Cirrus Logic, Inc. (CRUS) is a fabless semiconductor company that develops low-power, high-precision mixed-signal processing solutions globally. Due to the rapid proliferation of technology, the semiconductor industry has seen a steady rise in demand on the backs of its widespread usage in digitization initiatives.

According to the Semiconductor Industry Association (SIA), worldwide semiconductor sales rose 1.9% in September compared to the prior month, marking the seventh consecutive month of increased sales. Moreover, for the third quarter, sales of semiconductors totaled $134.7 billion, indicating an increase of 6.3% compared to the second quarter of 2023.

For the second quarter of fiscal 2024 (ended September 23), CRUS’ revenue came in at $481.06 million, down 11% year-over-year. However, the figure was near the higher end of the company’s forecast. Its gross margin stood at 51.3%, higher than its forecasted range of 49%-51%. The company’s non-GAAP EPS declined 9.5% from the prior-year quarter to $1.80.

With such mixed results in view, let’s look at CRUS’ key financial metrics to understand why it could be prudent to watch and wait for a better entry point in the stock.

Analyzing Cirrus Logic, Inc.'s Financial Performance: December 2020 to September 2023

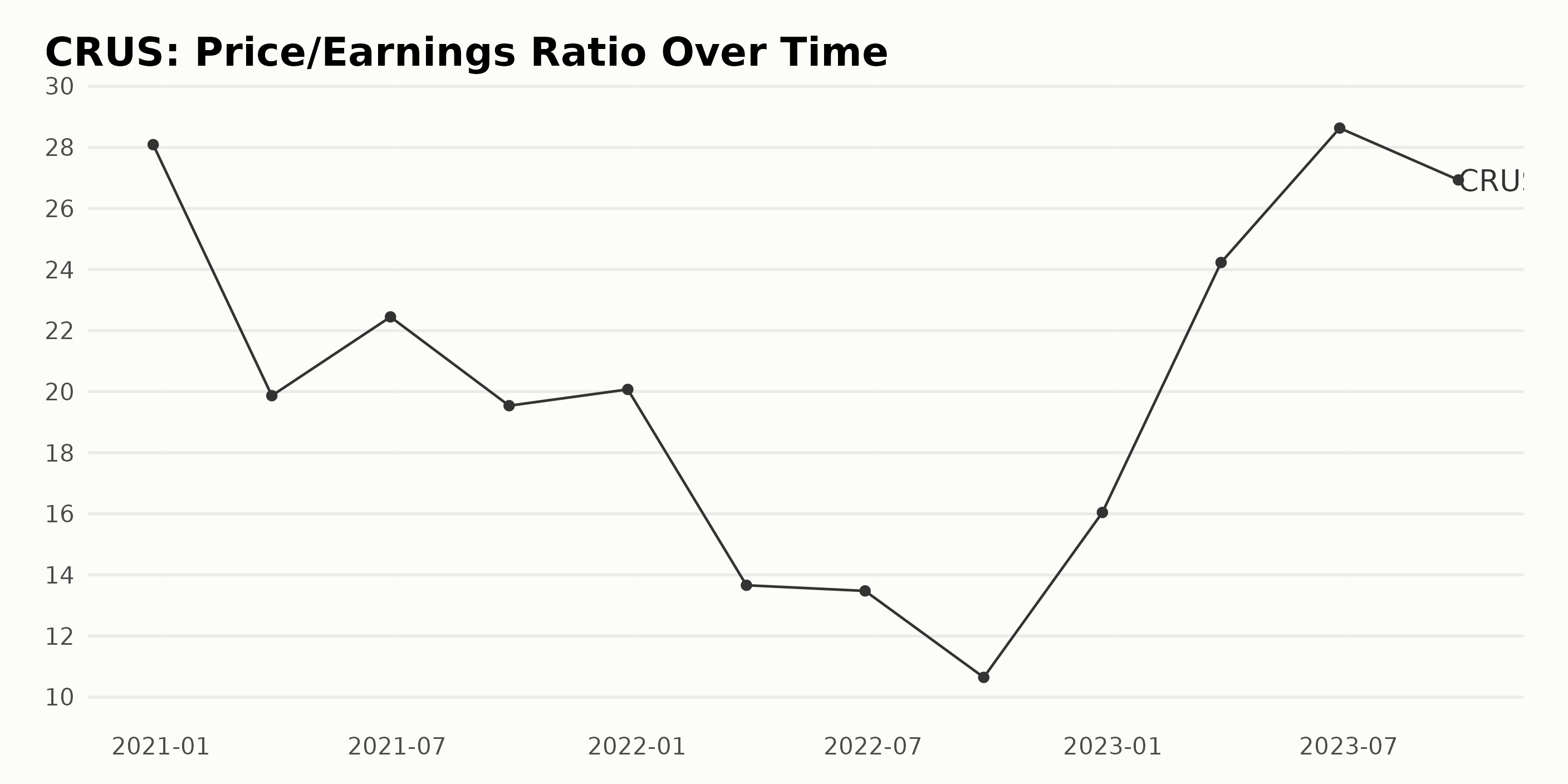

The Price/Earnings Ratio (P/E) of CRUS has shown significant fluctuations over a given time period, as noted:

- From December 2020 to December 2023, the P/E ratio saw a reduction from 28.09 to 26.93. This represents a growth rate of -4% over three years.

- The highest P/E ratio observed in this period was 28.63 in June 2023.

- The lowest P/E ratio was 10.64 in September 2022.

- Overall, from December 2020 to September 2022, the P/E ratio experienced a general downtrend, decreasing by roughly 62%.

- However, between September 2022 and September 2023, the P/E ratio demonstrated an uptrend, increasing by over 153%.

- These fluctuations denote considerable volatility in the performance of CRUS.

This summary emphasizes more recent data, noting a relatively high P/E ratio in September 2023 (26.93), up from the lowest value of 10.64 in 2022.

