Zoom, a well-known video conferencing company, will buy Five9, a company that sells software allowing users to reach customers across platforms, and record notes on their interactions. As TechCrunch noted this morning, the deal is merely “Zoom’s latest attempt to expand its offerings,” having “added several office collaboration products, a cloud phone system, and an all-in-one home communications appliance” to its larger software stack in recent quarters. Both companies are publicly traded.

But the Five9 deal is in a different league than its previous purchases. Indeed, the $14.7 billion transaction represents a material percentage of Zoom’s own value. That tells us that the company is not simply making a purchase in Five9, but is instead making a large bet that the combination of its business and that of the smaller company will prove rather accretive.

Zoom is worth $101.8 billion as of the time of writing, with the company’s shares slipping just over 4% today; the stock market is largely off this morning, making Zoom’s share price movements less indicative of investor reaction to the deal that we might think. Still, it doesn’t appear that the street is excessively thrilled by news of Zoom’s purchase.

That perspective may be reasonable, given that the Five9 transaction is worth nearly 15% of Zoom’s total market cap; the company is betting a little less than a sixth of its value on a single wager.

Not that Five9 doesn’t bring a lot to the table. In its most recent quarter, Five9 posted $138 million in total revenue, growth of 45% on a year-over-year basis.

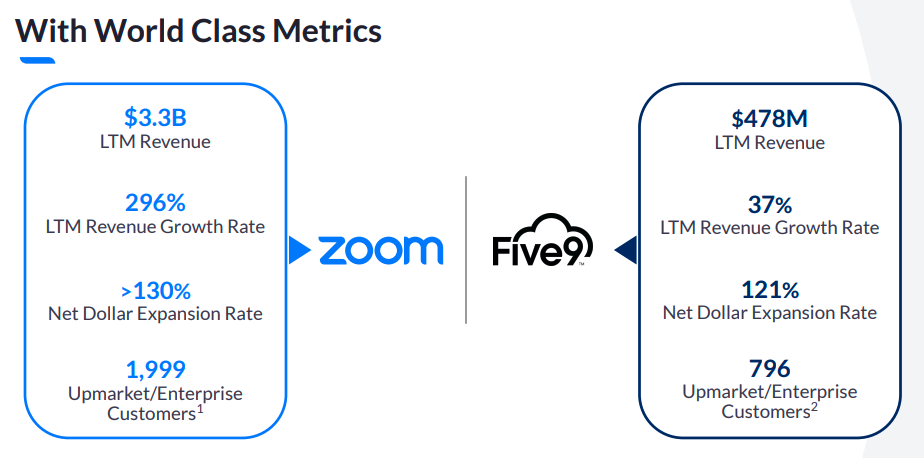

Still, as Zoom reported in an investor deck concerning the transaction, the smaller company’s growth rate pales compared to its own:

Image Credits: Zoom investor deck

This is where the deal gets interesting. Note that Five9’s revenue growth rate is a fraction of Zoom’s. The larger company, then, is buying a piece of revenue that is growing slower than its core business. That’s a bit of a flip from many transactions that we see, in which the smaller company being acquired is growing faster than the acquiring entity’s own operations.

Why would Zoom buy slower growth for so very much money? One thing to consider is that Five9’s most recent quarterly growth rate is quicker than the growth rate that it posted over the last 12 months. That implies that Five9 has room to accelerate growth compared to its historical pace, bringing its total pace of top-line expansion closer to what Zoom itself manages.