Results confirm PLS as one of the world’s elite uranium projects

KELOWNA, BC, Jan. 17, 2023 – FISSION URANIUM CORP. (“Fission” or “the company”) is pleased to announce the results of a Feasibility Study conducted by Tetra Tech Canada Inc. (“Tetra Tech”) and titled “Feasibility Study on the Patterson Lake South Property” (the “FS”) for its PLS property in Canada’s Athabasca Basin region.

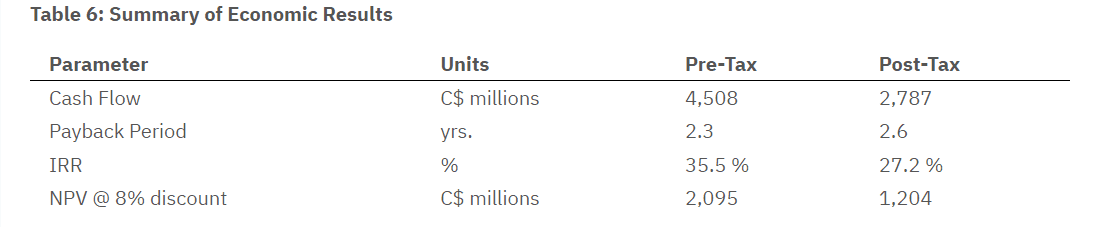

These impressive FS results further enhance the robust economics outlined in the 2019 pre-feasibility study (the “PFS”). Highlights include a longer mine life of 10 years, greatly increased after-tax NPV of $1.204B at 8% discount, higher after-tax IRR of 27.2% while still maintaining a very low OPEX of $13.02/lb. All currency figures are expressed in Canadian dollars unless denoted otherwise. The exchange rate used is 0.75 US$/C$1.00. Of additional note, initial CAPEX is marginally lower (~2%) than the PFS for a total of $1.155B – a remarkable achievement given current global inflation. The results confirm the economic strength of the PLS project as well as its minimal environmental footprint. With nuclear energy and the uranium sector strengthening year on year, Fission is ideally positioned to continue developing PLS through the environmental assessment and licensing phase. The FS has an effective date of January 17, 2023.

Ross McElroy, President and CEO of Fission, commented, “With greatly enhanced economics, including an increase of 42% to the mine life, an incredible 71.5% increase in post-tax NPV and a 10.2% growth in post-tax IRR, this feasibility study confirms the Tier 1 PLS project as one of the most economically significant and elite uranium development projects in the world. Showing CAPEX to be lower than in the 2019 Prefeasibility report, particularly with the pressures of high global inflation, is a remarkable achievement and speaks volumes regarding the team’s design and planning abilities. Beyond the economics, the shallow, high-grade nature of our deposit gives us a very small environmental footprint – an advantage that we have built on with comprehensive monitoring since the start of drilling in 2012 and increasing Indigenous engagement. Going forward, thanks to the strength of this feasibility study and the success of our ongoing social engagement, we will continue advancing through the Environmental Assessment and on towards a construction decision.”

- Construction timeline of 3 years with an estimated initial capital cost of $1.155B

- Increased mine life to ten years with LOM production of 90.9 million lbs of U3O8

- Addition of R840W orebody into the FS mine plan contributing to increased Mineral Reserves

- Average unit operating cost of $13.02/lb U3O8

- Robust post-tax economics:

- IRR of 27.2%

- NPV of $1.204B at 8% discount

- Payback period of 2.6 years

While the FS only considers Indicated Resources from the R780E, R840W and R00E zones, the mine plan has been deliberately designed to easily accommodate additional material from the R1515W and R1620E zones based on the potential future conversion of Inferred Resources to Indicated Resources. The majority of mineralization at these two on-strike, high-grade zones is currently defined as Inferred Mineral Resource classification and thus not considered for inclusion in the FS mine plan. As proven by the Company’s drilling at the Triple R deposit’s R780E, R840W and R00E zones, Fission has an excellent track record of converting Inferred-category resources to Indicated-category. As a result, there is a clear path for growing the deposit, potentially leading to an increased resource as well as a longer mine life.

- Mine Life and Zone Expansion: The FS mine plan has increased the mine life to 10 years. Both the R780E and R840W zones are open at depth and along the plunge to the east. Further opportunity exists to grow the resource in those directions, potentially extending the underground mine life even further.