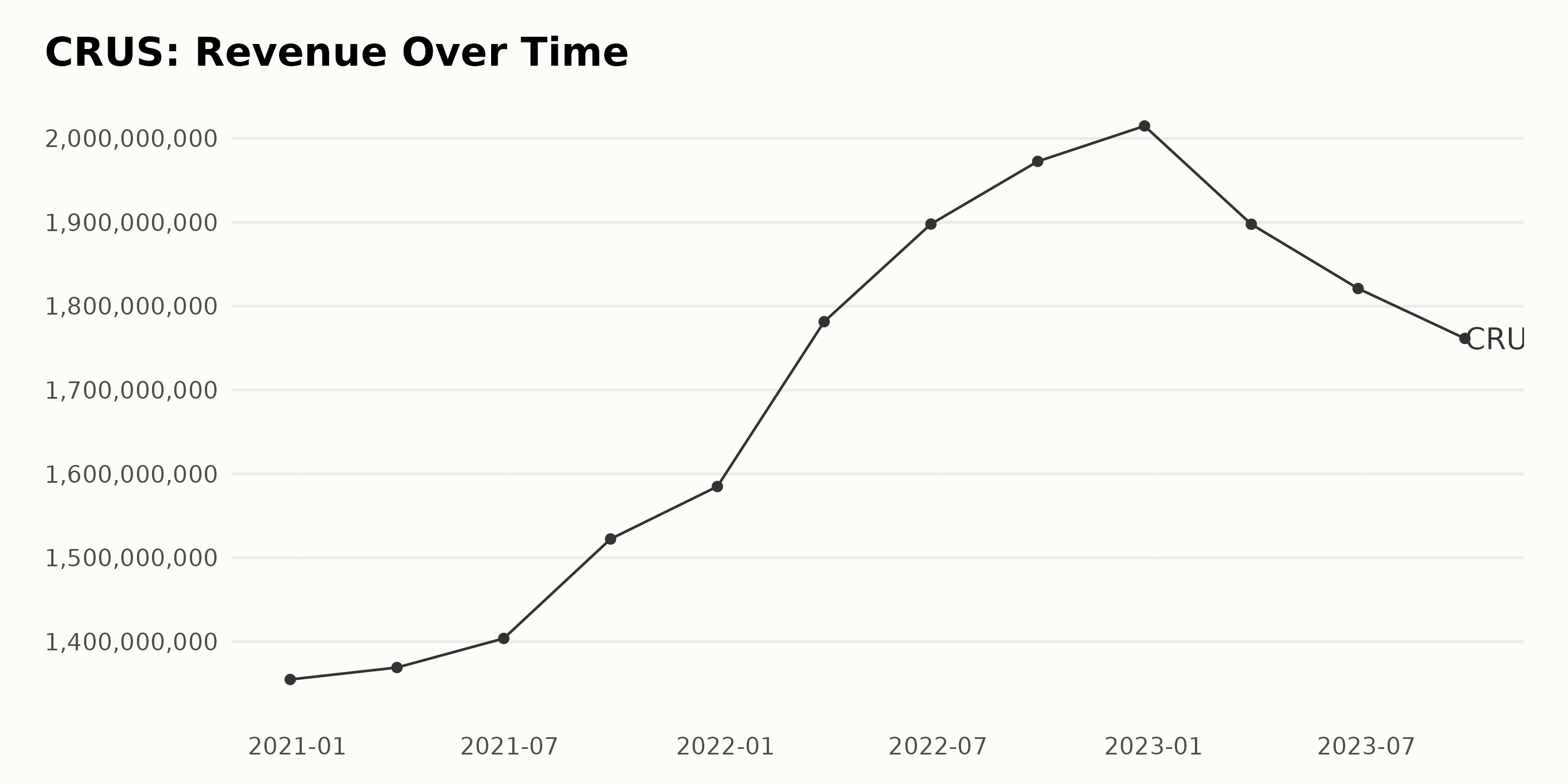

The trailing-12-month revenue of CRUS showed an overall upward trend from December 2020 to December 2022, with some fluctuations over the periods in between. Here are the significant points:

- Beginning at $1.35 billion in December 2020, the revenue experienced a slight increase to $1.37 billion by March 2021.

- There was a consistent rise in the successive quarters of 2021, with revenue ending the year at $1.59 billion in December.

- In the year 2022, CRUS' revenue peaked in December at $2.01 billion, marking the highest point in the series. This represents a remarkable growth rate of 48% compared to the starting value in December 2020.

- However, the first three quarters of 2023 showed a decline, with revenue dipping to $1.76 billion in September, indicating a downward fluctuation in more recent data.

It's noteworthy that despite recent dips, the revenue of CRUS is still significantly higher than its initial values, attesting to the company's growth over this period.

