Residential real estate services company Anywhere Real Estate (NYSE:HOUS) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 3.1% year on year to $1.54 billion. Its GAAP profit of $0.06 per share was also 78% below analysts’ consensus estimates.

Is now the time to buy Anywhere Real Estate? Find out by accessing our full research report, it’s free.

Anywhere Real Estate (HOUS) Q3 CY2024 Highlights:

- Revenue: $1.54 billion vs analyst estimates of $1.63 billion (5.7% miss)

- EPS: $0.06 vs analyst estimates of $0.27 (-$0.21 miss)

- EBITDA: $94 million vs analyst estimates of $131.2 million (28.4% miss)

- The Company is expecting to realize $120 million in cost savings in 2024

- Gross Margin (GAAP): 35%, in line with the same quarter last year

- Operating Margin: 16.3%, up from 13.1% in the same quarter last year

- EBITDA Margin: 6.1%, in line with the same quarter last year

- Free Cash Flow Margin: 6.4%, similar to the same quarter last year

- Market Capitalization: $445.1 million

"I am proud of our third quarter performance as Anywhere delivered strong Operating EBITDA and free cash flow, invested meaningfully in the business for future growth, gained luxury share, and strengthened our balance sheet," said Ryan Schneider, Anywhere president and CEO.

Company Overview

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

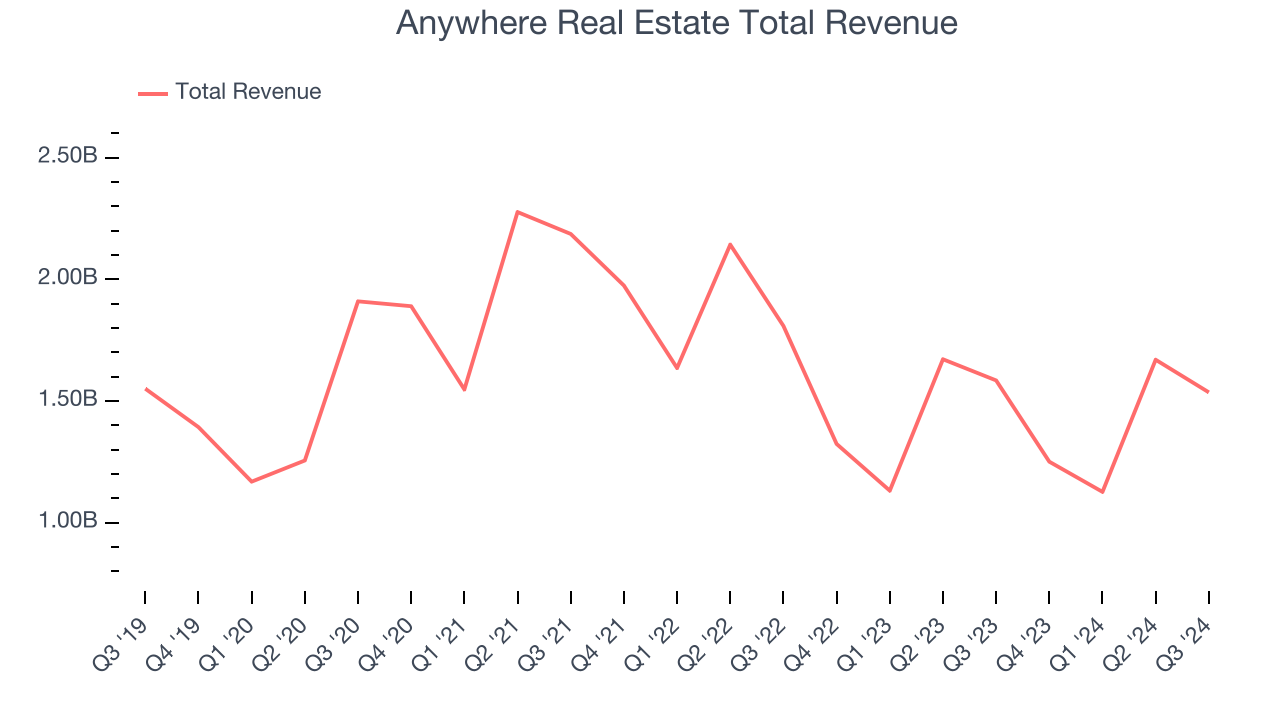

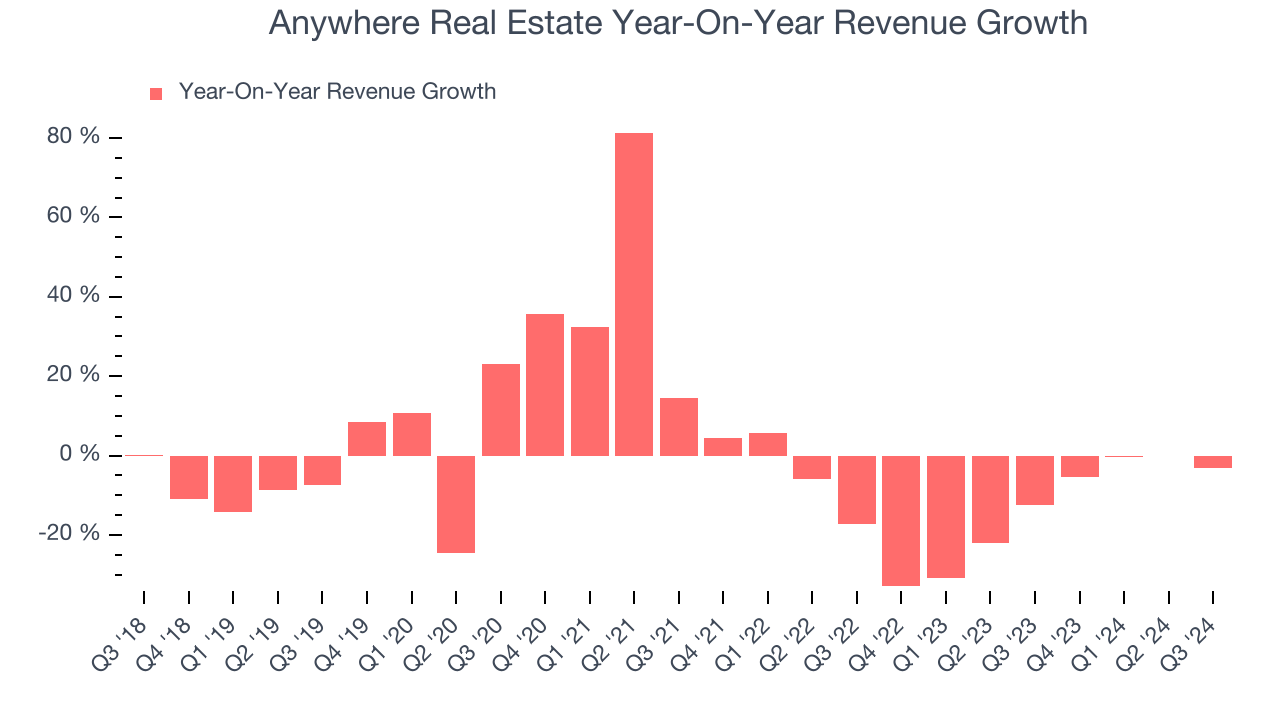

