Service (MTRX) Q3 CY2024 Highlights:

- Revenue: $165.6 million vs analyst estimates of $169.5 million (2.3% miss)

- EPS: -$0.33 vs analyst expectations of -$0.32 (3.1% miss)

- EBITDA: -$5.88 million vs analyst estimates of -$2.98 million (97.3% miss)

- The company reconfirmed its revenue guidance for the full year of $925 million at the midpoint

- Gross Margin (GAAP): 4.7%, down from 6% in the same quarter last year

- Operating Margin: -6.5%, down from -2.7% in the same quarter last year

- EBITDA Margin: -3.6%, down from -0.3% in the same quarter last year

- Free Cash Flow was $9.97 million, up from -$29.35 million in the same quarter last year

- Market Capitalization: $310.5 million

“We are reiterating our full-year fiscal 2025 revenue guidance, supported by continued demand strength within our core infrastructure and industrial end-markets,” said John Hewitt, President and Chief Executive Officer.

Company Overview

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

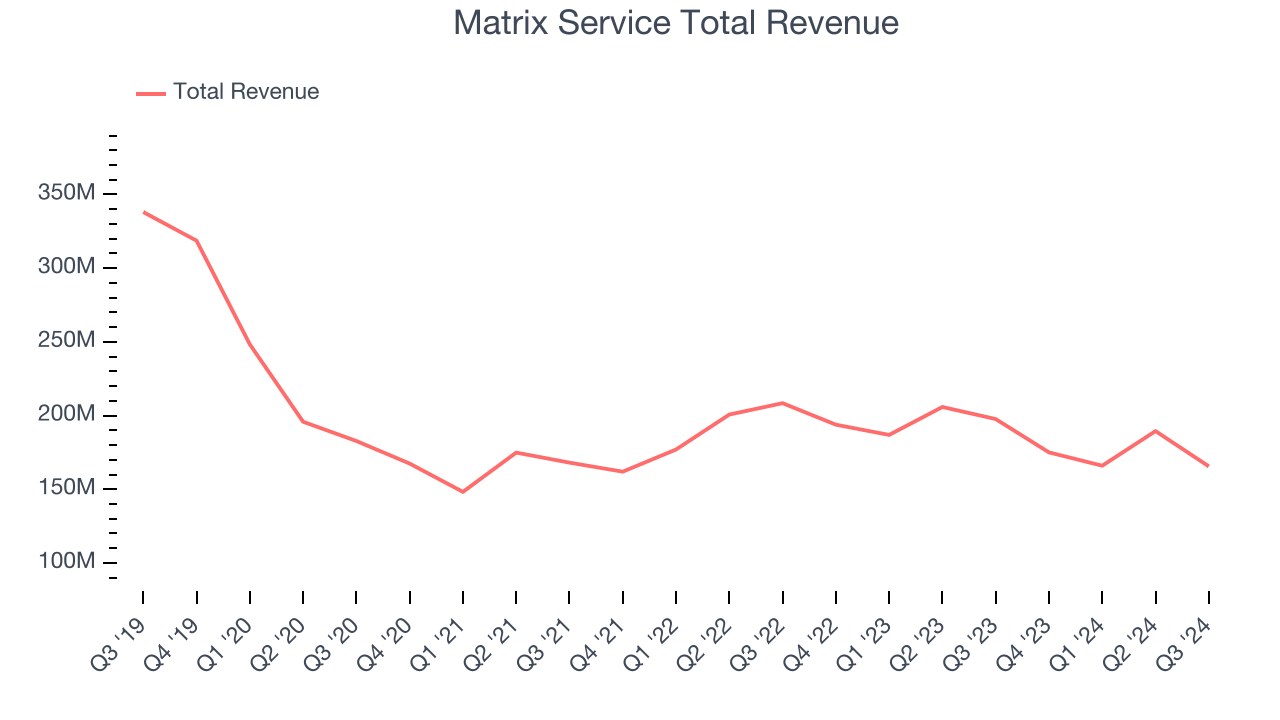

Sales Growth

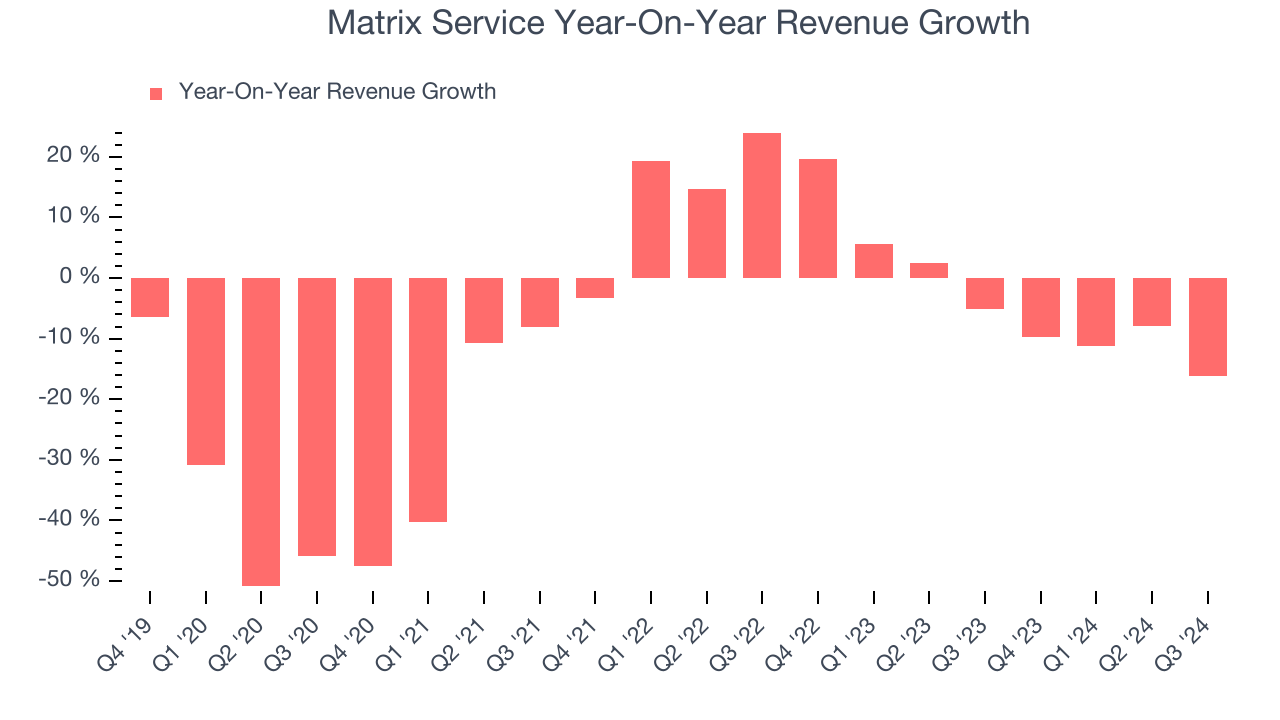

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Matrix Service’s demand was weak over the last five years as its sales fell by 13.5% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Matrix Service’s annualized revenue declines of 3.5% over the last two years suggest its demand continued shrinking.

This quarter, Matrix Service missed Wall Street’s estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $165.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 37.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and illustrates the market thinks its newer products and services will spur faster growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

