Over the past six months, Ruger’s shares (currently trading at $37) have posted a disappointing 13.6% loss, well below the S&P 500’s 13.5% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Ruger, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we don't have much confidence in Ruger. Here are three reasons why there are better opportunities than RGR and a stock we'd rather own.

Why Is Ruger Not Exciting?

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

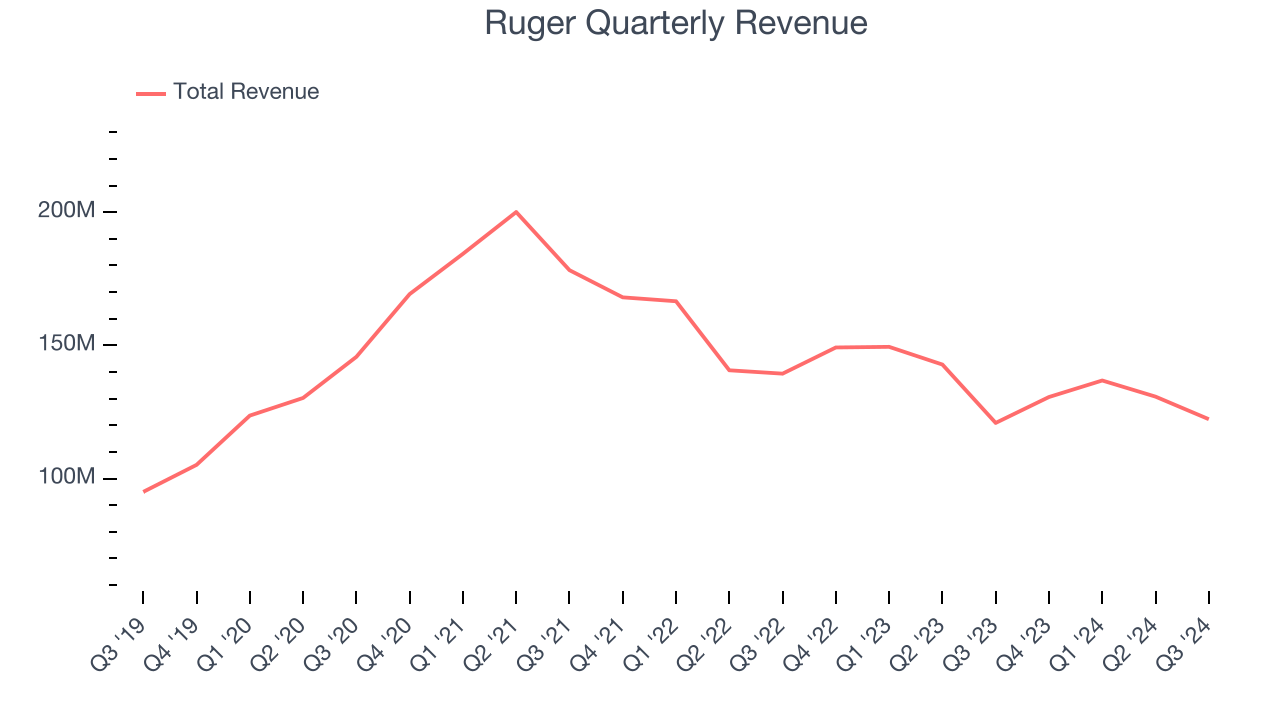

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Ruger grew its sales at a sluggish 4.1% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