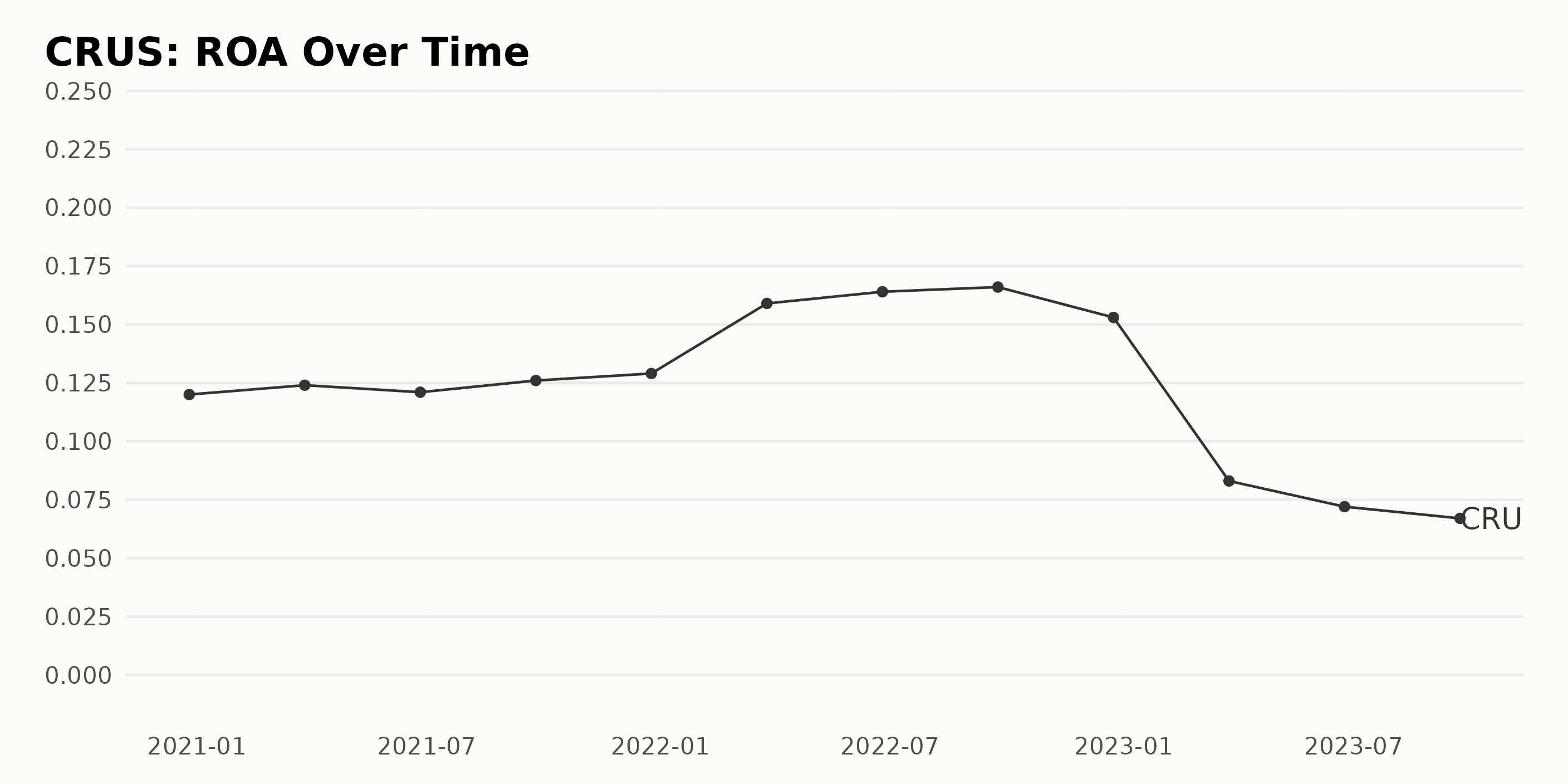

The ROA trend and fluctuations for CRUS over the period provided can be summarized as follows:

- The ROA was at 0.12 in December 2020, which slightly increased to 0.124 in March 2021.

- There was a minor dip in June 2021, when it went down to 0.121. However, the ROA rebounded and showed an upward trend, reaching 0.126 in September 2021 and further increasing to 0.129 in December 2021.

- In the first three quarters of 2022, we witnessed a significant rise in ROA, from 0.159 in March, 0.164 in June, to 0.166 in September.

- A sudden drop was observed in December 2022 to 0.153, followed by a more significant decrease during 2023. The ROA went down to 0.083 in March, decreased to 0.072 in June, and reached its lowest point at 0.067 in September 2023.

The ROA of CRUS displayed an increasing trajectory from the beginning of the data series until the third quarter of 2022, after which there was a sharp decline. The total growth rate from December 2020 to September 2023, measured by the final value from the initial value, suggests a decrease, i.e., -44%.

