Stock options can be used for many purposes, from collecting income with covered calls and iron condors to taking directional bets or hedging your portfolio. Stock options provide insights without even actually trading them. Stock options can be used to gauge information about the underlying stock.

While predicting anything in the stock market can be futile, you can listen to what the market itself implies about the potential move for a stock heading into an event.

What is the Implied Move of a Stock

The options market can help gauge the potential price move for a stock on an event like an earnings report release. You’ve likely seen financial television programs where experts are interviewed about an upcoming earnings report after the close, and the experts say something like, “Well, the options market is pricing in an 8% move on the earnings.”

This is not a prediction but rather an indication of how much of a price move the market expects. It may or may not come to fruition, but it does help prepare you for the magnitude of the potential move. The more expensive the at-the-money (ATM) spread is, the more volatility can be expected.

When to Calculate the Implied Move

The most suitable time to calculate a stock's implied move would be ahead of a catalyst event. It could be a product launch, court ruling, FDA decision or, most often, an earnings report. These are volatility events, and the options market will price in the volatility. Whenever a catalyst event is coming up, you can calculate the implied move of any optionable stock in any stock sector in the stock market.

How to Calculate an Implied Move of a Stock

To calculate the implied move, you should first find an at-the-money (ATM) straddle as close to the current price of the stock. If your platform doesn't provide single transaction straddle execution, then you can select the nearest strike price, add the call and put options prices at that strike to derive the value of the straddle.

The straddle price is how much the options market is pricing in the post-catalyst movement. Take the straddle price and divide it by the current underlying stock price to get a percentage that the options market is pricing in for the catalyst. The equation would be:

(ATM straddle price) divided by (stock price) = +/- implied percentage move

Calculating an Example

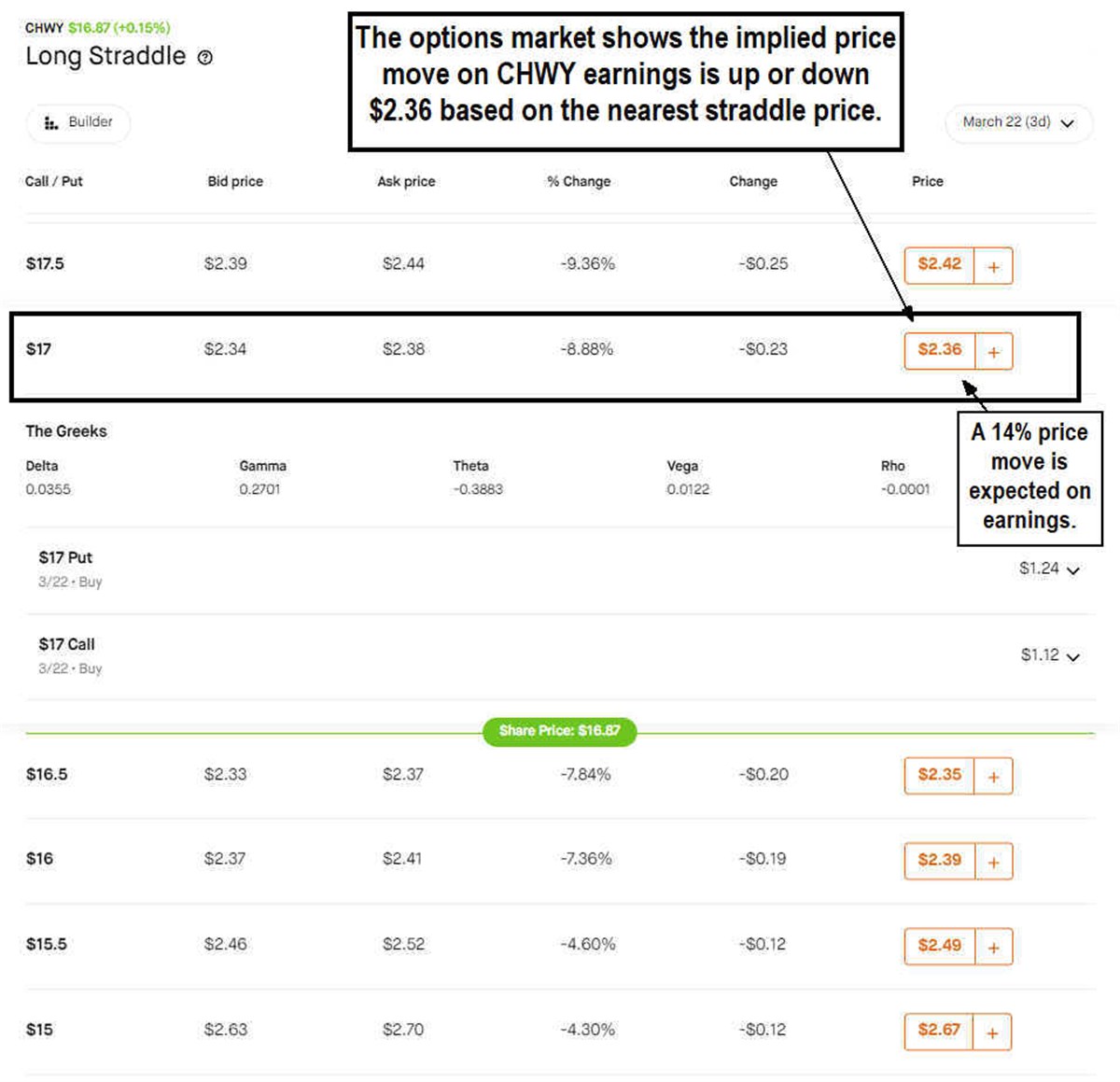

Let’s calculate the implied price move for online pet store Chewy Inc. (NYSE: CHWY). Chewy will be releasing their earnings after the bell tomorrow. The current price of Chewy is $16.87. We take the nearest strike price at $17 and look up the price of the straddle. You can calculate the straddle price by just adding the $17 call and put options. The Chew $17 spread is $2.36. Divide the straddle price by the current price of Chewy, which is 14%. The market is pricing in a 14% move on CHWY stock for earnings.

The CHWY candlestick chart illustrates where the market believes CHWY stock will move to after its earnings announcement.

With CHWY trading at $16.86, the 14% upside implied price move would be $19.23, and the 14% downside implied price move would be $14.51. A 14% implied price move can be considered high volatility. The $17 call has a 223% implied volatility. This naturally adds more extrinsic value to the price of the options. Considering the intrinsic value of the $17 call is zero, the price is comprised of all extrinsic value at $1.12. The underlying stock would have to move 14% to break even if you were to take the long straddle into earnings.

Use Cases for Implied Pricing

The implied price moves help to provide insights into the potential price range for the stock after the catalyst occurs (IE, earnings report release). It provides an idea of the type of volatility expected and prepares you to find potential opportunities. When you have the expected price range, consider the boundaries as potential opportunities to trade.

Remember, these are expected price moves, and they aren't always correct. This isn't a big secret. You aren't the only one watching these price ranges. Assume everyone is watching them. Based on that information, you can expect there will be action around the implied price ranges, so react accordingly; don't predict.