- Additional Zones: The FS mine plan has a future opportunity to accommodate the potential conversion of Inferred Resources to Indicated Resources at two high-grade, on-strike zones – R1515W and R1620E – that are not yet part of Mineral Reserves.

- Mineralization Upgrade: The FS mine plan does not include areas of Inferred Mineral Resources in the R00E, R840W and R780E zones. An opportunity exists to upgrade to Indicated Mineral Resource with future planned drilling.

- The underground mine plan eliminates direct physical impacts on Patterson Lake and the Clearwater River drainage. Other than a dock, freshwater intake and treated effluent diffuser, all other infrastructure related to mining and processing at PLS is set back to maintain an acceptable riparian buffer to the shoreline of Patterson Lake.

- The revised Project layout maintains a compact footprint, and facilities have been placed to avoid local areas of old-growth jack pine forest and heritage resource sites.

- In the absence of hydro utilities, using LNG for site power generation instead of diesel, while only marginally reducing the greenhouse gases, significantly decreases emissions of particulates and sulphur and nitrogen compounds.

- Metallurgical test work indicates that the Project will be able to meet the water quality ranges for treated effluent discharges found at other uranium mining operations in Saskatchewan.

- Modelling of the Tailings Management Facility (TMF) interactions with groundwater indicates that the current design will be protective of groundwater quality in the long term and thus protective of the Patterson Lake drainage.

- At year-end 2022, Fission had engagement agreements with all the Indigenous groups with the potential for impacts to their traditional land use and treaty rights due to the Project.

- Fission responded to local concerns over the proposed bypass of Highway 955 around the site by leaving the road route as it is.

The FS was prepared by independent consultants led by Tetra Tech, who carried out the process and infrastructure design, capital cost and operating cost summary, financial analysis and overall compilation, assisted by SLR Consulting (Canada) Ltd. (resource estimation), Mining Plus Canada Consulting Ltd. (mineral reserve estimation, mining design, mining infrastructure, mining capital and operating costs), Clifton Engineering Group Ltd. (environment, permitting, socio-economics and tailings), and BGC Engineering Inc. (geotechnical and hydrogeological aspects).

In addition to managing radiological issues common to uranium mining, key technical challenges to developing the operation will be 1) accessing the deposit through the saturated sandy overburden and 2) recovery of the crown pillar reserves using artificial ground freezing techniques.

To access the deposit, a decline is planned through the dewatered overburden using a tunnel shield method and a hydrostatic segmental concrete tunnel liner, a common technique for developing through soft ground. In addition to the decline, two vertical shafts will be developed to provide a dedicated ventilation system for the mine and secondary egress. The crown pillar will be partially recovered with the installation of an artificial ground freezing system, using holes drilled from offset underground drifts below the crown pillar zones. Once the holes are drilled, a refrigerated brine solution is pumped through the holes to freeze the ground, providing ground improvement and reducing the permeability of the rock.

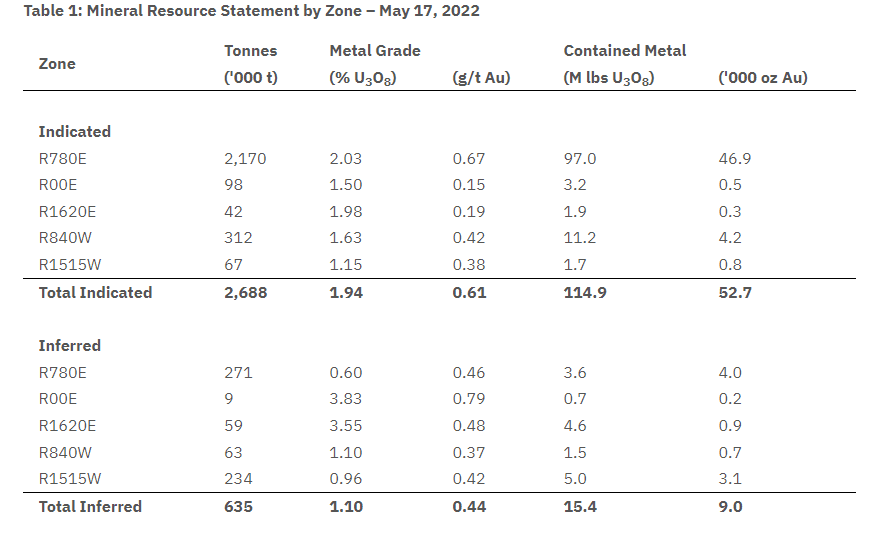

The updated Mineral Resource estimate used as the basis for the FS was previously disclosed by Fission in a press release dated September 12, 2022. The FS Mineral Resource estimate is shown in Table 1.

