Golden Minerals Company (“Golden Minerals”, “Golden” or the “Company”) (NYSE-A: AUMN and TSX: AUMN) is pleased to announce additional assay results from 20 recently completed diamond drill holes and to announce it has commenced a reverse circulation drill program focusing on resource definition at its Rodeo gold-silver mine located in Durango State, Mexico.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210916005176/en/

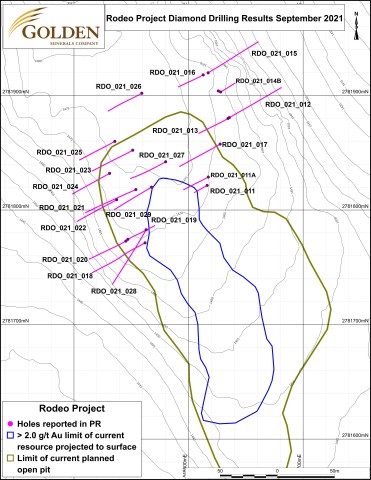

Figure 1: Diamond drill-hole locations, Rodeo Project (Graphic: Business Wire)

The reverse circulation program is being conducted by Major Drilling and will consist of 35 drill holes totaling approximately 2,500 meters. The program is designed to expand on the high-grade resource currently being mined and to drill several exploration targets located adjacent to the open pit. The reverse circulation drilling is expected to be completed in September.

The Company has reported assay results from an additional 20 holes, totaling 1,253 meters, from the ongoing diamond drilling program that is exploring for the continuation of Au-Ag mineralization to the north of the current mining area. Drilling has intersected several wide zones of disseminated gold mineralization and has identified several additional high-grade zones that appear to be hosted in a series of silicified structures running parallel to the high-grade gold zones currently being mined. Highlights of the new assay results include:

RDO_21_028

- 78.7m grading 1.06 g/t Au and 10.1 g/t Ag

- Including 13.9m grading 2.88 g/t Au and 4.3 g/t Ag

RDO_021_022

- 70.0m grading 0.56 g/t Au and 6.0 g/t Ag

- Including 14.2m grading 1.07 g/t Au and 14.8 g/t Ag

RDO_021_018

- 64.4m grading 0.85 g/t Au and 8.6 g/t Ag

RDO_021_011A

- 26.0m grading 0.82 g/t Au and 6.5 g/t Ag

Significant results are summarized in the table below, with complete results available on the Company website. [link]

Hole ID |

From |

To |

Interval |

Au (g/t) |

Ag (g/t) |

RDO_021_011 |

Hole lost before reaching target depth |

||||

RDO_021_011A |

21.3 |

47.3 |

26.0 |

0.82 |

6.5 |

including |

21.3 |

26.9 |

5.6 |

1.71 |

6.4 |

including |

46.8 |

47.3 |

0.6 |

5.65 |

77.9 |

RDO_021_012 |

24.0 |

40.8 |

16.8 |

0.74 |

7.1 |

including |

35.8 |

40.8 |

5.1 |

1.43 |

16.6 |

RDO_021_013 |

27.2 |

27.7 |

0.5 |

1.04 |

6.2 |

RDO_021_014 |

Hole lost before reaching target depth |

||||

RDO_021_014B |

No Significant Results |

||||

RDO_021_015 |

59.2 |

59.7 |

0.5 |

1.15 |

1.5 |

RDO_021_016 |

29.2 |

30.8 |

1.6 |

1.00 |

3.1 |

RDO_021_017 |

24.5 |

53.6 |

29.1 |

0.58 |

6.0 |

including |

43.7 |

45.8 |

2.2 |

1.04 |

10.2 |

including |

51.1 |

53.6 |

2.6 |

1.97 |

26.1 |

RDO_021_018 |

0.0 |

64.4 |

64.4 |

0.85 |

8.6 |

including |

0.0 |

4.5 |

4.5 |

2.39 |

1.9 |

including |

0.0 |

1.6 |

1.6 |

5.81 |

2.1 |

including |

34.3 |

53.9 |

19.6 |

1.07 |

14.4 |

including |

45.6 |

52.6 |

7.0 |

1.51 |

21.3 |

RDO_021_019 |

23.5 |

24.9 |

1.4 |

1.16 |

16.3 |

RDO_021_019 |

43.2 |

44.6 |

1.4 |

1.14 |

27.4 |

RDO_021_020 |

3.0 |

49.9 |

47.0 |

0.58 |

2.9 |

Including |

3.0 |

8.3 |

5.3 |

1.22 |

3.2 |

Including |

35.9 |

42.1 |

6.2 |

1.21 |

3.8 |

RDO_021_021 |

9.7 |

37.2 |

27.5 |

0.64 |

2.2 |

Including |

10.2 |

13.8 |

3.7 |

2.79 |

3.1 |

RDO_021_022 |

0.0 |

70.0 |

70.0 |

0.56 |

6.0 |

Including |

0.0 |

10.2 |

10.2 |

1.00 |

3.2 |

Including |

55.8 |

70.0 |

14.2 |

1.07 |

14.8 |

RDO_021_023 |

No Significant Results |

||||

RDO_021_024 |

1.5 |

33.1 |

31.6 |

0.39 |

1.2 |

Including |

1.5 |

11.2 |

9.7 |

0.62 |

1.5 |

RDO_021_025 |

No Significant Results |

||||

RDO_021_026 |

No Significant Results |

||||

RDO_021_027 |

18.9 |

19.9 |

1.0 |

2.66 |

9.6 |

RDO_021_028 |

0.0 |

78.7 |

78.7 |

1.06 |

10.1 |

Including |

0.0 |

13.9 |

13.9 |

2.88 |

4.3 |

RDO_021_029 |

9.4 |

44.0 |

34.6 |

0.73 |

4.5 |

Including |

23.0 |

34.0 |

11.0 |

1.25 |

7.3 |

Note: Intervals in the table represent drilled length. It is expected that true thickness is approximately 80% of drilled length because drill holes were oriented approximately perpendicular to the gold mineralization that dips at about 25 degrees to the northeast. Estimated true widths range from 70% to 90% of drilled widths depending on dip of the vein and inclination of the hole. Intervals and grades have been rounded to either one or two decimal places.

Warren Rehn, President and Chief Executive Officer of Golden Minerals, commented, "The diamond drilling continues to intersect gold-rich zones adjacent to and north of the current pit. The mineralized parallel structures east and west of the pit will be tested further with the reverse circulation drilling. We expect to complete the drill program in September and should have all results in hand early in Q4. I anticipate that increases to the mineral inventory will be incorporated into the mine plan later this year.”

About Rodeo

Rodeo is a gold-silver open pit mine located in Durango State, Mexico. Production began in January 2021, with material being trucked to the Company’s oxide mill at the Velardeña Properties located around 115 kilometers away via road. Rodeo’s current expected life per the terms of an independently prepared, NI 43-101-compliant Preliminary Economic Assessment (April 2020) is 2.5 years.

Cautionary Note to United States Investors Regarding Estimates of Indicated Mineral Resources

This press release uses the terms "mineral resources" and "indicated mineral resources" which are defined in, and required to be disclosed by, Canadian National Instrument NI 43-101 (“NI 43-101”). We advise U.S. investors that these terms are not recognized under SEC Industry Guide 7. Accordingly, the disclosures regarding mineralization in this news release may not be comparable to similar information disclosed by Golden Minerals in the reports it files with the SEC. The estimation of measured resources and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that any or all mineral resources are economically or legally mineable or that these mineral resources will ever be converted into mineral reserves. In addition, the SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. U.S. investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2020 and other SEC filings.

Review by Qualified Person and Quality Control

The technical contents of this press release have been reviewed by Matthew Booth, a Qualified Person for the purposes of NI 43-101. Mr. Booth has over 17 years of mineral exploration experience and is a Qualified Person member of the American Institute of Professional Geologists (CPG 12044).

To ensure reliable sample results, Golden Minerals uses a quality assurance/quality control program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates and reference standards in each batch of samples. Core is photographed and sawn in half with one half retained in a secured facility for verification purposes. Sample preparation (crushing and pulverizing) is performed at an independent ISO 9001:2001 certified laboratory in Chihuahua or Zacatecas, Mexico. Prepared samples are direct-shipped to an ISO 9001:2001 certified laboratory in Canada.

About Golden Minerals

Golden Minerals is a growing gold and silver producer based in Golden, Colorado. The Company is primarily focused on producing gold and silver from its Rodeo Mine and advancing its Velardeña Properties in Mexico and, through partner funded exploration, its El Quevar silver property in Argentina, as well as acquiring and advancing selected mining properties in Mexico, Nevada and Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the Company’s plans and expected timeline for the reverse circulation drill program at the Rodeo Mine, estimates of true widths of the gold mineralization at previous drill holes, anticipated increases to the Company’s mineral inventory, and the expected life of the Rodeo Mine. These statements are subject to risks and uncertainties, including the reasonability of the economic assumptions at the basis of the results of the Rodeo project Preliminary Economic Assessment and technical report; changes in interpretations of geological, geostatistical, metallurgical, mining or processing information; and interpretations of the information resulting from exploration, analysis or mining and processing experience. Golden Minerals assumes no obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed with the SEC by Golden Minerals, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

For additional information please visit http://www.goldenminerals.com/.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210916005176/en/

Contacts

Golden Minerals Company

Karen Winkler, Director of Investor Relations

(303) 839-5060