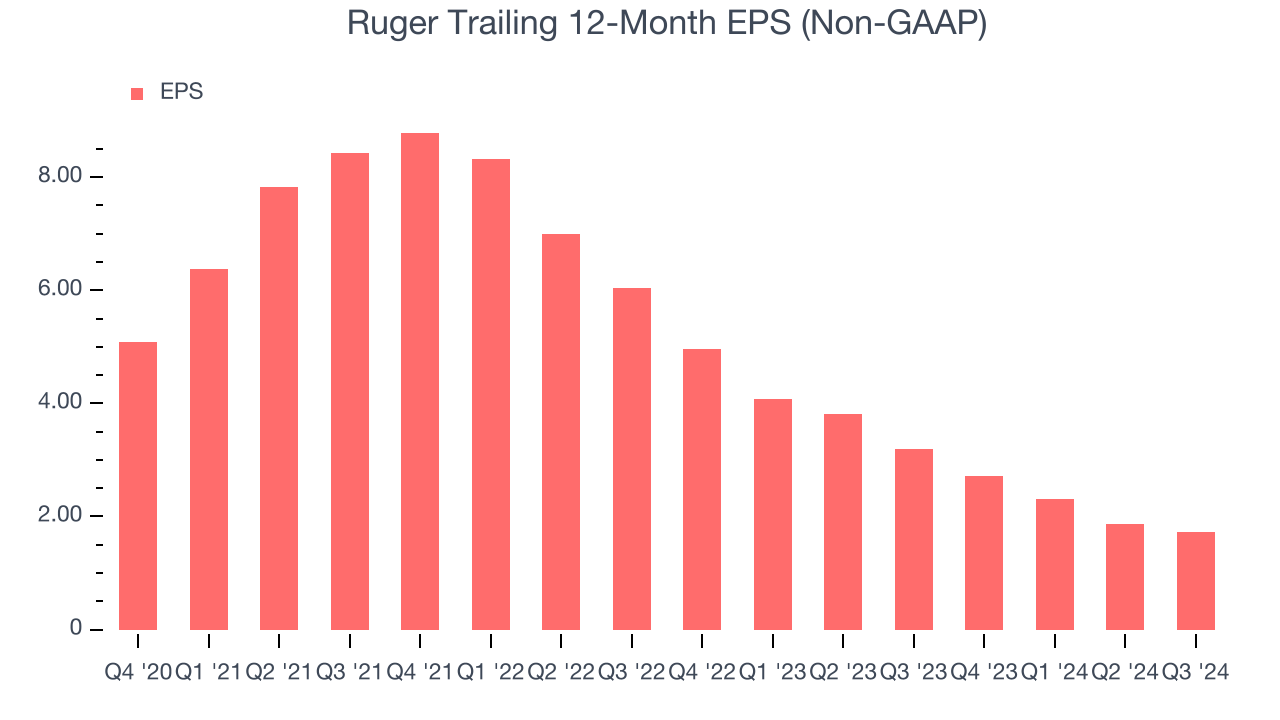

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ruger’s full-year EPS dropped 131%, or 23.2% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Ruger’s low margin of safety could leave its stock price susceptible to large downswings.

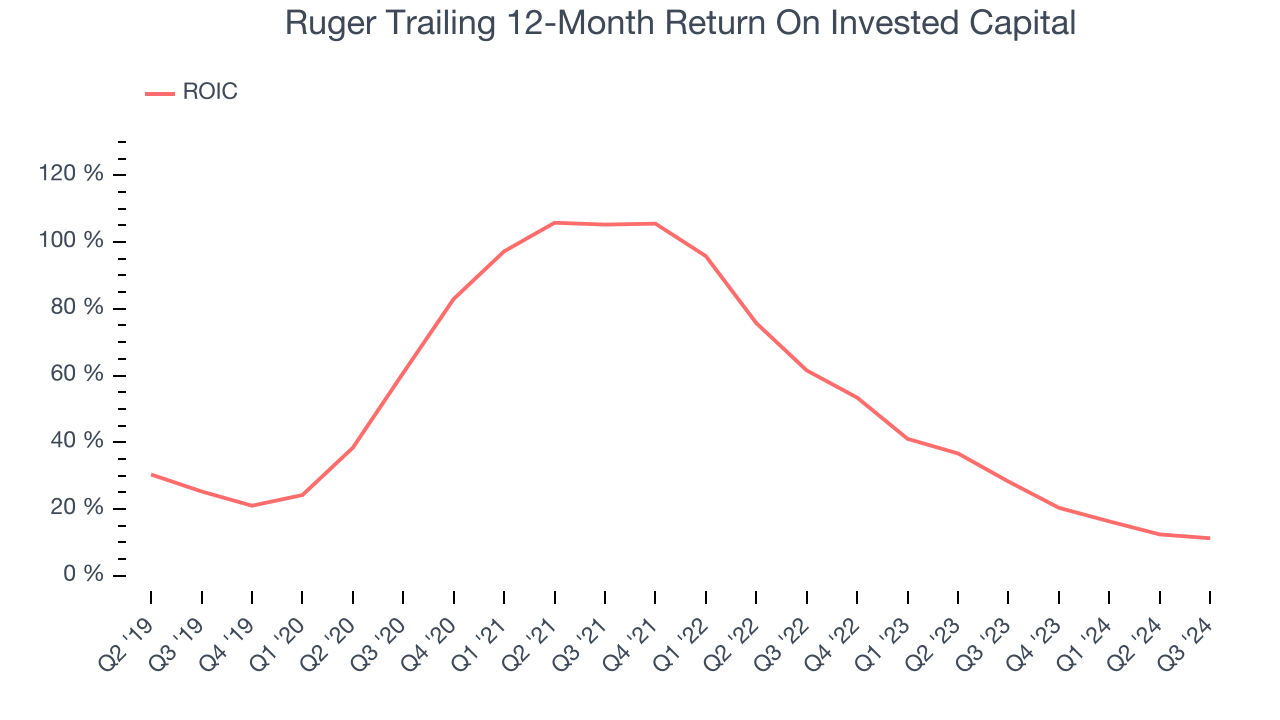

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Ruger’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Ruger’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 13.1× forward price-to-earnings (or $37 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Ruger

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.