Notes:

1. CIM (2014) definitions were followed for Mineral Resources.

2. Mineral Resources are reported at a cut-off grade of 0.25% U3O8, based on a long-term price of US$50/lb U3O8, an exchange rate of C$1.00/US$0.75, and cost estimates derived during the PFS with a metallurgical recovery of 95%.

3. A minimum mining width of 1 m was applied to the resource domain wireframe.

4. Mineral Resources are inclusive of Mineral Reserves.

5. Numbers may not add due to rounding

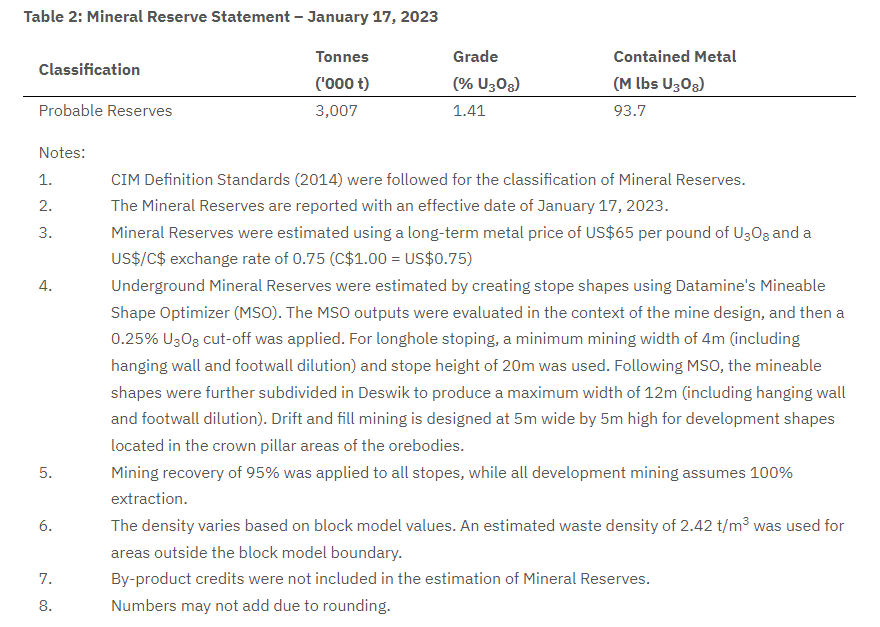

Mineral Reserves

An updated estimate of Mineral Reserves for the Project was carried out by Mining Plus based on the underground mine plan that captures the majority of the High-Grade Indicated Resources in the R780E, R840W and R00E zones. The FS supersedes all previous mine plans and Mineral Reserve statements. The Mineral Reserves are summarized in Table 2.

The FS is based on accessing the deposit using a decline developed from a position southwest of the deposits in close proximity to the processing plant and waste stockpile areas. The area of the decline is temporarily dewatered while the development progresses through the overburden. The decline excavation is planned to use a tunnel shield method utilizing a hydrostatic segmental concrete liner for ground support. In addition to the decline, two vertical shafts are excavated sequentially to provide a dedicated ventilation system for the mine (one fresh air intake shaft and one exhaust air shaft). After the decline extends through the overburden and transition bedrock zone, more typical hardrock development can commence. Mining uses the Longhole Stoping method in a longitudinal retreat orientation with Cemented Rock Fill as backfill.