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Anywhere Real Estate’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Anywhere Real Estate’s recent history shows its demand has stayed suppressed as its revenue has declined by 14.1% annually over the last two years.

This quarter, Anywhere Real Estate missed Wall Street’s estimates and reported a rather uninspiring 3.1% year-on-year revenue decline, generating $1.54 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, an improvement versus the last two years. While this projection shows the market believes its newer products and services will catalyze better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

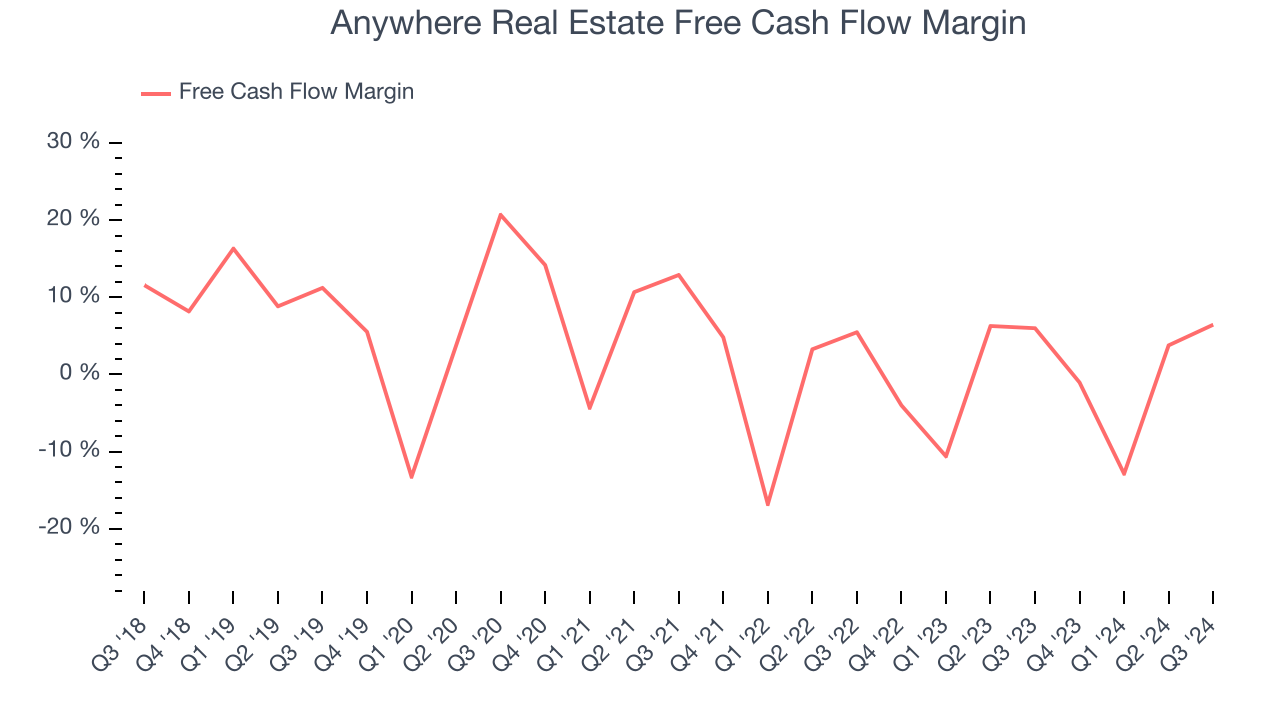

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Anywhere Real Estate broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Anywhere Real Estate’s free cash flow clocked in at $99 million in Q3, equivalent to a 6.4% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Over the next year, analysts’ consensus estimates show they’re expecting Anywhere Real Estate’s breakeven free cash flow margin for the last 12 months to remain the same.

Key Takeaways from Anywhere Real Estate’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. However, the company is expecting to realize $120 million in cost savings in 2024. The stock seems to be reacting positively to this and traded up 1.2% to $4.05 immediately following the results.

Is Anywhere Real Estate an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.