Casella Waste Systems trades at $104.48 and has moved in lockstep with the market. Its shares have returned 6.3% over the last six months while the S&P 500 has gained 6%.

Is now the time to buy Casella Waste Systems, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We don't have much confidence in Casella Waste Systems. Here are three reasons why CWST doesn't excite us and a stock we'd rather own.

Why Is Casella Waste Systems Not Exciting?

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

1. Slow Organic Growth Suggests Waning Demand In Core Business

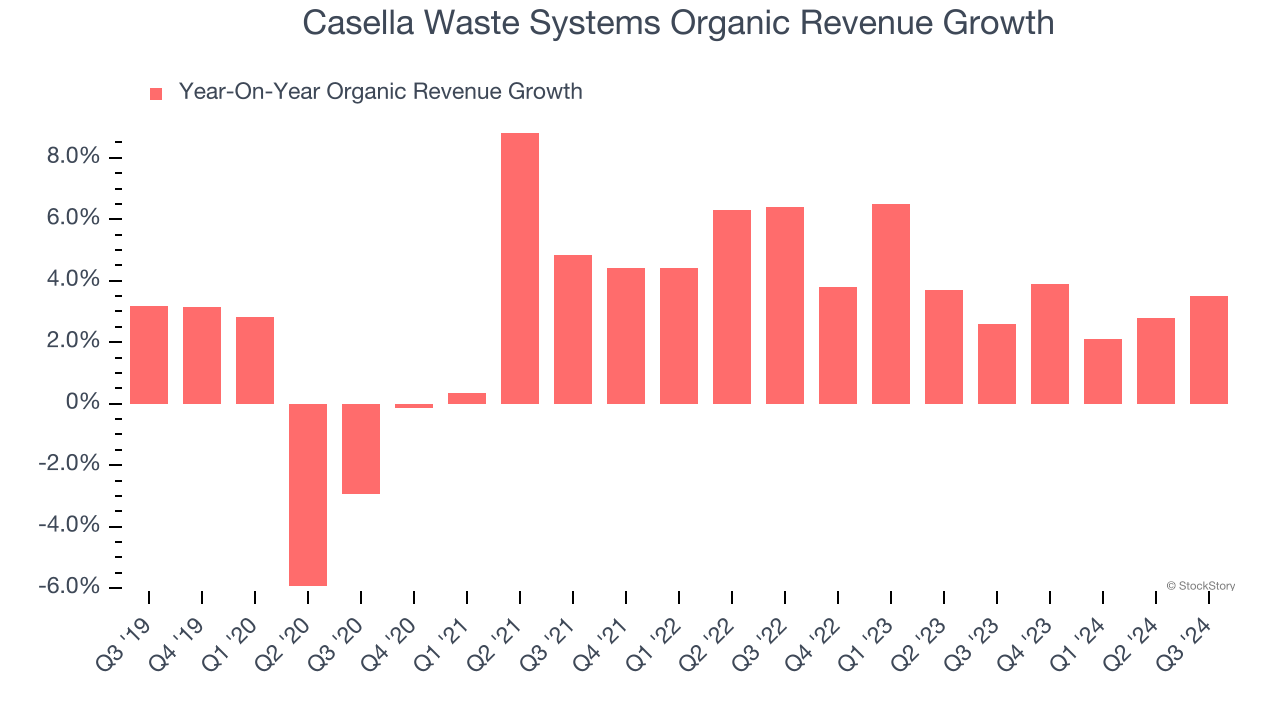

Investors interested in Waste Management companies should track organic revenue in addition to reported revenue. This metric gives visibility into Casella Waste Systems’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Casella Waste Systems’s organic revenue averaged 3.6% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. EPS Trending Down