A partial recovery of the mineralized material approaching the contact between the overburden and bedrock is achieved by utilizing artificial ground freezing to achieve a bulk freeze. The ground is frozen by way of drilling holes into the overburden and shallow bedrock using underground drilling collared from a dedicated freeze drift below the crown area. Upon completion of the ground freezing holes, a refrigeration plant pumps a chilled brine solution through the holes to create a frozen cap to provide increased ground stability and reduced groundwater inflow. Once frozen, a low disturbance Drift and Fill mining method with Cemented Hydraulic Fill is utilized to extract the mineralized material. Roadheader tunnelling equipment will be used in the crown pillar areas to remove the need for explosives. A portion of the Mineral Resources approaching the overburden contact will be sterilized due to geotechnical constraints; however, this sterilized material could be further evaluated for eventual extraction in future analysis.

Tetra Tech completed the design for the process plant and related infrastructure facilities for this FS using proven uranium extraction technology, processes and equipment and has drawn on its knowledge of other Athabasca uranium plants, including Rabbit Lake, Key Lake, and McClean Lake. The processing plant has been designed to process ore at a nominal throughput of 1,000 t/d to produce market-grade uranium concentrate. The average LOM mill feed grade will be 1.41% U3O8, and the anticipated U3O8 recovery will be 97.0%.

A conventional grinding and leaching circuit will be used for the recovery process. The ore will be trucked from the mine to the ROM pad and ground in a single-stage semi-autogenous grinding circuit to 150 µm. The ground ore will be leached using sulfuric acid and hydrogen peroxide at 50°C. The leached slurry will be fed to a counter-current decantation circuit followed by a clarification stage to produce the pregnant leach solution. A solvent extraction (SX) circuit will purify and concentrate uranium in the solution for yellowcake precipitation. The precipitated yellowcake will be calcined at 450°C before packaging in drums.

Tailings will be neutralized and deposited in the Tailings Management Facility. The TMF utilizes the previous surround design method of tailings management, a common method used in uranium mines in northern Saskatchewan. Effluent and contact water will be treated, monitored, and sampled before being discharged.

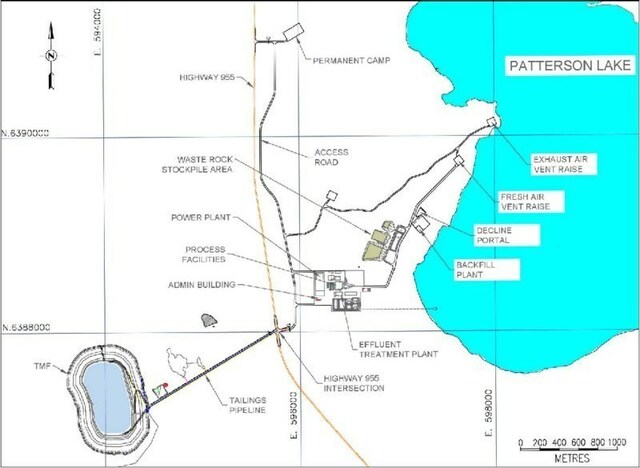

The major components of infrastructure include:

- Backfill plant and refrigeration plant

- Surface ventilation fans and LNG direct-fired heater

- Decline portal

- LNG power plant

- Process facilities

- Tailings management facility

- Administration building, fuel bay, warehouse and maintenance facility

- Effluent treatment facility

- Permanent camp

The general arrangement of the site infrastructure is provided in Figure 1.

- Uranium price of US$65/lb U3O8, based on long-term consensus forecasts

- Exchange rate of 0.75 US$/C$1.00

- Gross revenue of $7,875 million

- Less Saskatchewan Government Gross Revenue Royalties of $571 million

- Net revenue of $7,304 million

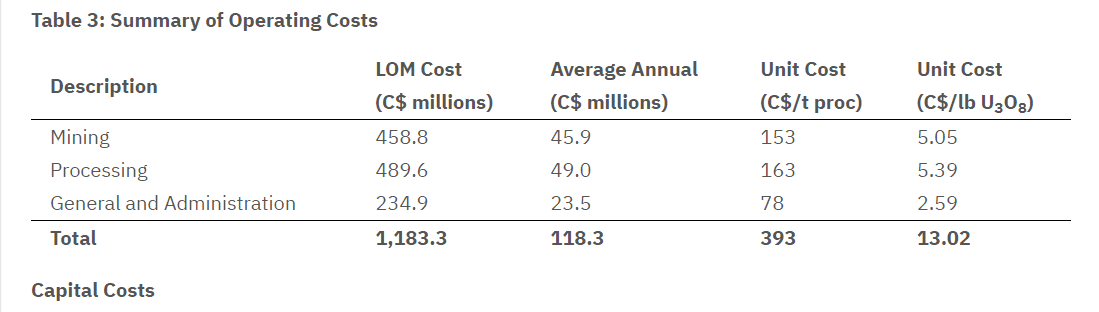

A summary of operating costs is shown in Table 3.