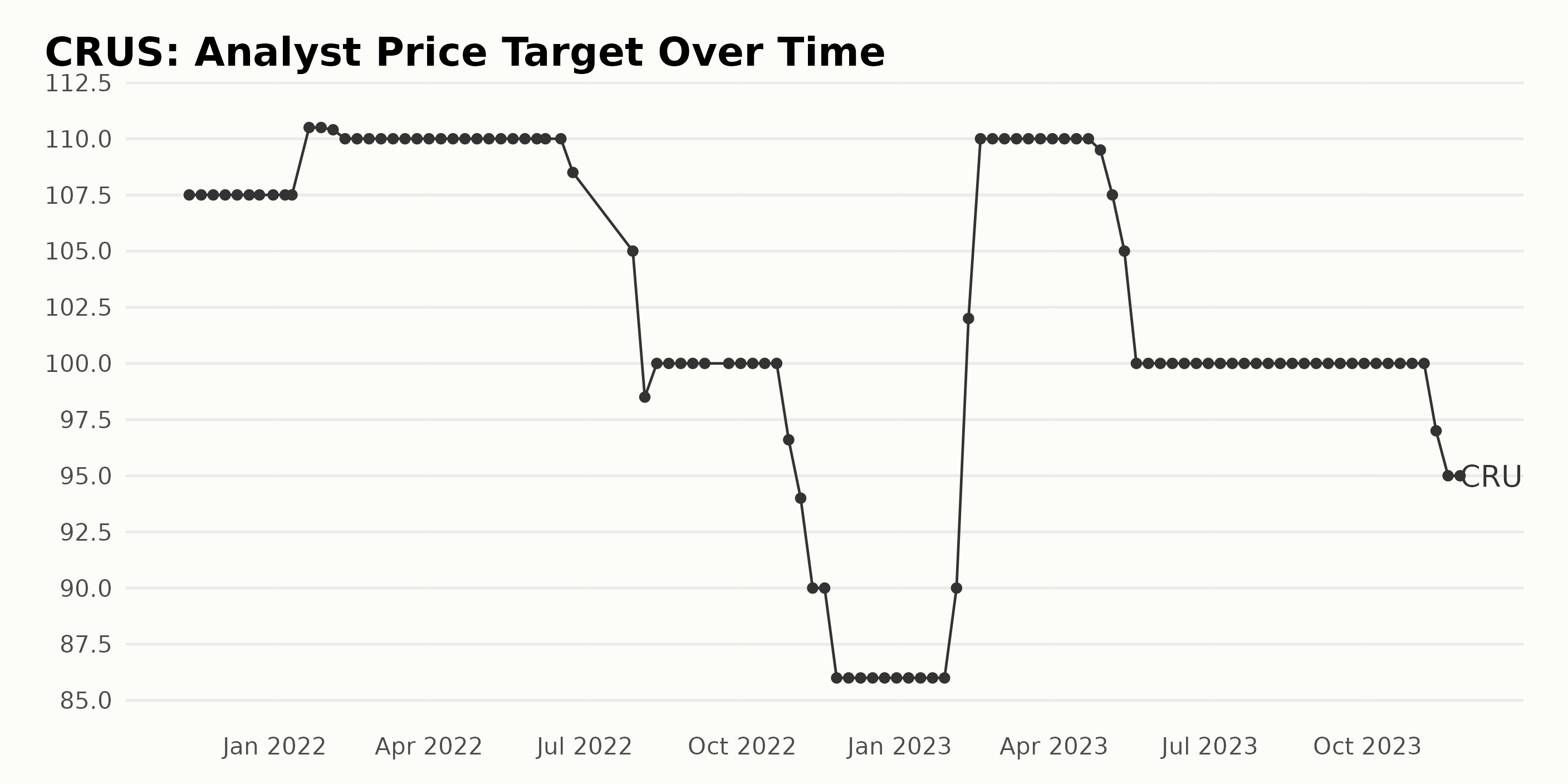

The analyst price target data for CRUS from November 2021 to November 2023 shows an overall decreasing trend with several fluctuations throughout.

- Between November 12, 2021, and January 21, 2022, the analyst price target remained consistent at $107.50 before slightly increasing to $110.50.

- There was a slight decline in the target from $110.50 in early February to $107.50 in late June 2022.

- From late July to early August 2022, the target drastically dropped from $108.50 to $98.50 but quickly recovered to $100, remaining until late October 2022.

- In late November, the target had fallen to $86 but then rose again over the next few months, reaching once again a peak of $110 by mid-February 2023.

