Online grocery marketplace and delivery service company Maplebear Inc. (NASDAQ: CART) operates as Instacart. Instacart has had over 25 million people use its service in the past year. Its network of retailers expanded to over 600 brands and 800,000 store locations, going beyond just grocery stores to include retailers like Sally Beauty Holdings Inc. (NYSE: SBH) and The Home Depot (NYSE: HD). Despite inflationary pressures forcing consumers to tighten their spending, the convenience and time-saving benefits provided by Instacart have kept its business robust and profitable. Unlike its competitors, Instacart was already profitable prior to its IPO.

Maplebear operates in the consumer discretionary sector, competing with delivery services like Door Dash Inc. (NASDAQ: DASH), Uber Technologies Inc. (NYSE: UBER), and Amazon.com Inc. (NASDAQ: AMZN).

Instacart Is More Than Just Delivery

While the business of delivering groceries may seem pretty straightforward, Instacart has turned it into a science.

Instacart has integrated an AI-powered customer service bot called Carebot, which has reduced the percentage of requests that require a live agent and customer service resolution times to under three minutes.

Instacart also derives advertising revenues from over 6,000 advertisers, which generates around 30% of its total revenues. It delivers advertising through different contexts, including Recipes, Occasions, and Bundles, helping brands showcase their products in use cases to inspire discovery. The company has also partnered with its competitors Uber Eats and DoorDash to include restaurant meal deliveries,

Here’s How Instacart Helps Consumers Stung By Inflation

The cost of groceries has surged since the pandemic. More and more consumers have to trade down from brands to private-label products. Instacart has pursued affordability initiatives that integrate retail loyalty programs into the app, resulting in 40% YoY increases in loyalty savings per order. It’s working with large retailers to use its Eversight pricing solution to help shift from marked-up prices to same-as-in-store prices on key value items.

Local Grocery Store Flyers Becoming Available in the Instacart App

The company also created its Flyers product, which digitizes merchants’ weekly flyer ads into its app, enabling users to participate in sales promotions. It also promotes $0 delivery fees for orders made within the “Super Saver” delivery windows. Over 90% of Instacart customers will have access to three or more flyers, which will drive additional savings. Over 20% of flyer visits result in customers adding items to their carts. Instacart also expanded SNAP EBT payment acceptance to over 15,000 Walgreens Boots Alliance Inc. (NASDAQ: WBA), Dollar Tree Inc. (NASDAQ: DLTR)-owned Family Dollar, Giant Eagle, and Rite Aid stores.

Business Customers are the Golden Catch for Instacart

Instacart continues to grow its customer base of businesses, which make larger and more frequent orders than household customers. More than one million businesses have used Instacart in the last year to stock and restock office supplies and snacks, and restaurants are experiencing last-minute needs for ingredients. For businesses, Instacart transactions are a tax write-off as a business expense.

