McDonald's Corporation's (MCD) third-quarter financial performance outperformed analysts' projections with an adjusted Earnings Per Share (EPS) of $3.19, against an anticipated $3, while its revenue surpassed the consensus estimate of $6.58 billion, reaching a respectable sum of $6.69 billion.

The company experienced a financial upswing as price increases offset decreasing customer footfall at its United States-based restaurants.

A noteworthy increase of 8.8% was reported in MCD’s global same-store sales for the quarter, outperforming estimates of 7.8%, while U.S. same-store sales increased 8.1%. The sales growth can also be attributed to targeted marketing strategies and an influx of digital and delivery orders.

Despite the declining traffic plaguing the restaurant industry, MCD succeeded in broadening its appeal to middle- and high-income consumers, enlarging its market share. Company executives asserted that the fast-food giant continues to outpace competitors in most of its leading markets in terms of consumers’ perception regarding value and affordability.

In the face of increasing competition, MCD appears well-positioned. I think it seems worth considering adding it to your portfolio now. Some key metrics supporting a bullish outlook will be discussed below.

Analyzing McDonald's Corporation's (MCD) Financial Performance from 2020 to 2023

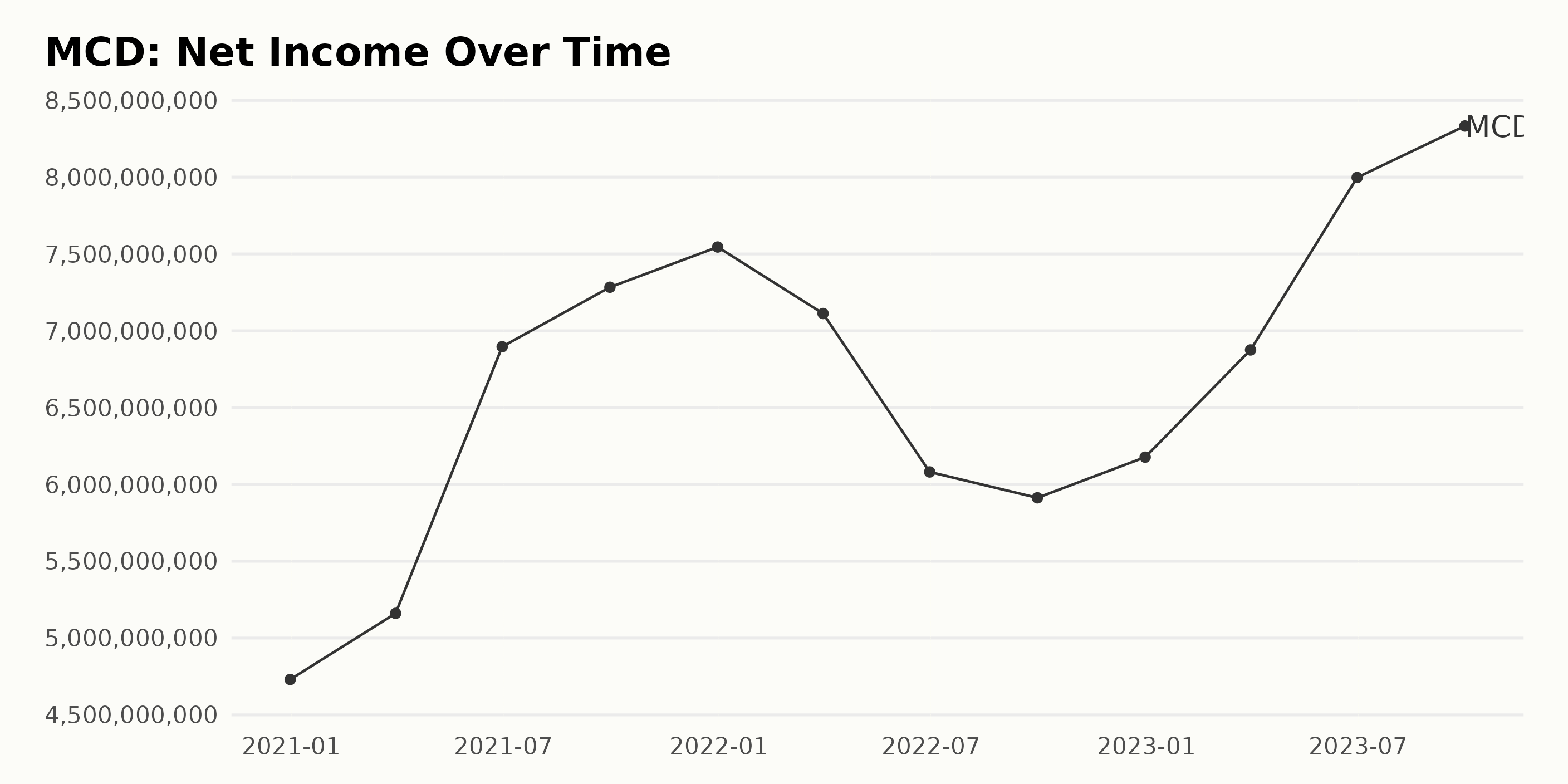

The trend and fluctuations in the trailing-12-month net income of MCD from the end of 2020 to the end of 2023 can be summarized as follows:

- On December 31, 2020, MCD reported a Net Income of $4.73 billion.

- There was a steady increase in Net Income through 2021, culminating at $7.55 billion on December 31, 2021, which represented a growth rate of approximately 59.60% over the previous year.

- In 2022, however, there were noticeable fluctuations, with Net Income first falling to $7.11 billion by the end of March, then decreasing further to $6.08 billion by the end of June. There was a minor recovery to $6.18 billion by the end of December 2022.

- In 2023, MCD observed a strong upward trajectory in Net Income, starting the year at $6.88 billion in March and ending with a Net Income of $8.33 billion in September.

Overall, MCD registered significant growth in Net Income from the end of 2020 to the end of the available data in September 2023, showing an increase of approximately 76.15%.