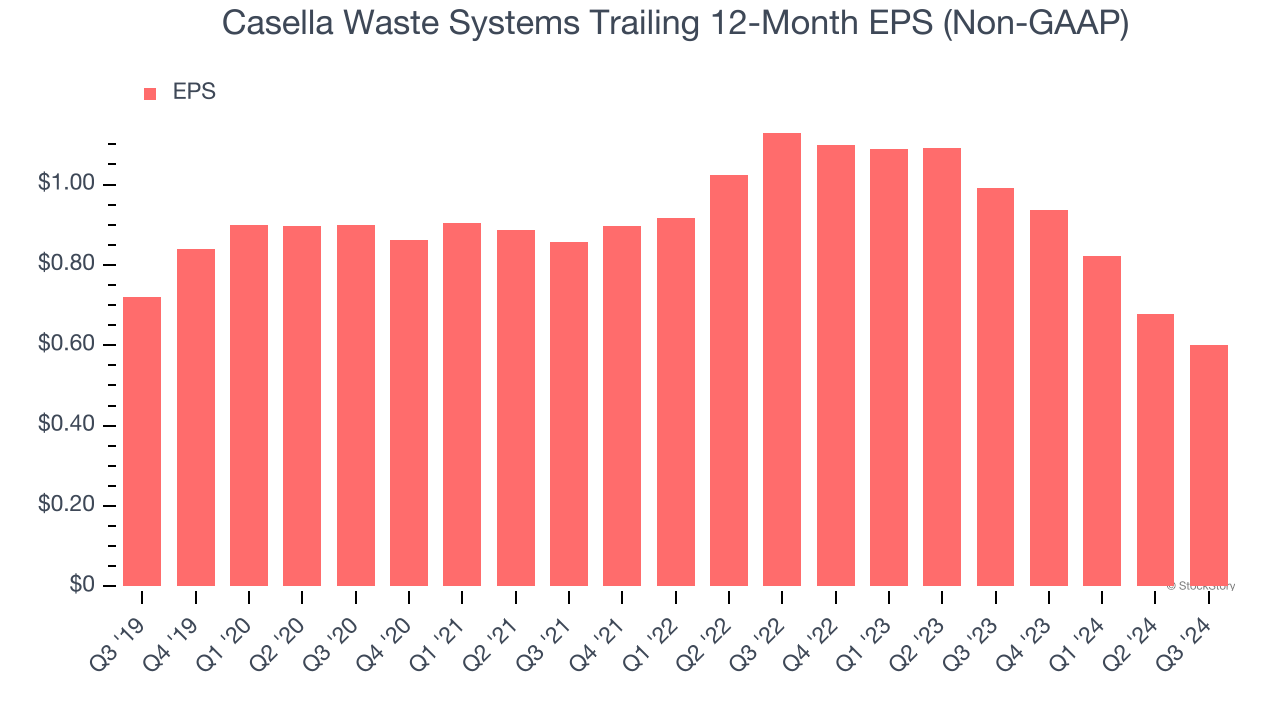

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Casella Waste Systems, its EPS declined by 3.6% annually over the last five years while its revenue grew by 15.5%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

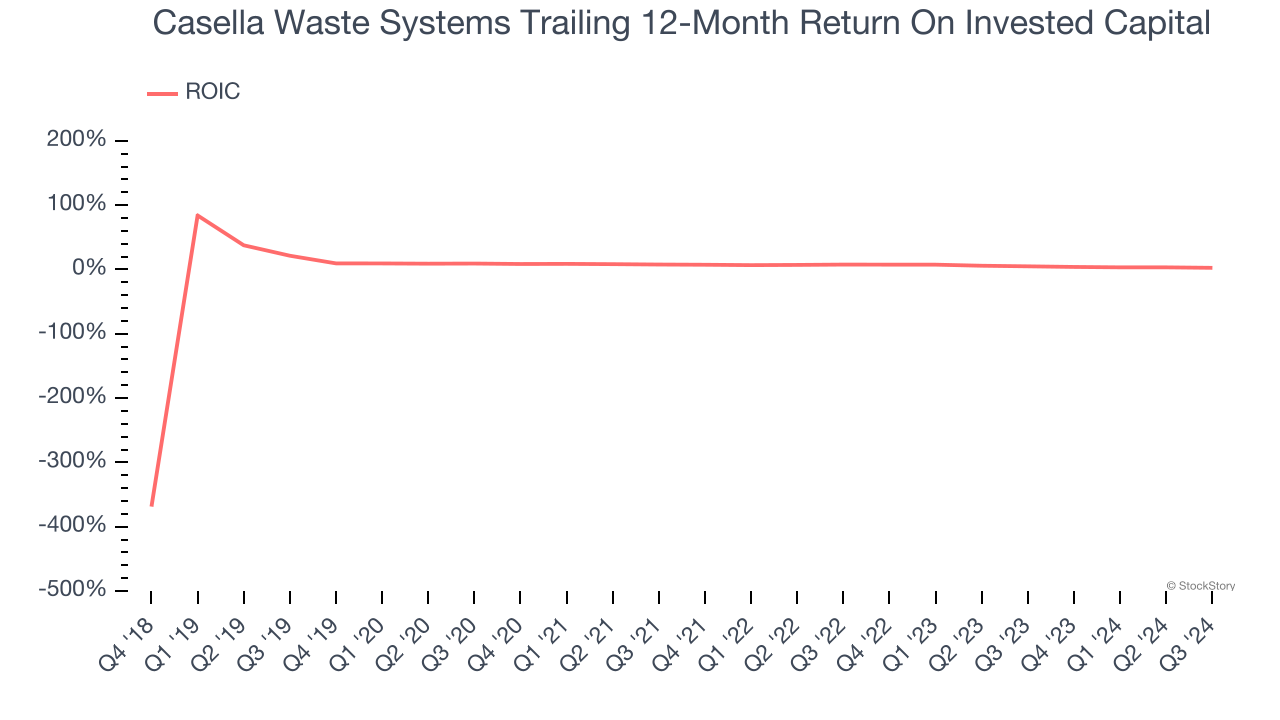

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Casella Waste Systems’s ROIC averaged 4.7 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Casella Waste Systems isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 128.3× forward price-to-earnings (or $104.48 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Would Buy Instead of Casella Waste Systems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.