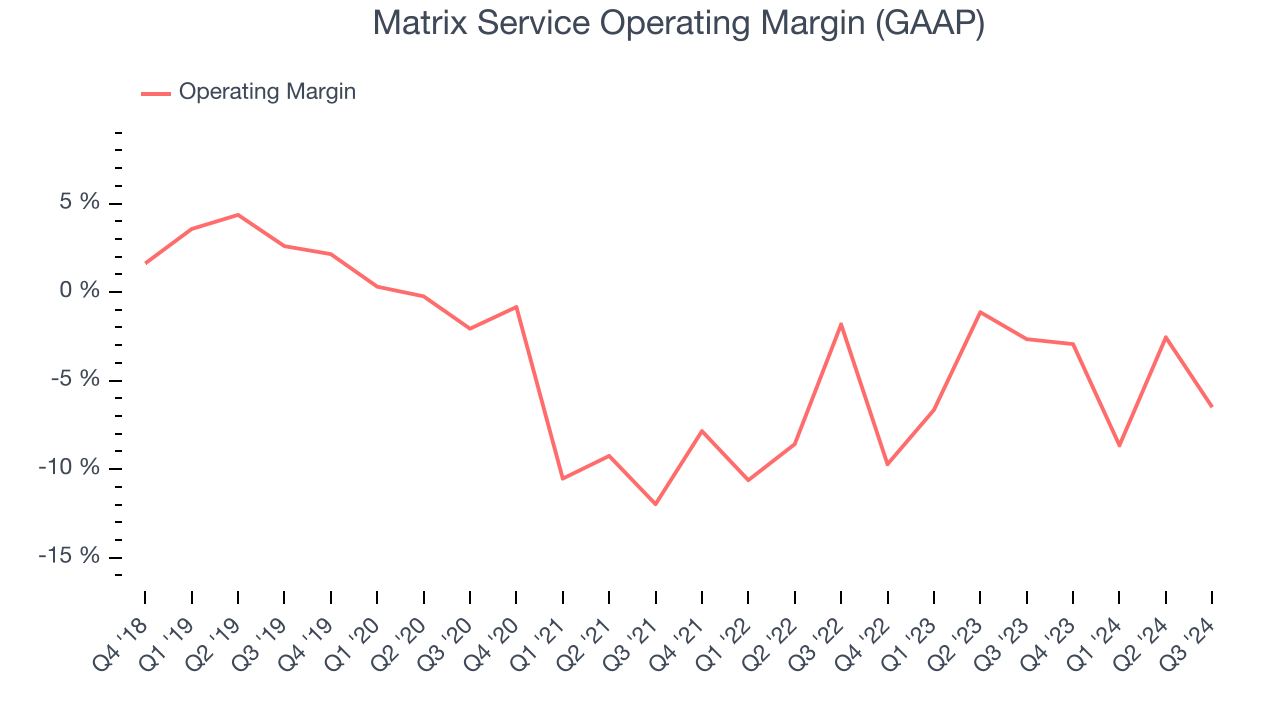

Operating Margin

Matrix Service’s high expenses have contributed to an average operating margin of negative 4.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Matrix Service’s annual operating margin decreased by 5.4 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

Matrix Service’s operating margin was negative 6.5% this quarter. The company's lacking profits are certainly concerning.

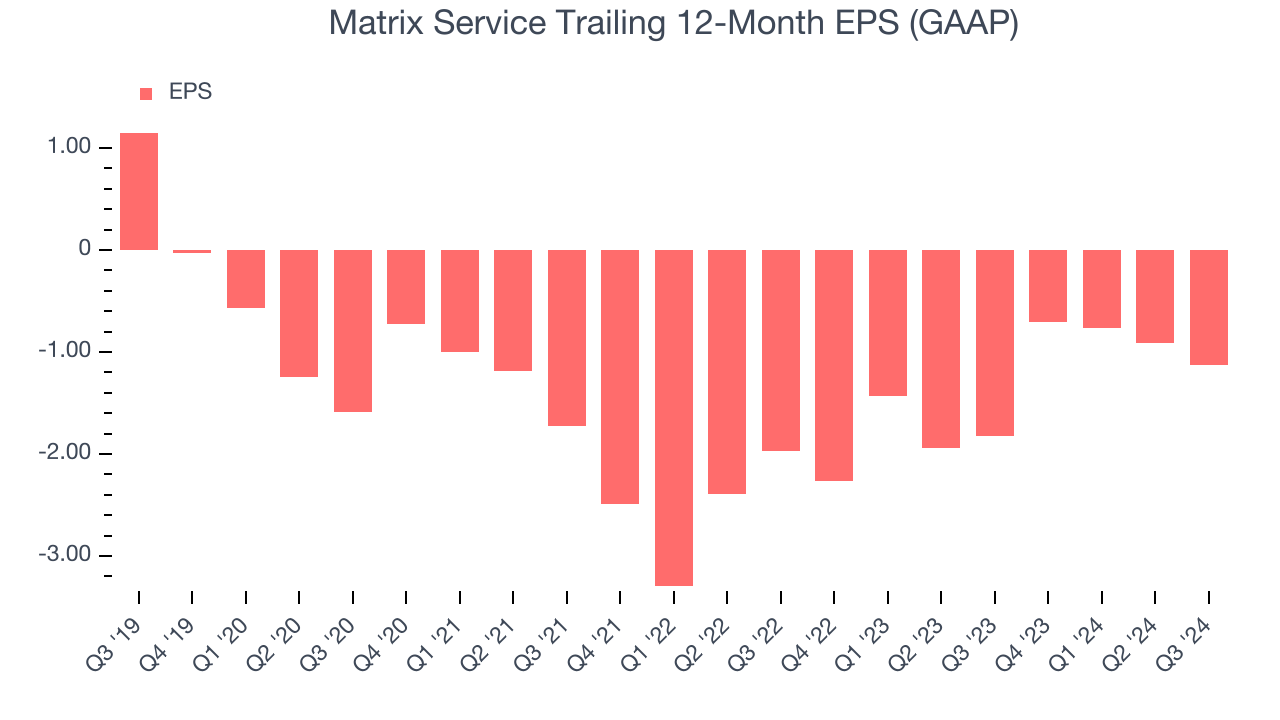

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Matrix Service, its EPS declined by more than its revenue over the last five years, dropping 24.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of Matrix Service’s earnings can give us a better understanding of its performance. As we mentioned earlier, Matrix Service’s operating margin declined by 5.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Matrix Service, its two-year annual EPS growth of 24.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Matrix Service reported EPS at negative $0.33, down from negative $0.12 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Matrix Service’s full-year EPS of negative $1.13 will reach break even.

Key Takeaways from Matrix Service’s Q3 Results

It was good to see Matrix Service’s full-year revenue forecast beat analysts’ expectations. On the other hand, this quarter's revenue and EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better, but the stock traded up 5% to $13.55 immediately after reporting. This was likely due to the optimistic outlook.

Is Matrix Service an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.