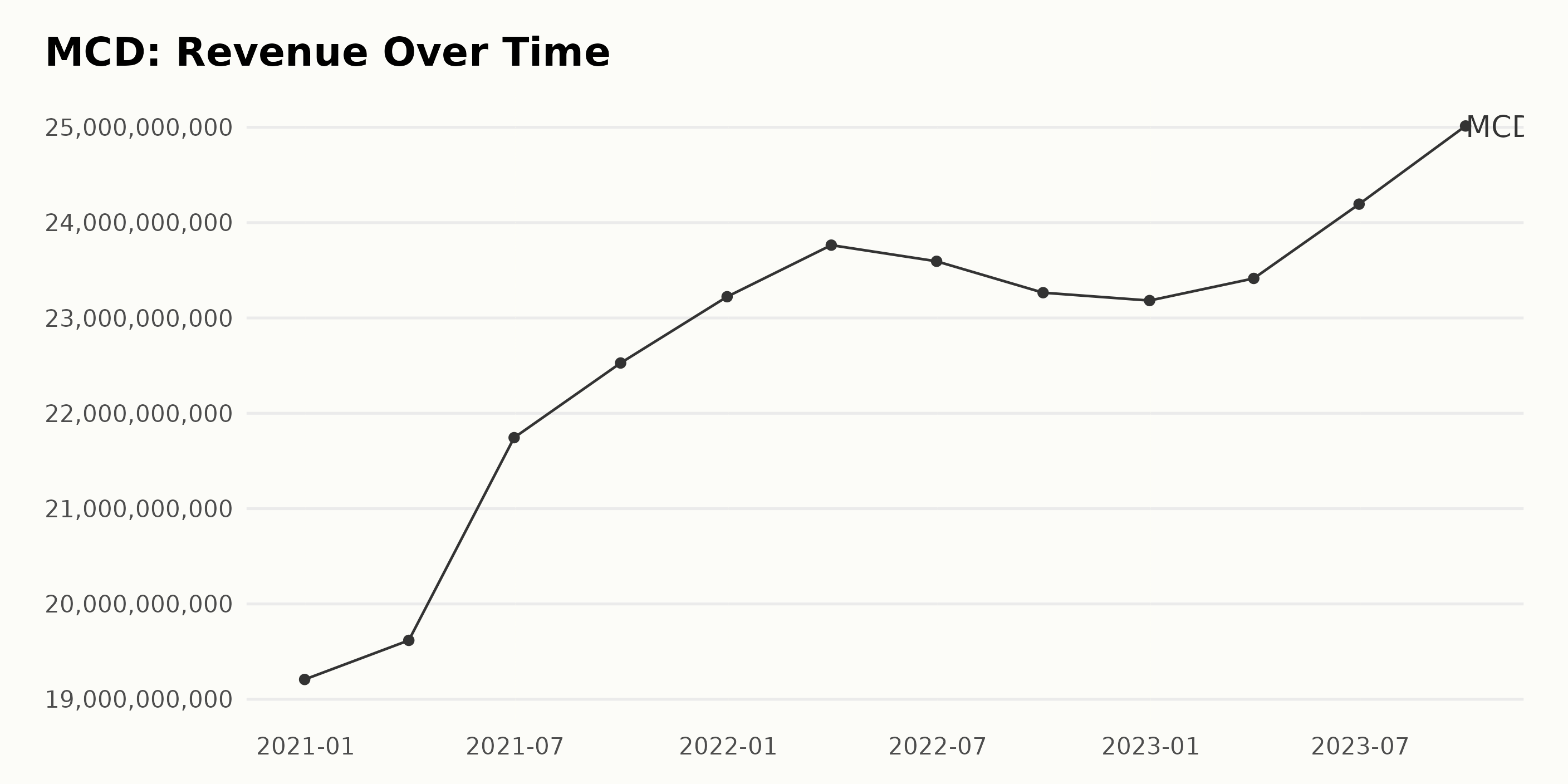

Here is a summary of the trend and fluctuations in the reported trailing-12-month Revenue of McDonald's Corporation (MCD):

- On December 31, 2020, McDonald's Corporation reported a Revenue of $19.21 billion. A consistent growth pattern can be observed in the corporation's Revenue in the ensuing quarters.

- By March 31,2021, the Revenue grew to $19.62 billion.

- By the end of June, 2021, there was a significant increase, with Revenue reporting at $21.74 billion.

- September 30, 2021 saw yet another increase, reaching $22.53 billion.

- Capping off the year on December 31, 2021, Revenue climbed higher to $23.22 billion.

- In the following year (2022), despite an initial growth in the first quarter to $23.76 billion, an unexpected downward trend followed.

- June 30 showed a slight decrease to $23.59 billion.

- This fall continued into September 30, where it decreased to $23.27 billion.

- Slightly lower still, the year ended on December 31 with a Revenue of $23.18 billion.

- Renewed growth appears in the data from 2023.

- An upturn started on March 31, as Revenue rose to $23.41 billion.

- Further growth continued in June to $24.19 billion.

- Finally, the series ends on September 30, 2023 with a peak Revenue report of $25.01 billion.

In terms of growth rate from initial observation till the last, there is a substantial increase. The Revenue of McDonald's Corporation has grown from $19.21 billion in December 2020 to $25.01 billion by September 2023, which translates to a notable growth overall. This reflects the resilient performance of McDonald's Corporation despite some fluctuations in 2022.