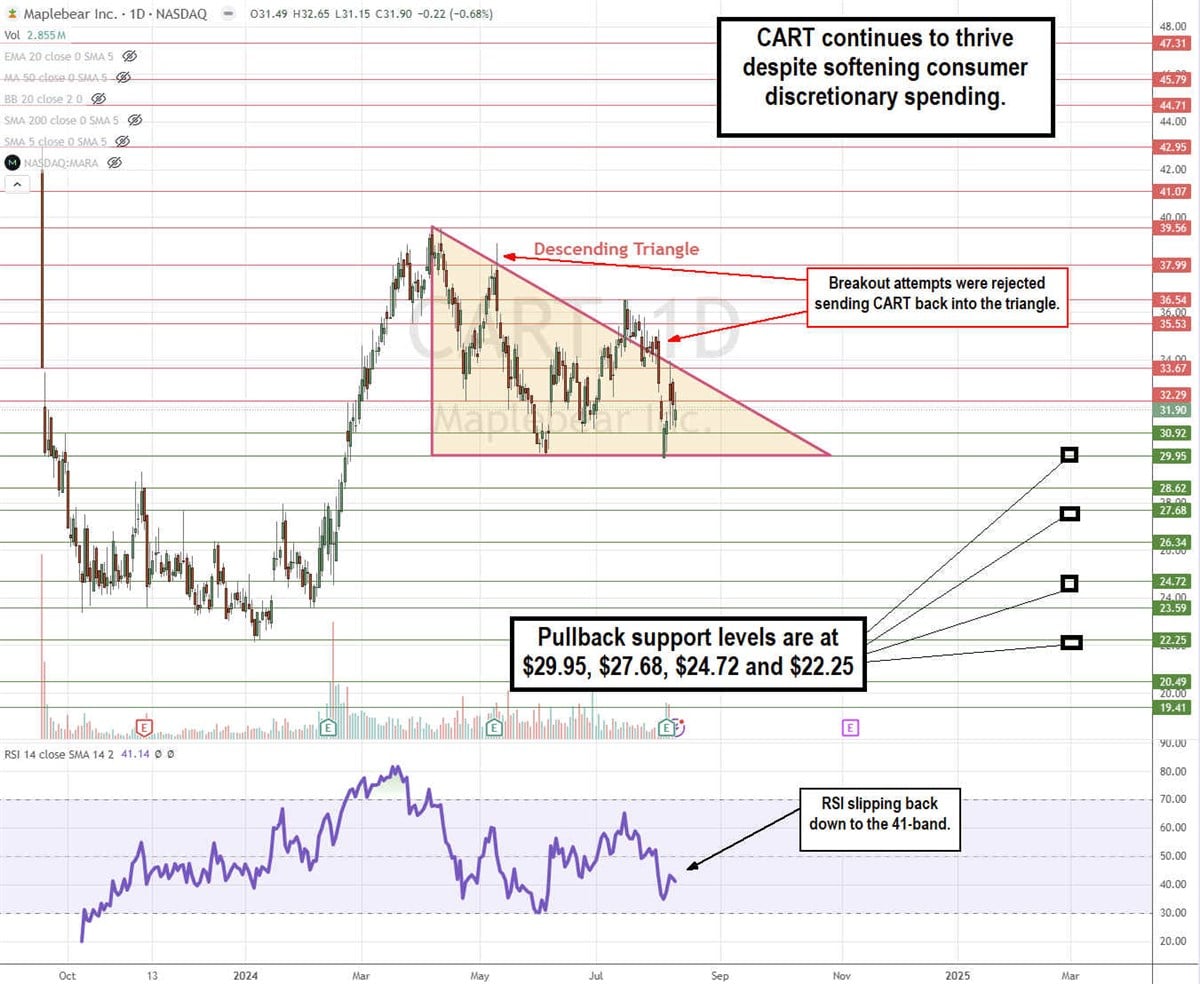

CART Stock is in a Descending Triangle Pattern

The daily candlestick chart for CART indicates a descending triangle pattern comprised of a descending upper trendline that started at $39.58 and a flat-bottom lower trendline support at $29.95. Each breakout attempt to pierce the upper trendline resistance has failed, causing CART to trade between the two trendlines. As CART gets closer to the apex point, it will eventually break out through the upper trendline resistance or break down through the lower trendline support. The daily relative strength index (RSI) is stalled at the 41-band. Pullback support levels are at the $29.95 flat-bottom support, $27.68, $24.72, and $22.25.

Instacart Continues To Roll Out Profits

Instacart reported Q2 2024 GAAP EPS of 20 cents, beating consensus estimates by 8 cents. Adjusted EPS rose 89% YoY to $208 million. Revenues rose 15% YoY to $823 million, beating consensus estimates by $18.65 million. Transaction revenue rose 17% YoY to $595 million. Advertising and other revenue rose 11% YoY to $228 million. The company executed its $1 billion stock buyback and authorized a new $500 million buyback program. Total orders rose 7% YoY to 70.8 million.

Gross Transaction Value (GTV) is the total dollar value of all transactions processed through the Instacart platform, including the cost of groceries and product orders, fees, and any associated charges. It reflects the overall volume of business conducted on the platform. GTV grew 10% YoY to $8.194 billion

The company expects GTV to grow 8% to 10% in Q3 2024, representing $8.1 billion to $8.25 billion. The company expects a modest growth contribution from restaurant orders in Q3. Instacart expected adjusted EBITDA to be between $205 million and $215 million.

Caper Carts are The Next-Gen: AI-Powered Smart Shopping Carts

Instacart is expanding beyond online grocery delivery revenues by rolling out its Caper Carts. These AI-powered in-store shopping carts are designed to enhance the in-store shopping experience. They come with a video screen that instantly recognizes and weighs items placed in your car through its built-in sensors and cameras. Items are placed on your virtual list displayed on the screen, which keeps a running tally of your grocery bill.

It can offer you personalized recommendations and relevant ads based on your shopping habits and preferences. It will apply your loyalty program for automatic discounts and digital coupons directly on the screen. You can also check out by paying directly on the cart, thereby skipping the traditional checkout line and receiving a digital receipt. Customers can re-order what they bought in their Caper Carts with one tap on the app. Caper Carts are just starting to launch with ALDI in Austria and plan to roll out in the United States.

Instacart CEO Fidji Simo commented, ”There is a lot more runway to grow our marketplace and enterprise platform online for sure, but even if we double or triple online grocery penetration, more than two-thirds of grocery shopping will still be in-store, and that's why our enterprise technologies now go beyond e-commerce with a suite of in-store technologies.”

Maplebear (Instacart) analyst ratings and price targets are at MarketBeat. There are 24 analyst ratings on CART stock, comprised of 13 Buys and 11 Holds, with a 31.87% upside to the average consensus price target of $42.70.