- From late April to mid-May 2023, the target then declined steadily from $110 to $105. It stayed steady at $100 from late May until November of the same year.

- The series ends on a slightly decreasing note, with the target dropping from $100 to $95 in November 2023.

From the first recorded value of $107.50 in November 2021 to the last value of $95 in November 2023, CRUS experienced a decrease of roughly 12%. Even though there were periods of rise and stability in the target price, the general trend was a decline over this two-year period.

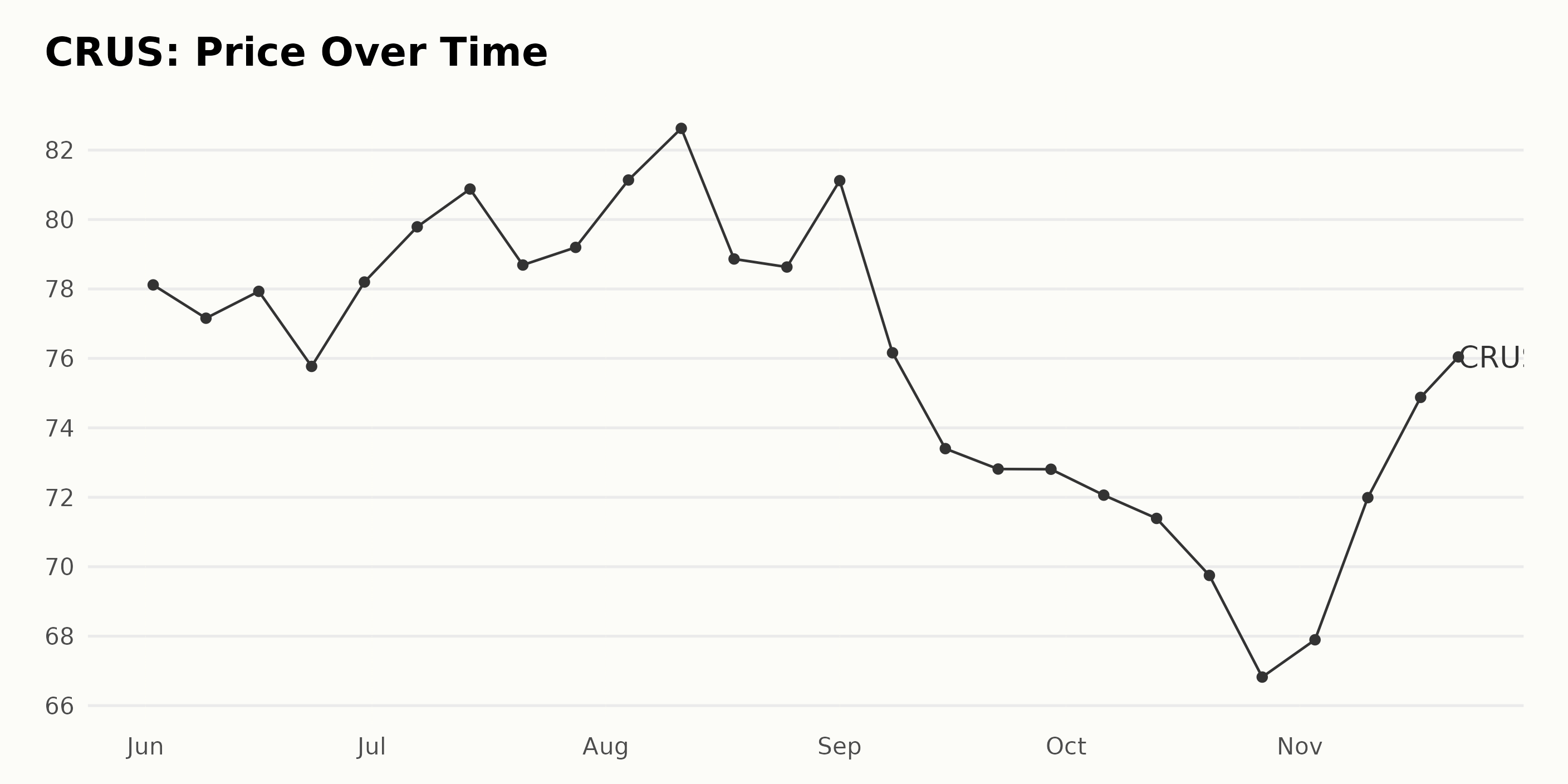

Analyzing Cirrus Logic Inc.'s Share Price Fluctuations: June to November 2023

After analyzing the mentioned dataset, the share price of CRUS seems to be experiencing fluctuations, leading to a mixed trend. Here's a summary of the changes:

- On June 2, 2023, the price was $78.12.

- The price underwent minor fluctuations throughout June, ending up with a slight increase to $78.20 by June 30, 2023.

- In July, the price continued to fluctuate but saw an overall increase, ending at $79.20 by July 28, 2023.

- In August, the price peaked at $82.63 on August 11, 2023, before dropping back down to $78.63 by August 25, 2023.

- During September, there was a noticeable decrease in the price, ending up at $72.81 by September 29, 2023.

- The downward trend continued in October, with the price dropping to $66.82 by October 27, 2023.

- Starting from the end of October up to November 22, 2023, the price showed a steady increase, reaching $75.85.

In conclusion, while there were periods of increase and decrease in the share price from June to November 2023, it displayed a slight overall decrease when comparing the start and end points. Therefore, we can note a mildly decelerating trend in this period. However, it's important to take into account market volatility and other influencing factors. Here is a chart of CRUS' price over the past 180 days.

Analyzing Cirrus Logic's Performance Through POWR Ratings: Momentum, Quality, Value

Based on the information provided, the POWR Ratings Grade of CRUS, which belongs to the 92-stock Semiconductor & Wireless Chip category, exhibits fluctuations between B (Buy) and C (Neutral) grades over several months in the year 2023. Here are some key points on the POWR Grade:

- The highest rank achieved was #15 in the week of August 5, 2023, with a grade of B (Buy).

- In many instances, while the POWR grade was B (Buy), it managed to hold a superior rank, being in the top 30 among 92.

- As of the latest data point, on November 24, 2023, CRUS had a POWR grade of C (Neutral) and is ranked #20 in its category.

- Over the course of these months, the POWR grade shifted between B (Buy) and C (Neutral), indicating fluctuation in performance.