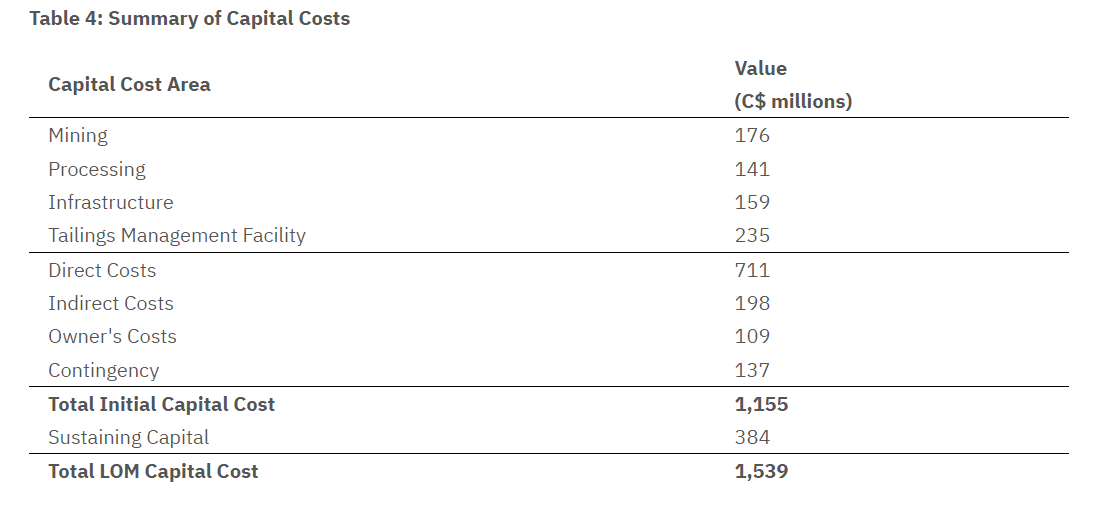

A summary of capital costs is shown in Table 4.

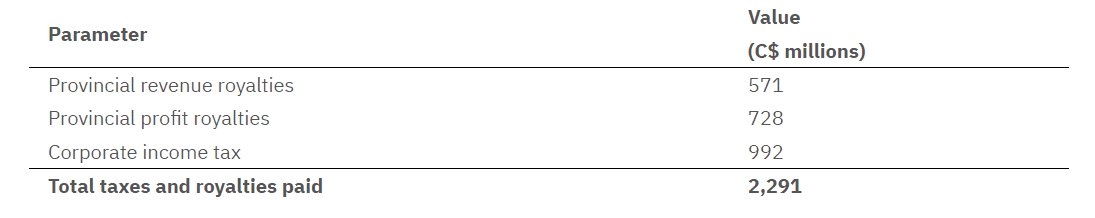

A summary of taxes and royalties paid to provincial and federal governments is shown in Table 5.

Table 5: Summary of Taxes and Royalties

Pre-tax and post-tax economic results are summarized in Table 6.

Uranium mineralization of the Triple R deposit at PLS occurs within the Patterson Lake Conductive Corridor and has been traced by core drilling over ~3.18 km of east-west strike length in five separated mineralized “zones”, which collectively make up the Triple R deposit. From west to east, these zones are R1515W, R840W, R00E, R780E and R1620E. Through successful exploration programs completed to date, Triple R has evolved into a large, near-surface, basement-hosted, structurally controlled high-grade uranium deposit. The discovery hole was announced on November 05, 2012, with drill hole PLS12-022 from what is now referred to as the R00E zone.

