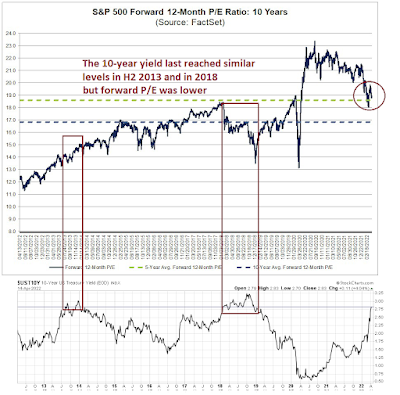

As the Powell Fed has signaled it is dead set on a hawkish policy that does not preclude inducing a recession, valuation will matter soon. The 10-year Treasury yield stands at 2.8% and the S&P 500 forward P/E is 19.0. The last time the 10-year reached these levels was 2028 when the forward P/E traded mostly in a range of 15-16 but bottomed at a panic low of 13.6. The previous episode of a similar 10-year yield was in H2 2013 when the forward P/E was in the range of 13.5-15.

All else being equal, this implies downside risk of -15% to -30% for the S&P 500. That's why US equity investors are playing with fire.

The full post can be found here.