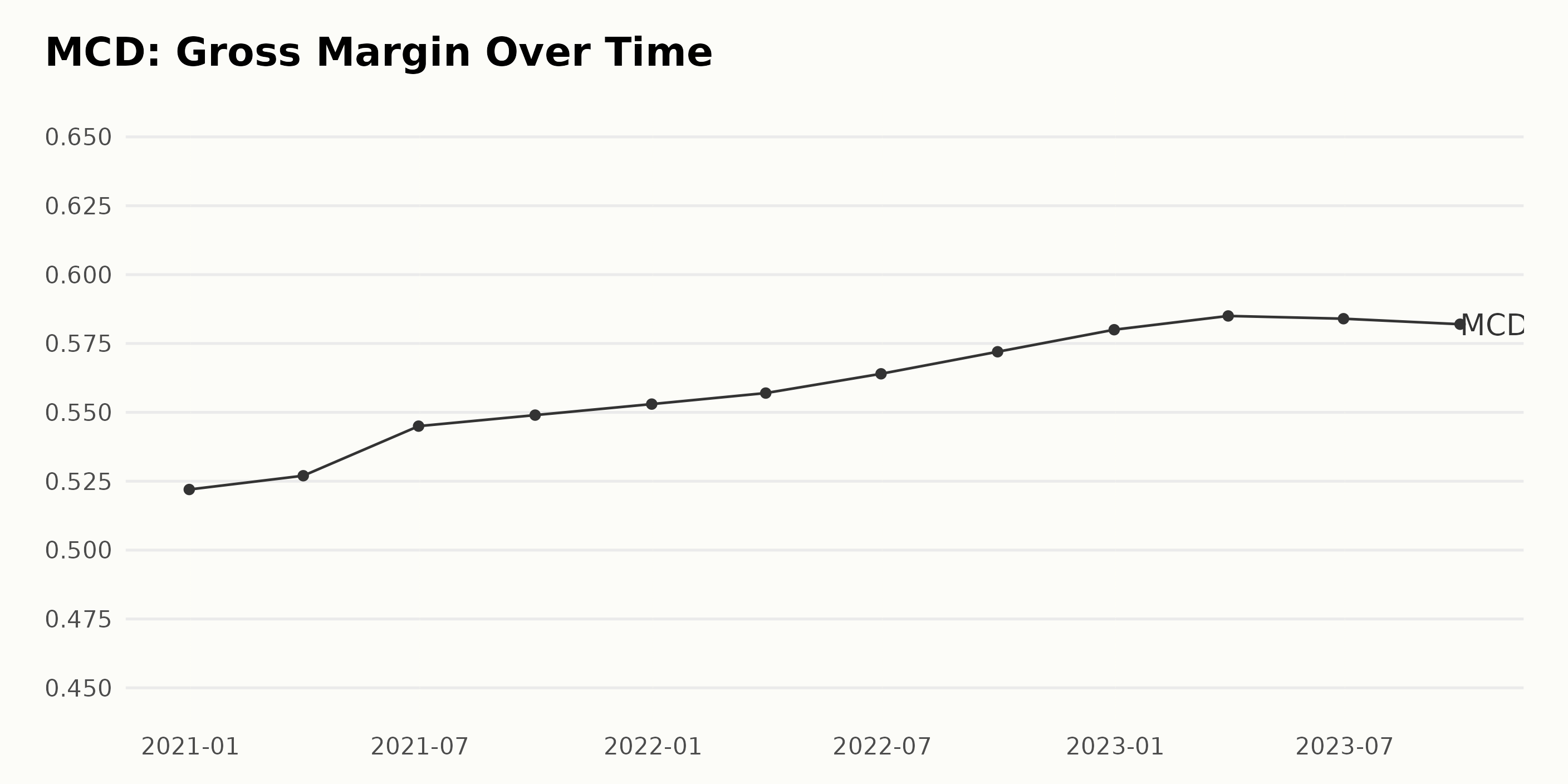

McDonald's Corporation (MCD) has seen a consistent upward trend in its Gross Margin from December 2020 to September 2023. Here are key data points:

- On December 31, 2020, the Gross Margin stood at 52.2%.

- By the first quarter of 2021 (March 31, 2021), it slightly increased to 52.7%.

- By the end of the second quarter (June 30, 2021), Gross Margin grew to 54.5%, indicating an onset of a stronger growth pace.

- The Gross Margin closed in at 54.9% at the end of the third quarter (September 30, 2021).

- By the close of 2021 (December 31, 2021), the figure was situated at 55.3%, showcasing a steady increase throughout the year. The upward trajectory continued into 2022.

- At the end of the first quarter (March 31, 2022), the Gross Margin grew to 55.7%.

- By the mid-year market (June 30, 2022), the Gross Margin had risen to 56.4%.

- McDonald's Corporation witnessed another welcomed increase by the end of the third quarter (September 30, 2022) at 57.2%.

- The year closed with the Gross Margin at an impressive 58.0% on December 31, 2022.

- The company maintained its trend during the first half of 2023, reaching 58.5% by March 31. Interestingly, there was a slight dip in June 2023, with the Gross Margin recorded as 58.4%. Lastly, by the end of the third quarter of 2023 (September 30), the Gross Margin dropped marginally to 58.2%, marking the first notable fluctuation in the otherwise consistent growth pattern.