The R1515W, R840W and R00E zones make up the western region of the Triple R deposit and are located on land, where overburden thickness is generally between 55 m to 100 m. R1515W is the westernmost of the zones and is drill defined to ~90 m in strike length, ~68 m across strike and ~220 m vertical and where mineralization remains open in several directions. R840W is located ~515 m to the east along the strike of R1515W and has a drill-defined strike length of ~430 m. R00E is located ~485 m to the east along strike of R840W and is drill defined to ~115 m in strike length. The R780E and R1620E zones make up the eastern region of the Triple R deposit. Both zones are located beneath Patterson Lake, where water depth is generally less than six metres, and overburden thickness is generally about 50 m. R780E is located ~225 m to the east of R00E and has a drill-defined strike length of ~945 m. R1620E is located ~210 m along strike to the east of R780E and is drill defined to ~185 m in strike length.

Mineralization along the Patterson Lake Corridor trend remains prospective along strike in both the western and eastern directions. Basement rocks within the mineralized trend are identified primarily as mafic volcanic rocks with varying degrees of alteration. Mineralization is both located within and associated with mafic volcanic intrusives with varying degrees of silicification, metasomatic mineral assemblages and hydrothermal graphite. The graphitic sequences are associated with the PL-3B basement Electro-Magnetic (EM) conductor.

The 31,039-hectare PLS project is 100% owned and operated by Fission Uranium Corp. PLS is accessible by road with primary access from all-weather Highway 955, which runs north to the former Cluff Lake mine.

This News Release describes a Mineral Resource estimate, an updated Mineral Reserve estimate, and an FS Life of Mine Plan and cash flow based upon geological, engineering, technical and cost inputs developed by Tetra Tech and other study participants. A National Instrument 43-101 Technical Report will be filed on SEDAR and made available on the Company’s website within 45 days. The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Hassan Ghaffari, P.Eng., Dr. Jianhui (John) Huang, P.Eng., Patrick Donlon, FSAIMM, FAusIMM, and Dr. Sabry Abdel Hafez, P.Eng., of Tetra Tech, Mark Mathisen, C.P.G., of SLR Consulting (Canada) Ltd., Catherine Schmid, P.Eng. and Randi Thompson, P.Eng., of BGC Engineering Inc., Maurice Mostert, P.Eng., of Mining Plus Canada Consulting Ltd., and Wayne Clifton, P.Eng. and Mark Wittrup, P.Eng., P.Geo., of Clifton Engineering Group Ltd., each of whom is a “qualified person” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“).

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed on behalf of the company by Ross McElroy, P.Geo., President and CEO for Fission Uranium Corp., a qualified person.

Fission Uranium Corp. is a Canadian-based resource company specializing in the strategic exploration and development of the Patterson Lake South uranium property – host to the class-leading Triple R uranium deposit – and is headquartered in Kelowna, British Columbia. Fission’s common shares are listed on the TSX Exchange under the symbol “FCU” and trade on the OTCQX marketplace in the U.S. under the symbol “FCUUF.”

ON BEHALF OF THE BOARD

“Ross McElroy”

____________________________

Ross McElroy, President and CEO

ir@fissionuranium.com

www.fissionuranium.com

TSX SYMBOL: FCU

OTCQX SYMBOL: FCUUF

FRANKFURT SYMBOL: 2FU

Certain information contained in this press release constitutes “forward-looking information”, within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward looking statements contained in this press release may include statements regarding the future operating or financial performance of Fission and Fission Uranium which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com. The forward-looking statements included in this press release are made as of the date of this press release and the Company and Fission Uranium disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Featured image MegaPixl @ Tashka-4

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Fission Uranium Corp. Market Jar Media Inc. has or expects to receive from Fission Uranium Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) fifteen thousand four hundred and forty CAD for 32 days (23 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on pressreach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on pressreach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Fission Uranium Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Fission Uranium Corp.’s industry; (b) market opportunity; (c) Fission Uranium Corp.’s business plans and strategies; (d) services that Fission Uranium Corp. intends to offer; (e) Fission Uranium Corp.’s milestone projections and targets; (f) Fission Uranium Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Fission Uranium Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Fission Uranium Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Fission Uranium Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Fission Uranium Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Fission Uranium Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Fission Uranium Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Fission Uranium Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Fission Uranium Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Fission Uranium Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Fission Uranium Corp.’s business operations (e) Fission Uranium Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Fission Uranium Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Fission Uranium Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Fission Uranium Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Fission Uranium Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Fission Uranium Corp. or such entities and are not necessarily indicative of future performance of Fission Uranium Corp. or such entities.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube