Shares of Rite Aid (NYSE: RAD) have been on a sluggish path to becoming a near-penny stock, despite being one of the most entrenched brands in American Households. This name has become synonymous with children's 'boo boos' and first-aid kits. Indeed there is some hidden value to be had in the intangible worth of brand reputation, as well as decades of quality upkeep and market share retention.

However, investors may have been more patient than they once were, especially after enduring a six-year bear territory in the stock. Luckily for these same investors, other fundamental (more tangible) factors may help reduce these losses.

Rite Aid turns out to be the cheaper name within the pharmaceutical retailer's space, and despite posting initial slowdowns in their first quarter 2024 earnings results, the stock is reacting with some optimism.

Rising by as much as 6.5% during the opening hours of Thursday's trading session, there may be some hints as to whether this stock hopes to return to its former glory.

Rite Aid analyst ratings may be onto something, as they have assigned a consensus price target of $2.75, translating into an 81% upside ceiling from today's prices. It would be beneficial for investors to understand how and why these potential targets are realistic, and it all comes down to a ticking time bomb.

Walking on a Mine Field

When investors look deeper into Rite Aid's valuations, the typical market capitalization (computed as the current stock price multiplied by the number of shares outstanding) points to the company is worth $83.5 million roughly. However, enterprise value, a figure derived by taking market capitalization, adding total cash balances, and subtracting total debt, turns out to be significantly higher.

Because Rite Aid carries $5.8 billion in debt and only $164 million in cash balances, the company can be reasonably said to be drowning in debt obligations.

Considering that the current obligations on these longer-term debt maturities are only $6 million per quarter, Rite Aid seems to have enough cash on hand to withstand the payments of these higher debt loads. The risk, however, comes from the very source of this cash. As the company does not generate positive operating income, it heavily relies on taking on more debt to fund operations and a mix of issuing common stock, thus diluting current shareholders.

At one point or another, creditors will cease giving the company more loans, and further dilutions will only drive the stock price further into a small-cap company.

Now that valuations have reached one of their lowest historical levels in the stock, accompanied by Rite Aid's bottom spot within the industry, it would seem that conditions are becoming ripe for a strategic buyer to come to rescue the old-timer or at least for an activist investor to step in and effect some change.

Markets seemingly vote for further liquidity injections for the U.S. economy shortly; when traders hover over leading indicators, developments may open a path for such a catalyst.

Last Hail Mary

The United States economy is facing an inverted yield curve. In this event, shorter-term treasury yields (such as the 2-year yield) rise above those yields of longer-term bonds (such as the 10-year). This implies that broader markets are selling shorter-term bonds and buying longer-term bonds.

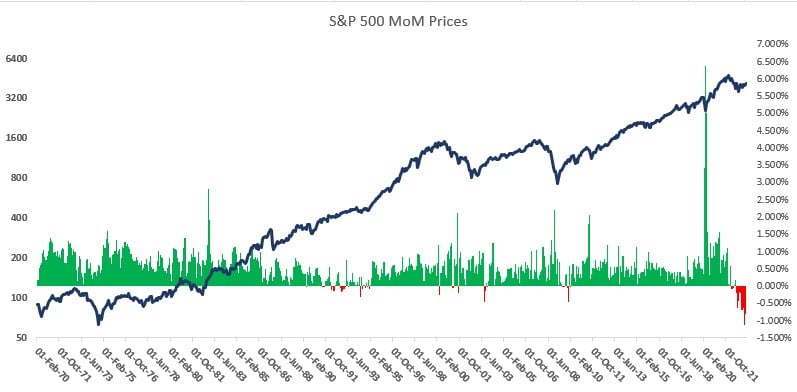

This monetary shift can severely affect liquidity levels for financial markets. Subsequently, the U.S. federal reserve has reduced the money supply "M2" by the largest magnitudes in history, further drying up financial market liquidity. The below image represents the increments (green bars) and declines (red bars) of the M2 money supply, overlaid by the price of the S&P 500 and its relative reactions to these liquidity levels.

What this means for investors, in the grand scheme, is that the FED may step in to stimulate liquidity measures in one way or less orthodox ones as the money supply lowers and bond yields remain inverted; markets cast their vote in the expectation of such events.

Considering that, according to Rite Aid's earnings presentation, underlying product lines are still in a somewhat healthy ecosystem, taking out the unhealthy operations of the current business model can provide a new route to unlock value. If these FED catalysts are realized, and liquidity and cheap financing result, then two speculative scenarios may occur.

First, Rite Aid may be able to refinance some of its debt obligations at better terms, allowing them to keep investing in what is working alongside technological advances that may expand margins and market share.

Second, an interested strategic buyer may acquire the entire brand to adopt the product line into their existing ecosystem. RX comparable sales grew by 13.3% during the past twelve months. Script sales count increased by 4.7% during the same period, thus offering a relatively attractive portfolio of products that are still growing despite the overall toxicity of the company.

While this is a risky and speculative path, those investors being 'okay' with a Hail Mary can benefit from holding onto such a possibility.