The overall growth rate from December 2020 to September 2023, as calculated from the first to last value of this data series, is at approximately 11.5%. This indicates a strong performance in terms of McDonald's Corporation Gross Margin.

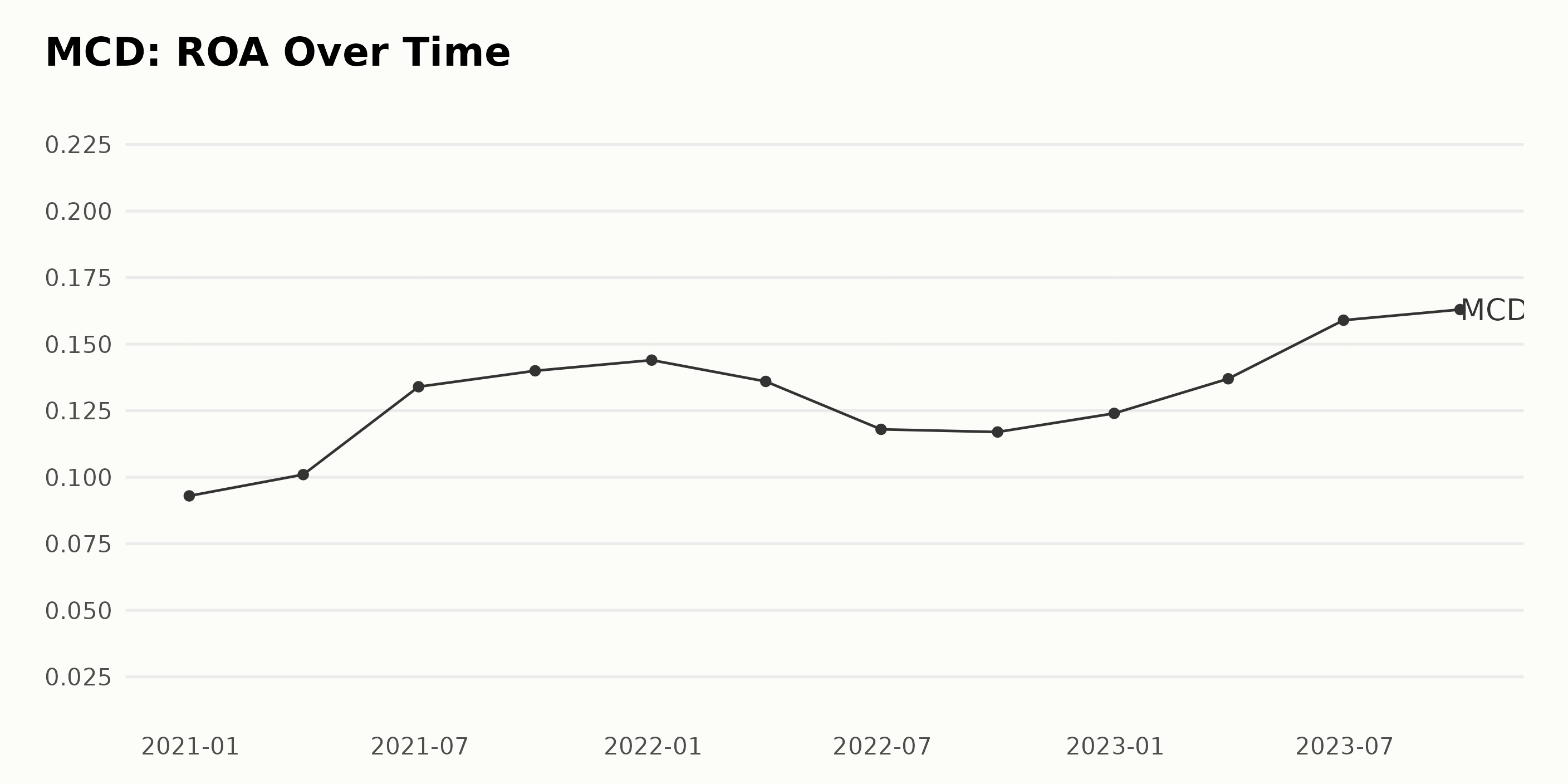

Based on the provided data series, the Reported Return on Assets (ROA) of McDonald's Corporation (MCD) has seen various trends and fluctuations over the observation period. Keith points from the data are as follows:

- As of December 31, 2020, MCD’s ROA stood at 9.3%.

- From the start of 2021 through mid-2022, the company experienced a general growth trend in ROA. The ROA value peaked in September 2021 at 14.0%, followed by a brief decline to 11.7% by September 2022.

- This downward trend was later reversed with a gradual increase visible in the last quarter of 2022 and first quarter of 2023. By June 2023, the company witnessed a significant upturn reaching an ROA of 15.9%.

- As of September 30, 2023, the company's performance remained robust, with an ROA of 16.3%, indicating the highest rate in the provided data series.

To calculate the growth rate, measuring the last value from the first: The initial figure of 9.3% (December 31, 2020) grew to 16.3% by September 30, 2023, showing a growth rate of 7.0 percentage points or approximately 75.3% over the period. This brief summary encapsulates the final observation and recent years' data is more heavily emphasized, as instructed. Overall, it suggests that despite interim fluctuations, MCD has improved its asset efficiency during the tracked period.

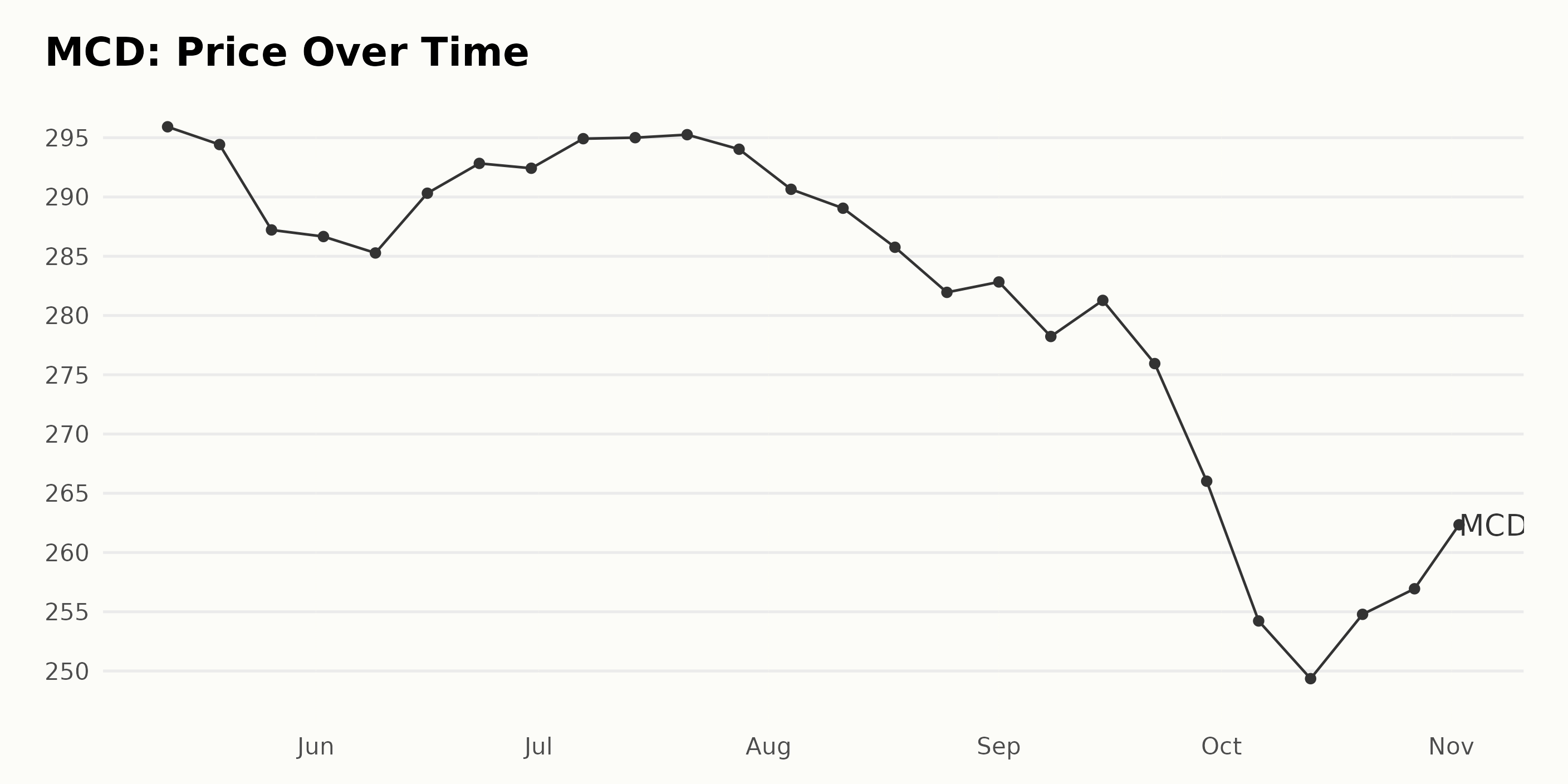

McDonald's Share Prices: A Downward Journey with Slight Recovery in Late 2023

The share prices for McDonald's Corporation (MCD) over the reported period exhibit a general declining trend:

- On May 12, 2023, the share price was $295.92.

- By May 26, 2023, the share price had dropped to $287.22, continuing a downward trend.

- In early June, the share price reached its lowest point within the month at $285.28 (June 9, 2023) before rebounding to close June at $292.43 (June 30, 2023).

- The share price remained fairly steady throughout July, with a closing price of $294.03 on July 28, 2023.

- August witnessed another significant downward adjustment, culminating in a share price of $281.95 by the end of the month (August 25, 2023).

- Despite minor recovery in early September, reaching $282.83 by September 1, 2023, the value decreased steeply to close September at $266.02 (September 29, 2023).

- The most significant decrease in this period was recorded in October, with the share price dropping to its lowest point at $249.36 by mid-October (October 13, 2023). However, there was a recovery toward month-end, closing at $256.94 on October 27, 2023.

- By the last reported date on November 2, 2023, the share price had further increased to $262.34.

In conclusion, the data reveals a general and consistent downward trend in the share price of McDonald's Corporation (MCD) from May to October 2023, followed by a slight recovery as of November 2023. The rate of decline seems to accelerate toward the end of the reported period, particularly from August onward. Here is a chart of MCD's price over the past 180 days.

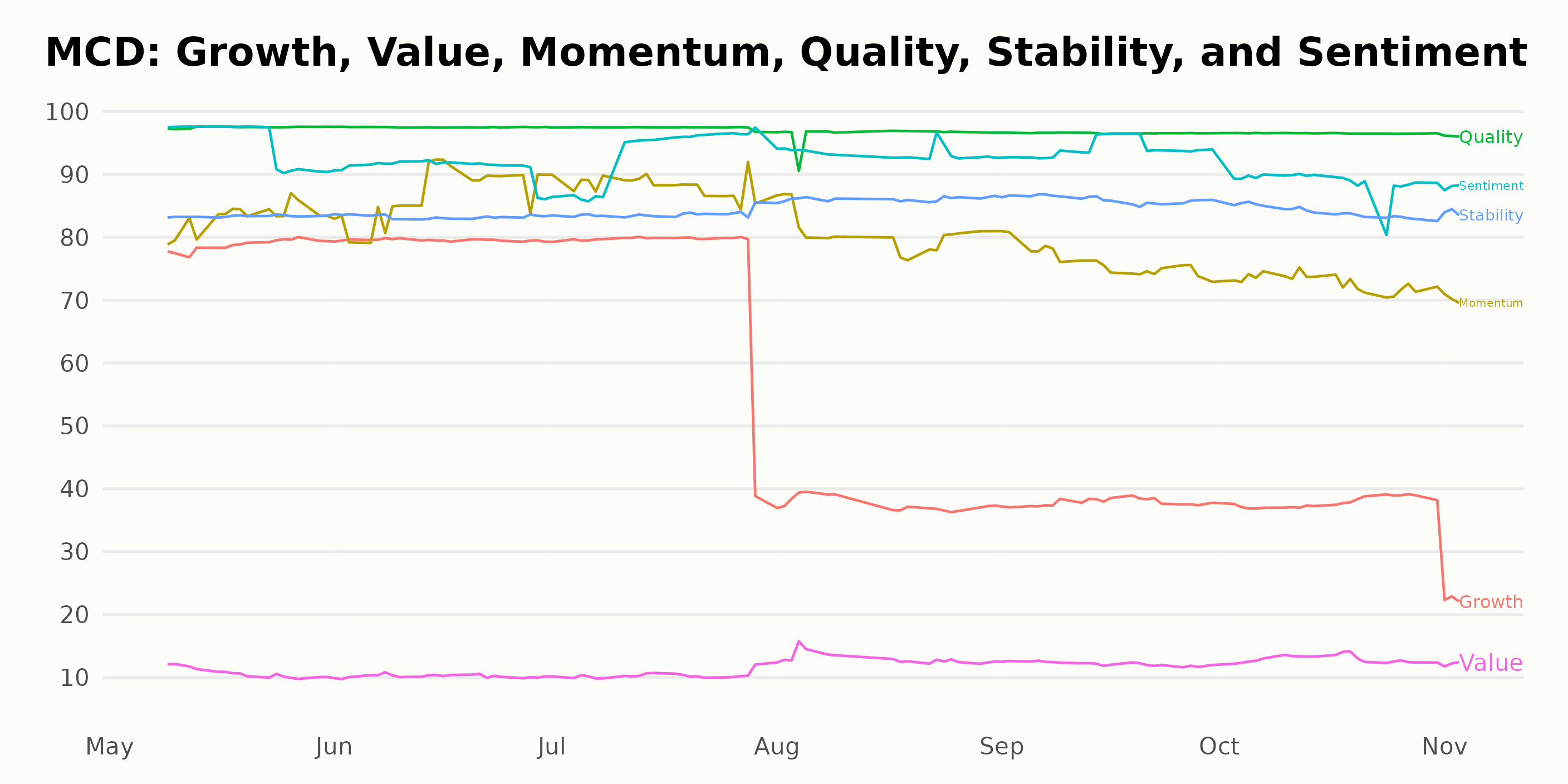

Assessing McDonald's Corporation Performance: A Deep Dive into Quality, Sentiment, and Momentum Ratings

MCD has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #9 out of the 44 stocks in the Restaurants category.

Looking at the POWR Ratings for McDonald's Corporation (MCD) across six key dimensions, we see that the three most noteworthy dimensions are Quality, Sentiment, and Momentum. The Quality dimension consistently receives the highest of the ratings among these three, maintaining a score of 97 or above from May through October 2023. Here is a detailed look of these dimensions over time: Quality:

- May 2023: 97

- June 2023: 97

- July 2023: 97

- August 2023: 96

- September 2023: 97

- October 2023: 97

In the Sentiment category, the company maintains a high rating with some minor fluctuations over the course of a few months. Sentiment:

- May 2023: 95

- June 2023: 91

- July 2023: 93

- August 2023: 93

- September 2023: 94

- October 2023: 89

The Momentum dimension shows a clear upwards trend from May to July 2023 (from 83 to 88) but starts to decline afterwards from August to November 2023 (from 81 to 70). Momentum:

- May 2023: 83

- June 2023: 87

- July 2023: 88

- August 2023: 81

- September 2023: 76

- October 2023: 73

- November 2023: 70

It's important to take these ratings into consideration as each plays a significant role in the strategic growth and stability of McDonald's Corporation (MCD).

How does McDonald's Corporation (MCD) Stack Up Against its Peers?

Other stocks in the Restaurants sector that may be worth considering are Nathan's Famous Inc. (NATH), Domino's Pizza Group plc (DPUKY), and Biglari Holdings Inc. (BH) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

MCD shares were trading at $268.03 per share on Friday afternoon, up $1.18 (+0.44%). Year-to-date, MCD has gained 3.39%, versus a 15.15% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post McDonald's (MCD) Earnings Beat: Buy or Sell? appeared first on StockNews.com