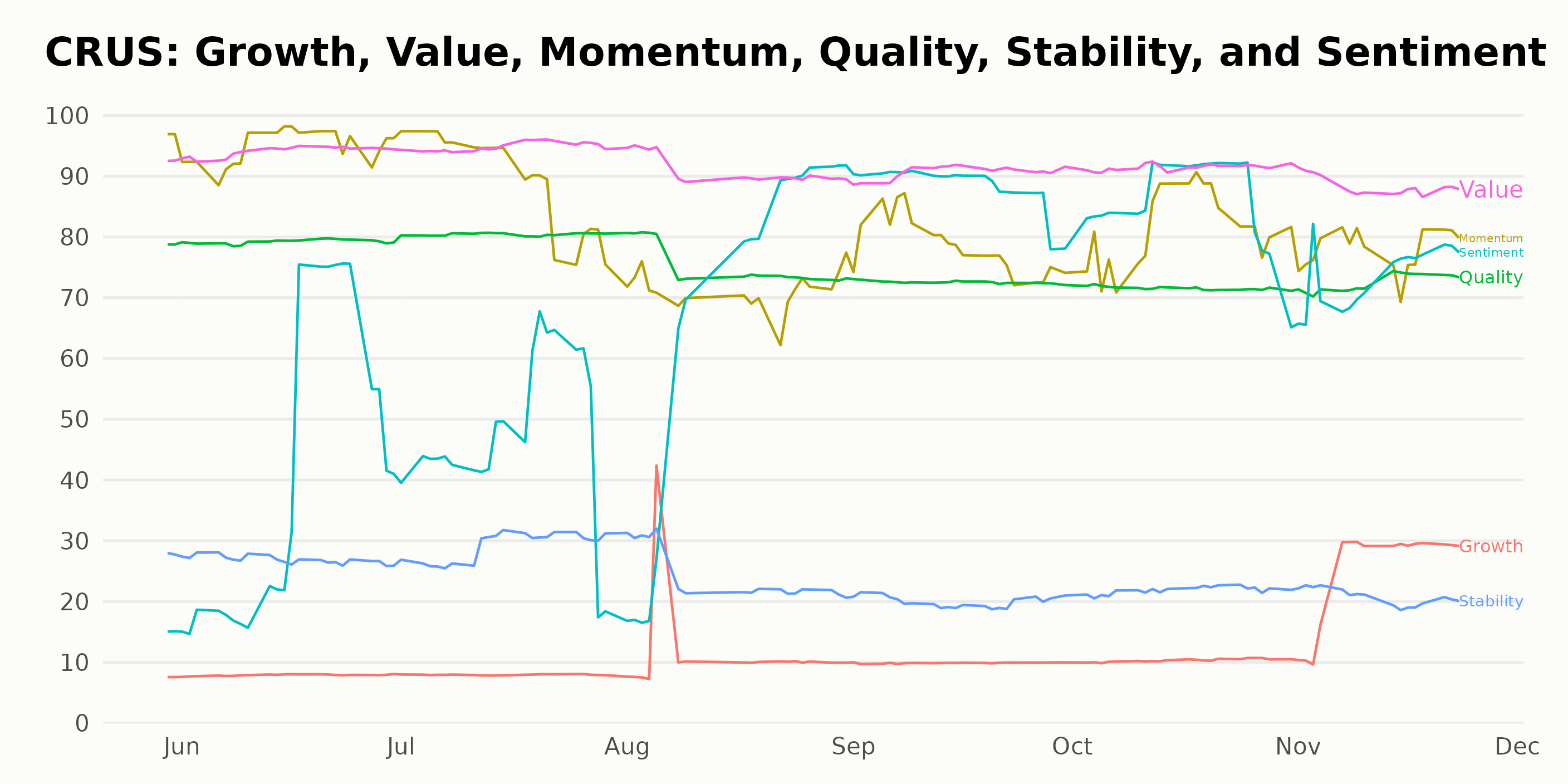

The POWR Ratings for CRUS provide valuable insight into the company's performance across various dimensions. Based on the data, three dimensions register as most noteworthy: Momentum, Quality, and Value. Discussions below explore these dimensions more in-depth:

- Momentum: This dimension of CRUS initially exhibited its highest value of 97 in May 2023. However, the subsequent months demonstrated a clear downward trend, dropping notably to 71 by August 2023. After a brief rise, reaching 82 in October 2023, Momentum remained steady at 78 for both September and November 2023.

- Quality: Throughout the provided timeline, Quality ratings remained relatively consistent for CRUS, starting at 79 in May 2023 and fluctuating between the upper 70s and lower 80s through July 2023. While the score decreased marginally to 73 in the later months of 2023, this dimension remains an area of strength for Cirrus Logic.

- Value: The Value dimension reported consistently high scores for CRUS throughout the timeframe, making it one of the company's strongest metrics within the POWR Ratings. Starting at 93 in May 2023 and rising slightly to 95 by July 2023, it maintained a score in the low 90s through to November 2023, when it registered 88.

These dimensions, collectively, highlight some critical aspects of CRUS’ performance and potential, according to the POWR Ratings model.

How does Cirrus Logic, Inc. (CRUS) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are Everspin Technologies, Inc. (MRAM), ChipMOS TECHNOLOGIES INC. (IMOS), and STMicroelectronics N.V. (STM) - they have better POWR Ratings. Click here to explore more Semiconductor & Wireless Chip stocks.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

CRUS shares were trading at $77.21 per share on Friday morning, up $1.36 (+1.79%). Year-to-date, CRUS has gained 3.67%, versus a 20.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Can Cirrus Logic, Inc. (CRUS) Capitalize on the Chip Industry Boom? appeared first on StockNews.com